Council Committee Endorses 2% Sales Tax

And blasts state policy restrictions while insisting tax is far from a 'Milwaukee bailout.'

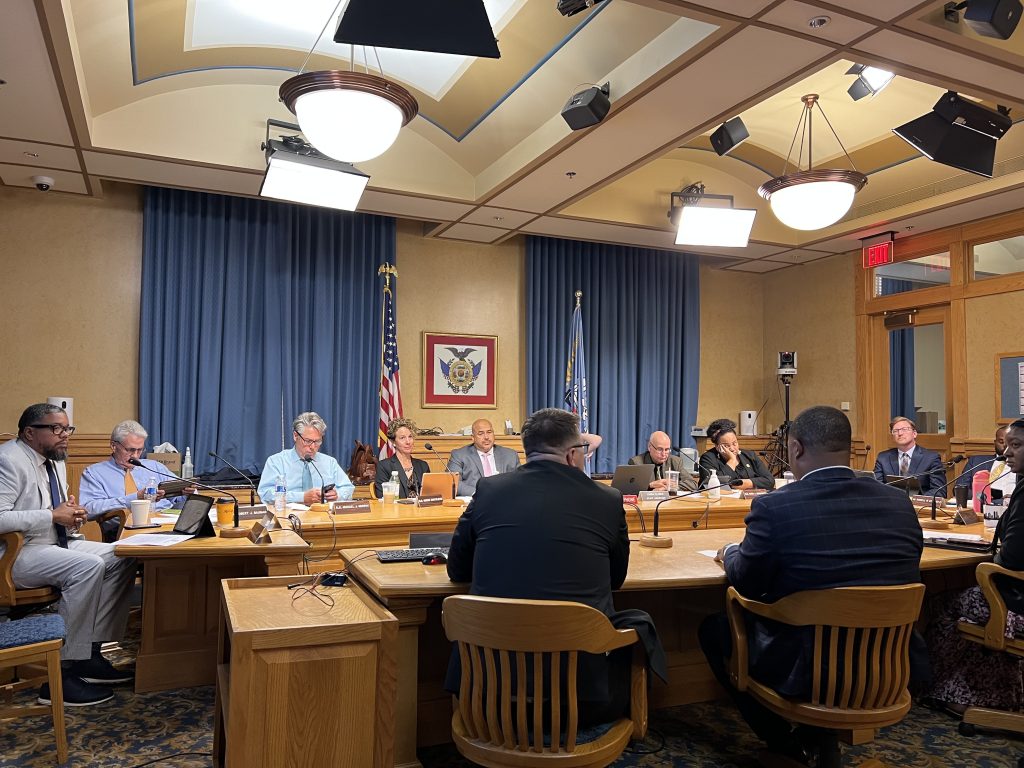

A new 2% sales tax for the City of Milwaukee cleared a major hurdle Monday.

Without a single vote in objection, the Common Council’s Steering and Rules Committee recommended approval of the tax. The move sets up a July 11 vote and a possible Jan. 1 implementation.

Approval would avoid the city’s looming fiscal crisis, one that a report released Monday said would force the elimination of 700 of the approximately 1,600 police officers, 250 of the approximately 700 firefighters and 400 general city employees.

But the proposal, enabled as part of statewide legislation signed into law last week, isn’t without controversial provisions.

“There are large portions of Act 12 that we do not accept,” said Common Council President José G. Pérez.

The Republican-led proposal sets minimum staffing levels for the city’s public safety departments, removes control from the Fire & Police Commission, bars spending property tax revenue on diversity, equity and inclusion efforts and prohibits extending the streetcar with property tax revenue.

The committee voted 6-0-2 to recommend enacting the tax. Ten of the 15 council members will need to vote for the tax.

But it also set aside $781,000, symbolically housed within the Office of African American Affairs and Office of Equity and Inclusion, to possibly sue over the proposal, requested the City Attorney’s Office explore legal pathways to overturning the provisions and requested the Department of Public Works move forward on pursuing new grants to extend the streetcar system.

The sales tax vote, which came after five hours discussing the matter and taking public testimony, wasn’t met with enthusiasm. But council members said the alternative would be far worse.

“I don’t see how you say no to the sales tax without saying yes to the cuts, and the cuts are unthinkable,” said Alderman Scott Spiker.

Spiker was joined in supporting the measure by Pérez, Marina Dimitrijevic, Michael Murphy, Mark Borkowski and Robert Bauman.

Bauamn said he was moved to change from his prior public stance in opposition because of views shared by his constituents. “The regular citizens I’ve heard from do seem to be in support, and they’re definitely not in support of the level of cuts that have been described by the budget director,” he said.

Pérez said he has heard similar sentiments from his consituents.

But both Milele A. Coggs and Russell W. Stamper, II abstained, citing planned community meetings. Spiker also said he wanted to hear from his constituents. After the meeting, Pérez said he was unaware if those meetings have been formally scheduled, but would attend them whenever they were held.

“I and many others thought this should have been an issue decided by the citizens,” said Coggs of a referendum requirement that was eliminated at Mayor Cavalier Johnson‘s request.

The Milwaukee Bailout

Multiple council members said they were frustrated by the description of the process as a “Milwaukee bailout.”

“We have been choked, choked, by the state Legislature on the revenue stream and then they have the tenacity to blame us for being bad managers,” said Ald. Murphy. The state has held shared revenue flat for more than two decades, a factor which now costs the city an estimated $155 million annually, and also maintains prohibitions on enacting new revenue sources or increasing property tax revenue beyond new construction levels.

“They view the city of Milwaukee as a carcass you can kick around,” said Bauman of the Republican-controlled Legislature.

“The narrative coming out of [Speaker Robin Vos‘s] office is just factually inaccurate and wrong,” said Murphy. “We wouldn’t be in the situation if we had been treated fairly from the very beginning.”

While the state has held revenue flat, the city has seen its costs rise due to inflation and growing pension costs. Murphy reiterated Monday that those rising pension costs are primarily for public safety employees who were exempted from the state’s Act 10 law for political reasons.

“The majority of them don’t live in our city anymore and that is a frustration for our citizens,” said Murphy.

But Johnson, who wasn’t present at Monday’s meeting, has touted the sales tax as a way to make sure non-residents are paying for the city services they benefit from.

The Pension Issue

The new legislation will address the pension issue, but at a great cost. New hires will be barred from entering the system and instead placed into the Wisconsin Retirement System.

Soft closing the pension system will impose an added cost on the city, primarily because the state is mandating the city use its estimated annual rate of return of 6.8% for the pension fund’s investments versus the city’s 7.5%. “We estimate an annual increase of costs of about $45 million,” said budget director Nik Kovac.

Milwaukee Employes Retirement System director Jerry Allen confirmed for the committee that there is no pathway to avoiding making the pension payments. “The pension payments are mandatory, they are required by law,” said Allen, who also noted that the pension system’s performance has consistently been among the top quarterile of those in the country.

“Long term, over the course of a generation, it’s a savings,” said Kovac of the pension changes. Despite the lower estimated rate of return, the budget director said the state benefits from a reduced cost-of-living adjustment.

An acturial report from a third-party consultant will determine the costs of the pension changes.

Additional state shared revenue will be increased for the city, but on a percentage basis far less than for other local governments.

Every other Wisconsin municipality is being given a minimum 20% funding increase, while the city will receive only 10%, $21.75 million. But Kovac said it was significant that the increase is being pegged to state sales tax collections which will put it on a pathway to growth.

Still, the budget director and council members would certainly like to see the 58% increase Madison will receive. Or even the 20% increase each of its suburbs is receiving.

Despite the cost increases, Kovac said the two revenue sources, coupled with $80 million in pension reserve funding and $93 million remaining from the city’s American Rescue Plan Act grant, would allow the city to pursue cost-to-continue budgets through 2027 without any major cuts.

Should the sales tax exceed state-estimated collections of $193.6 million, the first $23 million must go to expanding the staffing of the Milwaukee Police Department and Milwaukee Fire Department up to 1,725 sworn officers (including 175 detectives) from 1,623 and daily staffing of 218 in the fire department, up from approximately 190 today.

Kovac, using a “sketch” of his office’s projections, said the city would likely see increased relief in 2028 as collections grew beyond the minimum spending levels.

Potential Lawsuit

The city is taking the steps to gear up for potential lawsuits, while avoiding sounding too definitive about the possibility.

“This by no means mean we will sue,” said Alderwoman Coggs. But council members, members of the public and a deputy city attorney have already suggested a possible pathway.

“Home Rule is obviously the one that jumps out at everybody,” said deputy city attorney Todd Farris of the constitutional amendment. He said a thorough review would be undertaken.

Pérez declined to comment on legal pathways after the meeting and said there is no rush to file litigation. But he did note that even if all the new law’s policy restrictions were in place 20 years ago, the city would still have the same fiscal issues.

Support for Tax

More than a dozen community leaders spoke in support of adopting the sales tax, including Assembly Representatives Marisabel Cabrera, Kalan Haywood II and Evan Goyke, Metropolitan Milwaukee Association of Commerce CEO Tim Sheehy, VISIT Milwaukee CEO Peggy Williams-Smith, Journey House CEO Michele Bria, attorney Craig Mastantuono, Forward Latino national president Darryl Morin, Greater Milwaukee Committee President Joel Brennan, Fire Chief Aaron Lipski, library board member Mark Sain, Republican Party leader Gerard Randall and several citizens, including Patina Lawson.

“This feels a little bit dirty on how this was presented to the city of Milwaukee, I get it, but we have got to live to fight another day,” said Lipski, the fire chief. “This turns into mid-80s Detroit within a year if we don’t act.”

Nearly all of the speakers, including each of the state representatives, spoke against the policy restrictions embedded in the bill.

“I don’t think there is a way to remove those items, we certainly tried,” said Goyke. The three elected officials said they would all have voted for the proposal if it did not include any policy provisions, but still encouraged the city to adopt the sales tax.

Sheehy said he agreed with Bauman that the anti-streetcar provisions shouldn’t be in the bill. “We believe the city should have the tools and the responsibility to decide what transit systems should serve the city of Milwaukee,” he said.

The policy provisions go into effect whether or not the council adopts the sales tax.

Fourteen of the 15 council members were present for the debate, but only the eight committee members voted. The only council member not present Monday was Lamont Westmoreland.

Urban Milwaukee will have additional details on the sales tax, streetcar extension and other provisions in the coming days.

Legislation Link - Urban Milwaukee members see direct links to legislation mentioned in this article. Join today

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

More about the Local Government Fiscal Crisis

- Mayor Johnson’s Budget Hikes Fees, Taxes In 2025, Maintains Services - Jeramey Jannene - Sep 24th, 2024

- New Milwaukee Sales Tax Collections Slow, But Comptroller Isn’t Panicking - Jeramey Jannene - Jun 28th, 2024

- Milwaukee’s Credit Rating Upgraded To A+ - Jeramey Jannene - May 13th, 2024

- City Hall: Sales Tax Helps Fire Department Add Paramedics, Fire Engine - Jeramey Jannene - Jan 8th, 2024

- New Study Analyzes Ways City, County Could Share Services, Save Money - Jeramey Jannene - Nov 17th, 2023

- New Third-Party Study Suggests How Milwaukee Could Save Millions - Jeramey Jannene - Nov 17th, 2023

- Murphy’s Law: How David Crowley Led on Sales Tax - Bruce Murphy - Aug 23rd, 2023

- MKE County: Supervisors Engage in the Great Sales Tax Debate - Graham Kilmer - Jul 28th, 2023

- MKE County: County Board Approves Sales Tax - Graham Kilmer - Jul 27th, 2023

- County Executive David Crowley Celebrates County Board Vote to Secure Fiscal Future and Preserve Critical Services for Most Vulnerable Residents - David Crowley - Jul 27th, 2023

Read more about Local Government Fiscal Crisis here

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.

- December 28, 2020 - Cavalier Johnson received $400 from Tim Sheehy

- September 17, 2019 - Cavalier Johnson received $100 from Evan Goyke

- December 13, 2018 - José G. Pérez received $50 from Mark Borkowski

- April 4, 2016 - Russell W. Stamper, II received $250 from Gerard Randall

- March 23, 2016 - José G. Pérez received $250 from Darryl Morin

- March 18, 2016 - Robert Bauman received $100 from Craig Mastantuono

- February 20, 2016 - Cavalier Johnson received $250 from Robert Bauman

- February 12, 2016 - Robert Bauman received $100 from Todd Farris

- January 7, 2016 - José G. Pérez received $50 from Marisabel Cabrera

- October 22, 2015 - Mark Borkowski received $400 from Gerard Randall

- July 20, 2015 - Russell W. Stamper, II received $50 from Evan Goyke

- May 7, 2015 - Nik Kovac received $100 from Todd Farris

- May 7, 2015 - Nik Kovac received $10 from Cavalier Johnson

- May 5, 2015 - José G. Pérez received $10 from Cavalier Johnson

- November 30, -0001 - José G. Pérez received $100 from Peggy Williams-Smith

- November 30, -0001 - José G. Pérez received $100 from Craig Mastantuono

City Hall

-

Council Blocked In Fight To Oversee Top City Officials

Dec 16th, 2025 by Jeramey Jannene

Dec 16th, 2025 by Jeramey Jannene

-

Latest Effort to Adopt New Milwaukee Flag Going Nowhere

Dec 3rd, 2025 by Jeramey Jannene

Dec 3rd, 2025 by Jeramey Jannene

-

After Deadly May Fire, Milwaukee Adds New Safety Requirements

Dec 2nd, 2025 by Jeramey Jannene

Dec 2nd, 2025 by Jeramey Jannene

Sue the bastards!