More Bad News on State Budget

Due to lagging tax collections, meager state and UW reserves, sluggish economy.

Governor Walker greets people outside of the Rhinelander Area Chamber of Commerce during the “Working for Wisconsin” tour. 7/2/13. Photo taken July 2nd, 2013. Photo from the State of Wisconsin

New state revenue estimates are due to come out next week, and we should probably brace ourselves for bad news. A number of signs suggest that the revenue projections to be released next week by the Legislative Fiscal Bureau (LFB) will be reduced for both the current fiscal year and the 2017-19 budget.

A new report by the Wisconsin Budget Project examines the recent trends that point to ongoing economic and budget challenges. On the plus side, the report explains that the likely downturn in revenue projections will probably be partially offset by lower-than-expected Medicaid spending, but not by enough to keep a drop in tax revenue from exacerbating the state’s budget challenges.

The warning signs suggest that it will be difficult to find the funding for many of the spending initiatives and tax cutting proposals that the Governor and other lawmakers have suggested. If our fears are confirmed next week, state budget writers are going to have to choose between a controversial set of options: making deeper spending cuts, increasing borrowing, raising taxes, or closing tax loopholes.

The following are some of the factors that are likely to make it more challenging to balance the next budget:

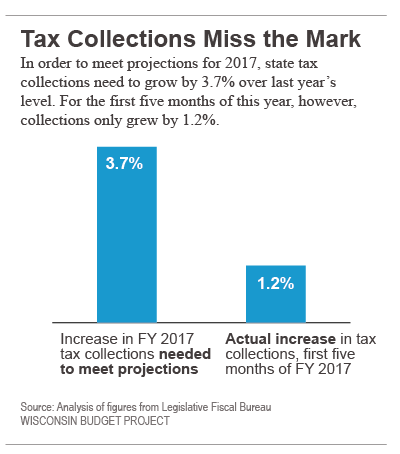

State tax collections lag – Tax revenue fell $78 million short of the projected amount in the 2015-16 fiscal year, and that trend seems to be continuing. Tax collections grew by only 1.2 % during the first five months of this fiscal year, which is far short of what is needed to keep this year’s budget in balance. Although lower-than-anticipated growth in Medicaid spending could help keep this year’s budget in the black, the slow revenue growth in recent months suggests that there is likely to be a downward revision in the revenue projections for the upcoming biennial budget.

Transportation Fund shortfall approaches $1 billion – The recent Transportation Solvency Study by the state Department of Transportation found that even after efficiencies and savings, the state’s transportation funding needs exceed available revenues by an estimated $939 million for the next biennium. Opposition to increasing the gas tax and transportation-related fees may cause policymakers to once again increase bonding – even though debt service is already 20 percent of the DOT budget – or to siphon more revenue for transportation from the General Fund.

UW System balances decline sharply — The last two biennial budget bills have compelled UW System campuses to spend down their “unrestricted” funds to dangerous levels. For the 2015-16 fiscal year, reserves and discretionary funds were merely 2.4% — or only about one-tenth the amount recommended by the National Association of College and University Business Officers. The sharp drop in their reserves severely limits their capacity to absorb additional budget freezes or cuts.

Demographic and workforce trends hamper state budget health – One of the key factors holding back state revenue growth is that the state economy has been growing much more slowly than expected. Although Wisconsin enjoys an unemployment rate of just 4.1%, our state’s job growth has lagged well below the national average. The Budget Project report explains that the low jobless rate at a time of lackluster job growth stems from a combination of factors, including little population growth, an aging populace, and a declining labor force participation rate.

Although there have been a few bright spots one can point to, most indicators of economic and fiscal health suggest that the new revenue estimates will be revised downward from the projections released in November. If that’s the case, it will be one more reason why state lawmakers should close some tax loopholes to generate the revenue needed for investments in critical areas like education that are essential for Wisconsin’s future economic health.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

UW- financial Reserves being cut to the bone. LOL… It seems some of our state colleges have enough money laying around to finance a new hotel in Oshkosh. Why is it that UW-Oskosh is being involved in a law suit to collect $11 million dollars doled out to special interests related to the university?

@Jason…you mean this project? http://www.uwosh.edu/today/16905/downtown-oshkosh-hotel-officially-under-new-ownership/

The one which “no state or tuition dollars are involved in the hotel project’s financing”? Looks more like a good private/semi-public partnership. The kind that conservatives scream for.

Didn’t catch all that? Oh, that would involve reading.

@SteveM…You have to go easy on Jason. He did read, it’s just that he read it on Breitbart “News”

Legalize, tax and regulate cannabis so we can keep it away from kids, unlike now, and use the 90-100 million annually in new tax revenue to help pay for all these massive budget shortfalls. Write your representatives, they are starting to listen, even Republicand like Speaker Vos are coming around. Responsible adult use should be tolerated. It’s not a left or right thing, it’s a basic civil rights issue. Prohibiton does not work. Let’s support personal liberty and responsibility vs big government nanny state intrusion. Free markets vs black markets. Let’s expand freedom and embrace fiscal responsibilty all while collcting enough tax revenue to actually be able to pay our bills for once. Legalize it Wisconsin. Write your reps!

Why is this story still posted? The projections were released the same day it was published and they show huge increases in tax revenue (~$450 million).

You obviously don’t mind lying to people, but I would think that embarrassment would motivate you to bury this trash.