County Sales Tax Hike Gets First Approval

County officials detail future cuts without sales tax plan, as Parks Department is halved and senior centers eliminated.

Milwaukee County Courthouse. Photo by Graham Kilmer.

Less than two weeks before the Milwaukee County Board is set to vote on a countywide sales tax increase, the body’s powerful finance committee is still just barely capable of summoning enough votes to recommend its passage.

A special meeting of the Committee on Finance was called Monday specifically to consider and make a recommendation on the proposed 0.4% sales tax increase. The committee only narrowly voted to recommend the sales tax increase for adoption to the full board, four to three. Supervisors Steve Taylor, Sequanna Taylor and Juan Miguel Martinez voted against the recommendation and Supervisors Shawn Rolland, Willie Johnson, Jr., Liz Sumner and Peter Burgelis voted yes.

The meeting was called in conjunction with the board’s Personnel Committee, whose review is also required as the proposal includes changes to the county’s employee pension system. The Personnel Committee, composed of Supervisors Johnson, Jr., Patti Logsdon, Burgelis, Tony Skaskunas and Steven Shea, voted unanimously to recommend approval to the full board. Logsdon was careful to point out that while she was voting in favor of a recommendation to the full board, she had not yet decided and would hold her decision until after her final town hall.

County Executive David Crowley released a statement after the committees recommended passage of the sales tax increase. “Thank you to committee members for sending a clear signal today that averting a fiscal cliff is critical to improving quality of life for all county residents and accomplishing our vision of a healthier, safer Milwaukee County for all,” the county executive said.

While the committees voted in favor of the sales tax increase, they did not arrive there without significant debate among the supervisors, and many on the board continue to indicate they are in roughly the same place as Logsdon, holding off on a decision. What’s new is that a handful of supervisors have also begun discussing the possibility of delaying a vote on the sales tax.

In order to begin collecting a sales tax on Jan. 1 — and build a whole year of sales tax revenue into the 2024 budget — supervisors would need to approve the increase prior to Sept. 1. A few supervisors asked about the possibility of scheduling a vote during the board’s recess in August in order to give them more time to make up their minds.

Chairwoman Marcelia Nicholson, who supports the sales tax and has prominently advocated for it, said, “We see every month, how difficult it is to get supervisors to show up for committee meetings and regular board meetings that have been calendared for months, and then months, almost years in advance. I can’t speak to the probability, I’ll just say it’s been very challenging to hold meetings in regular times, so it may be extremely challenging, especially if people have vacations set up.”

A motion by Sup. Martinez to table the sales tax question until the next committee cycle — in September — was rejected by the Finance Committee.

The committee did hear some new information from the county’s Office of Strategy, Budget and Performance (OSPB). Specifically, the office outlined what county services would likely be cut over the next five years without a sales tax and also a breakdown of how the tax increase would impact households of varying income levels.

Tax Impact by Household Income

Joe Lamers, OSPB director, told supervisors that his office used data from the Wisconsin Department of Revenue‘s Tax Incidence Study and “extrapolated that to 2023 numbers.”

The office estimates that families or individuals in the bottom 20% of income for the county, approximately $16,000 or less, would be impacted by approximately $48 annually. Those with a median income of approximately $61,000 would pay an estimated additional annual sales tax of $148 annually. Those at top 20% of county income ($221,000) would pay $409 annually. The top 1% of income ($983,000) would pay $1,095 annually.

Lamers said the administration is “acknowledging there’s a regressive aspect to the sales tax,” but noted that the expense per household to raise property taxes would likely be higher, across all income level. This was done by estimating the likely value of the home that county residents at various income levels live in.

What Would Be Cut?

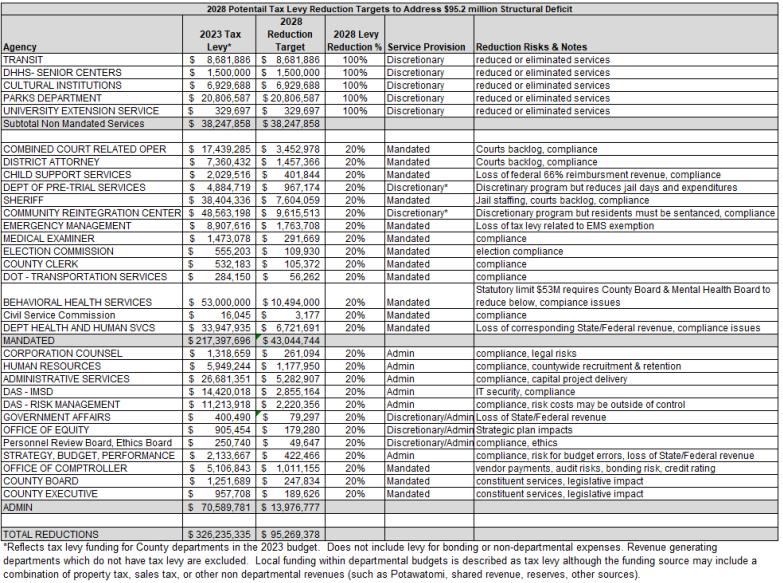

Lamers’ office also provided supervisors with a table outlining exactly where the cuts in service would likely be required over the next five years without a sales tax.

This was the first time specific numbers have been assigned to cuts in service that have been warned of for years. The county is mandated by state law to spend tax revenues on specific services. Anything not mandated by state law would be on the table for cuts in the coming years. Many are “highly valued government services,” Lamers told supervisors.

For example, without a sales tax, the county would likely have to cut $20.8 million from the Milwaukee County Parks budget. This represents approximately 48% of the department’s 2023 budget. But that’s only because the department, after years of budget cuts, has become so adept at generating revenue for the system through services and fees.

The table further shows, senior centers would be eliminated by 2028. Transit would lose all property tax support, ensuring that predictions of eliminating half of the routes in the system come true. All county funding for cultural institutions like the War Memorial, Milwaukee Art Museum and Milwaukee Public Museum, would be eliminated.

But it won’t only be non-mandated services like parks and cultural spending. Budget officials estimate that a 20% cut to all mandated services will also be needed to backfill the coming budget gaps. This would spell the end of alternative to incarceration programs the county operates for youth, for example. And the already backlogged county court system would see cuts across the board.

The Office of Emergency Management, the Medical Examiner’s Office, Behavioral Health Services, the Election Commission, Child Support Services and the Department of Health and Human Services are among those county agencies that would face a 20% budget reduction by 2028.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

More about the Local Government Fiscal Crisis

- Mayor Johnson’s Budget Hikes Fees, Taxes In 2025, Maintains Services - Jeramey Jannene - Sep 24th, 2024

- New Milwaukee Sales Tax Collections Slow, But Comptroller Isn’t Panicking - Jeramey Jannene - Jun 28th, 2024

- Milwaukee’s Credit Rating Upgraded To A+ - Jeramey Jannene - May 13th, 2024

- City Hall: Sales Tax Helps Fire Department Add Paramedics, Fire Engine - Jeramey Jannene - Jan 8th, 2024

- New Study Analyzes Ways City, County Could Share Services, Save Money - Jeramey Jannene - Nov 17th, 2023

- New Third-Party Study Suggests How Milwaukee Could Save Millions - Jeramey Jannene - Nov 17th, 2023

- Murphy’s Law: How David Crowley Led on Sales Tax - Bruce Murphy - Aug 23rd, 2023

- MKE County: Supervisors Engage in the Great Sales Tax Debate - Graham Kilmer - Jul 28th, 2023

- MKE County: County Board Approves Sales Tax - Graham Kilmer - Jul 27th, 2023

- County Executive David Crowley Celebrates County Board Vote to Secure Fiscal Future and Preserve Critical Services for Most Vulnerable Residents - County Executive David Crowley - Jul 27th, 2023

Read more about Local Government Fiscal Crisis here

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.

MKE County

-

Ron Johnson Says Free-Market Principles Could Fix Education

Jul 17th, 2024 by Graham Kilmer

Jul 17th, 2024 by Graham Kilmer

-

RNC Will Cause Some County Services To Be Moved to Wauwatosa

Jul 12th, 2024 by Graham Kilmer

Jul 12th, 2024 by Graham Kilmer

-

Hank Aaron State Trail Will Be Closed For RNC, State Fair

Jul 12th, 2024 by Graham Kilmer

Jul 12th, 2024 by Graham Kilmer

After reading this article it frankly does sound like the county could easily cut back on much of its operations even if the sales tax passes.