5 Key Problems With Foxconn Contract

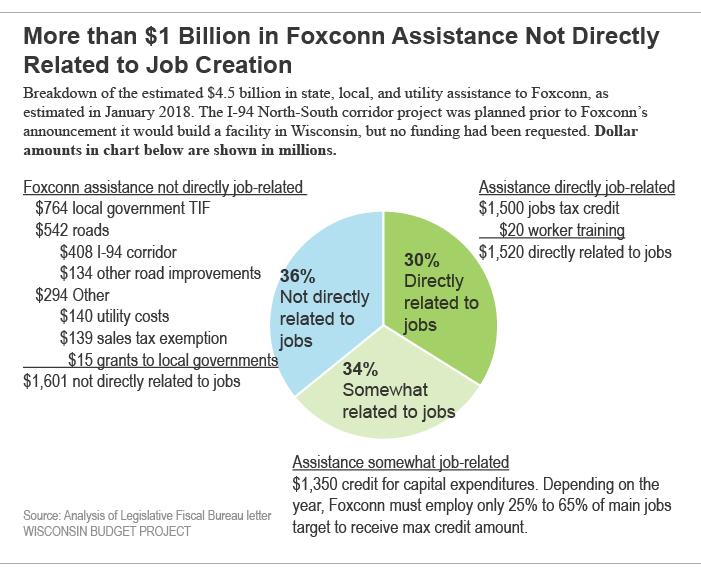

Company could create zero jobs and still benefit from $1.6 billion of the subsidy.

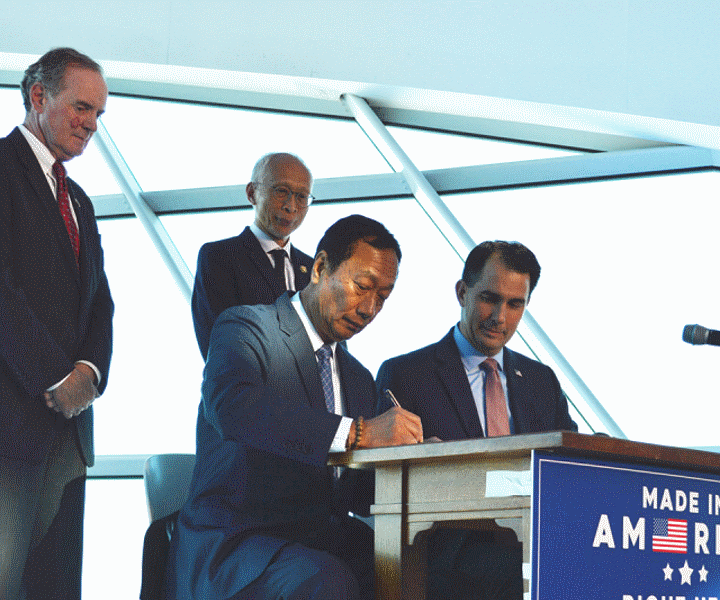

Foxconn chairman Terry Gou and Governor Scott Walker signing a memorandum of understanding. Photo from the State of Wisconsin.

Wisconsin policymakers have a vexing challenge this session: what should they do about the Incredible Shrinking Foxconn project? It’s especially a problem for Republican legislators because they not only approved the huge subsidies for Foxconn, but they also passed a bill during the lame duck session that gives themselves control of the Wisconsin Economic Development Corporation (WEDC) for the next couple of years. With that power comes increased responsibility for the difficult Foxconn situation.

Mounting evidence creates serious doubts that Foxconn will build a factory or other sort of enterprise in Racine County that comes anywhere close to the employment levels that Foxconn and the project’s backers promised. Some have suggested that the best thing for state taxpayers might be for Foxconn to pull the plug on the deal, but in light of the substantial public and private expenditures that have been made, efforts will presumably be made to keep the project alive.

As state and local policymakers and the general public consider the options, it’s important to understand the terms of the deal Wisconsin entered into with Foxconn. Here are five key issues to be aware of regarding the state’s contract with Foxconn:

1. An overlooked part of the current contract appears to make Foxconn ineligible for most of the capital investment tax credits because of changes in the project.

There has been almost no public discussion of the fact that the contract makes a large portion of the cash payments to Foxconn (i.e., the so-called investment “tax credits”) contingent upon building a Generation 10.5 LCD factory. Yet Foxconn first announced last June that that’s not what it plans to build. That decision appears to make Foxconn ineligible for the 15 percent tax credit for its expenditures for land and buildings.

Perhaps one reason that aspect of the contract has not gotten much attention is that insiders may have thought that WEDC would be willing to ignore it. (WEDC CEO Mark Hogan suggested just that, in comments made last August, claiming that “The contract also provides the company the flexibility to make the necessary business decisions to ensure the success of the project,” and indicating that he was not concerned that the company has changed its plans.) However, it will be harder to ignore the original contract, now that it appears that the revised plans will yield far smaller state and local benefits than what Foxconn originally promised.

2. Although parts of the contract protect state taxpayers by being based on performance, that isn’t true for a large portion of the subsidies.

Defenders of the Foxconn deal often claim that the contract protects state taxpayers because Foxconn won’t receive any credits if it doesn’t meet job thresholds. Although that claim is true in part, it’s also very misleading. More than a third of the planned subsidies — $1.6 billion — including the state and local infrastructure spending for the project, has little or no tie to job creation.

3. The state and local subsidies per job are much higher if Foxconn falls well short of the job creation targets.

Under the contract, Foxconn can get the maximum capital investment credits even if it falls well short of each year’s job target. For example, Foxconn can receive the maximum annual cash subsidy (“tax credit”) of nearly $193 million per year even if it employs only 520 people at the end of this year (25 percent of the target level) and 1,820 at the end of 2020 (which is just 35 percent of that year’s target of 5,200 jobs). Under that lower employment scenario, the job creation payments to Foxconn would be lower, but the investment subsidies are much less tied to the job levels.

In light of that factor, plus all the upfront subsidies that are independent of job creation, the total cost of state and local subsides will be much higher per job if Foxconn builds a smaller plant with fewer employees than initially promised. The huge subsidies for each job created are a concern for many reasons, including the fact that the revisions to Foxconn’s plans make it far less likely that project will have the purported employment benefits for blue collar workers and communities of color in southeast Wisconsin.

4. The contract may allow Foxconn to game the collection of payroll and capital expenditure tax credits.

There are several loopholes in the contract that could be detrimental for state taxpayers. For example, the contract calculates the number of Foxconn employees on the basis of employment at the end of the year, which is when the company hires seasonal workers at some of its factories. Doing so in Wisconsin could enable Foxconn to reach the triggers for both payroll and capital expenditure tax credits (which will actually be cash payments from the state) for the year. Since the contract bases eligibility for the tax credits on only the year-end snapshot of the payroll count, rather than an average payroll count through the year, Foxconn could deliberately inflate its payroll numbers at the end of each year to claim maximum credits for the year.

In addition, an audit showed that WEDC was willing to allow Foxconn to claim the payroll tax credits for people working outside Wisconsin. The audit recommended that WEDC modify its written procedures to require it to award tax credits only for the wages of employees who perform services in Wisconsin. Although WEDC recently said its board modified that policy, it has yet to make the change publicly accessible.

5. Foxconn has even more reason to renegotiate the contract than the state.

Both the state and Foxconn have strong reasons to want to renegotiate the contract, but Foxconn has the greater incentive to strike a new deal. First, it now appears very unlikely that Foxconn can hit the minimum job targets that it needs to reach to be eligible for the payroll tax credits. Second, the changes in the type of LCD factory seem to make Foxconn ineligible for most of the investment tax credits it was expecting over the next several years. If anyone is initiating an effort to strike a new deal, it should be Foxconn.

If Foxconn truly intends to go ahead with revised plans for the Mt. Pleasant facility, it will probably seek a new contract that helps it qualify for a larger portion of the nearly $3 billion of cash payments authorized by Governor Scott Walker and the legislature. Whether the state should agree to any changes of that nature is an open question because a better option might be to cut the state’s losses. On the other hand, renegotiating the contract could be an opportunity to close loopholes and change other contract terms to make it a less costly and less risky deal for state taxpayers.

But before we can have those deliberations, state policymakers need to acknowledge that some of the presumed economic benefits of the Foxconn project are now in doubt and that the current contract poses potential problems for both Foxconn and the state.

More about the Foxconn Facility

- Murphy’s Law: Total Cost of Foxconn Is Rising - Bruce Murphy - Dec 8th, 2025

- WEDC, Foxconn announce additional $569 million investment in Racine County - Wisconsin Economic Development Corporation - Nov 25th, 2025

- Foxconn Acquires 20 More Acres in Mount Pleasant, But For What? - Joe Schulz - Jan 7th, 2025

- Murphy’s Law: What Are Foxconn’s Employees Doing? - Bruce Murphy - Dec 17th, 2024

- With 1,114 Employees, Foxconn Earns $9 Million in Tax Credits - Joe Schulz - Dec 13th, 2024

- Mount Pleasant, Racine in Legal Battle Over Water After Foxconn Failure - Evan Casey - Sep 18th, 2024

- Biden Hails ‘Transformative’ Microsoft Project in Mount Pleasant - Sophie Bolich - May 8th, 2024

- Microsoft’s Wisconsin Data Center Now A $3.3 Billion Project - Jeramey Jannene - May 8th, 2024

- We Energies Will Spend $335 Million on Microsoft Development - Evan Casey - Mar 6th, 2024

- Foxconn Will Get State Subsidy For 2022 - Joe Schulz - Dec 11th, 2023

Read more about Foxconn Facility here

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock