October Home Sales Up 6.2%

Market Highlights: Sales Up Despite Low Inventory, Listing Drought Continues, Fed Tax Bill Will Impact Housing

November 10, 2017 – Home sales were up 6.2% in October in the Metropolitan Milwaukee market rebounding from a 1.1% decline in September.

The increase in sales is surprising because, for most of the year, the market has lacked enough homes in the “sweet spot,” under $300,000. However, in October, 76% of the homes sold were under $300,000, due to an increase in listings in 3 of the 4 metropolitan counties.

| County | October Sales | %

Change |

|

| 2016 | 2017 | ||

| Milwaukee | 880 | 987 | 12.2% |

| Waukesha | 501 | 520 | 3.8% |

| Washington | 180 | 169 | -6.1% |

| Ozaukee | 136 | 126 | -7.4% |

| 4 County Area | 1,697 | 1,802 | 6.2% |

October was the seventh time sales were up in 2017, and the 27th positive month since January of 2015, when the real estate market really emerged from the recession.

The increase in listings was easily gobbled up due to strong demand that is continuing into the fall months. The underpinnings of the local economy are solid, with employment, interest rates, and lending all performing well. The strong economy is producing interest in home buying, particularly among first-time buyers and Millennials, who brokers estimate comprise about 40% of the market this year.

Through October, the 4 county market is 1.3% ahead of sales in 2016, 17,862 in 2017 vs. 17,641 unit sales in 2016.

Storm Clouds on the Horizon

REALTORS® are concerned about the impact of proposed federal tax laws for several reasons. First, increasing the standard deduction would make the mortgage interest deduction less appealing.

Second, eliminating the deduction of state income and property taxes will lead to a net increase in federal taxes for property owners in the state.

Finally, due to the double whammy of tax increases and decreased MID use, property values are expected to decline 10% (after suffering a huge decline just a few years ago); not to mention the impact on the social benefits of homeownership.

We estimate that the provisions in the tax bill will reduce property values by the following amounts (by Congressional District):

- 1st Cong Dist. (Rep. Ryan) = $18,920

- 4th Cong Dist. (Rep. Moore) = $13,580

- 5th Cong Dist. (Rep. Sensenbrenner) = $21,630

- 6th Cong Dist. (Rep. Grothman) = $15,690

Property owners should call their Congressman/woman and express their feelings about the provisions of the federal tax bill that harm property and home ownership.

| County | October Listings | %

Change |

|

| 2016 | 2017 | ||

| Milwaukee | 1,090 | 1,203 | 10.4% |

| Waukesha | 525 | 494 | -5.9% |

| Washington | 175 | 205 | 17.1% |

| Ozaukee | 96 | 102 | 6.3% |

| 4 County Area | 1,886 | 2,004 | 6.3% |

Listings Up in October

October was the 4th month of the year with an increase in listings in the 4 county area.

Milwaukee County lead the way with 111 new listings and Washington and Ozaukee Counties added another 36. Waukesha County had 31 fewer listings, for a net gain of 116 new homes for sale.

Comparing 2017 to 2016, listings are about even, with 17,813 units in 2017 versus 17,807 units listed through October of 2016, a 0.03% increase.

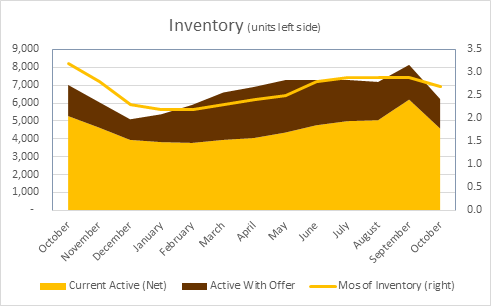

Inventory Very Tight

The seasonally adjusted inventory level for October was 4.5 months, down a bit from September’s 4.7 month level. The seasonally adjusted level was 5.2 months in October 2016.

Subtracting the 1,654 listings with an active offer from current listings presents an effective inventory level of 2.7 months. A year ago, the same calculation showed October’s inventory level at 3.2 months.

While REALTORS® are not concerned about the demand side, they are concerned about a lack of affordable inventory. Similar to a rain shower in the midst of a drought, October’s increase in listings is not enough to meet current demand, particularly for homes under $300,000.

2017 Projection

The lack of available homes for sale, is acting like an anchor on the year’s total sales. In order to match 2016’s total sales level of 21,007, the metropolitan market would have to sell 3,145 units in November and December. However, in the last two months of 2016, only 2,834 were sold.

The lower sales totals are not due to a declining market. Rather, a lack of homes to select from has caused buyers to spend an inordinately long time looking for a home.

Where to go

Buyers should seek the counsel of a REALTOR® in determining their best housing options, and sellers need a REALTORS® expert advice in making correct marketing decisions with their home.

The Greater Milwaukee Association of REALTORS® is a 4,000-member strong professional organization dedicated to providing information, services and products to “help REALTORS® help their clients” buy and sell real estate. Data for this report was collected by Metro MLS, Inc. a wholly-owned subsidiary of the GMAR.

* Sales and Listing figures differ between the “Monthly Stats” and “4th qtr” (or year-end) because the collection of “Monthly Stats” ends on the 10th of each month; whereas the “4th qtr” is a continuous tally to 12/31. For example, if a sale occurred on October 29th, but the agent does not record the sale until August 11th, that sale would not be included in the October sales figures (or any subsequent month’s total) but would be added to the annual total sales figure in the “4th qtr” total.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by Greater Milwaukee Association of REALTORS®

Inspiration Takes Root at the 2025 REALTORS® Home & Garden Show, March 21 – 30 at the Expo Center at Wisconsin State Fair Park

Jan 20th, 2025 by Greater Milwaukee Association of REALTORS®99th annual show to offer tips and trends in landscaping, gardening, home improvements, interior design and more.

REALTORS® Home & Garden Show to bring a cascade of ideas for your home to Wisconsin State Fair Park, March 22 – March 30

Jan 29th, 2024 by Greater Milwaukee Association of REALTORS®98th annual show to offer tips and trends in landscaping, gardening, home improvements, interior design and more