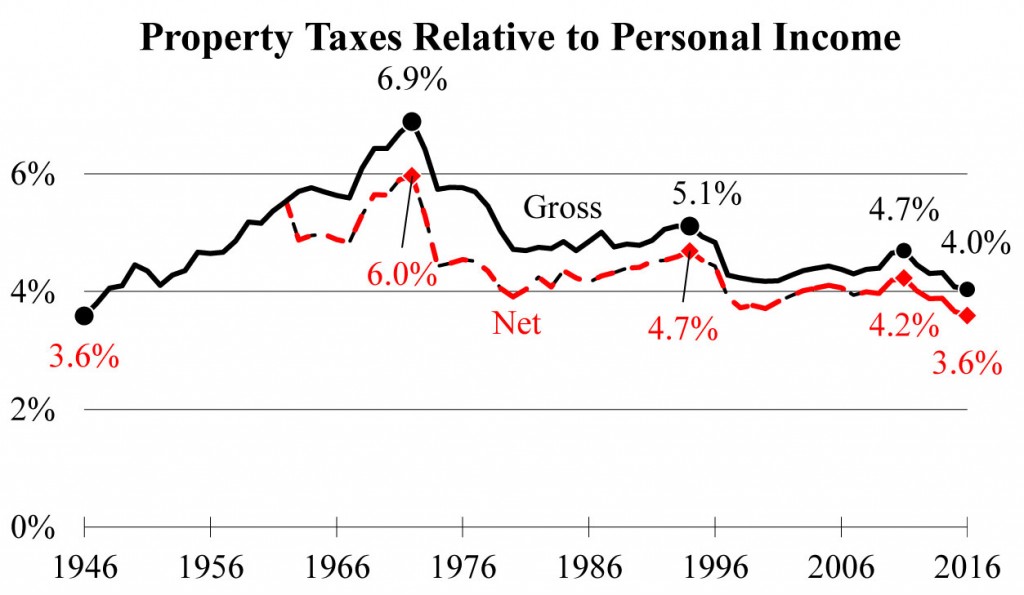

Property Taxes At Lowest Level Since 1946

Declined from 6.9% of personal income in late 1960s to 3.6% in 2016.

Final property tax figures for 2015-16 show that all units of government (municipalities, schools, counties, technical colleges, etc.) levied $10.62 billion last December (payable in 2016), a 2.3% increase over December 2014 levies. After all state credits are applied, net levies totaled $9.45 billion, a 1.4% increase.

This year, net property tax levies claimed 3.6% of personal income, the smallest percentage since 1945-46 (see chart). State-imposed property tax limits, state “buydowns” of property taxes, and increased state credits explain the decline since 1994.

The state has imposed revenue limits on schools since 1993-94 and on technical colleges since 2014-15. It has imposed levy limits on municipalities and counties since 2005-06. These limits were tightened beginning in 2011-12.

In 1997, the state increased school aids about $1 billion, which reduced school levies more than 16% due to revenue limits. It used $406 million to buy down technical college levies in 2014-15.

To ease the property tax burden, state tax dollars are used to fund various credits on property tax bills. Currently, state taxes and lottery revenues fund three credits totaling $1.17 billion. Since 2005-09, tax-funded credits have increased $533 million, or 114%. The 2015-17 state budget added $105.6 million to them to reduce 2015-16 tax bills.

WisTax

-

22 Counties Trail State in Job Growth

![Marinette County Courthouse. Photo by Bobak Ha'Eri (Own work) [CC BY 3.0 (http://creativecommons.org/licenses/by/3.0)], via Wikimedia Commons](https://urbanmilwaukee.com/wp-content/uploads/2017/10/1024px-2009-0619-Marinette-Court-185x122.jpg) Oct 11th, 2017 by Wisconsin Taxpayers Alliance

Oct 11th, 2017 by Wisconsin Taxpayers Alliance

-

Local Government Finances Are Stable

Sep 17th, 2017 by Wisconsin Taxpayers Alliance

Sep 17th, 2017 by Wisconsin Taxpayers Alliance

-

School Spending Falls Below National Average

Aug 29th, 2017 by Todd A. Berry

Aug 29th, 2017 by Todd A. Berry

No mentions of Fees on the rise or sales tax,. Vehicle, work place permits, school fees, fast food tax, beverage tax, taxes on booze and cigarettes, gun permits, hunting permits, utlities taxes, water, electric

It looks like somebody doesn’t like taxes (^)…

I would point out that the subtitle claims prop taxes were 6.9% in ’97, but it appears on the graph that they were only that high in the mid-Sixties, prior to white flight.

Meanwhile school districts all over the place are resorting to referendums so they can survive.

This is what responsible fiscal management and discipline can do for government budgeting. Great news for Wisconsin taxpayers!

Would not the real meaningful yardstick be to compare the mill rate to 1000 dollars of assessed valuation for residential property.? This article

ignores the Republican giveaway to corporate farms, forest cropland, and business properties, which are allowed to pay real estate taxes on “income potential” rather than fair market value, as does a residential homeowner.This story, which shows how the Taxpayers Alliance has morphed into a conservative newsletter producer, misleadingly uses in the comparison personal income, which includes all the 1% who are doing just great, but does not deal with the retired couple whose taxes are a significant part of their income on their home. Walker and his GOP posse in the legislature are following the Texas playbook, which requires the voiceless middle class and lower income people to support the business and banking community through regressive tax policies.

Dudemeister, you’re correct, the high point for taxes was in the late 1960s, and most of the reduction came in the 1970s, under Democratic governors Pat Lucey and Martin Schreiber and perhaps Republican Lee Dreyfus. More recently, under Walker.

and I should have added, we’ve now corrected the subhead, thanks!

Property taxes down? Sure. But all the fee increases for state parks, county parks, special school referendums to make up for the cuts, etc., all wash out the tax decreases. Fees are essentially a tax, no?

Thank you Scottt Walker and GOP taking a bankrupt govt, in the hole and forced to cut aids to schools, for bailing us out. Brilliant work. If you would have listened to them we would be Illinois. They have such dopey ideas.

Jason you are full of cap user fees to fix parks are different but they are only 5% of what we have saved, billions.

Lying Hanna again has no idea what he is talking about or lying. Only 7% of distrust went to referendum last year for operations. They are mismanaged. Rest are doing quite well.

Well Vincent WCD is now referring to the same way Trump refers to Hillary. Congrats!

Lying? The number of school district referendums doubled from 2009 to 2014. That’s a fact WCD.

http://www.wpr.org/wisconsin-school-districts-increasingly-turn-local-referendums-fund-operation

Thank you Casey. It’s a true honor. I always knew WCD admired Trump.

Doubled from what to what?? 10 to 20 out of 429? How come 95% of districts are well run,then you have 12 or so complete “National disasters” which people like Hanna and co. run, and another dozen or so, that are poorly managed, not unusual for schools.

Historically schools absorb lots of money with few results. NJ spends almost twice what we do, and they are worse. Zuckerberg gave them 100 million and what happened ? “Nutting”?

In Wisconsin since 1970, when the Unions really started going, we have raised spending tenfold, with 50% less students and things have gotten worse, cause the left cannot run anything.

They condemn, the white, male , libera,l racists that control Milwaukee , hundreds of thousands of kids to life on this streets cause they are impotent.

Ah I don’t run a school district. And I am not just talking about Milwaukee. I am talking about rural and suburban districts as well. You live in an echo chamber of conservative ideology. Call around. Talk to superintendents and other district leaders all over the state. Try talking to people on the front lines, people who actually know what they are talking about. You might learn something.

Zuckerberg didn’t give NJ that money. He gave Newark that money, with the full support of Chris Christie, Cory Booker, and reformers, the pro-school choice crowd, the people you support WCD.

WCD: “Doubled from what to what?? 10 to 20 out of 429?”

Try 206 in 2014 alone. “The bills come during an uptick in referendums — 206 in 2014, the most in at least 10 years, state records show — and the rate at which they pass.” http://host.madison.com/wsj/news/local/govt-and-politics/gop-proposals-would-limit-wisconsin-school-districts-ability-to-raise/article_01dfd1b8-e594-50d8-83b7-5b1d840ef632.html

Vince your numbers are crap, and handing out more money, for no reason, or to pay for repairs that they should have done with prior budgets, is just bad management. Schools, especially mismanaged MPS is dumb.

In all areas we want to see what the money is for. and it is always for goodies for the staffs, not the kids. L

Last year their were”e about 75 and some were for building expansions or replacement. About 12 horrible districts in state: “National Disasters like those run by Hanna and others and mismanagement in many districts by Lefties. Never reward mismanagement.

Since 1970 funding for schools has gone up by factor of ten, while students down by 40% and results are worse. All that money has gone into people like Hanna’s pockets and kids get nothing.

Once again, I do not work for a school district. No money is going into my pocket.

How are the numbers crap? Because the truth contradicts what you so desperately want to believe? I have a source. Feel free to try that sometime. No one here is just going to take your word when you say “the numbers are crap.”

“Last year their were”e about 75” – Ah so quite a bit more than the 20 you mentioned earlier. Imagine that.

Hanna your are symbol of this Left management, whiners, totally incompetent. There were 20 that wanted money for operating, the rest were for news building and maintenance. All fro mismanaged left run districts.