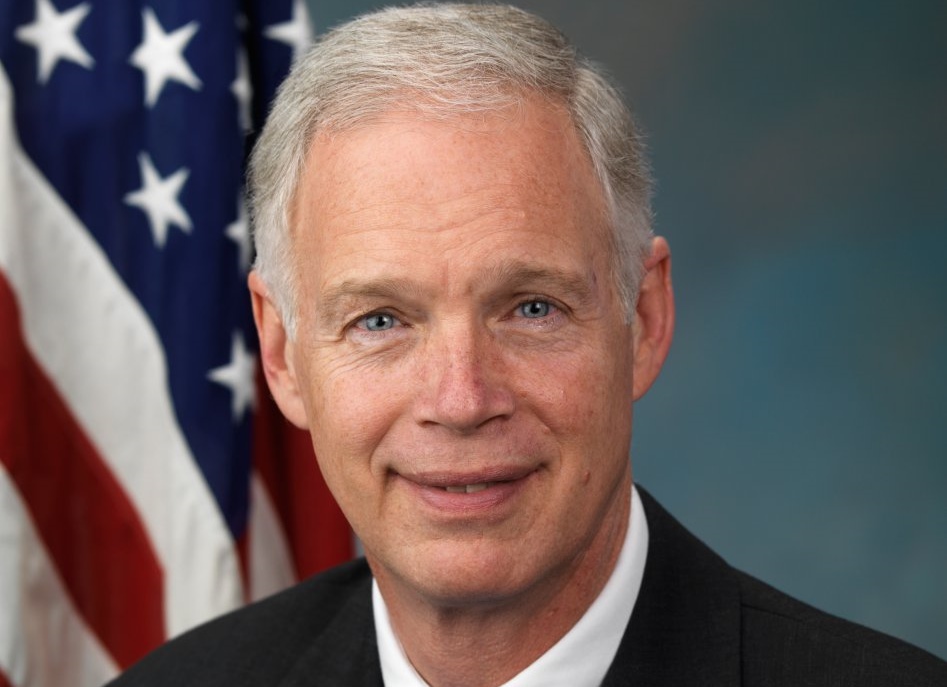

Johnson, Colleagues Send Letter to IRS Commissioner on Unchecked Misuse of Electric Vehicle Tax Credit

Senators request information after audit report reveals improperly claimed tax credits have increased despite inspector general first flagging issue in 2011

WASHINGTON — U.S. Senators Ron Johnson (R-Wis.), Chuck Grassley (R-Iowa), John Barrasso (R-Wyo.) and 12 of their colleagues sent a letter to IRS Commissioner Charles P. Rettig Monday requesting information to better understand how the IRS enforces the electric vehicle tax credit in light of a Treasury Inspector General for Tax Administration (TIGTA) audit report that detailed what appear to be systemic problems with the tax credit program.

“On September 30, 2019, the Treasury Inspector General for Tax Administration (TIGTA) released an audit report finding that taxpayers improperly claimed $72 million in tax credits for electric vehicles and that the IRS ‘does not have effective processes to identify and prevent [these] erroneous claims,’” the senators wrote. “Notably, in 2011, TIGTA released an audit finding $33 million in tax credits for plug-in electric drive motor vehicles—one in five of every claimed tax credit—were awarded to individuals who owned vehicles that did not qualify. In other words, despite recognizing this fraud eight years ago, it has not only persisted but become even more widespread.”

Sens. Johnson, Grassley and Barrasso were joined in sending the letter by Sens. James Lankford (R-Okla.), Joni Ernst (R-Iowa), Mike Braun (R-Ind.), Thom Tillis (R-N.C.), Pat Toomey (R-Pa.), John Cornyn (R-Texas), Jim Risch (R-Idaho), Ted Cruz (R-Texas), Mike Crapo (R-Idaho), John Kennedy (R-La.), Bill Cassidy (R-La.) and James Inhofe (R-Okla.).

The full text of the letter to Commissioner Rettig is below and can be found here.

January 27, 2020

The Honorable Charles P. Rettig

Commissioner

Internal Revenue Service

1111 Constitution Avenue, NW

Washington, D.C. 20224

Dear Commissioner Rettig:

On September 30, 2019, the Treasury Inspector General for Tax Administration (TIGTA) released an audit report finding that taxpayers improperly claimed $72 million in tax credits for electric vehicles and that the IRS “does not have effective processes to identify and prevent [these] erroneous claims.”[1] Notably, in 2011, TIGTA released an audit finding $33 million in tax credits for plug-in electric drive motor vehicles—one in five of every claimed tax credit—were awarded to individuals who owned vehicles that did not qualify.[2] In other words, despite recognizing this fraud eight years ago, it has not only persisted but become even more widespread. For this reason, we are writing to request information about what appear to be systemic problems with the plug-in electric drive motor vehicle tax credit program.

In 2009, the American Recovery and Reinvestment Act amended the New Qualified Plug-In Electric Drive Motor Vehicle credit to allow a credit of up to $7,500 to help taxpayers purchase a qualifying plug-in electric vehicle.[3] The 2011 TIGTA report found that individuals claimed more than $163.9 million in plug-in electric and alternative motor vehicle credits from January 1, 2010 to July 24, 2010.[4] Of the $163.9 million of claimed credits, TIGTA determined $33 million were claimed erroneously.[5] At the conclusion of that report, TIGTA recommended that the IRS develop a coding system to “identify vehicle makes and models or require the Vehicle Identification Number on forms used to claim” the electric vehicle credits.[6]

It is troubling that these improper payments continue and have more than doubled in size in the eight years since they were first reported. The apparently systemic problems with the electric vehicle tax credit are even more concerning as Congress considers a potential $16 billion expansion to the program, which overwhelmingly benefits wealthy electric vehicle owners in one state.[10]

To better understand how the IRS enforces the electric vehicle tax credit, please provide the following information and material:

- For each tax year since 2010, please provide the:

- Total number and dollar amount of electric vehicle tax credits claimed, broken down by state and household income;[11]

- Total number and dollar amount of electric vehicle tax credits claimed by individuals on leased vehicles, broken down by state and household income;

- Total number and dollar amount of electric vehicle tax credits claimed that were determined to be erroneous, broken down by state and household income; and

- Major categories of make and model of vehicles for which electric vehicle tax credit claims were determined to be erroneous.

- Has the IRS conducted a program-wide audit for the electric vehicle tax credit to determine the total amount of credits that were claimed improperly since the creation of the program? If so, please provide the results. If not, please state whether the IRS will provide this audit for Congress.

- Please explain how the IRS uses the vehicle identification number (VIN) to identify improper claims as well as other actions the IRS has implemented to reduce improper claims.

- How would a reporting requirement for dealers of electric vehicles improve the administration of the electric vehicle tax credit program, and what information would be most helpful for the IRS in administering the program effectively?

Please provide this material as soon as possible but no later than 5:00 p.m. on February 11, 2020. Thank you for your attention to this matter.

Respectfully,

Ron Johnson et al.

###

[1] Inspector Gen. for Tax Admin., U.S. Dep’t of Treasury, Ref. No. 2019-30-072, Millions of Dollars in Potentially Erroneous Qualified Plug-in Electric Drive Motor Vehicle Credits Continue to Be Claimed Using Ineligible Vehicles 4 (2019) [hereinafter 2019 Audit], available at http://treasury.gov/tigta/auditreports/2019reports/201930072fr.pdf.

[2] Inspector Gen. for Tax Admin., U.S. Dep’t of Treasury, Ref. No. 2011-41-011, Individuals Received Millions of Dollars in Erroneous Plug-in Electric and Alternative Motor Vehicle Credits (2011) [hereinafter 2011 Audit], available at http://treasury.gov/tigta/auditreports/2011reports/201141011fr.html.

[3] Id. at 1; 26 U.S.C. § 30D.

[4] 2011 Audit, supra note 1.

[5] Id.

[6] Id.

[7] 2019 Audit, supra note 2, at 5.

[8] Id. at 14.

[9] Id. at 4.

[10] Editorial, Subsidize My Electric Car, Please, Wall St. J. (Sep. 2, 2019), https://www.wsj.com/articles/subsidize-my-electric-car-please-11567459952.

[11] For requests regarding household income, please use adjusted gross income by standard income categories used for IRS Statistics of Income purposes.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.