The Lesson of Kimberly-Clark Layoffs

State gave huge tax giveaways to manufacturer, but company still laid off workers.

One of the Fox Valley’s largest employers has announced it is closing two Wisconsin plants and eliminating 600 jobs—but that won’t change its eligibility to claim a state tax credit that nearly eliminates the requirement for manufacturers to pay state income taxes. That’s because businesses can claim the credit even if they lay off workers, shutter factories, or ship jobs overseas.

The Manufacturing and Agriculture Credit costs the state an estimated $276 million this year in tax breaks for manufacturers and agricultural producers. That’s a lot of money. For example, that’s more than all the tuition and fees combined paid by students in Wisconsin’s technical college system.

For such a big tax break, you might think that the state would require a great deal of accountability on the part of manufacturers receiving the credit. But in fact, there is no requirement that businesses create even a single job to receive the credit. Kimberly-Clark’s announcement illustrates that allowing a corporation to get away with paying next to nothing in income taxes doesn’t mean that corporation will increase the number of workers it employs.

Nearly wiping out income taxes for manufacturers hasn’t done much to spur the growth of manufacturing jobs in Wisconsin. Wisconsin ranked 28th among the states in the rate of growth of manufacturing jobs between June 2016 and June 2017, based on the most current “gold standard” employment figures from the Quarterly Census of Employment and Wages. The number of manufacturing jobs in Wisconsin increased by only 0.8% during that period, compared to the national average of 1.1%.

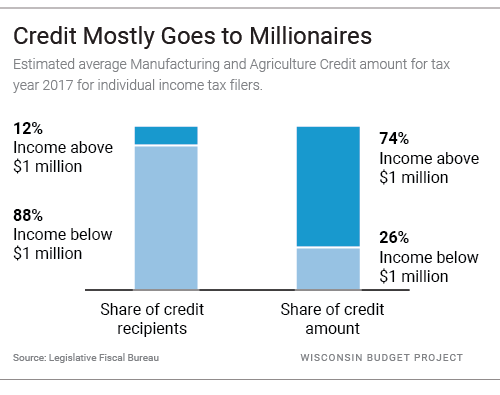

While the Manufacturing and Agriculture credit doesn’t do much to keep jobs in the state, it does serve another purpose: to line the pockets of the wealthy and well-connected who have rigged the system to their benefit. The credit is strongly slanted in favor of the very rich, to the point where millionaires take home nearly three-quarters of the portion of the credit that is claimed through the individual income tax, despite making up only 12% of the claimants (and a much smaller share of the total population). In fact, just 15 credit claimants—all with incomes of at least $30 million—received a combined tax break of $28 million from this credit. That averages out to a tax cut of a whopping $1.8 million each for these extremely wealthy claimants. These figures are based on the Legislative Fiscal Bureau’s analysis of the costs and distribution of this credit.

Now, Governor Walker and other state policymakers are saying that nearly wiping out the requirement for manufacturers to pay income taxes is not enough, and that Wisconsin should also publicly subsidize a portion of each job that Kimberly-Clark (and potentially other companies in the same situation) identifies as threatened.

Given the high cost of the Manufacturing and Agriculture credit, its failure to spur employment, and its extremely slanted nature, Wisconsin policymakers should be seeking to roll back the credit. Instead, Governor Walker and other lawmakers have proposed giving an even bigger break to Kimberly-Clark (and presumably other companies) by paying cash subsidies to maintain employment levels, similar to a portion of the incentive package that the state offered Foxconn.

After the Foxconn deal, it’s not surprising that legislators in the Fox Valley want Kimberly-Clark to get similar cash subsidies, on top of the state’s other tax credits. But the Foxconn deal was extraordinarily generous, and the state can’t afford to throw cash at every corporation that is cutting jobs or threatening job cuts. Doing so would make it more difficult for the state to make investments in its communities and families, and would hurt the state’s long-term economic competitiveness.

More about the Kimberly-Clark Plant Closings

- Op Ed: Growing Wealth Gap Hurts Wage Earners - Tamarine Cornelius - Jan 20th, 2019

- This Isn’t an Economic Development Strategy, This is an Extortion. - State Sen. Chris Larson - Dec 14th, 2018

- Kimberly-Clark to Keep Cold Spring Facility Open in Wisconsin - Gov. Scott Walker - Dec 13th, 2018

- Governor-elect Tony Evers Statement on Kimberly-Clark Announcement - Gov. Tony Evers - Dec 13th, 2018

- Kimberly-Clark Subsidy Stalled in Senate - Laurel White - Nov 28th, 2018

- Kimberly-Clark, Unions, Push for Subsidy - Laurel White - Nov 15th, 2018

- AFP-Wisconsin to Legislators: Reject Corporate Welfare - AFP Wisconsin - Nov 14th, 2018

- MacIver Institute Reminds Wisconsin Why Kimberly-Clark Bailout Is a Bad Idea - MacIver Institute - Nov 14th, 2018

- GOP Pushes Tax Giveaway Plan That Pays More for Fewer Jobs - One Wisconsin Now - Nov 14th, 2018

- Republican Opposition to Kimberly-Clark Bill Intensifies - Democratic Party of Wisconsin - Oct 4th, 2018

Read more about Kimberly-Clark Plant Closings here

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Let us talk loop holes. I have the ability to write off, property taxes, interest on my house, student loans, I can donate to the United Way. I get tax credits for child care and just having a child under 18 years of age. Are you going to criticize me if I get sick and can not work? Are you going to criticize an individual who collects unemployment benefits? Or if a worker falls from a $25 wage to a $15 dollar wage. Should we criticize Boston Store in Milwaukee when it closes up shop soon and collects welfare from the city of Milwaukee. Businesses sometimes loses to other competitors. Go pick on Amazon or better yet the failing government institutions who simply raise taxes when they fail.

Troll is aptly named. First, please familiarize yourself with H.R. 1 – our present tax bill. Second, The very point of the Walker ideology promotes is the rampant capitalism that kills Main Street and enslaves workers to monopolists, corporations and investors. Walker does this by making workers pay towards their own wages and pay privatized fees for things they thought their government used taxes to provide. Hugely, we are to also provide the expensive military for them to spread their rapacious capitalism throughout the world. Kimberly Clark is quite healthy financially. They just repatriated offshore profits (profits they should have paid taxes on for years) in the billions. The only sickness demonstrated here is greed. The people of Wisconsin deserve better from their public servants and the industries we allow to use our resources and workers.

I’m not sure what the comment above has to do with loop holes or this particular article pointing out that the Man&Ag Credit hasn’t done much for workers or the state.

Walker’s statement about giving them a deal like Foxconn to stay was a bluff anyway, just so he can say “I tried to save the jobs in the Fox Valley so vote for me”. It is a very dangerous bluff since other companies will call it and WI can’t afford to ‘buy’ jobs at the rate set by the conn deal.

Troll, the problem with your thinking is that you buy into the notion that corporations are persons. Even though, the Supreme Court says there are, does not make it true. Comparing your tax situation to Kimberly Clark doesn’t hold water. The problem with cutting taxes to encourage corporations to come to and remain operating in Wisconsin assumes that these decisions are made solely on the tax rate. In fact, the decision considers a plethora of factors including the quality of the schools in the area; the availability of an educated workforce, transportation to and from, the cost of healthcare as well as other factors. By not focusing on a broad range of factors, Walker has basically crippled economic growth in Wisconsin. Just look at the well-publicized search for an Amazon second headquarters. No site in Wisconsin was considered. Wisconsin simply does not have the total infrastructure Amazon is looking for. Our public schools are starved for money, our transportation system is stuck in the last century and our once world class college and university system is being picked apart by stronger and better funded state systems. And then there is our healthcare costs, which are some of the highest in the country. Why would any corporation saddle itself with those costs when locating in Minnesota (for example) are significantly less.

The Walker regime is practicing hammer and nail thinking, and we the people in Wisconsin suffer the consequence of his narrow thinking.

If you invested in Kimberly Clark the last ten years you have made about 2 percent a year. No one’s getting rich it is a dying company. Though, More than Obama,s billion in solar panels. Solyndra.

@Troll, Obama has nothing to do with Kimberly Clark layoffs nor anything to do with greasy Career Politician Scott Walker’s Wississippification of Wisconsin. Take your low wages, layoffs, political corruption, Confederate flags and Nascar highlights and take a hike.

Dump Walker 2018

Your right Terry it is horrible that government props up family supporting jobs like Kimberly Clark. Oh wait, all levels of government could use innovating technology to downsize 10 percent of the public workforce. No waiting twenty minutes to file a document at the Courthouse. I will miss the County employee in her jump suit .

@Troll, that gal in her “jumpsuit” is actually a member of the late great Dick Trickle’s pit crew. Your delusions are growing by the day. Hold it together son. For the sake of Wississippi…hold it together.

Dump Walker 2018

Right or wrong has nothing todo with anything it is competition for jobs in the country.

The 60’s saw Conservatives strongly opposed to any kind of incentives to business or labor. Then we started seeing our businesses go to the south, KC to Texas and many more so we had no choice but to give incentives.

Then we saw our companies going over seas for better labor and tax climate. Now we have to match that or see the country become just a bunch of Mcdonalds jobs.

There is no choice. We saw this under Doyle/Earl when the companies/jobs left.

We need our people to have jobs, fair trade deals and that is why they voted fro Trump. Jobs or welfare, our choice.

The left says food stamps and welfare, Conservatives say Jobs.

WCD,

“Conservatives say” paychecks so low, they “require food stamps and welfare.”

FIFY

“Without spending–there are no sales;

Without sales–there are no profits;

Without profits–there is no demand for workers;

Without demand for workers–there is no job creation;

and without job creation–there is no recovery!”

From economist @ptcherneva