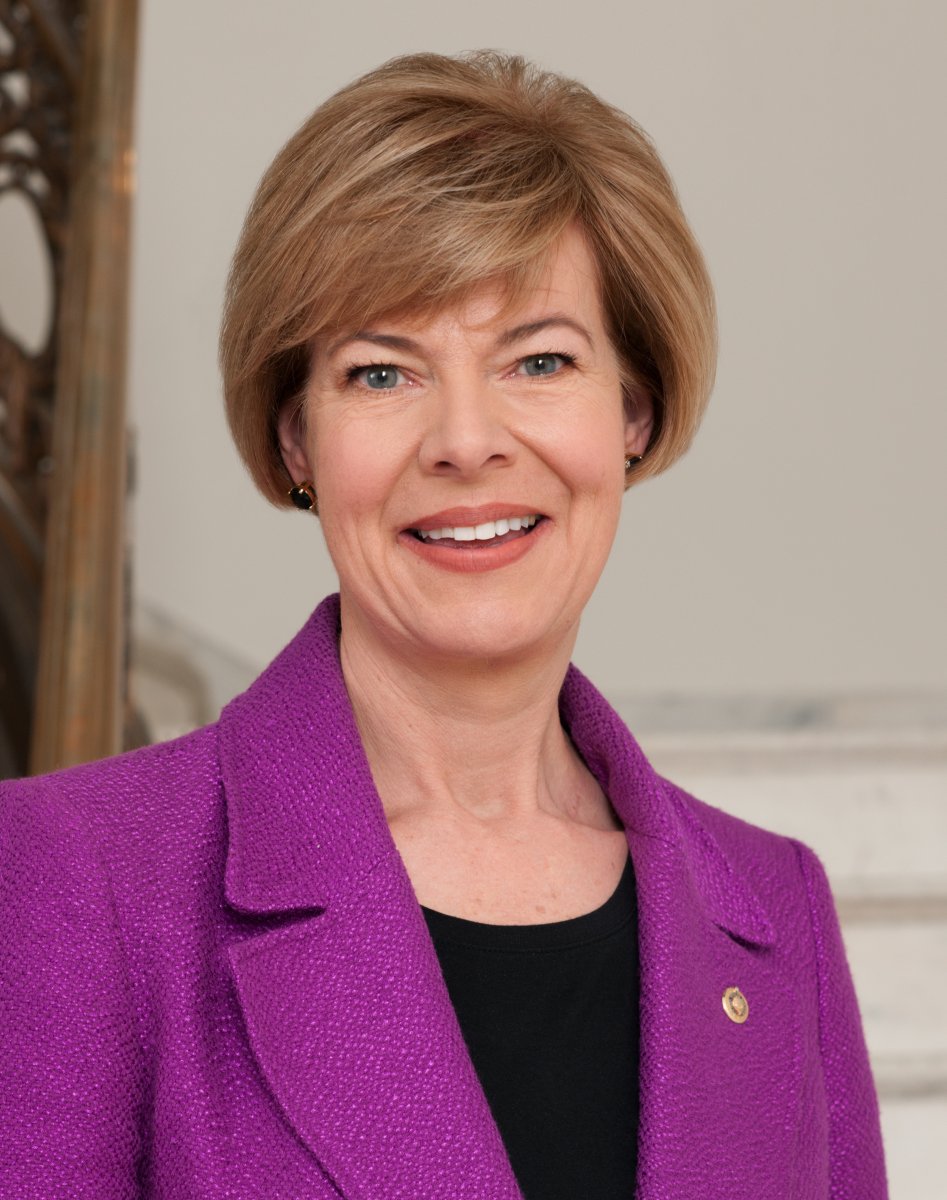

Baldwin, Manchin, Brown Lead Effort to Close Tax Loophole and Make Private Equity Pay Their Fair Share

On Tax Day 2024, Senators introduce bill to eliminate carried interest tax loophole and make wealthy fund managers pay what other American workers do

WASHINGTON, D.C. – As Americans mark Tax Day 2024, U.S. Senators Tammy Baldwin (D-WI), Joe Manchin (D-WV), and Sherrod Brown (D-OH) introduced the Carried Interest Fairness Act to eliminate a tax loophole that benefits wealthy money managers on Wall Street. The current carried interest loophole allows investment managers to often pay almost half the tax rate compared to most other Wisconsin workers.

“Currently, there is a loophole in our tax code that allows hedge fund managers to pay less in taxes for wage income than ordinary West Virginian and American workers, and these managers have taken advantage of it for far too long. Our commonsense legislation would close this loophole to ensure the wealthiest Americans are paying their fair share and contributing to our national economic growth rather than just their personal pockets. I urge my colleagues on both sides of the aisle to support this practical legislation that treats all workers fairly and moves to create a more equitable tax code,” said Senator Manchin.

“This loophole is yet another way wealthy special interests have rigged the system to work for them, at the expense of everyone else. Hedge funds and private equity firms shouldn’t pay less taxes than working people in Ohio. This bill is a commonsense solution to promote fairness and make Wall Street pay its fair share,” said Senator Brown.

The Carried Interest Fairness Act will require carried interest income to be taxed at ordinary wage rates. According to the Treasury proposal, closing this loophole will raise $6.5 billion in revenue over 10 years.

In addition to Senators Baldwin, Manchin, and Brown, this legislation is also co-sponsored by Senators Sheldon Whitehouse (D-RI), Chris Van Hollen (D-MD), Ed Markey (D-MA), Elizabeth Warren (D-MA), Mazie Hirono (D-HI), Amy Klobuchar (D-MN), Bernie Sanders (I-VT), Jack Reed (D-RI), Tim Kaine (D-VA), Peter Welch (D-VT), and Cory Booker (D-NJ).

The Carried Interest Fairness Act of 2024 is supported by AFL-CIO, American Federation of State County and Municipal Employees (AFSCME), Americans for Tax Fairness, Communications Workers of America (CWA), Main Street Alliance, Patriotic Millionaires, Public Citizen, Small Business Majority, United for Respect, NETWORK Lobby for Catholic Social Justice, National Women’s Law Center, Economic Policy Institute, and 20/20 Vision.

A one-pager on this bill is available here. Full text of this legislation is available here.

An online version of this release is available here.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by U.S. Sen. Tammy Baldwin

Baldwin, Warnock Push Trump to Follow Through on Promise to Crack Down on Corporate Investors Buying Up Single-Family Homes

Jan 20th, 2026 by U.S. Sen. Tammy BaldwinAhead of Trump speech on housing in Davos, Senators call on the President to back their bill on out-of-state investors buying up single-family homes