State Drops to 25th in Taxes, Fees

Drop since 2000, when Wisconsin ranked as 11th highest state.

Wisconsin is close to average in most measures of revenue and spending among the states, according to new figures from the Census Bureau.

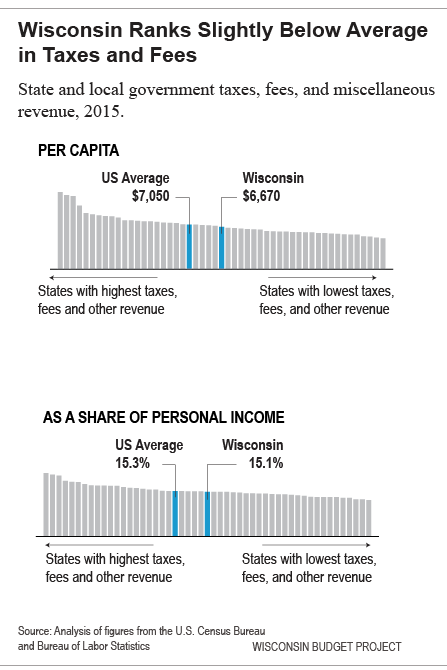

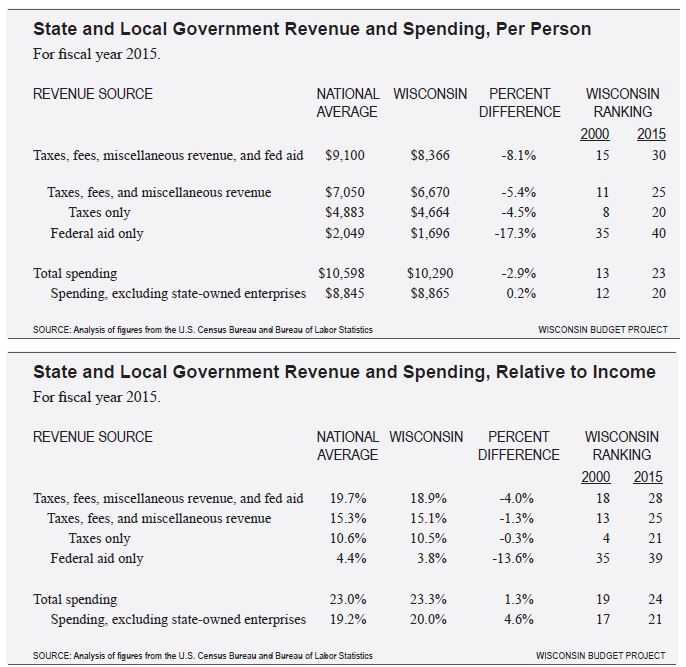

Wisconsin ranked 25th out of the 50 states in the combined amount of state and local taxes, fees, and other revenue collected per person in fiscal year 2015. Measured as a share of personal income, Wisconsin also ranks 25th among the states in taxes, fees, and miscellaneous revenue.

Some policymakers focus on Wisconsin’s ranking on taxes alone when evaluating its revenue compared to other states. But focusing just on taxes means that fees and other charges, which come from residents’ pockets, much like taxes do, are not taken into account. Combining taxes with fees and other revenue gives a broader and more complete measure of the money that governments in Wisconsin collect from their residents.

The average amount state residents paid in taxes, fees, and other revenue is slightly below the national average. In 2015, Wisconsin residents paid an average of $6,670 in taxes, fees, and other charges to state and local governments, $380 less than the national average. State residents paid 15.1% of personal income in taxes and other revenue, less than the national average of 15.3%.

In nearly every measure of revenue and spending, Wisconsin’s rank has dropped significantly over the last decade:

- In 2000, Wisconsin ranked 11th among the states in taxes, fees, and other revenue per person, before dropping 14 places by 2015. Wisconsin ranked 13th in total spending per person in 2000, before falling to 23rd in 2015.

- Wisconsin’s rankings in revenue and spending as a share of income have fallen as well. Measured relative to income, the state ranked 25th in taxes, fees, and miscellaneous revenue in 2015, down from 13th in 2000, and 24th in total spending, down from 19th.

Because per capita income in Wisconsin is well below the national average, our revenue collections are not as far below the national average when measured relative to income.

Wisconsin policymakers who advocate for tax cuts should know that Wisconsin governments are already a little below the national average in the amount of taxes and fees they collect from residents. Additional tax cuts could jeopardize Wisconsin’s public investments in high-quality education and health care, and make it more difficult to invest in public safety and transportation in our communities. That would hurt our economy in the long run, since those are the very things our businesses and families need to thrive.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

How does Wisconsin rate for corporate welfare?

After Foxconn, #1, by a mile.

“After Foxconn, #1, by a mile”

Link?

Wisconsin’s Foxconn offer would exceed the highest subsidy provided to a foreign company — $1.65 billion in 2012, made by Pennsylvania to Dutch Royal Shell, based in The Netherlands. http://www.politifact.com/wisconsin/statements/2017/aug/15/one-wisconsin-now/wisconsins-3-billion-offer-foxconn-gift-and-it-lar/

In fact at $3 billion it nearly doubles it. So you could argue we are leading the way in corporate welfare Chuck.

You could argue it but you’d need relevant facts to back it up.

It’s called a pithy comment Chuck, to make a point. How about “We’re #1 in Biggest Corporate Subsidy.” Does that work better for you Captain Literal?

No, that doesn’t work either because it’s not true.

“We Promised Foxconn the Largest Corporate Subsidy in the History of America.”

This article amazingly puts a negative spin on tax cuts. If a car dealer reduces their prices, do we complain? Or how about a grocery store offering discounts? Is that a problem? So why is it a problem if our government becomes more efficient and is able to pass on some savings to all taxpayers? We need to judge government programs on their outcomes, not on how much money we put into them.

It’s not an article, just another in an endless line of hyper partisan press release style filler pieces on here

Then go back to Breitbart Chuck. You won’t be missed. Troll elsewhere.

“Championing Urban Life in the Cream City”

Good Morning West Bend is a better publication for you.

What and miss this piece and so many of the others here that have so much to do with “covering real estate, politics, arts & entertainment and food & drink in the city of Milwaukee”? I don’t know man

The fact that this incredible improvement in ranking was possible while at the same time increasing employment and increasing school spending, getting closer to pre-recession levels, only shows how shockingly blatant the benefits overspending was to public-sector employees in the pre-Walker days.

Bravo, Governor and Legislature, bravo.