Matt Flynn Attacks Election Year Walker’s Property Tax Stunt

Democratic Challenger proposes real, long-term property tax relief for Wisconsin

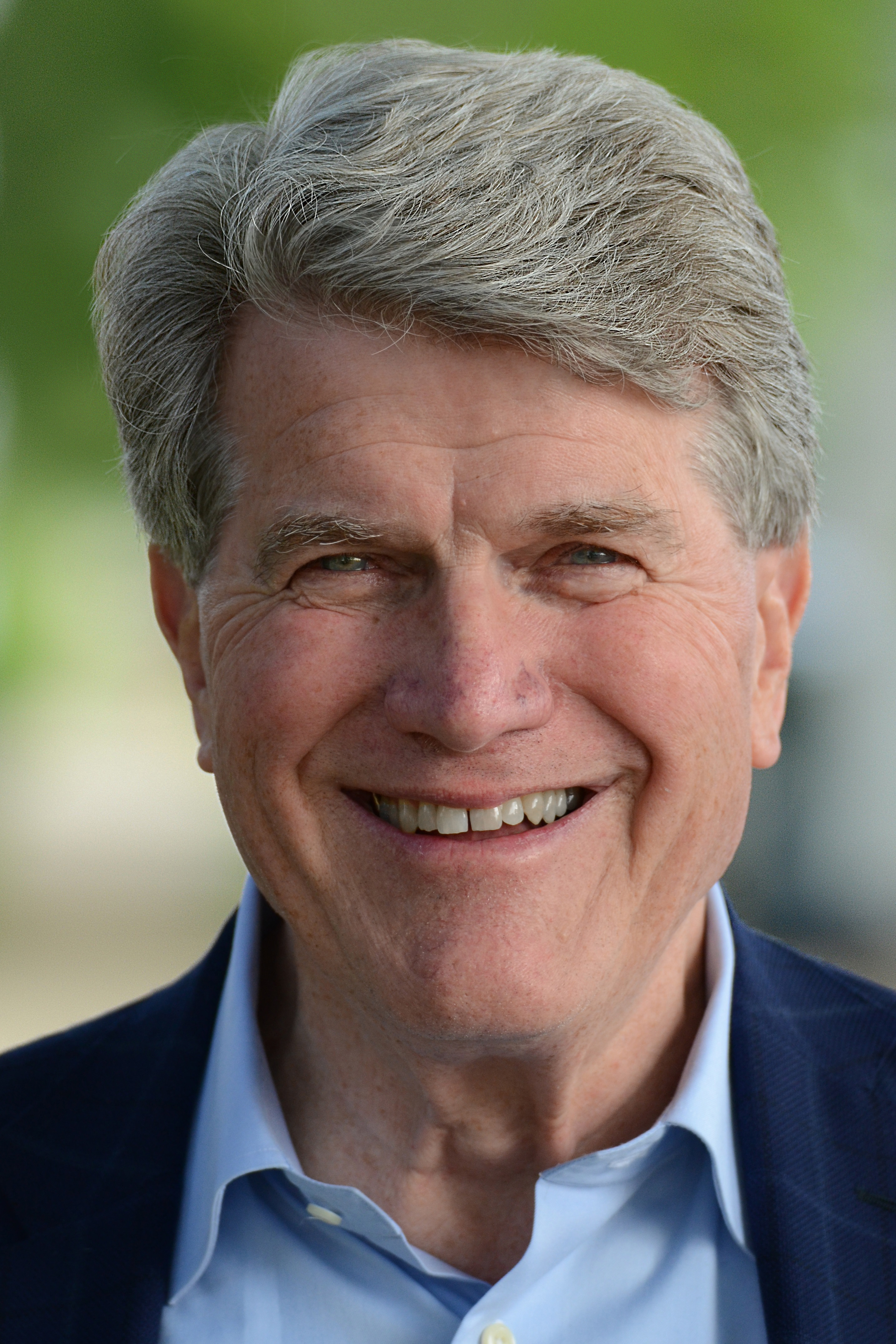

(Milwaukee) – Democratic gubernatorial candidate Matt Flynn today attacked Scott Walker for his property tax stunt and offered a better approach to property tax relief.

“Property taxes in this state are far too high. It’s a regressive tax that hurts middle and low-income people the most. Scott Walker has slashed spending on education and public services, requiring over one million Wisconsinites to vote to raise their property taxes to make up for state cuts,” said Flynn.

“Now, as a cheap election year trick, Walker has eliminated the state portion of the property tax, to give the false impression that he’s addressing the problem. The state portion of the property tax was a very small amount at $17 per $100,000 valuation. This cut is far too small. It doesn’t touch the real problem,” said Flynn.

Rural Wisconsinites have also been hit hard by a land use law passed in the 1990s to artificially overvalue land not used for agriculture. According to the Eau Claire Leader-Telegram, one landowner in Eau Claire County saw a 164% property tax increase last year as a result.

Additionally, the so-called “dark store” loophole is allowing corporations to shift the property tax burden squarely on the shoulders of homeowners. Bipartisan efforts to close the loophole this year have failed due to Walker’s lack of leadership.

Matt Flynn’s plan to create property tax relief includes:

- A greater shift to the progressive income tax for state revenues.

- Closing the “dark store” loophole and valuing property for its actual use, not theoretical use.

- Ending foolish investments like the Foxconn deal, which will cost Wisconsinites $1,774 per household. Instead, I will use that money to lower property taxes.

“We need property tax relief for Wisconsin families,” said Flynn. “The state has had one of the highest effective property tax rates in the nation. As governor, I will restore fiscal responsibility. I will create long-term property tax relief and put an end to Walker’s reckless election year stunts.”

Matt Flynn is a Navy veteran, attorney, and former Chair of the Democratic Party of Wisconsin. He attended law school at the University of Wisconsin–Madison.

For additional information, visit www.ForwardWithFlynn.com.

Forward with Flynn

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by Matt Flynn

Matt Flynn Announces Plan to Create New Office of Non-Profit Liaison

Jul 25th, 2018 by Matt Flynn"Philanthropic organizations in Wisconsin support tens of thousands of people every year."

Archbishop Rembert Weakland: Flynn and Attorneys Not Involved in Transfers

Jul 23rd, 2018 by Matt FlynnRetired Archbishop Rembert Weakland confirmed that neither Flynn nor any lawyers were involved in transfers of abusive priests.

Matt Flynn Files Strong Fundraising Report for First Half of 2018

Jul 17th, 2018 by Matt FlynnDemocratic challenger has raised nearly $700,000 since the start of the campaign