Growing Wealth Gap Hurts Wage Earners

Kimberly-Clark subsidy helps wealthy stockholders with no gain for workers.

Jan 20th, 2019 by Tamarine CorneliusThis Isn’t an Economic Development Strategy, This is an Extortion.

"By paying this ransom to a profitable corporation, Republican economic mismanagement opens Wisconsin up to further extortion from other profitable companies."

Dec 14th, 2018 by State Sen. Chris LarsonKimberly-Clark to Keep Cold Spring Facility Open in Wisconsin

Company, WEDC reach agreement on tax incentives that will retain nearly 400 jobs at Fox Valley facility

Dec 13th, 2018 by Gov. Scott WalkerGovernor-elect Tony Evers Statement on Kimberly-Clark Announcement

"Unfortunately, Republicans played politics with this issue for months, leaving Kimberly-Clark workers and their families in the dark and uncertain about their futures."

Dec 13th, 2018 by Gov. Tony EversKimberly-Clark Subsidy Stalled in Senate

Republicans “haven’t made any effort to build consensus," Democrat Shilling says.

Nov 28th, 2018 by Laurel White, Wisconsin Public RadioKimberly-Clark, Unions, Push for Subsidy

State Senate lacks votes to approve $70 million subsidy for 400 jobs.

Nov 15th, 2018 by Laurel White, Wisconsin Public RadioReject Corporate Welfare

"Taxpayer handouts to corporations are not the solution for providing Wisconsin with a pro-growth business environment that benefits all businesses."

Nov 14th, 2018 by AFP WisconsinMacIver Institute Reminds Wisconsin Why Kimberly-Clark Bailout Is a Bad Idea

"The proposed ‘pay-to-stay’ incentives package is a bad idea and it’s poor public policy."

Nov 14th, 2018 by MacIver InstituteGOP Pushes Tax Giveaway Plan That Pays More for Fewer Jobs

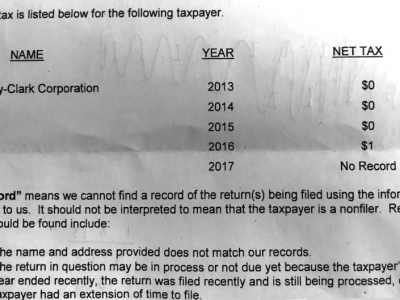

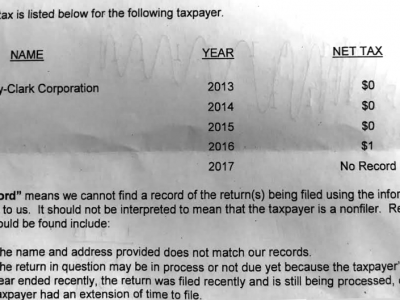

Kimberly-Clark Paid $1 in Net State Income Tax Since 2013, Wants $100 Million Windfall to Close Plant, Cut Over 100 Jobs

Nov 14th, 2018 by One Wisconsin NowRepublican Opposition to Kimberly-Clark Bill Intensifies

Lack of Leadership from Roth Makes Senate Vote Unlikely

Oct 4th, 2018 by Democratic Party of WisconsinSenator Craig Statement on Kimberly–Clark Legislation

"If brought to a vote, I would not support the proposed Kimberly-Clark tax incentive legislation."

Oct 3rd, 2018 by State Sen. David CraigScott Walker, GOP Seek Lame Duck Session to Send $100 Million to Corporation That’s Had $1 in Net State Tax Since 2013

Republicans Seek to Deny Giving Voters Voice on Latest Corporate Welfare Scheme

Oct 2nd, 2018 by One Wisconsin NowGovernor Walker Releases Statement on Kimberly-Clark

"My message to Kimberly-Clark employees is simple: we are fighting for you. We are working together to keep your jobs in Wisconsin."

Oct 2nd, 2018 by Gov. Scott WalkerDesperate Walker Wants to Hand Out More Election Year Corporate Welfare

Working Families Shouldn’t Have to Pay for Corporate Subsidies

Oct 1st, 2018 by One Wisconsin NowKimberly-Clark Won’t Get Tax Break

Company demands subsidy by September 30. Why that won’t happen.

Sep 17th, 2018 by Steven WaltersOne Wisconsin Now Statements on Scott Walker Latest Corporate Welfare Scheme

Desperate Governor Calling for ‘FoxValleyCon’

Sep 14th, 2018 by One Wisconsin NowWMC Pushes For Kimberly-Clark Subsidy

State’s biggest business lobby has spent nearly $20 million to elect conservatives.

Sep 13th, 2018 by Wisconsin Democracy CampaignKimberly-Clark Employees Remind Us Why Bailout Is A Bad Idea

"Wisconsin taxpayers should not be a bargaining chip in a negotiation between a private company and its union."

Aug 30th, 2018 by MacIver InstituteWalker Rewards Kimberly-Clark For Layoffs?

Proposed state deal gives company subsidy if no more than 7 percent of workers eliminated.

Aug 2nd, 2018 by Jon PeacockSay No to Kimberly-Clark Subsidy

They’re awash in profits from federal tax cuts and worker givebacks. Now they want more from state taxpayers?

Jul 26th, 2018 by State Sen. Chris LarsonKimberly-Clark Will Consider State Subsidy

Open to state incentives, the company says, now that union has agreed to concessions.

Jul 25th, 2018 by Brady CarlsonGovernor Walker Releases Statement on Kimberly-Clark, United Steelworkers Agreement

"The agreement reached between Kimberly-Clark and the United Steelworkers is outstanding news..."

Jul 24th, 2018 by Gov. Scott WalkerGovernor Walker, State Officials Push to Keep Kimberly-Clark Jobs in the Fox Valley

"We are committed to fighting for Wisconsin workers and communities."

Feb 15th, 2018 by Gov. Scott WalkerThe Lesson of Kimberly-Clark Layoffs

State gave huge tax giveaways to manufacturer, but company still laid off workers.

Feb 12th, 2018 by Jon PeacockKimberly-Clark Donated to Walker, Legislators

Paper industry gave $225,000. Walker wants state handout to Kimberly Clark.

Feb 7th, 2018 by Wisconsin Democracy CampaignGovernor Walker Calls for Increasing Tax Incentives for Kimberly-Clark

Proposal would more than double amount of tax credits available to company

Feb 5th, 2018 by Gov. Scott Walker