New Assessments Hike Residential Values By 17.7%

Property values surging across the entire city, but won't necessary mean a tax increase.

Milwaukee property owners should expect to see a sizable increase in the assessed value of their property when assessment letters are mailed Friday, but not necessarily a future tax increase.

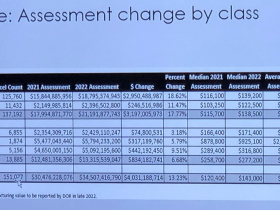

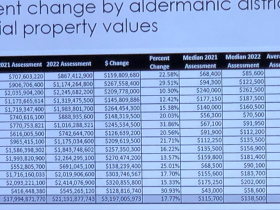

The average residential property’s assessed value climbed 17.77% since 2021, with an increase seen in every aldermanic district. The assessed value of commercial properties, which includes apartment buildings, is up 6.68%.

The average home value is now $154,469, up from $131,166.

“There were no decreases this year, the market is that intense,” said Assessment Commissioner Nicole Larsen of the aldermanic districts when she presented the values to the Judiciary & Legislation Committee.

She said there were positives, including neighborhood stabilization and the increased ability of homeowners to build wealth over time and to leverage their home equity to make repairs. “Overall it’s a good thing,” said Larsen.

Milwaukee conducted a citywide reassessment for the first time since 2020. The 2021 assessment was canceled after the 2020 process, the results of which were released early in the pandemic, included an average residential increase of 11.95% and triggered a record number of appeals. It was the first time the city’s combined property value exceeded the pre-Great Recession high of $28.65 billion.

Last year was the first time since 2002 the city didn’t conduct an annual reassessment. The 2022 assessment was the first conducted by Larsen and chief assessor Bill Bowers. Prior commissioner Steve Miner and chief assessor Peter Bronek retired, with both Larsen and Bowers coming from outside the department.

The greatest percentage increase, 31.86%, was seen in Alderman Khalif Rainey‘s seventh district. The average residential property value in the district is now $93,754. Alderman Russell W. Stamper, II‘s 15th district, the city’s most impoverished, saw the second-biggest percentage increase (30.93%, $69,978) and Mayor Cavalier Johnson‘s second district was third (29.51%, $123,076).

Alderman Nik Kovac‘s third district, which includes Riverwest and the East Side, saw the smallest percentage, 10.3%, but the average assessment is now $306,494, the highest in the city. The dollar value growth ($28,631) outpaced the seventh district’s growth ($22,651).

“I hope you guys have your crash helmets on when these values hit people’s mailboxes,” said Alderman Robert Bauman. “These will significantly impact people’s taxes.”

“This is big news,” said Ald. Michael Murphy. He said he hoped the assessor’s office would provide quality customer service to people, many of which he said would be mad when they called.

An increase in assessed value does not automatically trigger an increase in the corresponding property tax bill. The city does not derive additional revenue by increasing assessments, but instead uses the assessments to divide the state-capped property tax levy.

Simply put, if every property in the city doubled in assessed value, the city would need to cut its property tax rate in half to stay within state-imposed levy limits.

All else being equal, owners of properties that increased in value greater than the average rate (13.23%) could expect to see a proportional tax increase the following year.

“The more economically challenged districts are going to see a disproportionate increase,” said Ald. Scott Spiker. Those areas have seen declines or slower growth in the past decade, which has lowered their tax bills during that period.

The greater growth of residential values compared to commercial values will result in more of the property tax burden shifting to residents.

State law requires municipalities to conduct a complete assessment at least once every five years. Milwaukee has undertaken annual assessments in an attempt to make the property tax burden more equitable.

Property owners have until Monday, May 16 at 4:45 p.m. to file an appeal under a process known as “Open Book.” For the first time, the city will accept appeals online.

Larsen said property owners should contact the assessor’s office at 414-286-6565 to review their value before filing a formal appeal.

If no adjustment is made by the assessor, an appeal can be made to the city’s Board of Review and ultimately the state court system.

The values are expected to be available online when the letters are mailed April 15.

The 2022 assessment reflects the value of properties on Dec. 31, 2021. Manufacturing properties are assessed by the state and not included in the figures and not included in the figures in this article.

Suspend The Process?

Bauman, who said interest rate increases could trigger a recession and falling values, suggested the city suspend the assessment process for another year.

He asked if the city could still suspend the process.

“I will get back to you very quickly and let you know,” said Larsen.

“I guess the question is: if the numbers are there, can one turn a blind eye to it?” said Spiker.

Committee chair Ashanti Hamilton said he would like an answer, but that not all council members might agree with pausing the process at this point. He said some residents in his district might see the increases as a positive given that it would reflect the investments they have made into their properties.

UPDATE: An earlier version of this article labeled both the seventh and 15th districts as the most impoverished. It is only the 15th.

Legislation Link - Urban Milwaukee members see direct links to legislation mentioned in this article. Join today

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.

- July 18, 2024 - Cavalier Johnson received $15 from Steve Miner

- February 20, 2016 - Cavalier Johnson received $250 from Robert Bauman

- May 7, 2015 - Nik Kovac received $10 from Cavalier Johnson

City Hall

-

Council Blocked In Fight To Oversee Top City Officials

Dec 16th, 2025 by Jeramey Jannene

Dec 16th, 2025 by Jeramey Jannene

-

Latest Effort to Adopt New Milwaukee Flag Going Nowhere

Dec 3rd, 2025 by Jeramey Jannene

Dec 3rd, 2025 by Jeramey Jannene

-

After Deadly May Fire, Milwaukee Adds New Safety Requirements

Dec 2nd, 2025 by Jeramey Jannene

Dec 2nd, 2025 by Jeramey Jannene