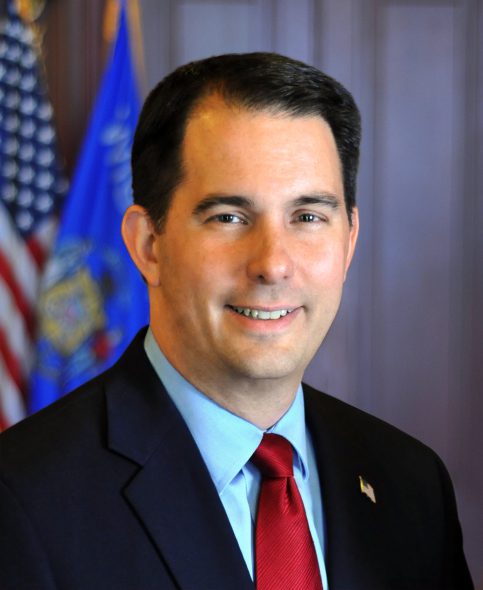

Expand Earned Income Tax Credit?

Walker favors it. Would help low-income working families.

Governor Walker has proposed increasing the state’s Earned Income Tax Credit for some families, a move that would improve child well-being and expand economic opportunity for families with low and moderate incomes. He included the measure in his proposal for the budget period that runs from July 2017 to June 2019.

Expanding Wisconsin’s EITC would give a much-deserved break to working parents with low and moderate incomes. The EITC lets working families keep more of what they earn to help meet basic needs and pay for things that allow them to keep working, such as child care and transportation. This tax credit offers working parents a hand up by encouraging and supporting work. It’s a modest investment that can make a big difference in the lives of families.

The EITC also boosts local communities and economies across the state. It puts more money in the pockets of low-wage workers, who then spend it at local businesses to pay for things like groceries and child care. Businesses like this tax credit because workers who can pay for basic necessities are more dependable employees when they can afford child care and reliable transportation.

Governor Walker has proposed expanding Wisconsin’s EITC in several ways, including:

- Increasing the credit for working parents with one child. Wisconsin EITC amounts are calculated as a percentage of the federal EITC, and Governor Walker has proposed increasing the state EITC for parents with one child from 4% of the federal credit to 11%. This change would meant that families with one child would have their state credit calculated the same way as families with two children, boosting the maximum EITC amount for families with one child from $139 to $383. About 129,000 families with one child would receive a larger credit under this proposal, reducing their taxes by $21 million a year.

- Reducing the EITC marriage penalty, by establishing a “honeymoon” period for recently-married filers, who could claim the larger of what they claimed in the year prior to marriage or the credit they can claim in the current year as a married couple. Married couples would be eligible for this provision for three years. Once this change is fully phased in, the increase in EITC amounts will cut taxes for married couples by $5.5 million a year.

- Allowing noncustodial parents to receive an EITC, smaller than the amount that custodial parents receive. Noncustodial parents still have financial and parenting obligations to their children, and receiving the EITC can help them meet these and other responsibilities, including serving as a role model to their children. Expanding eligibility to include noncustodial parents would cut their taxes by $230,000 a year.

All the changes would go into effect starting in tax year 2018.

The changes proposed by Governor Walker would help working parents make ends meet, encourage them to keep working, and reduce poverty among families. But the benefit of the proposed increase in the EITC is limited by the fact that state lawmakers cut nearly the same amount from the EITC in 2011. In effect, working families in are simply treading water in Wisconsin rather than getting the economic boost that an increase in the EITC would otherwise bring.

The 2011 cut reduced credit amounts for families with two or more children, while the Governor’s 2017 proposal increases the credit for families with one child. While the dollar amount of the 2011 cut and the proposed increase are about the same, the proposed increase would not go to the same families that had their credit cut.

The EITC is an effective tool for reducing poverty among working parents and their children. Children whose families receive the EITC do better and go farther in school, and work more and earn more as adults. If approved by the legislature, Governor Walker’s proposal to expand Wisconsin’s EITC will have long-lasting effects that improve the economic well-being of families and communities, and mitigate the harm that was done by cutting this credit in the past.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock