The City Milwaukee Wins National Praise for the Management of its Pension System

Mayor Barrett Congratulates Fellow City Leaders for the Honor

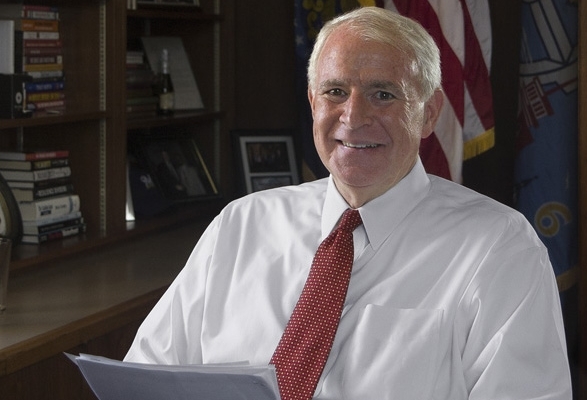

Milwaukee—Milwaukee Mayor Tom Barrett today congratulated members of the Milwaukee Common Council and other elected and appointed city officials for the recognition the city received for the management of its pension obligations.

The Pew Charitable Trusts, in a study released this week, noted Milwaukee has met its pension obligations in a sustainable and affordable way. David Draine, senior researcher at the Pew Center on the States, says this approach benefits both taxpayers and employees.

“Having studied 61 cities and the 50 states, the better-funded plans all share one characteristic; they have the discipline to pay their annual pension bills,” Draine said.

Mayor Barrett noted the leadership of Alderman Michael Murphy who has been instrumental in making certain the city has taken appropriate steps to maintain the pension fund’s strength.

“Our annual city budgets take our pension obligations seriously. We have responsibly addressed the annual funding needs of the pension system; we have made changes to the system by requiring that newly hired employees make additional contributions to their pensions; and, the pension board has carefully managed the assets in the pension fund,” Mayor Barrett said. “None of these steps were easy, but they all reflect responsible actions on the part of city leaders.”

The Pew study, which examined pension funds in all cities with a population of more than 500,000 and funds in the largest city in each state, found a shortfall of approximately $217-billion in the funds of those 61 cities. The study notes “wide disparities … in how prepared cities are to fulfill their pension obligations.” It says,

- Milwaukee and Washington, D.C., had surpluses at the end of fiscal year 2009, with enough money to cover 113 percent and 104 percent, respectively, of their liabilities, better than the best-funded state, New York, at 101 percent. [iv]

- In four cities—Charleston; Omaha; Portland, Oregon; and Providence, Rhode Island—pension systems were more poorly funded than those in Illinois, which at 51 percent was the lowest-funded state. [v]

- Charleston trailed all the other cities at 24 percent.[vi]

- Overall, the cities had enough money to cover 74 percent of their pension obligations in fiscal year 2009, compared with 78 percent for states.[vii]

The study from the Pew Center on the States is available at: http://www.pewstates.org/research/reports/a-widening-gap-in-cities-85899442341?p=1

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.