Tax Cuts Pass Under Dark Clouds

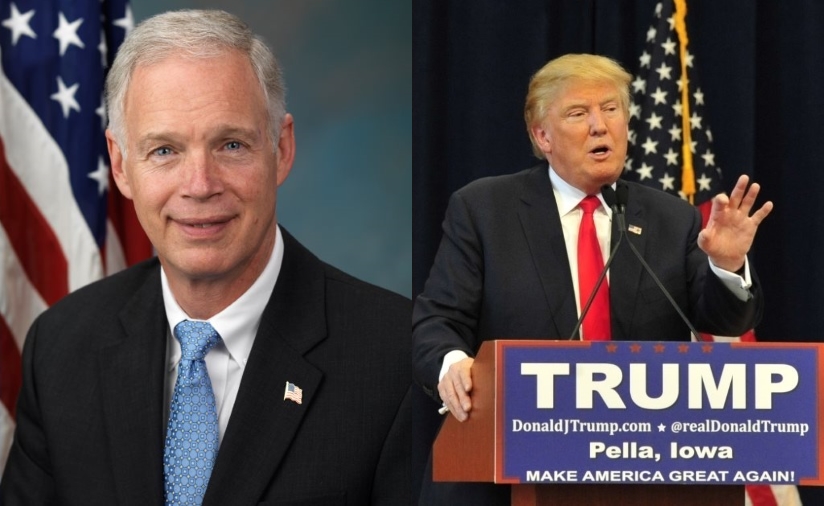

Secrecy and lies used to pass it. How much will Trump, Ron Johnson personally benefit?

Senate consideration of the GOP tax cuts on Friday was overshadowed by dark clouds. Special Counsel Robert Mueller accepted a guilty plea from disgraced National Security Adviser Michael Flynn, who pled guilty to lying to the FBI. Then Flynn dropped a bombshell: “My guilty plea and agreement to cooperate with the Special Counsel’s office reflect a decision I made in the best interests of my family and of our country.” The plea agreement suggests more to come. Who directed Flynn to talk to the Russians? Was Trump trying to obstruct justice by leaning on and then firing FBI Director James Comey?

More clouds. The GOP-led Congress went through a pretense of regular order to consider and vote on the tax cuts. The House and Senate bills were drafted behind closed doors. There were no hearings with expert testimony, no Treasury Department analysis, nor was there any interest in working with congressional Democrats, and the tax cuts were jammed through Congress in a pell-mell manner. Then there were the lies.

The Senate tax cuts are mostly for GOP donors (Washington Post), corporations, pass-through businesses and the rich – peanuts for the rest of us. The JCT reports that most folks earning less than $75,000 will actually pay higher taxes by 2027. Why? The Senate tax cuts are temporary for individuals and families, but permanent for corporations. What about pass-throughs?

Wisconsin GOP Senator Ron Johnson, always a showboat, made a big to-do about standing up for Main Street pass-throughs. However, the New York Times opined: “About 70 percent of all pass-through income goes to people in the top 1 percent of Americans who receive any income whatsoever.” Johnson pressured McConnell to agree to more tax cuts for pass-throughs — $114 billion (Washington Post). How much will Johnson and Trump benefit from their pass-through assets – and what about regular folks?

The Senate tax cuts passed early Saturday 51-49. Johnson voted yes, while Wisconsin Democratic Senator Tammy Baldwin voted no. Baldwin earlier said that the GOP bill was a “tax giveaway to the top 1 percent and powerful corporations.” Worst of all the tax cuts will increase the debt, lead to more inequality and limit the federal response to future economic crises. Moreover, it will lead to cuts in Medicare, Social Security and domestic spending. And, still no budget. One more dark cloud – a possible government shutdown. Soon.

This column was originally published by Wispolitics.com

Bill Kaplan wrote a guest column from Washington, D.C. for the Wisconsin State Journal from 1995 – 2009.

Op-Ed

-

Wisconsin Candidates Decry Money in Politics, Plan to Raise Tons of It

Dec 15th, 2025 by Ruth Conniff

Dec 15th, 2025 by Ruth Conniff

-

Trump Left Contraceptives to Rot; Women Pay the Price

Dec 8th, 2025 by Dr. Shefaali Sharma

Dec 8th, 2025 by Dr. Shefaali Sharma

-

Why the Common Council’s Amended Budget is Good Policy for Milwaukee

Nov 20th, 2025 by Alds. Marina Dimitrijevic and Russell W. Stamper, II

Nov 20th, 2025 by Alds. Marina Dimitrijevic and Russell W. Stamper, II

Awareness almost always lags behind reality. But with the pending tax bill, whatever the tinkering in conference, the reality of American corporate plutocracy becomes inescapable. With large majorities opposed to what they understood was in the bill, Republicans made it even worse at the behest of their donors, corporate lobbyists, and in their own naked financial self interest. We should eagerly await the chart of the tax windfall to the members of Congress, the self-dealing members of the cabinet and the president and his court.

Then there is the case of Senator Johnson. It was virtually impossible to find anyone who believed that Johnson would remain a “no” vote as he stood up for “the little people” like himself. Decaying regimes are largely peopled by mediocrities and opportunists. This one is no different.

Next, there are “the American people,” narrowly defined by Republicans as white, non-urban, reasonably well off, right-wing Christians. When confronted with the choice between the donors/corporations and their definition of “the American people,” guess who they went with, with a few bones thrown here and there. And next on the reactionary agenda for “the American people”: goodbye Medicare, Medicaid, Social Security as we know them.

Finally, what may be the biggest item: the punitive regional aspects of the legislation, which target “blue states.” This may be the biggest area in which perception lags behind reality. What is considered unthinkable, i.e., California secession, could become a non-joke fairly quickly. And once it becomes thinkable, it becomes possible. And the door will have been opened to the issue that we face being simply trying to preserve the republic. People who are playing with fire rarely realize it at the time, especially when they aren’t too bright and live in bubbles.

Frank, thanks for the way you laid this out for all of us to see. Working people just got hammered again. Lying Ryan, Corporate Welfare Walker and marbles Johnson have just given the 1% our once great country.