The Irony of the Government Shutdown

States that overwhelmingly backed Donald Trump now stand to lose the most in ACA subsidy battle.

![The White House. Photo by AgnosticPreachersKid [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0)]](https://urbanmilwaukee.com/wp-content/uploads/2019/07/White_House_DCj-1024x618.jpg)

The White House. Photo by AgnosticPreachersKid (CC BY-SA 3.0)

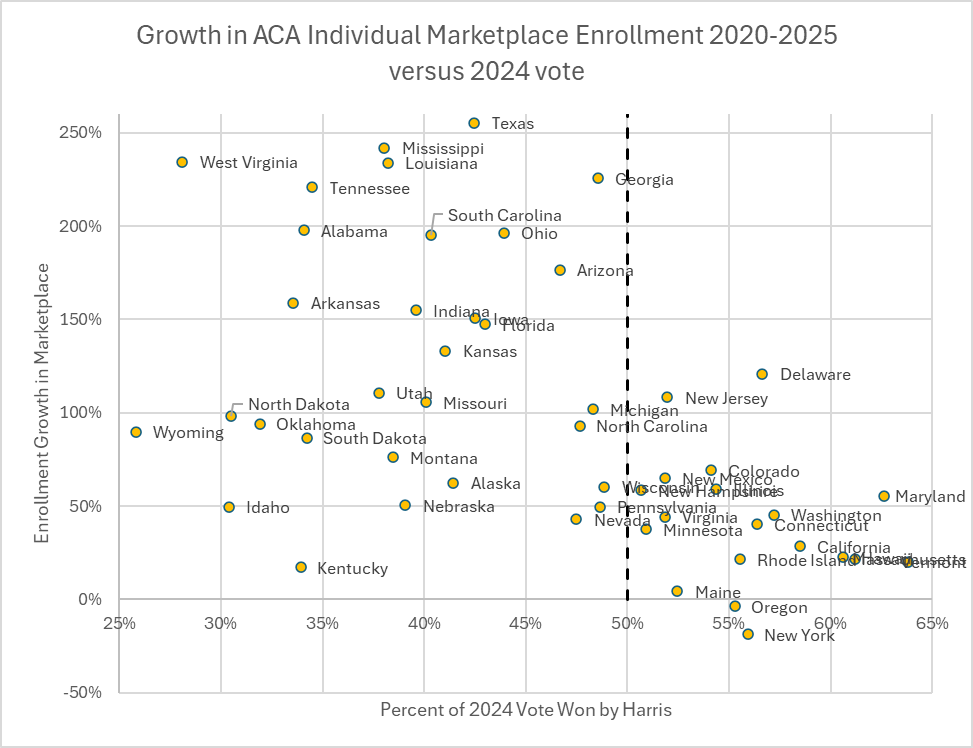

On the graph below, each state is represented by a dot. The vertical axis shows the percentage increase in ACA marketplace enrollment between 2020 and 2025. Enhanced premium tax credits enacted in 2021 made more people eligible for subsidies.

The horizontal axis shows the outcome of the 2024 presidential election, with states Trump won on the left of the dashed line and those Harris won on the right. Led by Texas, where enrollment rose 255%, the states with the highest increases all supported Trump.

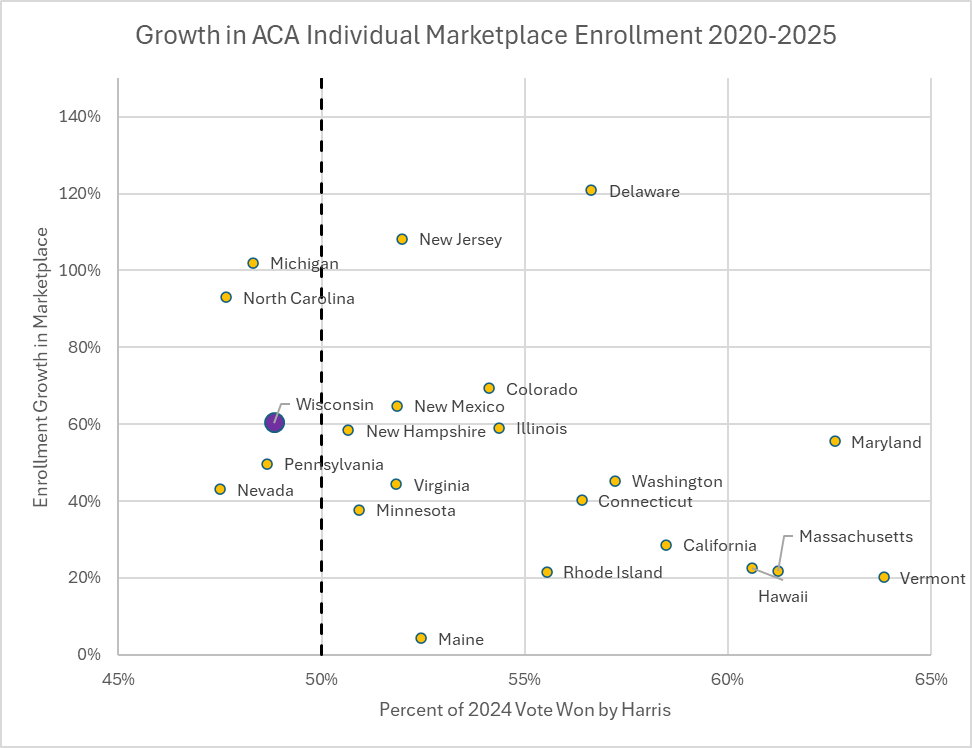

The next graph shows growth in states where Kamala Harris received at least 45% of the vote. With two exceptions (New York and Oregon, which established their own programs), every state saw increased enrollment in marketplace enrollment.

Although Wisconsin narrowly supported Trump, its enrollment grew a more modest 60%, similar to that of other competitive states, including Michigan, Pennsylvania, Nevada and North Carolina.

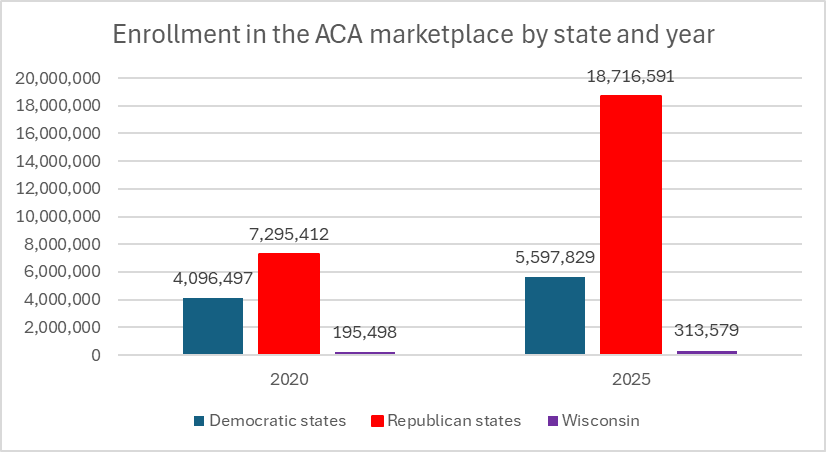

The next graph summarizes the results. Blue columns show total marketplace enrollment in Democratic-leaning states in 2020 and 2024. Overall, enrollment increased by 37%. Wisconsin’s enrollment rose by about 60%.

By comparison, enrollment in Republican-leaning states, shown in red, more than doubled—up 157%.

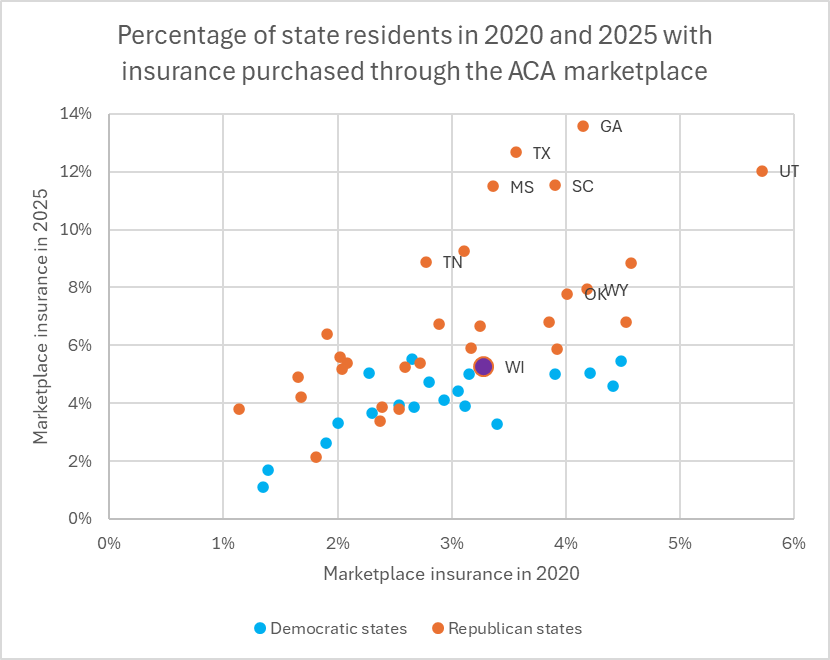

One might wonder whether the high growth rate found in the previous analysis results from low enrollment in 2020 rather than high enrollment in 2025. To examine this issue, marketplace enrollment was divided by each state’s population under age 65.

In the next graph, the results for 2020 are shown on the horizontal line. States voting for Trump are shown in red; those voting for Harris in blue. For example, marketplace enrollment in Texas grew from about 3.6% of the population under 65 in 2020 to 12.7% in 2025.

The chart below shows results for all states but Florida, which was 8.2% of the state’s under-65 population in 2020 and grew to 20.3% in 2025. It seems likely that these high percentages reflect the state’s retirees younger than 65.

Ironically, the number of people benefiting from enhanced premium tax credits is greatest in states that voted for Trump and Republican members of Congress. Yet Trump and other Republican politicians remain intent on eliminating those credits.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

Data Wonk

-

Life Expectancy in Wisconsin vs. Other States

Dec 10th, 2025 by Bruce Thompson

Dec 10th, 2025 by Bruce Thompson

-

How Republicans Opened the Door To Redistricting

Nov 26th, 2025 by Bruce Thompson

Nov 26th, 2025 by Bruce Thompson

-

The Connection Between Life Expectancy, Poverty and Partisanship

Nov 21st, 2025 by Bruce Thompson

Nov 21st, 2025 by Bruce Thompson

Many of the folks who are impacted by this won’t realize it until they get their notices of a premium change, probably sometime in November. I hope they all call Ron Johnson to vent (not that he cares).

Trump is proposing 10 billion dollars for bailing out the soybean farmers. Trumps tariff policies destroyed their market. If he can find this much money for soybean farmers, why can’t he find money for extending the tax credits for the persons covered under the Affordable Care Act.

I have worked with the homeless almost my entire life. I have seen first hand the effects of not being able to afford insurance. People having to utilize emergency rooms for care only to be turned away by these so called “NON-PROFIT” institutions. They can find the money if they want to. I sure hope Democrats hold out. It is a worthy cause for everyone!!!

I agree that there is a problem with medical care.

I also know that there is a problem with the national debt! We are paying interest on a debt.

We need to hold those in Congress accountable. There are those like Representative Fitzgerald. Billions to increase the pay of doctors working at the Veterans Hospital, and where was the investment in more doctors? What is 20% of those applying to the US Military Academy had the opportunity to become doctors? Not enough doctors – means . . .

What if the percentage of medical personnel in the active and reserve military was increased?

Is the US Government too large? Is the US Military too large? Last weekend, 23 people were shot in Chicago.

How is keeping the government closed helping? In the big picture, what is being accomplished?