The Decline of Reaganism

The Church of the Gipper is defied by Donald Trump. Will Republicans adjust their ideology?

Donald Trump’s surprising success in winning the Republican nomination for president has blown up what might be called the Church of the Gipper. Thoughtful conservatives will seize this opportunity to rethink how they can become more relevant to solving the challenges of 2016. It also offers a warning for the left: don’t fall in love with your solutions.

Rhetorically, Ronald Reagan’s presidency offered conservatives a feast: “The most terrifying words in the English language are: I’m from the government and I’m here to help.” Or this, from his 1st inaugural: “government is not the solution to our problem; government is the problem.

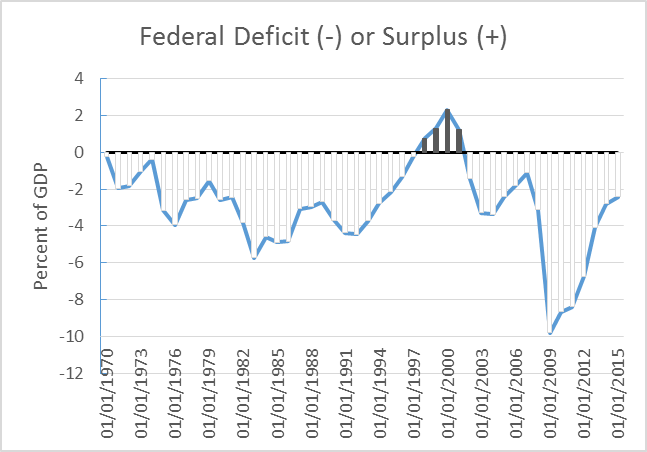

The record of the Reagan administration fell short of his anti-government rhetoric. The next graph shows the federal deficit (below the zero line) or surplus (above the line) since 1970. In the years right after Reagan succeeded Jimmy Carter, in 1981, the deficit about doubled before declining.

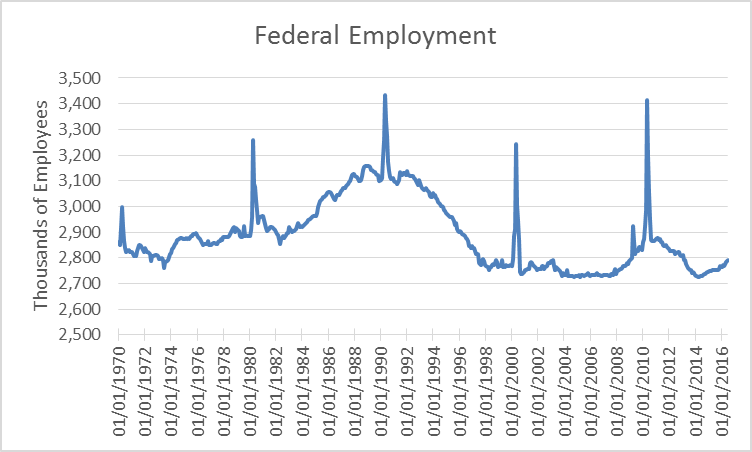

The next chart shows federal employment since 1970. Again, the record does not support the government-cutting myth. During the 1980s federal employment grew, only to shrink during the Clinton years. These results don’t tell the whole story because they don’t incorporate the growing use of contractors. (The spikes every ten years are explained by hiring for the census.)

In an article written as the Reagan administration wound down, the conservative economist Murray Rothbard summarized his disappointment with Reaganomics. He pointed not only to increased deficits and government spending, but also higher taxes. He argued that the most conspicuous examples of deregulation “were all launched by the Carter administration, and completed just in time for the Reagan administration to claim the credit.” The Reagan administration’s foreign economic policy, according to Rothbart, “has been the exact opposite of its proclaimed devotion to free trade and free markets.”

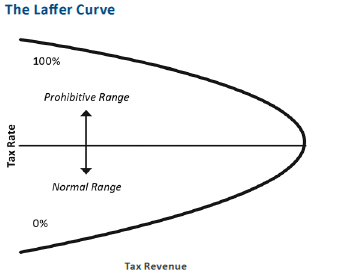

As time passed, the myth of the Reagan administration congealed into a cult-like set of beliefs. A key belief of the Church of the Gipper was “supply side economics,” as it was often called, whose most dramatic claim was that tax reductions would pay for themselves by generating more economic activity. This concept was summarized in the Laffer curve, shown below.

Although an ongoing survey of economists at major research universities found none who believed that tax reductions paid for themselves, this theory was widely adopted by politicians on the right, including George W. Bush and Dick Cheney, who claimed the Bush tax cuts had paid for themselves. It was the ultimate free lunch: lower tax rates to increase revenues.

Today, two main claims are made for cutting taxes, particularly taxes on the wealthy. The first is that, even if the cut does not pay for itself, it brings prosperity. The second is that the resulting cut in government promotes freedom. In this column I look at the first claim; a future article will examine the relation between freedom and government spending.

The prosperity argument underlies Rich States Poor States, a report published annually by the American Legislative Exchange Council (ALEC). The principal author is Arthur Laffer, who served on President Reagan’s Economic Policy Advisory Board. One of the founders of supply side economic, he invented the Laffer curve.

ALEC is very influential with Wisconsin Republican lawmakers, from the governor on down. As GOP state Sen. Leah Vukmir, Assistant Majority Leader in the Wisconsin Senate and 2016 ALEC National Chairman, comments, “State policymakers across America depend on Rich States, Poor States to provide an annual report on their current standing in economic competitiveness.”

The 2016 report lists 15 factors used to judge states. Half relate to taxes, both tax levels and their impact on wealthy people. Other factors include the number of public employees (bad) and right-to-work laws (good).

A few of their points might find agreement among some liberals if their tone weren’t so truculent. Examples include opposition to underfunding public employee pensions and to using tax expenditures to attract companies.

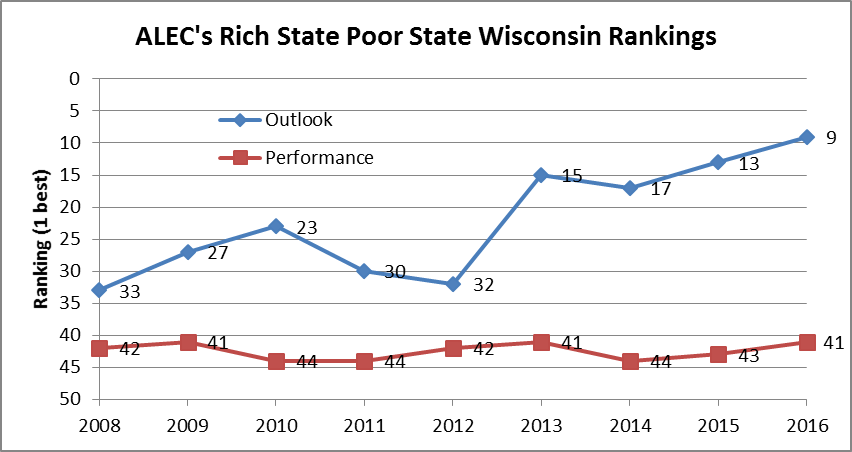

Under Gov. Scott Walker, Wisconsin closely followed the Rich States prescription. The state was rewarded by continual improvement in its standing. As the next graph shows, ALEC ranked Wisconsin as low as 33rd under Governor Jim Doyle based on state policies (called “Outlook”). The most recent report promotes Wisconsin to ninth place on policies.

Unfortunately, the policies promoted by ALEC have not generated a comparable improvement in the state’s economic performance. Over the past nine years Wisconsin has been stuck between 41st and 44th place among the states.

Since Reagan’s time, the Church of the Gipper has become more and more rigid ideologically, focused on punishing heretics. A major enforcement tool has been the Tax Pledge pushed by Grover Norquist and his Americans for Tax Reform. Candidates for public office are to pledge to:

ONE, oppose any and all efforts to increase the marginal income tax rates for individuals and/or businesses; and

TWO, oppose any net reduction or elimination of deductions and credits, unless matched dollar for dollar by further reducing tax rates.

In the words of the organization’s web site, “Since its rollout with the endorsement of President Reagan in 1986, the pledge has become practically required for Republicans seeking office, and is a necessity for Democrats running in Republican districts.”

Another prominent enforcer of Reaganomics is the Club for Growth. It is particularly well-known for running opponents in Republican primaries against GOP office holders who stray from the prescribed path. Although part of the Republican establishment, Club for Growth positions itself as an outsider in its quest to rid the Republican party of moderates. As its web site says, “The GOP establishment is scared. They’re scared of Club for Growth members like you.”

When Trump emerged as the leading Republican candidate for US President, the Club for Growth announced it was spending $2 million in Florida, $2 million in Illinois and Missouri, and millions more in other states on anti-Trump ads. The ads accused Trump of being a liberal, pointing to his support for single-payer healthcare, tax hikes on hedge fund managers, and his threatening new tariffs that would to shut out foreign products. The primary voters went ahead and chose Trump as their candidate.

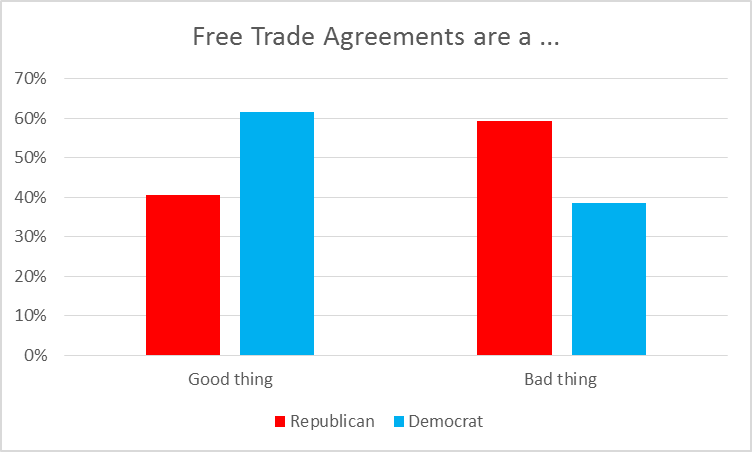

Today free trade actually gets more support from Democratic voters than Republicans. Here are the results from the Marquette Law School poll of Wisconsin voters. It asked whether free trade agreements in general are a good thing or a bad thing.

The rise of Donald Trump has come as a shock to many people. For most the shock was that someone so unprepared to be president could get so close.

For believers in the Church of the Gipper, there was a second shock, to learn how shallow was the support for Reaganomics among the party’s base. It was as if a conventional church had discovered its most active members were atheists.

An Ideology tends to go through an evolution. It often starts by identifying a problem and then suggesting a solution to that problem. At some point the solution takes over. Rather than test the solution against the problem, the emphasis shifts to protecting the solution from its critics.

The Trump ascendance offers an opportunity for Republicans and conservatives to rethink the tightening limits on their thinking. The tax pledge, for instance, effectively rules out the most efficient solutions to many of our challenges. For example, a market solution like a carbon tax or an exchange in carbon rights is the most efficient way to address climate change. By ruling out the best solution, Republicans are driven to deny that climate change exists. This also explains why the Republican alternative to Obamacare has been repeatedly promised over the past eight years, but never delivered.

For Democrats, particularly those Bruce Murphy calls the “Uber Liberals,” who seem more interested in purging Democrats who disagree with them than expanding the franchise, this is a cautionary tale. In the long run, to insist that everyone agree does not lead to a healthy political party.

Data Wonk

-

Scott Walker’s Misleading Use of Job Data

Apr 3rd, 2024 by Bruce Thompson

Apr 3rd, 2024 by Bruce Thompson

-

How Partisan Divide on Education Hurts State

Mar 27th, 2024 by Bruce Thompson

Mar 27th, 2024 by Bruce Thompson

-

Will Wisconsin Supreme Court Legalize Absentee Ballot Boxes?

Mar 20th, 2024 by Bruce Thompson

Mar 20th, 2024 by Bruce Thompson

Just commenting so I can follow the great comments soon to come.

Casey, I’ve wished UM allowed people to follow an article (get e-mails when somebody posts in the future) even though there is nothing I wish to respond to right now.

If you look at the deficit chart it is clear that the Bush Tax cuts did not pay for themselves but brought on a deficit. The Norquist “Tax Pledge” sounds nice, no new taxes forever, but in our real world has only brought us debt and more debt. As stated Government was not shrunk and cuts never matched revenue needs, thus DEBT is what we get from this rather idiotic pledge.

My political satire, entitled “Taking the Tea Party Republican Tax Pledge”, is on YouTube. Here is the link http://www.youtube.com/watch?v=Rfk6eVoUGPM

Do the federal employment figures include the military?

And is there a direct correlation between the # of federal employees and the perception of it’s overall effectiveness or lack of same?

I’m just not sure that equating that # with effectiveness can be used to make assumptions.

Also, how much of the deficit under Reagan was due to increased military spending?

And where are the facts to back up the implication in the article that lower taxes do not increase revenue?

All that is pointed to is the deficit, which in my opinion is a result of ever increasing spending (fault of both parties), not lower tax rates.

Numbers don’t lie. According to the Office of Personnel Management, Reagan did increase the size of government. The irony, it took a Democrat to significantly reduce it. Clinton reduced by 424,000 the number of civilian government employees as compared to the number given for Reagan’s final year.

https://www.opm.gov/policy-data-oversight/data-analysis-documentation/federal-employment-reports/historical-tables/total-government-employment-since-1962/