6 Trends Hurting State’s Workers

State’s shrinking middle class can’t be reversed unless these trends change.

Even as the state’s unemployment rate declines, Wisconsin workers face significant barriers to economic stability, according to a new look at the state’s labor market. Long-term stagnation in wages, a black/white economic disparity that is among the largest of any state, increasing levels of income inequality, a shrinking middle class, and limits on the ability to unionize are among the obstacles faced by Wisconsin workers, according to The State of Working Wisconsin 2017 by COWS.

Key findings of the report include:

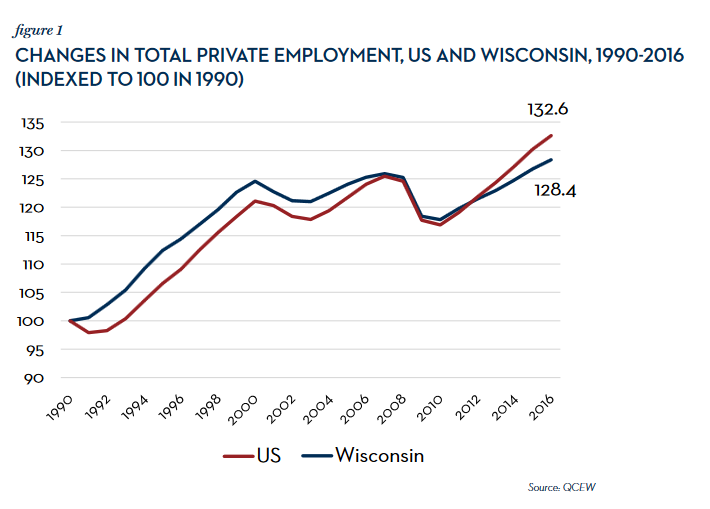

1. Wisconsin has fallen behind in job growth compared to other states. In 2016, Wisconsin had 128.4 jobs for every 100 jobs it had in 1990, compared to 132.6 jobs nationally. That gap is a relatively new occurrence, with the pace of job growth in Wisconsin exceeding the national average for the 1990s and the early part of the 2000s. During the recession, Wisconsin lost jobs at about the same rate as the national average.

It was after the recession that Wisconsin employment growth slowed compared to the national average. As noted in the report:

Wisconsin’s private sector job growth [between December 2010 and December 2016] ranks 34th. This means two-thirds of the states in the nation posted stronger growth over the same period. If Wisconsin’s private sector had added jobs at the national rate, the state would have added more than 300,000 jobs. Instead we added just 180,000 private sector jobs; the state is currently 120,000 jobs short of where we would be if we just grew at the national rate.

2. Wages for workers in Wisconsin and other states have been stagnant. According to the report:

Taking inflation into account, the wage of Wisconsin median worker is 92¢per hour more today than it was in 1979. That’s very slow wage growth – an annual raise of less than 3¢ per hour…Unlike the data on jobs, where Wisconsin’s story is markedly worse than the national trends, the wage data is more or less in line with the national picture.

3. Economic opportunities are limited by race. Even as Wisconsin’s overall unemployment rate has dropped to very low levels, the state’s African American unemployment rate remains high — higher than the state’s overall unemployment rate in the worst months of the recession, in fact. At an unemployment rate of 11%, African American workers seeking jobs are facing an unemployment rate nearly three times as large as the white unemployment rate in the state.

It’s not just adults who face limits on opportunity based on their race. The poverty rate for black children in Wisconsin is nearly four times as high as the poverty rate for white children, a gap that is the third largest in the country.

4. The income gap between the rich and poor is at a near-record level. The wide chasm between the very highest earners and everyone else in Wisconsin poses hardships for families, communities and businesses. In Wisconsin, 1 out of every 6 dollars of income winds up in the pockets of the top 1% of earners, a share that has more than doubled since the 1970s. Between 1979 and 2014, the average income of the top 1% in Wisconsin grew over 130%, while the average income of the remaining 99% grew by only 9%. For more about income inequality in Wisconsin, read Pulling Apart 2017: Focus on Wisconsin’s 1%, August 8, 2017.

6. Declining rates of unionization go hand-in-hand with a declining middle class. The share of Wisconsin workers with union membership has declined sharply in recent years, especially since 2011 when lawmakers passed Act 10, limiting collective bargaining rights for public sector workers. The report notes that “unions have played a critical role in Wisconsin’s economic history, helping secure better wages and working conditions for their members and for workers throughout the state.” Unionized workers earn more in wages and other compensation than non-union workers who are otherwise the same, and the higher wages help push additional households into the middle class. Union workers are also better off than their counterparts with regards to health insurance, retirement, and paid time off. The decline in union coverage weakens forces that help build the middle class.

Some Wisconsin lawmakers have championed tax cuts for corporations and the wealthy, limits on the ability to unionize, and rollbacks of rules protecting Wisconsin’s air, water, and land as measures that would boost employment in the states. But as the report notes,

Notably, there is no evidence that any of the economic reforms of the last six years have changed the trajectory for the state. Job growth lags, wages are stagnant, inequality is growing. Wisconsin has fallen off national pace on job growth, in spite of the reforms. Wages remain stagnant and inequality is growing in step with national trends, in spite of the reforms. The one place where economic policy has clearly changed the state and moved it away from national trends is in union coverage. Act 10 did not speed up our job growth, but it decimated unions in the state.

For more on the challenges facing Wisconsin workers, read The State of Working Wisconsin 2017 by COWS.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Another George Soros funded story.. It is good to see his Billions being put to use. No comparisons to Illinois I see. (Wisconsin is doing better).

No comparisons to Minnesota I see. (Wisconsin is doing worse). And once again Troll goes with ad hominem and says nothing about the content itself. Troll On!

Vince, last I looked Minnesota has an underfunded state pension and Obamacare rates that have gone through the roof.. Scott Walker has protect state pensions and Obamacare here is expensive but not Minnesota expensive.

Heaven’s to Betsy. You miss the point entirely. I mean entirely. You are a good Troll but not a smart man.

What I find interesting is how shallow people understand IL’s total fiscal & tax picture. The proposed tax hikes in IL that some say will drive all these residents/businesses to WI… even after those IL tax hikes go into effect, their rates will still be LOWER than WI.

Wow, makes you wonder where all our money is going? Paying double the price for half the work to Republican contributors, that’s where.

Even with healthcare, you make the same wrong assumptions, WI’s Obamacare rates have been documented to be much higher than MN. It’s interesting that you’re “misinformed” when it furthers your argument.

http://www.citizenactionwi.org/report_mn_wi

Key Findings

Wisconsin health insurance exchange premiums for single coverage will be on average 79% to 99% higher than premiums in Minnesota, before tax credits are applied. That is a difference of over $1,800 a year.

The health insurance cost differential will be even worse for some major Wisconsin cities. Rates in La Crosse are 136% higher than the Minnesota average, rates in Eau Claire are 116% higher, and rates in Milwaukee are 112% higher.