Tax Break for Wealthy Keeps Growing

11 claimants will get $22 million tax break under Manufacturing and Agriculture Credit.

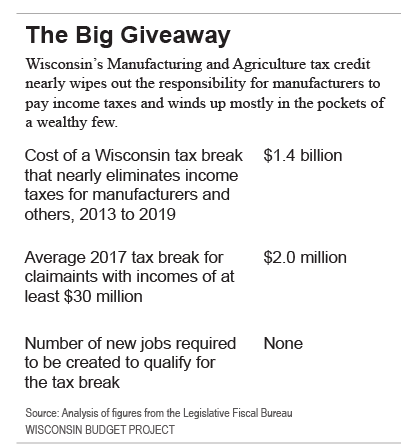

A tax break that has cost far more than originally anticipated has resulted in enormous tax breaks for a wealthy few, according to a new analysis from the Wisconsin Budget Project.

The Manufacturing and Agriculture Credit nearly wipes out state income tax liability for manufacturers and agricultural producers in Wisconsin. Only about three out of every thousand individual income tax filers receive this tax break, but in 2017 alone the credit will cost the state $299 million in reduced revenue. Looking ahead, the cost of the credit swells even more, ballooning to more than $650 million for the upcoming two-year budget period that starts in July 2017.

The cost of this tax cut has taken lawmakers by surprise. In fact, the credit is now estimated to cost more than double what lawmakers originally thought when the amendment creating the credit was quietly slipped into the 2011-13 budget bill.

Nearly all the value of the tax break goes to the very wealthy. In fact, just 11 claimants, all of which had incomes of $30 million or more, receive an estimated combined tax break of $22 million in 2017. That works out to an average tax break of more than $2 million each.

What are Wisconsin residents getting in exchange for a runaway tax cut that benefits only a few? Very little. In fact, there is no requirement that manufacturers create even a single new job in order to be eligible to receive this credit. Manufacturers that lay off workers, move jobs overseas, and close facilities can still receive the tax break.

The Manufacturing and Agriculture credit is the latest example of a counter-productive tax-cutting agenda in Wisconsin. The focus on cutting taxes has done little to boost job creation, but has reduced the resources needed to make the kind of public investments that make Wisconsin a great place to live, work, and do business. Wisconsin’s cuts in state support to public schools are among the largest in the country, endangering the strong public education system that gives Wisconsin students one of the best educations in the country. Wisconsin has also made deep cuts to the University of Wisconsin System, making it harder for universities to add classes in high-demand fields, and for students to graduate on time. Instead of investing in our schools and higher education system, Wisconsin has prioritized tax cuts like this one, which wind up mostly in the pockets of the wealthy and do little to boost employment.

For more about problems with the Manufacturing and Agriculture Credit, read The Big Giveaway is Getting Bigger: Updated Figures Show Growing Tax Credit is Inefficient, Costly.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Just one more way that Wisconsin has become an oligarchic plutocracy.

Funding for the public good keeps getting slashed so the wealthiest can sit on their millions and say “Let them eat cake.”

Meanwhile those who get those tax breaks can afford to keep funding Walker and the legislators providing those breaks and “the best government money can buy.”

Progressives! Liberal! Weak-Minded Swing-Voters!

Do you know how you fight this? Break them up. Break up the large corporations that corner the market. Break up the trusts that frack our clean water. Break up the institutions that stifle democracy by any means necessary.

FDR did this and kept democracy safe for generations. History doesn’t repeat but it rhymes, so we need to break them up.

Take a page from their playbook, start with the most hated of corporations… Comcast/Warner/Spectrum/Verizon… whatever they go by today. Break them up, create local jobs as the pieces compete with one another and watch as their industry doesn’t wield the same political clout as before.

I’d love to see all corporate taxes eliminated.

You know what could happen if my company had it’s ~33% taxes returned.

My employees would make more money.

My employees would have more benefits.

My employees would have better equipment to use.

My customers would be able to buy from me for cheaper.

My tools that I buy would be cheaper.

My materials that I buy would be cheaper.

My employees would make more money.

My customers would be able to buy from me for cheaper.

If I am able to sell cheaper, I will be able to sell more.

If I am able to sell more, I will be able to hire more employees.

If I am unable to hire more people, I will have to pay my employees more money so they stay with my company.

If I pay my employees more money so they stay with my company, I will pay new hires more money to entice them to come to my company.

If I didn’t have to pay corporate taxes at my current rate of ~33%….

Did I mention that I drug test? Crap – there went half of my potential employees.

What ACTUALLY happens when “your company” gets it’s ~33% taxes returned:

* The CEO’s salary goes up 33%.

Any comment on the actual story Ben?

Ben (post 3): So many half-truths; so little time, so let me choose a few.

If corporations ACTUALLY paid 33% in taxes (in reality, after loopholes many profitable corporations pay nothing at all), and those taxes were eliminated:

• Why would employers choose to pay higher salaries than today since today’s salaries are effectively subsidized by that 33% tax, and eliminating the tax also eliminates that subsidy.

With a 33% tax, each $100 in wages reduces corporate taxes by $33, meaning that only $67 each $100 in wages comes out of the owner’s pocket. By contrast, with a 0% corporate tax, each $100 in wages actually takes $100 out of the owner’s pocket.

Claiming that lower corporate income taxes (which, by law, only taxes income AFTER paying wages) will result in non-executive pay hikes is beyond weak.

• While zero corporate taxes would allow you to sell for less, there is little reason to believe you would gain market share, since all of your competitors would get the same cost advantage.

• If corporate taxes are dropped, personal taxes will go up to make up the difference. Or are deficits no longer a problem?

Ah Ben, if your corporate taxes were eliminated, how do you propose that we pay for the roads that you and your company uses, or the schools that you and your employees attend, or any of the other shared social benefits that you depend on for your continued success? Are you willing to see income tax rates like there were during the Eisenhower era?

@Vincent Hanna

Lots of silly sheep….believing everything they read.

This isn’t a new tax credit ~ this is just a renaming of an existing credit available.

The intention of these tax credits was to lessen the burden on our farmers. How many want to pay $12.00 for a gallon of milk?

A big issue with our tax system is there are so many tax credits available. And there are so many differing view points of those tax credits. If we had a simple tax system, 75% of the political differences would disappear.

Ben, I don’t believe milk would be $12.00/gallon if this tax credit was removed. What’s the price of milk in other states without it?

@Jeff

Please elaborate more on the shared social benefits, and I would be glad to discuss ways to eliminate them and lower our overall tax burden.

@Tom D

“With a 33% tax, each $100 in wages reduces corporate taxes by $33, meaning that only $67 each $100 in wages comes out of the owner’s pocket. By contrast, with a 0% corporate tax, each $100 in wages actually takes $100 out of the owner’s pocket.”

I’d like to point out that the 33% corporate tax ACTUALLY comes out of the pockets of my customers. I need to charge my customers more money in order to pay taxes.

“I need to charge my customers more money in order to pay taxes.”

Ben, by law, these taxes are applied only AFTER paying wages.

So no, you don’t need to charge your customers any more to pay wages.

@Tim

There are numerous ways to look at it.

Wisconsin and California have the largest agricultural subsidies, and these 2 states combined account for approximately 35% of the countries milk production.

A benefit of the above mentioned agricultural tax, creates an incentive for manufacturing companies to spend on R&D, which in turn, helps our farmers become more efficient when spending and investing in those products and services.

Look at the difference of milking parlors now compared to the norm just 10 years ago. So this is a benefit of this tax credit to society — more milk production = more supply = lower costs

The tax credit listed above, is on state taxes.

Our Federal Government has an entirely different array of subsidies for agricultural businesses, spending approximately $25,000,000,000 PER YEAR. 25 billion……twenty-five BILLION.

These subsidies, by the way, are what we, tax payers, pay to the government – and they decide to spend it how they chose.

How our tax system is set up, is just a joke.

Farmer Produces Milk (yes, the cow produces the milk)

Farmer Sells Milk for a government decided amount of money

Farmer pays taxes on sales revenue

Shipping Company transports milk to processing facilities.

Shipping Company pays taxes on revenue.

Processing company performs extensive lab testing. (This is not a bad thing)

Milk is processed, pasteurized and homogenized. Milk is then packaged and sold to stores.

Manufacturing company pays taxes on revenue.

Shipping Company transports milk to stores.

Shipping Company pays taxes on revenue.

Stores sell milk.

Stores pay taxes on revenue.

Federal government takes in all this tax money on milk, and uses it to create subsidies for farmers.

If we reduced taxes on the farmers, and truckers, and manufacturers by the amount of the subsidies and reduced subsidies the same as the taxes…..how is this a bad idea for the consumer?

Subsidy:

* pay part of the cost of producing (something) to reduce prices for the buyer.

Presumably when a government subsidizes something, it’s because it’s an essential good or service, which lowering the cost of provides a social benefit that balances or outweighs the opportunity cost of the subsidy (opportunity cost meaning the ability to use that same money elsewhere).

The opposite of a subsidy would then be an excise tax:

Excise taxes are taxes paid when purchases are made on a specific good, such as gasoline. Excise taxes are often included in the price of the product. There are also excise taxes on activities, such as on wagering or on highway usage by trucks.

Now most of the things we excise tax make sense. But some of the things we subsidize don’t make sense to subsidize, and in fact should be (and sometimes are) excise taxed. Oil comes to mind.

By total dollar amount, most government subsidies are paid to large corporations who don’t really need the money or produce anything essential. This is largely the result of corrupt politicians, lobbying, the Koch brothers, and ALEC.

@happyjack

If my customers don’t pay for my cost of taxes, who will pay them?

@Ben

You will.

As far as setting your prices, you should determine that by supply and demand – you want to maximize price * units sold, so far as your production capacity allows.

As far as hiring workers, you want to have as many workers as you need to comfortably meet current and expected demand.

Generally speaking you want to increase demand. A good way to do that is to lower the tax burden of the lower economic bracket, as they will spend the largest fraction of that increased available income. By the same token, you can increase demand by raising the minimum wage to be more in line with historical productivity increases.

sorry, that should have been maximize:

(price – production cost) * units sold

Note that the corporate tax is AFTER wages and all that, so it doesn’t effect production cost. Consequently it doesn’t effect the optimal price.

If you really want to, you can raise your prices. But by definition when you move your price away from the optimal point, you’re decreasing your revenue. (In this case, by decreasing units sold.) And I don’t understand why any company would want to decrease their revenue.

But go ahead… commit economic suicide. There will be other companies there to fill in the resulting demand gap. Quite happily.

Ben, I still don’t understand. If I go to another state that doesn’t have these tax breaks, milk doesn’t cost $12.00/gallon.

So, were you lying before? Why would you say something that isn’t true?

Farmer Produces Milk (yes, the cow produces the milk) – farmers also produce other things besides milk.

Shipping Company transports milk to processing facilities. – shipping companies also transport other things besides milk

Shipping Company transports milk to stores. – shipping companies ship other things besides milk

Stores sell milk. – stores sell other things besides milk.

If we reduced taxes on the farmers, and truckers, and manufacturers by the amount of the subsidies and reduced subsidies the same as the taxes…..how is this a bad idea for the consumer?

because milk would be too expensive for the consumer.

Ben (posts 11 & 15):

Corporate income tax does NOT come out of the customers’ pockets. It is a tax on profits (not sales) and profit is, by definition, money in the OWNERS’ pockets.