$1.6 Billion of Foxconn Payout Won’t Create Jobs

And another $1.4 billion somewhat related to job creation.

Foxconn chairman Terry Gou and Governor Scott Walker signing a memorandum of understanding. Photo from the State of Wisconsin.

An updated calculation of the public assistance provided to Foxconn shows that the costs have risen as high as $4.5 billion when multiple forms of assistance from state government, local governments, and utilities are included. This letter from the Legislative Fiscal Bureau describes the various categories of Foxconn public assistance.

This comprehensive accounting of public costs allows us to more accurately identify how much each new job created by Foxconn will cost to taxpayers. With an eventual employment target of 13,000 jobs at Foxconn, the cost per job would be $344,000 ($4.5 billion cost divided by 13,000 jobs). Governor Scott Walker has said that the economic activity engaged in by Foxconn will indirectly create another 22,000 jobs outside of Foxconn. Adding those jobs into the calculation would change the cost to $128,000 per job ($4.5 billion cost divided by 35,000 jobs). However, these cost-per-job figures assume that Foxconn meets all employment goals; if Foxconn employs fewer than 13,000 workers, or if some of the 22,000 other jobs are outside Wisconsin, the cost per job will be higher.

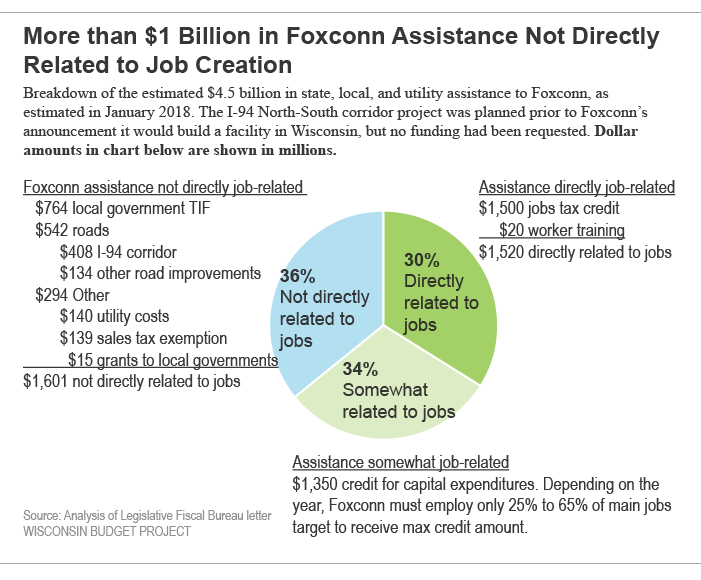

Proponents of the Foxconn deal have justified the large cost of the assistance package by pointing to the number of jobs the company could bring—but more than a third of the public assistance to Foxconn (36%) has no direct connection to job creation. That assistance, which totals $1.6 billion in coming years, includes:

- $764 million in tax increment financing (TIF), which will redirect local property taxes to pay for the debt service on capital costs associated with the Foxconn project.

- $542 million for roads, including $408 million in general state tax dollars for the I-94 North-South corridor. This improvement isn’t specific to the Foxconn development, but the Legislative Fiscal Bureau included it in the letter describing Foxconn costs because no money had been requested for the project prior to the Foxconn development. The state is also anticipated to pay for an additional $134 million of improvements to smaller roads associated with the Foxconn site.

- $294 million in other costs. That amount includes $140 million for the American Transmission Company to build a transmission line project to provide electrical power to the Foxconn factory. It also includes a $139 million sales tax exemption for materials used in the construction of the Foxconn facility, as well as $15 million in state grants to local governments for Foxconn costs.

Another 34% of the assistance to Foxconn, amounting to $1.4 billion, is somewhat related to job creation. This amount takes the form of payments to Foxconn to partially pay for construction and equipment costs of its factory. These payments to Foxconn are reduced if the company does not hit a specified percentage of the main jobs target, with the percentage ranging from 25% in 2019 to 65% in 2025. For example, although the company anticipates employing 13,000 workers by 2022, Foxconn could still receive the maximum capital investment payment for that year so long as it employed at least 5,200 workers (40% of 13,000). In addition, Foxconn would need to hit specified capital investment targets to receive the maximum investment credits.

The smallest portion of the assistance to Foxconn is the 30% that is directly related to job creation. This includes up to $1.5 billion in payments to Foxconn to defray payroll costs over the next fifteen years. It also includes $20 million for the state to provide grants for worker training.

Much of the state assistance will take the form of checks sent to Foxconn, rather than reducing Foxconn’s taxes. That’s because Wisconsin’s tax laws have a special tax break for manufacturers that allows them to pay nearly nothing in state income tax. Even without the assistance package, Foxconn would have next to no state income tax liability, so the credits for capital investment and employment would have little value unless they take the form of state money sent to Foxconn.

Wisconsin is putting billions of dollars of public money at stake on a single, enormous project. There is no way to know for sure at this point how many people Foxconn will employ or how long the factory will be operational. But what is clear, at this point, is that the $4.5 billion in public money that state and local governments are spending to benefit Foxconn represents resources that will not be available to invest in Wisconsin’s K-12 schools, university system, or communities.

More about the Foxconn Facility

- Foxconn Acquires 20 More Acres in Mount Pleasant, But For What? - Joe Schulz - Jan 7th, 2025

- Murphy’s Law: What Are Foxconn’s Employees Doing? - Bruce Murphy - Dec 17th, 2024

- With 1,114 Employees, Foxconn Earns $9 Million in Tax Credits - Joe Schulz - Dec 13th, 2024

- Mount Pleasant, Racine in Legal Battle Over Water After Foxconn Failure - Evan Casey - Sep 18th, 2024

- Biden Hails ‘Transformative’ Microsoft Project in Mount Pleasant - Sophie Bolich - May 8th, 2024

- Microsoft’s Wisconsin Data Center Now A $3.3 Billion Project - Jeramey Jannene - May 8th, 2024

- We Energies Will Spend $335 Million on Microsoft Development - Evan Casey - Mar 6th, 2024

- Foxconn Will Get State Subsidy For 2022 - Joe Schulz - Dec 11th, 2023

- Mount Pleasant Approves Microsoft Deal on Foxconn Land - Evan Casey - Nov 28th, 2023

- Mount Pleasant Deal With Microsoft Has No Public Subsidies - Evan Casey - Nov 14th, 2023

Read more about Foxconn Facility here

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Great reporting, many thanks.

Sarcasm.

What’s $1.6 billion among friends?

/s

Boondoggle! Walker Foxconned Wisconsin!

Enjoy your taxes going through the roof!

OK, I really don’t where to start with this hyperbole. But let’s start with the what is likely a political hack job that is the motivation for even drafting this article.

First off, none of the “other” ($1.6B) are payments to Foxconn but rather expenditures incurred by others to support the project (except for $100M, see below):

** I work in the electrical utility industry, so I can speak with credibility to the ATC costs. The $140M is already out-of-date. ATC announced earlier this week that after a more detailed design review the range has dropped to about $113M to $122M, typical of any capital project; a tighter cost estimate comes out once the particulars of the need and design are laid out. The ‘costs’ here are not going to be born by anyone by Foxconn, the rate payers of WI aren’t going to pay for these. The consumption of electricity by Foxconn will pay these costs back over time. This construction is not being made for the ‘general system’ in WI that would be paid for by all ratepayers. This has been totally misconstrued by the media as they just DON’T understand investment and cost basis in the electrical distribution system in this society. These costs are totally different than the utility relocation costs associated the downtown MKE streetcar system (which I totally support that great addition to MKE!) that the State ruled the City of MKE had to pay for, not the utility companies on behalf of all of their rate payers.

** For the expansion of I-94, if you haven’t driven the stretch between College Ave and Hwy 142 in Kenosha County, it’s the non-upgraded segment (where Foxconn’s campus is going to be located coincidentally) that was planned for when the North-South Freeway project was committed to (the rest of I-41/I-94 has already been upgraded). The stretch in question wasn’t done as planned for for budgetary reasons overall and was delayed long before Foxconn was on the radar. So spending the money now to complete an already planned upgrade is just a matter of reshuffling budgetary priorities by the State (And the Federal gov’t will pay for about 55% of that total anyways, just like they (which is actually “we” anyways) for any Interstate highway project regardless of why and when it’s done).

** The waived sales taxes on materials purchased specifically for the construction of the plant is a non-starter. Think logically on this (I know that can be tough for a jingo journalist), if Foxconn didn’t build this facility, there WOULD be NO purchases to tax, so giving Foxconn a 5.6% ‘break’ on NOT paying sales taxes that NO ONE would collect anyways is a smart sweetener to the deal. Those dollars were NEVER part of any budgetary projection by local / State gov’t and aren’t taking away from any other planned / needed expenses!

** For the $794M (granted that is a big number especially for local government units to take on, but they do have a financial backstop from the State) in TIF spending (land acquisition, utility relocations, water, sewer, new police and fire stations, etc including future interest costs on the amount borrowed through the bonding issue paying for these upfront costs). Foxconn pays this ALL back via the property taxes, granted over probably a 15 to 20 year time-frame, based on the (guaranteed) value of the buildings of their campus at $1.4B (below). This is how all TIF Districts work across WI and the country. And once the TIF is paid back, ALL property taxes paid by these buildings flows as a NET INCREASE into the budgets of these local governments. So future expenses of gov’t have additional revenues to work with, that’s a good thing!

Here’s a breakdown (source: https://www.constructionequipment.com/foxconn-wins-unanimous-approval-city-and-county-boards)

*** Under the agreement, Tax Incremental Financing (TIF) revenue, made possible through Foxconn’s $10 billion direct investment, Foxconn’s upfront cash investment of $60 million and special assessments, will fund all public improvements and development costs. Those costs include $168 million for land acquisition, $88.4 million for water infrastructure, $71.4 million for sewer and $11.5 million for road improvements.

In addition, the agreement offers Foxconn a $100 million development incentive over 10 years. In return, Foxconn has guaranteed that the TIF district will add $1.4 billion in value to the area by 2023 and has agreed to pay the difference in tax revenue should that valuation come up short.

The other road costs ~ $134M for local roads WOULD be directly related to the Foxconn campus and would NOT be spent absent this need. Those are the only direct costs that are not recouped by specific revenue streams paid for by Foxconn.

So, the BOTTOM LINE of new cash spent is an additional $134M, by the State of WI out of a granted “tight” road construction budget and a borrowed $794M by local governments on a $1.4B expansion (that’s just Foxconn’s buildings) of their property tax base vs minuscule property taxes on basically 2500 acres of farmland. Hmmmm …. tough choice there.

These are the FACTS – get them straight before publishing such an obviously inaccurate and inflammatory story.

In fact YOU ALL NEED to publish a RETRACTION and CLARIFICATION on this story or find yourself in court.

Chris Kuhl – Milwaukee