The Battle Over ‘Astounding’ State Surplus

Now up to an 'unprecedented' $6.8 billion. But can Evers and Legislature agree on any plans to spend it?

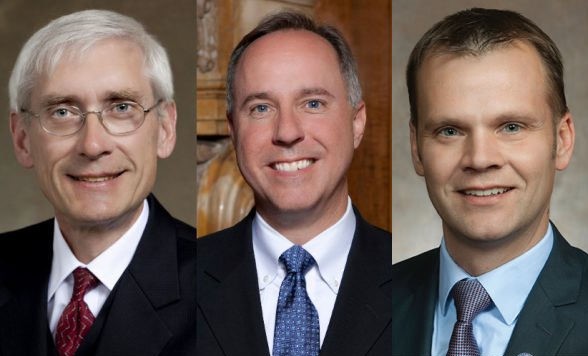

Tony Evers, Robin Vos, Devin LeMahieu.

This is a historic moment for Wisconsin.

A new report by the nonpartisan Wisconsin Policy Forum (WPF) entitled “The Astounding State Surplus,” has just upped the state surplus, previously estimated at $6.5 billion, to an even higher figure — of $6.8 billion.

Yet the budget surplus could have been even higher, had the Republican-controlled Legislature accepted federal dollars to expand Medicaid in Wisconsin for the last biennial budget. “Wisconsin would get $1.6 billion in federal funding over the next two years by expanding Medicaid to 138% of the poverty level, but the Wisconsin budget committee has continued to reject Medicaid expansion proposals, despite the financial benefits it would provide to the state,” as the watchdog group HealthInsurance.org noted.

Gov. Tony Evers had urged the Legislature to accept this money, to no avail, and his administration “is bringing back a past proposal to use available federal funds to expand the Medicaid program, which would provide an ongoing savings of $392.1 million in the 2023-25 budget and future ones as well as a one-time federal incentive of $1.16 billion over the next two years,” the WPF report noted. “If lawmakers cut the Medicaid expansion, as they have in previous years, then that would mean $1.55 billion less for the state general fund in the next budget.”

Which would be a huge loss for Wisconsin taxpayers and a reminder of how stark the disagreements between Evers and Republican legislators have been over the past four years. Will that change now that they have $6.8 billion in their pockets? Can they seize the moment and make historic improvements in this state?

The early signs are less than encouraging. Evers supports a big increase, of $2 billion in state funding for K-12 schools, but Assembly Speaker Robin Vos has countered that Republicans would support some increase but only if funding for school choice is expanded. Some Republicans back statewide universal vouchers. It’s hard to imagine Evers, a former teacher and state superintendent of schools, whose career has been dedicated to public schools, supporting this.

An additional issue for public schools is the increasing cost of special education which they are required by federal law to provide. The rate at which special education in Wisconsin’s public schools is funded by the state has drastically declined, from 70% in 1973 to about 30% by 2019, according to another report by the Wisconsin Policy Forum. The state Department of Public Instruction has submitted a budget request calling for the state to provide 45% of the funding for special education in the first year and 60% in the second year and continue increasing it to 90% by the 2026-27 budget year, as the Wisconsin Examiner has reported.

Republicans are also pushing a proposal to change the progressive state income tax to a flat tax, something the losing candidate for governor, Republican Tim Michels championed. Adding to the irony is that Wisconsin already has a flat tax system, when all state and local taxes (the progressive income tax and regressive sales and property taxes) are considered, as Urban Milwaukee’s Data Wonk has concluded. Nearly all taxpayers in the state (95%) pay about the same (10.1%-10.5% of their income) in state and local taxes with only the richest 5% paying less, about 8% of their income, the analysis by Bruce Thompson found. So if the goal is a flat tax system, the income tax rate for the top 5% should actually be increased. Instead Republicans want a flat income tax that will reduce the portion of that tax paid by the state’s wealthiest people.

Evers, by contrast, supports a 10% tax cut for “working families,” individuals making less than $100,000 per year, which would bring them closer to the lower percent in taxes paid by the top 5% of taxpayers and create a flatter total tax system in Wisconsin. But you can bet Republicans will insist the 10% is extended to the wealthiest taxpayers. There’s no issue Vos and LeMahieu have talked about more than tax cuts. Odds are they will load up the budget with this and dare Evers to veto it.

LeMahieu has talked about spending more on state roads, something Evers ran on in 2018 (“Let’s fix the damn roads!”) and included in past budgets, but Republicans opposed. That should be an area where some agreement can be reached, though there will be a tussle on where and how the money is spent.

LeMahieu has also talked about more funding for local government. As many stories by Urban Milwaukee have documented, state shared revenue to local governments has been declining in real dollars for 20 years, starving Milwaukee’s city and county governments. Evers has proposed a 4% increase in state shared revenue in each year of the biennial budget.

LeMahieu has also suggested the Legislative might need to allow local governments another taxing source aside from the property tax. Milwaukee officials have been pushing for a 1% sales tax for both the city and county.

In short, compromises won’t come easily.

“I don’t want to be sitting here in four years with $30 billion in surplus because we can’t give on any issues,” LeMahieu has said. Evers would agree. But they are very far apart on how to get there, and even further — veritable light years — from how Vos sees the future.

Murphy's Law

-

National Media Discovers Mayor Johnson

Jul 16th, 2024 by Bruce Murphy

Jul 16th, 2024 by Bruce Murphy

-

Milwaukee Arts Groups in Big Trouble

Jul 10th, 2024 by Bruce Murphy

Jul 10th, 2024 by Bruce Murphy

-

The Plague of Rising Health Care Costs

Jul 8th, 2024 by Bruce Murphy

Jul 8th, 2024 by Bruce Murphy

While you continue to beat a dead horse, Bruce, please don’t stop. Even the blind, deaf and biased Republicans of Wisconsin may someday see their pathetic ways and realize that supporting the common good is the only path to real and lasting political accomplishment.

I say more tax cuts for the rich.