Robbing General Fund for Roads?

Gas tax lagging; legislators may raid education, health care funding.

Governor Walker and other state lawmakers have said they are open to redirecting money from a pot intended to support education, health care, and safe communities, and using the money for roads instead. That approach could lead to future budget cuts that damage academic opportunities for Wisconsin schoolchildren, lengthen the amount of time to graduation for University of Wisconsin students, and make it harder for communities to afford important services like trash collection and street cleaning.

State road projects are funded with resources from Wisconsin’s Transportation Fund. About a decade ago, state lawmakers froze the gas tax on each gallon of gas sold – the main source of revenue for the Transportation Fund – and inflation has eaten away at the tax’s value since then, shrinking the amount of resources available to build and maintain Wisconsin’s transportation network. The result is that there is not currently nearly enough money coming into the Transportation Fund to pay for all the highway projects lawmakers want.

A natural solution to this quandary would be to increase the amount of money coming into the Transportation Fund by removing the freeze on the gas tax and letting it rise with inflation. Another common-sense approach would be to pare back planned highway projects to fit the amount of revenue available.

But state lawmakers are taking a look at a third approach: using money from Wisconsin’s General Fund to spend on highways and other transportation projects. Taking resources from the General Fund would give lawmakers the luxury of putting off finding a permanent solution to the imbalance in the Transportation Fund, but would shortchange Wisconsin school children, families, and workers.

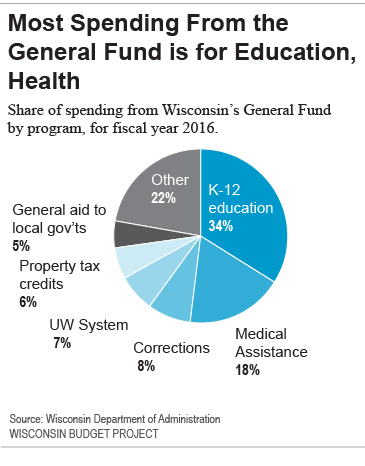

Most spending from the state’s General Fund is for education and health, and taking money from the General Fund for transportation would reduce resources available for those important state priorities. Out of every dollar spent from the General Fund:

- 34¢ goes to K-12 education;

- 18¢ goes to making sure Wisconsin residents with low incomes have access to medical care;

- 8¢ goes to the state’s corrections program;

- 7¢ goes to the University of Wisconsin System;

- 6¢ goes to property tax credits;

- 5¢ goes to general aid to local governments; and

- 22¢ goes to other services.

Some lawmakers point to past transfers in the other direction – from the Transportation Fund to the General Fund – to justify their actions. But recent transfers from the General Fund to the Transportation Fund have far outstripped transfers in the other direction. In fact, by the end of 2019 lawmakers will have diverted a net total of $886 million from the General Fund to pay for transportation purposes, if the Governor’s 2017-19 budget recommendations are included. That figure could rise if lawmakers take additional money from the General Fund, as is under discussion.

(The Wisconsin Constitution prohibits transferring money out of the Transportation Fund to use for other public services. But the amendment does nothing to prohibit transfers in the other direction – using money from the General Fund for transportation purposes.)

In a sense, lawmakers want to have their cake and eat it too: They want to keep the freeze on the gas tax and not let it rise with inflation, but still fund all their favorite road projects. They need to take a hard look at increasing the gas tax or scaling back highway projects, rather than using money from the General Fund and taking resources away from state priorities that make Wisconsin a great place to live – priorities like excellent public schools, safe communities, and accessible higher education.

Transportation

-

Congestion Pricing Cuts Air Pollution in New York City

Dec 14th, 2025 by Jeff Wood

Dec 14th, 2025 by Jeff Wood

-

FTA Tells Milwaukee to Crack Down on Fare Evasion — Even Where Fares Don’t Exist

Dec 12th, 2025 by Graham Kilmer

Dec 12th, 2025 by Graham Kilmer

-

Will GOGO’s Bus Service Ever Get Going?

Dec 9th, 2025 by Jeramey Jannene

Dec 9th, 2025 by Jeramey Jannene

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

I sure hope Scooter loses and we can get a Governor that will actually take some action and fix things.

Index the gas tax to inflation (LIKE HOW IT USED TO BE) and the issue would be fixed. Jeez…