Flat Income Tax a Bonanza for Wealthy

Republican proposal skewed to help the rich, cutting income tax for millionaires by 53%.

A proposal to replace Wisconsin’s progressive income tax with a flat income tax has created considerable enthusiasm among the state’s Republican legislators. An earlier Data Wonk column looked at some the issues raised by the flat tax—mainly, how it would increase the portion of the state’s expenses that fall on low-income people.

The term “progressive” refers to taxes that take a higher percentage of high incomes than of low incomes. Taxes that take a higher percentage of low incomes are called “regressive.” Flat taxes apply the same percentage rate to everyone. Individual taxes may be progressive, regressive, or flat. How those elements interact determines how the state’s tax system should be classified.

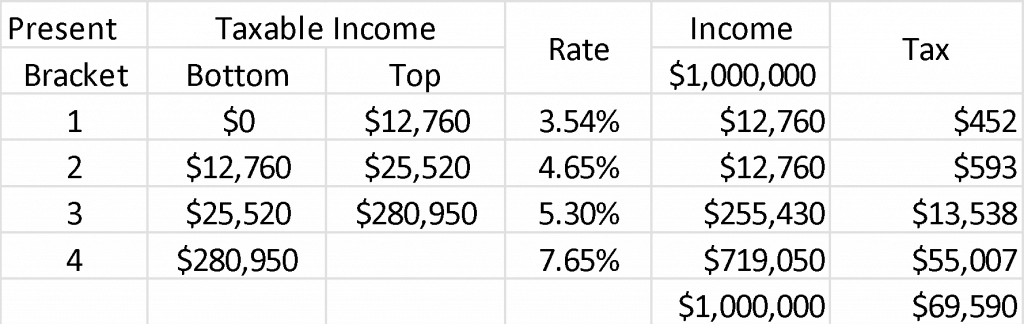

Under current law, the first $12,760 of taxable income is taxed at the rate of 3.54%. For someone whose income is at or below $12,760, that is all the tax that is required. A taxpayer with a higher income would also pay that tax on the first $12,760 of income but then pay 4.65% on income between $12,760 and $25,520. The portion of income over $280,950 would be taxed at 7.65%.

The last two columns in the table show the calculation for someone with a taxable income of one million dollars. The second to last column shows the allocation of the million dollars to each of the brackets. The last column shows the tax generated by each of the brackets. Together they add up to $69,590 for a rate of 6.959% for someone earning a million dollars.

Under the proposed law, taxable income would be taxed at the rate of 3.25%. Thus, the millionaire would pay $32,500, a saving of $37,090 or 53% compared to present law.

Progressivity

This proposal would eliminate the only progressive part of Wisconsin’s tax system, the income tax, which takes an increasing proportion of income as income increases. By contrast, regressive taxes take an increasing proportion of income as income goes down. Of the three taxes used by state and local government to fund most of their operations, both sales taxes and property taxes are regressive.

However, this generalization does not apply to the top 5% of taxpayers. Even with its progressive income tax, when combined with sales and property taxes, the top one percent paid 7.7% of their income in state and local taxes, while those in the next 4% below paid 8.5%.

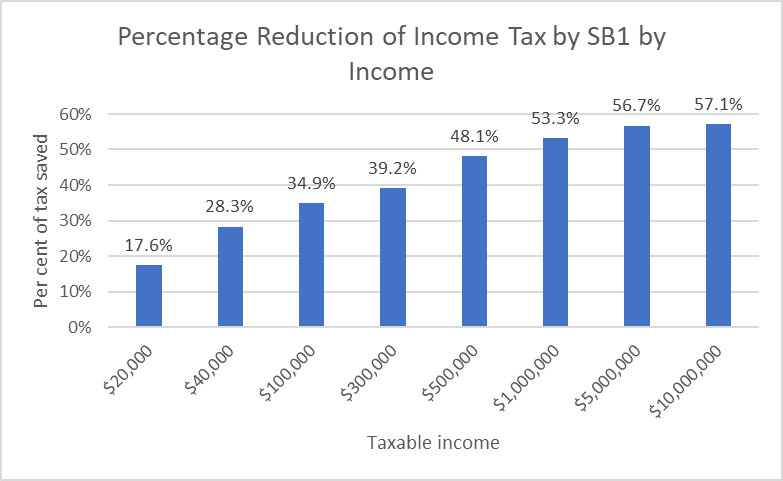

The tax structure proposed by AB 1 and SB 1 is heavily skewed to benefit the wealthiest Wisconsin taxpayers. The next graph shows the percent of the decline in income tax for people in different income brackets. Someone making taxable income of $20,000 would see a 17.6% decline in income tax. This percentage would rise as income increased. Millionaires would see their tax cut by more than half.

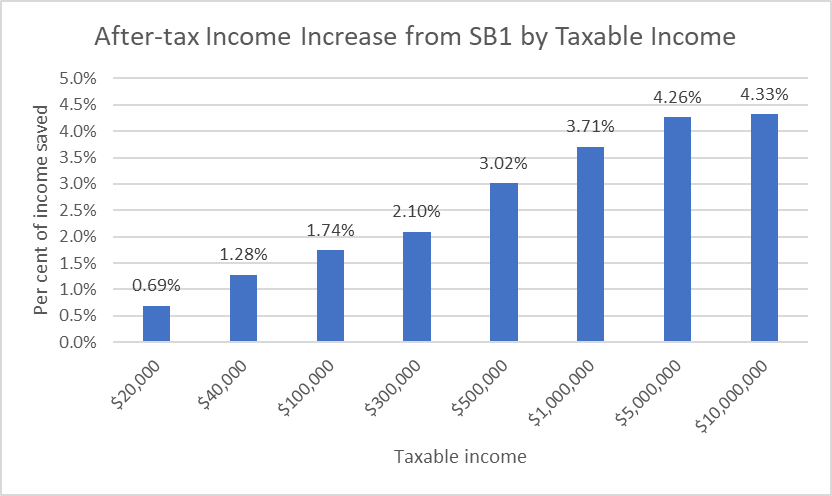

The next graph shows the percentage in after-tax income that would result from SB1 for people of various incomes. Someone making $10 million would see a 4.33% increase in income compared to 0.69% for the person making $20,000.

Will Flat Tax Raise Enough Revenue?

Most of the benefit of the flat tax proposed by SB1 flows to the wealthiest Wisconsin residents. Yet it is designed so that its supporters can claim that every taxpayer would expect lower taxes. It succeeds in doing this trick because it would result in substantially less revenue than under present law.

During most of the 21st century, Wisconsin’s state and local budgets have experienced repeated structural deficits. It is only in the last four years that it has experienced substantial surpluses. There is no evidence that these surpluses will continue in the future, particularly if, as a recent PolitiFact argues, these surpluses largely reflect payments from the federal government to counter the COVID-19 pandemic.

Wisconsin faces substantial challenges, such as restoring shared revenue to local units of government like the city and county of Milwaukee or restoring Wisconsin’s commitment to fund two thirds of public education costs. Instead, the sponsors of AB1 and SB1 propose to give those funds to the least needy residents of the state.

Are SB1 and AB1 Good Politics?

In proposing to replace Wisconsin’s graduated income tax with a flat tax, these Republican legislators seem willing to confirm the charge of their critics that their most serious goal is to make the wealthiest people more wealthy. So far as I can tell, this a political loser.

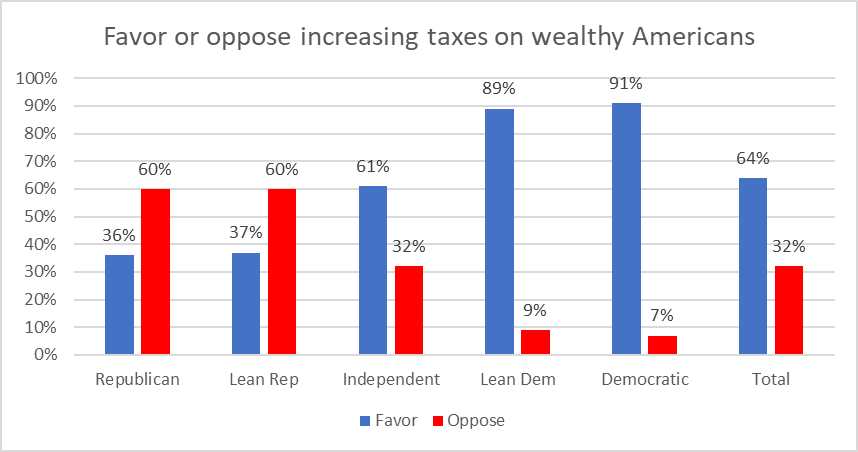

In March & June of 2016 the Marquette Poll asked a sample of registered Wisconsin voters whether they would “favor or oppose increasing taxes on wealthy Americans and large corporations in order to help reduce income inequality in the U.S.?” Two thirds of the respondents answered in the affirmative including two thirds of independents. In short, the flat tax is the kind of proposal that can help win a Republican primary, but not a general election.

The Marquette Poll has not asked that question more recently. However polling by others such as one in in 2021 from Vox, suggest that this consensus has not changed in the years since. As Gallup’s summary of research concludes, “Americans generally favor increasing taxes on the rich.” To argue that taxes on the rich should be dramatically reduced when the rich are already paying a lower portion of income would seem to be a tough sell.

Taken as a whole, Wisconsin’s tax structure is already regressive at the top. Very wealthy people on average pay a lower percentage of their income in total taxes than do lower and middle income. Rather than “flattening” the Wisconsin tax structure, the proposed “flat” tax would extend that regressiveness to the rest of the income range.

In turn, that proposal would make income inequality greater because the state income tax would no longer partially compensate for Wisconsin’s regressive sales and property taxes.

Data Wonk

-

Why Absentee Ballot Drop Boxes Are Now Legal

Jul 17th, 2024 by Bruce Thompson

Jul 17th, 2024 by Bruce Thompson

-

The Imperial Legislature Is Shot Down

Jul 10th, 2024 by Bruce Thompson

Jul 10th, 2024 by Bruce Thompson

-

Counting the Lies By Trump

Jul 3rd, 2024 by Bruce Thompson

Jul 3rd, 2024 by Bruce Thompson

The Legislative Fiscal Bureau has released a report on the bill. When fully implemented the Republican proposal would reduce reduce the state’s revenue by $5.06 billion annually. For perspective, the UW System’s share of general purpose revenue in 2023 is $1.3 billion. The Department of Corrections also receives $1.3 billion. The total of $2.6 billion is slightly more than half (51%) the total tax cut. To put it another way, you could eliminate all state funding for corrections and the UW system, and still need to cut another $2.46 billion in state spending to pay for the tax cut. Here is the analysis:

https://mail.google.com/mail/u/0?ui=2&ik=417a43af47&attid=0.1&permmsgid=msg-a:r8160673036122179602&th=185bc9dbfc8343a2&view=att&disp=inline&realattid=185bc89cebac21c91761