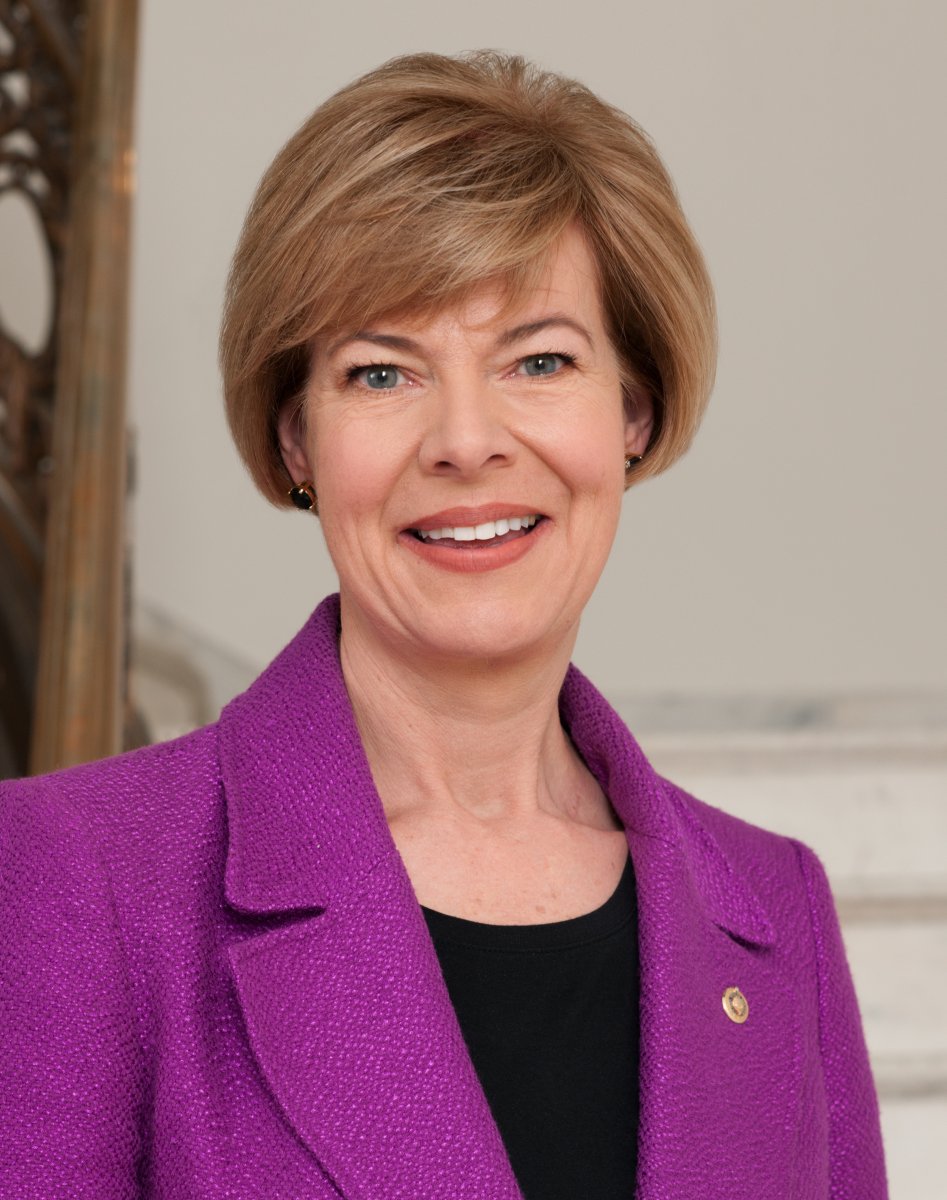

Baldwin Pushes to Provide Milwaukee Residents Tools to Compete Against Wealthy Out-of-State Investors in Housing Market

As of last year, out-of-state landlords owned over 7,000 single family homes in Milwaukee, up 50 percent since 2017 and 476 percent since 2005

WISCONSIN – Today, U.S. Senator Tammy Baldwin (D-WI) called on the Federal Home Loan Bank (FHLB) of Chicago to continue working with her office and Milwaukee affordable housing nonprofits to expand opportunities for Milwaukee residents to compete with wealthy, out-of-state investors for homes in Milwaukee neighborhoods. Senator Baldwin is asking the FHLB of Chicago to work with lenders in Milwaukee to provide unique and innovative financial products to first-time homebuyers or mission-oriented organizations that seek to compete with out-of-state investors for properties in their communities.

In November, the Federal Housing Finance Agency (FHFA), which oversees the FHLB System, concluded a year-long review of the System by releasing a report identifying that the Banks should be more active in addressing the affordable housing crisis. Senator Baldwin saw an opportunity for a new, innovative partnership between the FHLB of Chicago and affordable housing advocates, like Acts Housing and the Community Development Alliance, two organizations working to create a loan product for graduates of their homebuyer counseling programs to be able to compete with wealthy investors. By forging this partnership and creating a mortgage product for graduates of these community partners’ homebuyer counseling programs, more Wisconsinites can have a path towards homeownership.

As of last year, out-of-state landlords owned over 7,000 single family homes in Milwaukee, up 50 percent since 2017 and 476 percent since 2005. Typically, out-of-state investors rent their properties for well above what a homeowner would pay in monthly costs. According to an analysis by Marquette University and the Milwaukee Journal-Sentinel, out-of-state investors have almost exclusively targeted majority-Black neighborhoods in Milwaukee.

“We know that racial inequities in homeownership rates and lack of access to affordable housing are challenges in Milwaukee County,” said Milwaukee County Executive David Crowley. “Rather than wealthy, out-of-state investors buying up homes just to make a profit, we must work to put Milwaukee’s housing stock back into the hands of Milwaukeeans. I am grateful for the leadership and partnership of Senator Tammy Baldwin in working with our community to expand affordable housing options, boost homeownership rates among our communities of color, and help us advance racial and health equity in Milwaukee County.”

“Institutional purchases of single-family homes in Milwaukee coupled with mortgage rates that are at 20+ year highs have made homeownership increasingly out of reach for far too many families,” said Michael Gosman, President & CEO, Acts Housing. “This year Acts Housing has supported more than 300 families with low-to-moderate income to become first-time homebuyers, but our community compels us to do more. We are eager to work with all potential partners, including public and private sector stakeholders, to make sure exponentially more families in our region have a path towards sustainable homeownership. We are profoundly grateful to Senator Baldwin for elevating these issues for the benefit of hardworking families.”

Full text of the letter can be found here and below.

An online version of this release is available here.

Dear Mr. Ericson,

I write to you out of concern for the affordable housing crisis across the nation and in Wisconsin. Over the last year, the Federal Housing Finance Agency (FHFA) has conducted a review of the Federal Home Loan Bank (FHLB) System. On November 7, 2023, the FHFA released a report sharing its findings, FHLBank System at 100—Focusing on the Future. Over the coming months, as you work with the FHFA to implement the recommendations of the report, I encourage you to continue leading the way among the 11 regional Banks in offering innovative programs to address the affordable housing crisis facing so many areas of Wisconsin today. I am encouraged by the progress you have made working with my staff and housing leaders in Milwaukee to develop financial products to serve first time homebuyers who face barriers to accessing credit in markets increasingly dominated by large, out-of-state investors. I am hopeful that your efforts will bear fruit next year.

In Milwaukee, the affordable housing crisis has been exacerbated by out-of-state investors buying up single family homes. These investors are particularly attracted to urban centers hollowed out by the decline in manufacturing jobs, which provides buyers with ready access to cash the opportunity to buy many properties cheaply. As of last year, out-of-state landlords owned over 7,000 single family homes in Milwaukee, up 50 percent since 2017 and 476 percent since 2005. Out-of-state investors typically rent their properties for well above what a homeowner would pay in monthly costs. According to an analysis by Marquette University and the Milwaukee Journal-Sentinel, out-of-state investors have almost exclusively targeted majority-Black neighborhoods in Milwaukee.

While rental homes are an important part of meeting affordable housing needs, they should not come at the expense of first-time homebuyers looking to provide for their families, root themselves in a community, and build wealth. Unfortunately, the phenomenon in Milwaukee pits deep-pocketed and sophisticated investors against middle- and low-income families seeking homeownership. Homeownership is the most common way families build assets and wealth, yet homeownership rates have not recovered from the Great Recession, according to the 2020 Census. Black homeownership rates nationally are below the rate in 1968 when housing discrimination was first made illegal with the Fair Housing Act. In Wisconsin, Black homeownership rates have declined to 23 percent, the third-lowest in the nation.

The Community Development Alliance and Acts Housing are two organizations working to create a loan product for graduates of their homebuyer counseling programs, which are approved by the Department of Housing and Urban Development. These are prospective borrowers who—for any number of reasons—may not be eligible for traditional mortgage financing. The loans would be originated and serviced by Acts, which maintains the relationship with the borrower, but would be sold to banks in the region seeking credit from their regulators for lending within their communities under the Community Reinvestment Act (CRA).

The recently finalized Community Reinvestment Act (CRA) rule will increase the demand for exactly the kinds of loans that Acts and others in Milwaukee are looking to do. The rule will evaluate banks on their lending to low- and moderate-income borrowers, with special emphasis on smaller loans. Currently, Acts and other lenders are limited by their scale and the lack of access to a reliable secondary market, but with help from FHLB Chicago and its members, they could increase their scale to a level that could turn the tide in Milwaukee’s neighborhoods.

The FHFA report noted that the agency will soon begin “requiring the FHLBanks to establish mission-oriented collateral programs that could improve their support of safe, sustainable housing finance and community development products that lack a reliable secondary market outlet” (emphasis added). While the timeline for this requirement could be over a year away, I am encouraged that it so closely mirrors your efforts with my office and Acts Housing. I hope that you will take the FHFA’s proposed requirement as encouragement and not let an impending rule delay your efforts to spearhead the development of an innovative mortgage product and a reliable secondary market for its loans.

While I am greatly encouraged that you are working with FHFA to implement the recommendations of the report, I also recognize that solutions are needed now in Wisconsin. The lack of affordable housing is getting worse as interest rates are kept stubbornly high, pushing traditional mortgages out of reach for so many in our region. In closing, I want to offer my office as a resource to work with you, the FHFA, and the many mission-oriented lenders and affordable housing advocates in Wisconsin towards our shared goal. Together I believe we can increase access to affordable housing that would allow low- and moderate-income families to buy homes and begin living their American Dream.

Sincerely,

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by U.S. Sen. Tammy Baldwin

On 3rd Anniversary of Roe Being Overturned, Baldwin, Blumenthal, and Murray Lead Senate Dems in a Bill to Restore Abortion Access Nationwide

Jun 24th, 2025 by U.S. Sen. Tammy BaldwinWomen’s Health Protection Act comes as Trump and Congressional Republicans move to restrict a woman’s right to choose and toward a national abortion ban

Baldwin Joins Bipartisan Group Urging Trump Admin to Reverse Closure of Job Corps Centers

Jun 23rd, 2025 by U.S. Sen. Tammy BaldwinBaldwin has been outspoken advocate for Wisconsin’s Job Corps centers that help young Americans get career training and are a path to good-paying jobs

In fairness I skimmed this article because of it long winded nature to a very simple problem. Why not just restrict out of state (and country) home ownership? Living in MKE how do I benefit from CA residents buying up cheaper property in WI? Yes everyones house value theoretically goes up in price but it doesn’t reflect true housing supply and demand, it just reflects an economy based on investment above all other things. (And an economy where money influences all our politicians to not actually solve any problems. Why else would Tammy be so pro bombing of civilians?

Duanne, the problem isn’t so much out-of-state ownership as it is CORPORATE ownership. But banning out-of-state corporations won’t do much, because the same people would just establish a Wisconsin corporation to buy Wisconsin homes; they may already do this today.

Large landlords almost always set up a separate corporation for each property they own so that one property’s bankruptcy won’t impact their ownership of the others. Those corporations are usually chartered in the same state as the property. Where a corporation is chartered has nothing to do where its owners live or where it does business. A O Smith, for example, has been chartered in Delaware for decades.

Banning out-of-state INDIVIDUALS from buying Wisconsin homes would make people think twice about moving to Wisconsin because they would be required to rent first (to establish residency) before they would be permitted to buy.

This would especially be a problem for cities located on state boundaries (like Kenosha, Beloit, La Crosse, & Superior) because it would prohibit local people from moving into Wisconsin; for example a South Beloit (Illinois) resident would be prohibited BY LAW from buying and moving into a home two blocks away in Beloit (Wisconsin) without going going through the hassle & expense of moving twice (the first time into a Wisconsin rental) and then waiting to become legally a “Wisconsin resident” (by which time the house they wanted would surely be sold to somebody else).