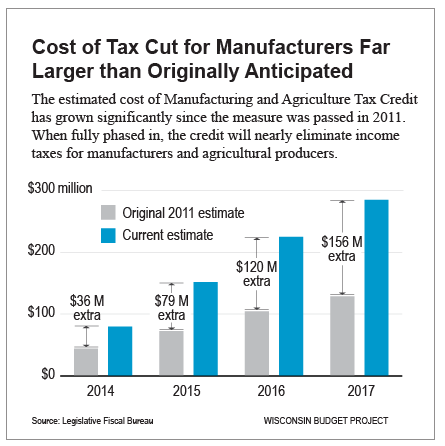

State Corporate Tax Credit is Soaring

Rising to $279 million, more than double projections. No new jobs required to get credit.

Media outlets have done a very good job in recent weeks of reporting on improprieties in the administration of a jobs tax credit program; yet they have been mum on the subject of a far bigger tax credit problem. Ironically, the recent controversy concerns allegations that the Wisconsin Economic Development Corporation (WEDC) has granted jobs tax credits in excess of a $10 million per year cap, but most of the press corps hasn’t even mentioned that the cost of an uncapped corporate tax credit is expected to balloon to $279 million in the next fiscal year, which is more than twice the original cost projection!

What makes this even more ironic and disappointing is that the credit that is now being scrutinized is one that is limited to corporations that are adding jobs in Wisconsin. Although not all the corporations getting that credit have delivered, the state can recover the credit if they don’t. The far larger credit that has largely been ignored has no such constraints. It virtually eliminates the corporate income tax for manufacturers regardless of whether they are adding jobs or, like Oscar Mayer, are in the processing of phasing out all or part of their Wisconsin operations.

In Iowa, there is a big controversy over that state’s decision to give Oscar Mayer substantial tax breaks for retaining some jobs while significantly reducing the total number of Iowa employees. Yet in Wisconsin the situation is even worse because corporations can receive the manufacturing credits without any commitment to create or retain jobs.

The much smaller jobs credit program administered by WEDC is far more defensible, since the credits are tied to jobs, but there have been a number of irregularities that have generated controversy. Although I think the reporters continue to miss the much more important problem relating to corporate tax breaks, I give them credit for some good stories over the last couple of months about tax credits awarded by WEDC. For example:

- On Nov. 19, a Milwaukee Journal Sentinel article by Jason Stein reported that the Legislative Fiscal Bureau sent a letter to WEDC several months ago warning the organization that it appears to have awarded $21 million more in tax credits to corporations than it is authorized to issue.

- And the following day a very good article by Matt DeFour of the State Journal rebutted the WEDC argument that what they have done is permissible. He explained that even if we accept the WEDC rationale, the annual amount of the credit allocations could exceed the $10 million per year cap by an average of $7 million per year from 2015 through 2017.

- WKOW has done several good stories about companies that are receiving jobs tax credits, even as they are phasing out jobs. Among its reports was a story last week about Johnson Controls: “A Wisconsin-based company that will lay off 277 employees in suburban Milwaukee in 2016, and could still claim millions of dollars in state tax credits for jobs created at that same location, announced Tuesday it expects to post record profits as well next year.”

- In mid-October, Dee Hall and Tara Golshan of the Wisconsin Center for Investigative Journalism wrote Tales of the WEDC, which is a scorecard of sorts for a number of the incentive packages awarded by the WEDC, including some “clear failures as well as some deals that have potential.”

Kudos to all these reporters for taking a hard look at the performance of WEDC in handing out jobs tax incentives; that sort of review is long overdue. However, the bottom line is that those tax breaks have a relatively modest cost, and the state can potentially compel the recipients to pay those credits back if they don’t deliver on their job promises. Meanwhile the manufacturing credit for corporations has exploded to the point where it will soon cost more than 25 times the size of the WEDC-administered jobs credit, and corporations are eligible regardless of whether they are increasing their Wisconsin workforce or slashing it.

Dump corporate taxes all together or make them flat tax with instant depreciation credits and get jobs here from Ill.

Yes because that worked so well for Kansas. Oh wait, no it didn’t. It didn’t create new jobs or lure companies to the state, and the unemployment rate got worse.

“Corporate tax cuts are ineffectual in boosting economic activity.”

http://www.nber.org/papers/w20753

Vincent Hanna, unfortunately there’s an issue with my database access at the moment so I can’t read that paper, but I’d like to point out you really cherry picked that statement.

Full text in abstract: “we find that increases in corporate tax rates lead to significant reductions in employment and income. We find little evidence that corporate tax cuts boost economic activity, unless implemented during recessions when they lead to significant increases in employment and income.”

AG the bottom line is that Kansas proves that you can’t cut your way to economic growth. The results have been absolutely disastrous in that state.

Large corporations have not created any jobs in WI or the USA for decades. They have taken the tax breaks and credits granted, closed millions of production jobs in the USA, and shifted production overseas. Then turn around and sell their products here with no tariffs while the same countries impose 10% and higher tariffs on USA products.

An example is Nike, make shoes in China for $1 and sell them here for $100. This is great business for Nike but not our regional economy. Corporations use our roads and access to markets, and security protection and pay no tax.

In WI, we should offer WI produced products and services no taxes or sales tax. Add 20% tariffs on imports. Although the new TPP trade agreement may already prevent this approach.

I was Chair of the Chamber Progress Steering Committee for decades. Wisconsin jobs are not coming for large companies like Kearney and Allis Chalmers, they have to come from small businesses that are now very uninterested in getting more than 49 employees. There are so many reasons that little guys do not want to grow too much like the Allen Bradley, Chalmers Kearneys’, Millers etc.

They make enough money to be comfortable then screw it, the Left makes enemies of them and wants to tax them to death. Wake up , Grow up Wisconsin.

@David Yup. I believe the research shows that big business has been a net job destroyer in America over the past 30 years.

Politically across the spectrum spends money, and I am sure smart business people do not care if customers are from the right or left. I am a progressive liberal and always try to shop and spend at small family businesses. Some taxes are a heavy burden on small businesses especially the property taxes. If I know a business owner is obnoxious to good governance and treats employees poorly, and offends the sensibilities of the common good, I do not shop there and I spread the word on Facebook and other venues. This has worked in dropping profits of these ugly company citizens. Even the poorest citizens in the state, 53206, and 53204, actually have the highest density purchasing power in the state due to the density of demographics in these urban areas. They still have money to spend on necessities.

When I was employed, I managed a small business program with the utility to assist them with energy efficiency projects. Many of them were able to reduce the energy bill by 30% or more. There are other ways to help out small to medium businesses that are the real job creators. Universal health coverage would be one example to completely take this issue out of the hands of the employer – Medicare for all. Tax credits and benefits should go in their direction, and no sales taxes on their products and services produced and sold in WI. Cut their property taxes.