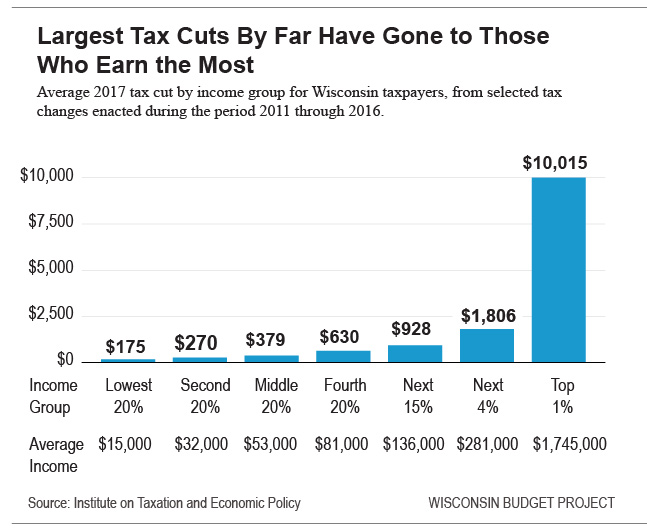

Most Walker Tax Cuts Benefit Wealthy

More than $10,000 for members of top 1%, just $175 for poorest 20% in state.

A series of major tax cuts passed between 2011 and 2016 has been a boon to the wealthy, giving big tax breaks to Wisconsin residents with the highest incomes. A new analysis by the Wisconsin Budget Project takes a look at the outsized tax benefit lawmakers have provided to the top 1% by income in the state, and contrasts it to the much smaller tax breaks received by residents in the other 99%.

There are several ways of comparing the size of the average tax cuts received by residents in different income groups. But in this case, all of the methods point to the same conclusion: the tax cuts that lawmakers have passed in recent years have provided much larger tax breaks to the wealthiest than to other groups of taxpayers. The analysis examines how the tax cuts stack up in three different ways:

Measured as a share of revenue loss to the state: Out of every dollar in new tax cuts, the top 1% of Wisconsin residents by income got $0.24. The bottom 20% by income got just $0.02, even though there were twenty times as many taxpayers in the bottom 20% compared to the top 1%.

Measured in terms of average tax cut: Taxpayers in the top 1% by income – a group with an average income of $1.7 million – receive an average 2017 tax cut of $10,015, compared to $175 for taxpayers with incomes in the lowest 20%, a group with an average income of $15,000.

That means that taxpayers in the top 1% receive an average tax cut 57 times as large as taxpayers in the bottom 20% by income. Put another way, the top 1% is saving more on taxes each week from recent tax cuts than the lowest income group will save over the course of the whole year.

Measured as a share of the taxpayer’s income: The tax cuts the top 1% receive (0.70% of income) are more than twice as large on average as the tax cuts taxpayers with the lowest incomes receive (0.33% of income). This comparison takes into account the relative sizes of the incomes of the different groups.

The full analysis, which is based on information from the Institute on Taxation and Economic Policy, is available on the Wisconsin Budget Project website: Missing Out: Recent Tax Cuts Slanted in Favor of those with Highest Incomes.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

This is such a flawed study… (ignores EITC, doesn’t use standard deduction for those who quality, omits taxes such as business license taxes, gross receipts taxes and severance taxes, assumes 2013 Act 145 was a straight cut for property taxes to tech college districts when instead it just spread the taxes around the state, and more) but even using their highly flawed numbers, low income earners got a much greater percentage of the taxes they paid cut.

Of course people making an average of 1.75 million are going to get greater cuts than those making $15k a year. They barely pay any taxes now and most of the tax cuts were for income and property taxes which the lowest income people don’t pay much, if any, of.

What does percentage matter to a low income worker if their cut is $5?

I dunno, but what do tax cuts matter to someone who doesn’t have to pay much, if anything, in taxes?

So, the Dems want an issue here it is. Change the tax code and make the first $30000 completely tax free for everybody. ?$15 an hour or $150 an hour the first $30000 is non-taxable and this encourages people to work by making wages for entry level workers worth more with no waiting for EITC or anything else. And those currently working get a raise. AND this money will be spent creating more jobs in the community where it’s earned not invested in some stock or vacation in a far away place with a strange sounding name. Make it revenue neutral by increasing the upper level tax bracket percentages. Reward workers who really work and don’t drive a compute like I do.

If you don’t pay Wisconsin state taxes and your classified as poor why would you expect a tax cut if you have n’t paid any taxes?

A big thank you to our courageous and far-sighted Republican leadership in Wisconsin. With any luck, we’ll soon catch up to Kansas in all the key measurables like revenue growth and budget deficits.

The point being lost or ignored here is the fact: those of means have no requirement for a significant tax cut. If I’ve heard it once I’ve heard it a hundred times; the tax money typically gets socked away or invested. It simply does nothing to grow the local economy. Conversely, when the government invests in the citizenry the return is magnified throughout the community in myriad ways. It was the GI Bill that gave the United States it’s ‘middle class.’ The investment in the space program resulted in new technologies which created a societal payback of $10.00 for every dollar invested. Enough of this constant false argument of taxes being evil – they are not. Taxes benefit everyone – even the wealthy.

I think I read this nearly identical press release re-issued about every three to four months, just slightly altered with a different author from a different liberal think tank.

New tune, guys. Or please do continue… Ms. Vinehout has to memorize something soon, I suppose.

Sort of like how right-wing “think” tanks (Americans for Prosperity, etc.) issue the same press release every three to four months?