How to Solve City, County Pension Problems

Massive costs need bold, innovative solutions and state legislation.

Over at least the past 20 years, the citizens of urban Milwaukee have suffered as staffing numbers have been cut relentlessly in police, fire, parks and other departments. Capital spending has been postponed for parks, buildings, roads, buses and other areas. Revenue sharing from the state has essentially been frozen for years, and Milwaukee cannot impose a local sales tax without state approval. Rising pension costs show no signs of abating, as City and County task forces have warned. The quality of life in a vibrant metropolitan area has been threatened.

It doesn’t have to be this way, and solutions are out there.

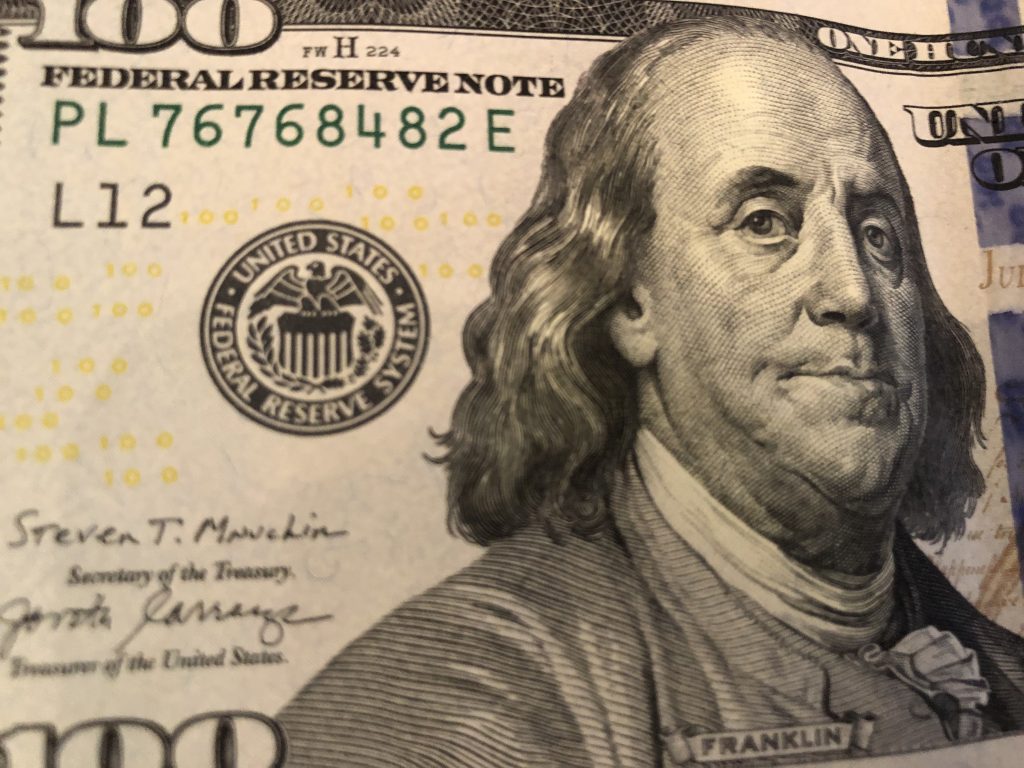

The Legislature could take the lead, offering a compromise of sorts. First, it could require the city and county within one year to make one-time payments to the respective pension funds in amounts sufficient to bring the funded status to 120%, calculating the liabilities with a discount rate matching the average duration of the liabilities (approximately 10 years) and accounting for the county’s liability for over $240 million in pension obligation bonds that must be repaid within nine years.

Using the data published for the fiscal year ending December 31, 2020, I estimate that the city and county would be obligated to pay about $8.5 billion and $3.1 billion, respectively. Clearly, such sums are not readily available.

This observation leads to the second piece of legislation, namely the authorization for the city and county to employ the procedures of Chapter 9 of the Bankruptcy Act. The inability to make these one-time “gross up” payments means that both the city and county would meet the “insolvency” requirement of Chapter 9 to file Plans of Debt Adjustment, which can restructure contracts and debts but with—and this is key—the consent of a certain percentage of at least one group of the impaired creditors, in this case employees and beneficiaries. If only pensions are at issue, it would be unnecessary to adjust other debts.

But what would those Plans of Debt Adjustment include? How would they deal with those crushing debt payments?

Let’s examine these two options from the perspectives of the city and its employees and retirees. Because the City of Milwaukee Employees’ Retirement System (CMERS) is not 100% funded, becoming substantially equivalent to WRS would mean no cost of living adjustments (COLAs) until fully funded. That’s a huge cost saving.

No COLAs are not necessarily unfair because the CMERS benefit structure has never considered Social Security income in evaluating the living standards of retirees. Most retirement consultants recommend a target of replacing about 75-80% of an employee’s final average salary, reasoning that a retiree no longer pays pension contributions or FICA taxes and that many large expenses, such as child-rearing, college, and mortgage payments, are often in the rear-view mirror. Social Security is modestly redistributive and aims to replace about 90% of earnings for very low income earners, about 40% for the average person, and lower percentages for high income earners.

Simply put, many CMERS retirees receive well over 40% of their final average salary in the form of a pension, meaning they hit that 75-80% target.

Without getting into all the details of potential cost savings from creating a new pension system substantially equivalent to WRS, let’s assume that savings of 15% of total pension liabilities would be generated and that liabilities would be calculated with a discount rate of 5.4% (which WRS has used recently to calculate the required annual contribution—currently a total of 13.5% of payroll). Using data from the CMERS 2020 Consolidated Annual Financial Report, I estimate a new unfunded liability of $1.037 billion. Amortizing that over 15 years (at 5.4% discount) means annual payments of about $105.5 million, on top of $80.5 million (13.5% of payroll, which was a little over $596 million in 2020).

This leads into the fourth piece of required legislation—authorization for a local sales tax of, say, 1%. The recent Report of the Mayor’s Task Force on CMERS concluded that a 1% local option sales tax should raise about $87 million. That means the city would then have $207 million available to fund required payments of about $186 million. And the better news is that the required payments would drop to around $100 million (even after accounting for salary increases) in 15 years.

By this point, you might be thinking that this sounds promising, but what about that New Brunswick option? New Brunswick reduced its discount rate from 6.25% to 4.75%, dramatically increasing its liabilities. At the same time, converting to a career average plan, eliminating automatic COLAs, and transitioning to longer working careers saved about 25% of the total liability. The move to contingent inflation indexing required higher annual contributions from employees.

Let’s put it all together now. It’s something like a carrot and stick approach for the Legislature. The carrot is the potential for a local sales tax, and the stick is forcing both the city and county in Milwaukee into Chapter 9. Giving everybody one year before the payments are due allows time for actuaries to evaluate the options and for good faith negotiations to take place between the city and its employees and retirees. The object is to prepackage the Chapter 9 filing with necessary agreements already in hand before the Petition is filed. That way, the cost and delay of such Chapter 9 filings as the Detroit bankruptcy can be avoided.

The analysis is similar for the county, except that it has those massive pension obligation liabilities to pay off. The county and its employees paid a combined 36.9% of payroll into the pension plan in 2020, and a local sales tax should leave room to make required payments for 15 years and then either join WRS or have a fully funded shared risk plan.

Furthermore, to the extent that some employees received unwarranted, unearned and unfunded windfalls from the now notorious “backdrop” program, estimated by some to have cost at least $460 million, Chapter 9 offers a vehicle for a potential claw back or even a compensating reduction in future pension payments to even things out.

This plan can work. Allowing debts to strangle a major metropolitan area is in the best interests of no one. Asking the Legislature to permit a small local sales tax in the confines of Milwaukee County should not be the stuff of ideological arguments, especially when it’s accompanied by pension reform leading to the same result endorsed by close advisors to former Governor Scott Walker. Those people correctly concluded that WRS is just about the most fair, secure and sustainable retirement system in the country and shouldn’t be messed with.

W. Gordon Hamlin, Jr. graduated from Harvard Law School in 1978 and is now retired from active practice. He was a 2016 Fellow in Harvard’s Advanced Leadership Initiative and founded Pro Bono Public Pensions that same year.

Op-Ed

-

Wisconsin Candidates Decry Money in Politics, Plan to Raise Tons of It

Dec 15th, 2025 by Ruth Conniff

Dec 15th, 2025 by Ruth Conniff

-

Trump Left Contraceptives to Rot; Women Pay the Price

Dec 8th, 2025 by Dr. Shefaali Sharma

Dec 8th, 2025 by Dr. Shefaali Sharma

-

Why the Common Council’s Amended Budget is Good Policy for Milwaukee

Nov 20th, 2025 by Alds. Marina Dimitrijevic and Russell W. Stamper, II

Nov 20th, 2025 by Alds. Marina Dimitrijevic and Russell W. Stamper, II

Sounds like a really good solution to the pension system which is essentially costing us lives in the city. We are paying people who no longer even work for us instead of hiring more police to stop the record breaking homocides.