Ron Johnson Peddles Myths on Social Security

Republican U.S. Senator's push to 'save' it would actually destroy the program.

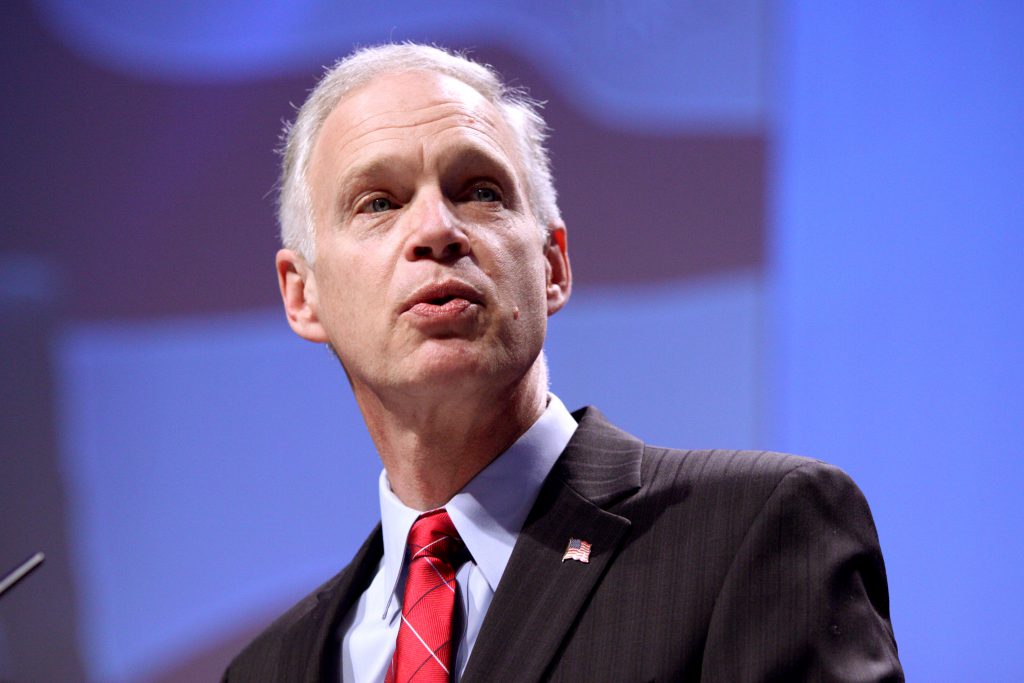

Ron Johnson. Photo by Gage Skidmore from Peoria, AZ, United States of America / Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0)

Sen. Ron Johnson is too slick for Wisconsin’s good.

This August he proposed moving Social Security Insurance (SSI) into the federal government’s discretionary budget. He claims this will help improve it. Here’s what it really means: Congress would have to authorize Social Security spending and its annual automatic cost-of-living increases each and every year!

Why would Johnson want to mess with our successful, 87-year-old social insurance program that provides most older Americans with the majority of their income? Well, Johnson offers two reasons, neither of which stands up to scrutiny.

First, every time he mentions Social Security, he rails against federal budget deficits as if SSI is contributing to them. Johnson’s hocus-pocus is a lie. By law, Social Security cannot contribute to the federal deficit because it is required to pay benefits only from its trust funds, which are financed by a dedicated payroll tax of 12.4% of income, split evenly between employees and employers, Rather than running a deficit, the trust had a reserve fund of $2.85 trillion at the end of 2021.

Conveniently left out of Johnson’s attempt to scapegoat Social Security for deficit spending is the fact that he has repeatedly voted to increase the very federal budget deficits he rails against.

These tax cuts provided almost nothing for you or us, but they handed huge tax breaks to the very wealthiest Americans and largest corporations. They helped Johnson personally as well as his largest campaign contributors, such as multi-gazillionaires Diane Hendricks and Richard Uihlein.

In fact, 83% of the Trump tax cuts Johnson voted for went to the richest 1% of the population, and, according to Forbes magazine, for the first time in American history the richest 400 Americans paid less taxes than any other group, including our poorest citizens. So, when deficits help Johnson and his wealthy backers, he’s more than fine with them. His real goal is to cut social spending, which is why he conflates deficits with SSI, and why he voted against providing veterans benefits to cover the servicemen and women burned in toxic burn pits early this year, only reversing his vote after a huge public outcry.

The other claim Johnson makes about making SSI “discretionary” is that his goal “is to save Social Security.” But this assertion relies on two myths that Johnson peddles, neither of which comes close to the truth.

Myth #1: Making SSI discretionary would “save” the program. This is an Orwellian claim. Rather than save, it would set SSI up for death by a thousand cuts. Here’s an example of real-life impact:

Sharon taught English at North Division High School in Milwaukee and later Milwaukee Area Technical College. She retired after muscular sclerosis made it impossible for her to work. Sharon is able to survive in dignity in a small, assisted-living apartment because of Social Security. Putting SSI on the annual budget chopping block would undermine Sharon’s modest but dignified retirement and sense of security. She and tens of millions like her would annually face the intense stress of fearing her housing, income, and health care could be ripped from her by Republicans holding SSI and Medicare hostage as a bargaining chip during congressional budget debates.

Myth #2: Social Security was “set up wrong” because it isn’t invested in the stock market, where it would earn much higher returns. In truth, your paycheck deductions go into a trust fund from which benefits are paid out to elderly and infirm citizens.

If Johnson was sincere about “saving Social Security,” he would simply raise the income ceiling on the Social Security tax. Currently, employees and employers contribute to SSI 6.2% on all taxable income up to $147,000. Simply lift that ceiling to $200,000 and, voila, the solvency issues begin to disappear.

Another possible approach would be to tax investment income. Right now, only wages are taxed. But Johnson would never vote for either of these because they would require the most privileged Americans to pay more.

Social Security works. It keeps 40% of the nation’s senior citizens and millions of citizens with disabilities out of poverty.

We need to make sure that millionaire politicians like Ron Johnson keep their hands off our successful old age insurance program. Expecting them to tell the truth would be asking too much.

Michael Rosen and Charlie Dee are retired MATC instructors, Rosen in Economics and Dee in American Studies. Both were long-time leaders of AFT Local 212, Rosen as president for 17 years, Dee as Executive VP for 14 years. Dee co-authored a history of the ’69 strike, “Forty Days That Forged a Union.”

Reprinted with permission of Wisconsin Examiner.

Op-Ed

-

Unlocking Milwaukee’s Potential Through Smart Zoning Reform

Jul 5th, 2024 by Ariam Kesete

Jul 5th, 2024 by Ariam Kesete

-

We Energies’ Natural Gas Plans Are A Mistake

Jun 28th, 2024 by John Imes

Jun 28th, 2024 by John Imes

-

Milwaukee Needs New Kind of School Board

Jun 26th, 2024 by Jordan Morales

Jun 26th, 2024 by Jordan Morales

Social Security IS NOT PART of the Federal Budget. It is a balanced program that provides more than Retirement Income to almost all of us. Today income exceeds payments to people the extra income is added to the SS Trust Fund.

It was added into the Federal Budget to make Military Spending seem to be taking less Tax dollars than the Military does. That happened in Johnson’s Viet Nam war. I do not know why the progressives have not pushed to separate it today. Would make the attacks by Johnson and the rest much more difficult.

In simple straight-forward terms, this piece explains Ron Johnson’s greed and racism. Every goal of his is designed to benefit and enrich the already enriched white population of the country.

blurondo, Johnson’s goal only favors the 400 richest Americans, the uber wealthy master caste. His policies hurt everyone else. Those hurt most are communities of color AND poor rural white communities. Johnson’s racist lies are intended to distract rural whites from joining with communities of color against Johnson’s greed and that of his wealthy donors.

SSI (“Supplemental Security Income”—a federal welfare program for low income people) is NOT the same as Social Security. I THINK this article is discussing Social Security and NOT SSI, but it is so badly worded that I can’t tell.

Yes there is a little confusion SSI is for “Disabled individuals” who have limited income and is paid out of the SS Trust pot SSD is for individuals who have worked and become disabled and that is paid out of the SS Trust pot as well.

From the Social Security Administration website:

“SSI is financed by general funds of the U.S. Treasury–personal income taxes, corporate and other taxes. Social Security taxes collected under the Federal Insurance Contributions Act (FICA) or the Self-Employment Contributions Act (SECA) do not fund the SSI program.” (Emphasis from the government website.)

https://www.ssa.gov/ssi/text-over-ussi.htm

Thanks for the info