Tax Gimmick Would Have Little Benefit

Gov. Walker's back-to-school sales tax holiday comes with a $11 million a year price tag.

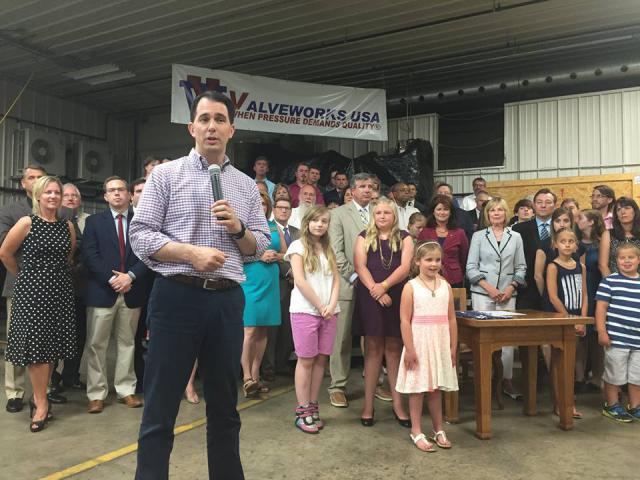

Governor Scott Walker signs the 2015-17 State Budget into law at Valveworks USA in Waukesha. Photo from the State of Wisconsin.

Governor Walker has said he will include a back-to-school sales tax holiday in his proposed budget, a gimmick that would reduce the resources available to support Wisconsin’s schools, university system, and communities, without providing any real economic benefit.

The sales tax holiday would exempt purchases of school supplies, computers, and clothing from the sales tax for two days in August 2017 and again in August 2018. That change would cost the state an estimated $11 million a year in lost tax revenue.

A sales tax holiday would do little to boost consumer spending or give a tax break to Wisconsin families with low incomes. There are a whole host of downsides to a sales tax holiday, including:

- Instead of encouraging consumers to spend more money, sales tax holidays simply shift the timing of the spending;

- A sales tax holiday on back-to-school items involves lawmakers picking winners and losers among types of goods that are exempt from the sales tax; and

- Sales tax holidays are not an effective tool for giving a tax cut to individuals with low incomes, since a large amount of savings is given to people in higher income groups as well. In fact, wealthier families are often better positioned to take advantage of the tax break because they can more easily shift the timing of their purchases – an option that is more difficult for families living paycheck to paycheck.

Governor Walker’s proposal comes at a time when voters are making it clear they want more resources for schools rather than less. Voters are much more likely now to approve school district requests for exceeding state-imposed spending caps than they were a few years ago, even as the number of requests has increased. By reducing resources available for education or other important public services, the proposed sales tax holiday flies in the face of what voters have been expressing when they approve school referendums.

Lawmakers who want to boost public education and who value prudent management of the state’s finances should steer clear of a sales tax holiday. This proposal provides no clear benefit to Wisconsin families and students, instead making it harder for Wisconsin to support public schools.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

We are always told that sales taxes are the ‘most regressive’ taxes by The Left, because they are paid equally by everyone, regardless of income level; an example of a non-progressive tax. Now giving someone a break on sales taxes all of a sudden benefits the wealthy to a greater degree?

I’m aware the Wisconsin Budget Project probably isn’t loaded with budget analysts used to doing differential equations in their spare time, but the slightest hint of internal consistency would be nice.

After reading the article, it doesn’t say anything about sales taxes not being regressive, or that the holiday wouldn’t benefit lower income families. All it says is that they will likely have more difficulty in taking advantage of it compared to wealthier families.

WashCoRepub, this tax-cut is indeed targeted to the better-off (and away from the poor).

The biggest piece of this is computers, and the poor don’t buy new $2,000 computers, and—even if they have an old computer—don’t have extra cash to stock on printer ink, toner, or paper. (The GOP’s failed 2015 tax holiday legislation would have exempted all these things, even certain iPods up to $250 each.)

Hi Scott. So good to see you’re coming up out of your hidey-hole since your last disaster. I wonder if this is in some way connected to your lousy poll numbers? You’re so honest and incorruptible it makes me proud to be a Wisconsin citizen.