Who Benefits from Trump Tax Cuts?

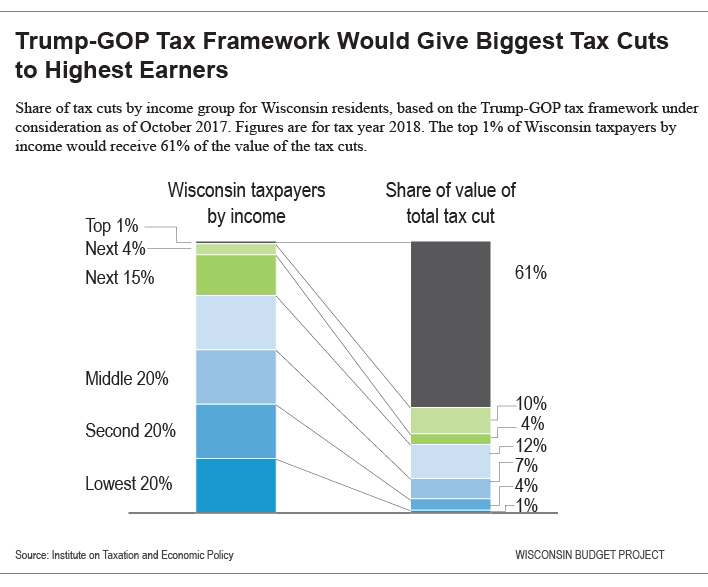

In Wisconsin the top 1% will get 61% of the tax cut.

The tax plan being advanced by President Trump and Republican members of Congress would mostly benefit the extremely rich, despite initial claims by proponents that it would be targeted at members of the middle class.

Provisions included in the tax framework include:

- Reducing the corporate income tax rate from 35% to 20%;

- Eliminating the Alternative Minimum Tax, which insures that wealthy individuals pay at least some level of federal income tax;

- Eliminating the estate tax. Currently, only estates of more than $5.5 million for individuals or $11 million for couples pay any estate tax;

- Reducing the number of income tax brackets;

- Doubling the amount of the standard deduction and eliminating the personal exemption; and

- Ending the deduction for state and local taxes paid.

Here are six charts that show how the Trump-GOP tax framework would affect Wisconsin taxpayers:

1. The top 1% of earners in Wisconsin would get 61% of the value of the tax cut. The proposed tax cut is so tilted that 61¢ out of every $1 of the tax cut would go to the top 1%, a group with an average income of $1.8 million. The remaining 99% of Wisconsin taxpayers would share the other 39% of the value of the tax cut. The bottom 60% of taxpayers, who have incomes of less than $67,200, would receive a paltry 13% of the total value of the tax cut.

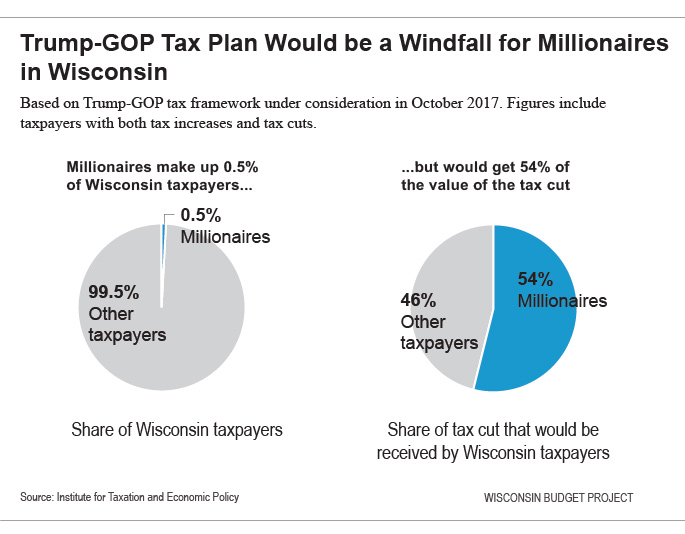

2. Wisconsin millionaires would get a bonanza.

Millionaires make up just one-half of one percent of Wisconsin taxpayers. Yet they would receive more than half – 54% – of the value of the tax cut.

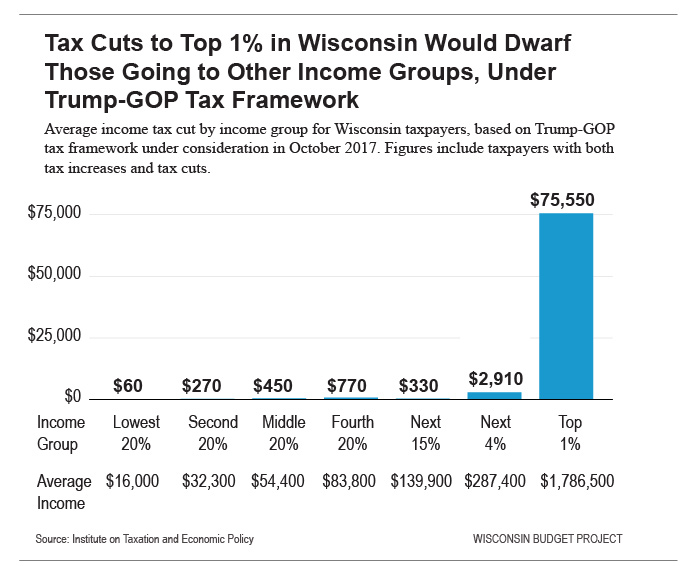

3. Wisconsin taxpayers in the top 1% would receive an average tax cut of nearly $76,000 in 2018 – enough to lay out cash sufficient to buy a Porsche or a Maserati. Taxpayers in other income groups would receive much less, with average tax cuts of a size more appropriate to buying a spiffy set of car seat covers.

The average tax cut received by the top 1% would be more than 1,200 times larger than the average tax cut received by Wisconsin taxpayers in the bottom 20% by income. That means that taxpayers in the top 1% would save more in taxes in the equivalent of eight hours than people in the bottom 20% would save all year long.

(By the way, that $76,000 average tax cut for taxpayers in the top 1% is enough to cover the average yearly healthcare costs for 44 kids in Wisconsin.)

Tax Cuts to Top 1% in Wisconsin Would Dwarf Those Going to Other Income Groups, Under Trump-GOP Tax Framework

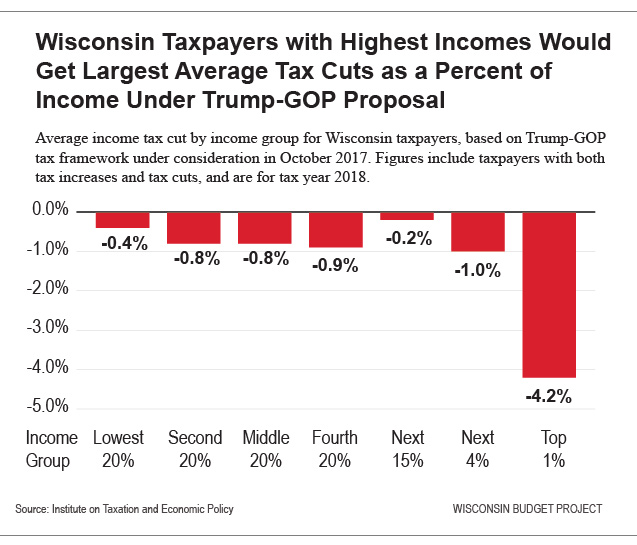

4. Even taking into account relative income size, the top 1% would get the biggest tax cut.

Measured as a share of income, Wisconsin residents with the highest incomes would receive the largest tax cut. Their tax cut would amount to 4.2% of their income on average, more than four times as large as the tax cut of 1.0% of income that taxpayers with slightly lower incomes would receive. The other income groups would receive tax cuts as a percent of income that range between 0.4% and 0.9%.

Wisconsin Taxpayers with Highest Incomes Would Get Largest Average Tax Cuts as a Percent of Income Under Trump-GOP Proposal

5. and 6. The Trump-GOP tax framework could result in an income tax hike for a sizeable share of Wisconsin taxpayers. One out of every eight taxpayers in Wisconsin would actually pay more in taxes under this plan. The Institute for Taxation and Economic Policy describes why some taxpayers would pay more under this framework:

“The plan relies heavily on repealing the deduction for state and local taxes paid in order to lessen the revenue loss associated with enacting top-heavy tax cuts for corporations, business owners, multi-million dollar estates, and high-income individuals.

Taken on its own, repeal of the state and local tax deduction would primarily impact higher-income earners. In the context of the overall framework, however, its ultimate impact falls more heavily on families in the middle- and upper-middle portions of the income distribution. This is because while the taxpayers at the very top of the income distribution would initially be impacted by repeal, the tax cuts they receive in return for giving up their deduction are more than enough to offset that impact. The framework is far less generous in offering offsetting tax cuts to middle-income families.”

The share of taxpayers who will lose out under the tax plan is much higher if one considers how the plan will be paid for. As the Center on Budget and Policy Priorities points out: “Sooner or later, the cost [of the plan] will need to be offset through some combination of spending cuts and tax increases.” For most Americans, the spending cuts and tax increases needed to offset the cost of the Trump-GOP tax cuts would cause their incomes to fall more than they would gain from the tax cuts. In fact, every income group in the bottom 95% of the spectrum by income would be net losers on average, while the top 5% by income would be net winners.

For more information: Vast Majority of Americans Would Likely Lose From Senate GOP’s $1.5 Trillion in Tax Cuts, Once They’re Paid For, Center on Budget and Policy Priorities, October 4, 2017.

What’s next for the Trump-GOP tax plan? First, the Senate will have to pass a 2018 budget framework with “reconciliation instructions” for tax reform, which could happen as early as next week. The House of Representatives has already passed its budget framework, which looks different from what the Senate has put together. The two houses will have to reach an agreement on the framework. For more on the intricacies of how the tax plan will move forward, read Before they can cut taxes, Republicans need to pass a budget, Vox, October 3, 2017.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Trump has little say on tax cuts. Paul Ryan and Chuck Schumer have more say than Trump. Though I understand why you want the productive to get nothing more then they already have and reward the individuals that give little to nothing to our society. For every two workers in society there is one that collects a check from the government. This can only last for so long.