Baldwin Leads Colleagues on Bill to Close Tax Loophole and Make Wall Street Pay Its Fair Share

Loophole allows investment managers to often pay almost half the tax rate compared to most other Wisconsin workers

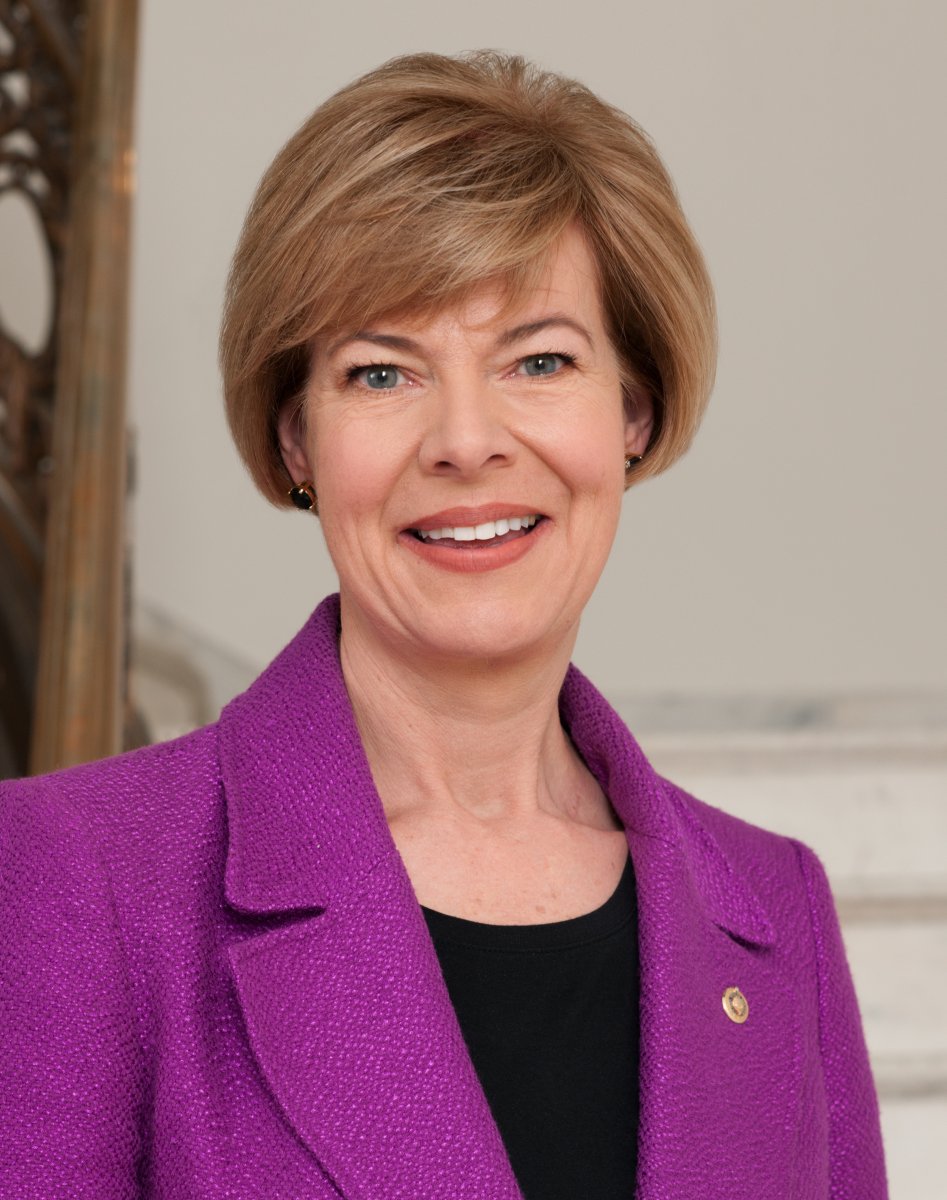

WASHINGTON, D.C. – Today, U.S. Senator Tammy Baldwin (D-WI) led thirteen of her colleagues in introducing the Carried Interest Fairness Act to eliminate a tax loophole that benefits wealthy money managers on Wall Street. The current carried interest loophole allows investment managers to often pay almost half the tax rate compared to most other Wisconsin workers.

The carried interest loophole allows investment managers to pay the lower 23.8 percent capital gains tax rate on income received as compensation, rather than the ordinary income tax rates of up to 40.8 percent that they would pay for the same amount of wage income. The Carried Interest Fairness Act requires carried interest income to be taxed at ordinary wage rates. According to the Treasury proposal, closing this loophole will raise $6.5 billion in revenue over 10 years.

Despite President Donald Trump previously saying, “…we will eliminate the carried interest deduction and other special interest loopholes…” during the 2016 election, his 2017 Tax Cuts and Jobs Act “failed to eliminate [the] key deduction used by wealthy investment firms that Trump had vowed to kill,” leading PolitiFact to rate this a “Promise Broken.” Senate Republicans rejected an amendment to the tax bill by Senator Baldwin to close the loophole, which all Senate Democrats supported in 2017.

The bill is co-sponsored by Senators Chris Van Hollen (D-MD), Patty Murray (D-WA), Brian Schatz (D-HI), Ed Markey (D-MA), Amy Klobuchar (D-MN), Tim Kaine (D-VA), Jeff Merkley (D-OR), Jack Reed (D-RI), Peter Welch (D-VT), Elizabeth Warren (D-MA), Cory Booker (D-NJ), Bernie Sanders (I-VT), and Mazie Hirono (D-HI). Representative Marie Gluesenkamp Perez (D-WA-03) also introduced this bill today in the U.S. House of Representatives.

“The carried interest loophole is an expensive subsidy of the billionaire executives who are raiding the public purse right now to pay for their next private island,” said Porter McConnell, Senior Director of Take on Wall Street at Americans for Financial Reform. “We commend Senator Baldwin for her leadership on closing this egregious loophole so that working families can stop subsidizing ultra wealthy hedge fund and private equity executives.”

“The carried interest loophole is an unfair Wall Street tax break that enriches billionaires who end up paying lower tax rates than teachers, nurses, and firefighters.” said Oscar Valdés Viera, research manager at Americans for Financial Reform. “We applaud Senator Baldwin for her unwavering leadership in introducing the Carried Interest Fairness Act and urge the Senate to swiftly move on this legislation.”

“The carried interest loophole gives a class of the wealthy elite – hedge fund managers and executives – an enormous and unfair advantage by allowing them to pay a significantly lower tax rate on their compensation than working- and middle-class Americans. Senator Baldwin’s Carried Interest Fairness Act would work to close this loophole, enhancing tax fairness, narrowing the growing wealth gap, and providing crucial revenue for investments in the American people,” said Casey Conroy, Senior Fiscal Policy Analyst at 20/20 Vision.

“Small business owners work hard every day to keep their doors open, staff on payroll and shelves stocked. Meanwhile, investment managers pay a lower tax rate than Main Street because of a ridiculous loophole. Main Street Alliance and our 30,000 members strongly support Senator Baldwin’s Carried Interest Fairness Act. Our tax code should focus on supporting the 20 million new small business owners who have started since 2020, not glitzy hedge funds,” said Richard Trent, Main Street Alliance Executive Director.

“The carried interest tax loophole stands as one of the most glaring examples of how the ultra-wealthy exploit and rig our broken tax system to their advantage,” said David Kass, executive director of Americans for Tax Fairness. “It’s common sense—Wall Street hedge fund managers shouldn’t pay lower federal tax rates than nurses, teachers, and most working Americans. This change is long overdue and represents a critical step toward a fairer tax system that ensures these uber-wealthy individuals pay their fair share like everyone else.”

“There is no reason that private equity managers, some of the wealthiest people in the country, should get away with paying lower tax rates than average families, especially as the care crisis continues to strain family budgets. Closing the carried interest loophole is an important step towards making sure the wealthiest are paying their fair share and that our tax code works for all of us, not just those at the top,” said Melissa Boteach, Vice President for Income Security and Child Care/Early Learning at the National Women’s Law Center.

A one-pager on this legislation is available here. Bill text of this legislation is available here.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.