Who’s To Blame for Pension Mess?

County’s countless expensive mistakes go back at least 15 years -- and still no solution.

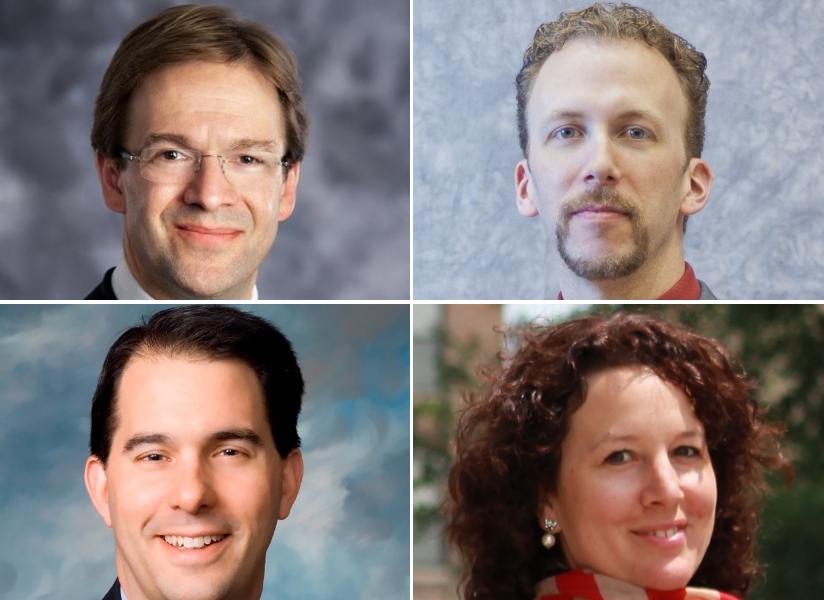

County Supervisor Sheldon Wasserman served for 14 years in the state legislature, but has never seen anything quite like Milwaukee County government.

Wasserman, who was appointed vice-chair of the county board Finance Committee, was naturally aware of the huge county pension scandal of 2001-2002, but had assumed, this being 15 years later, the issue had long since been resolved.

Wrong. “So one of the first things we discuss at the Finance Committee is this problem with the pension and that problem with the pension,” Wasserman says. “It was clear that the whole thing wasn’t over.”

No indeed. A recent report found that hundreds of county retirees have been getting paid the wrong amount, either an underpayment or overpayment. The report came just a few months after the county discovered it had underpaid nearly 1,300 county retirees, and would have to pay out $11 million to make up for the underpayments — in addition to $6 million more that hadn’t been budgeted to fully cover those retirees over their projected life expectancy. And all this comes on top of another error that blew up in 2014 but had actually been discovered in 2007 and never solved: overpayments to retirees in the neighborhood of $26 million.

At one memorable county board meeting, pension office director Marian Ninneman promised there would be no more errors and boasted she had in place a “fail-safe system.”

“I asked, ‘can you guarantee me this,’” Wasserman recalls. “And she said, ‘Supervisor, you are suffering from pension fatigue.’”

Wasserman was flabbergasted and asked what was pension fatigue. Ninneman’s answer, Wasserman recalls, was “Government officials who are tired of dealing with pension problems.”

One week after Ninneman’s bizarre diagnosis (to Wasserman, who ironically is a full-time physician), the latest pension problem blew up and Ninneman resigned. Sources say Milwaukee County Executive Chris Abele gave her the option of resigning or being fired.

“I have never seen anything like this,” Wasserman says. “After three different administrations and 15 years since the worst scandal ever to rock county government, no one has gotten it right. I have absolutely no trust in the system.”

Abele concedes the problem. ‘I’ve never had a solid feeling that we have an effectively managed system,” he says.

County Board chairman Theo Lipscomb blames all the problems on Abele and none on the board. “I’m not blaming Abele for the mistakes that predate his first election, but he’s been county executive for nearly six years. As the most powerful County Executive in Wisconsin, Abele should take responsibility for the growing list of pension errors.”

In fact, the $11 million in underpayments went back as long as 15 years ago when Tom Ament was county exec, and were itemized in a report released in 2007, when Scott Walker was the executive, as the Milwaukee Journal Sentinel reported. But they’ve never been fixed.

As for the $26 million in overpayments, board members passed a unanimous resolution in 2007 to stop the overpayments and then never checked (nor did the Walker administration) to make sure this actually happened. Then after Abele discovered the problem in 2014 and tried to stop all future overpayments, Lipscomb and the board adamantly refused to allow this, with then-board chair Marina Dimitrijevic calling Abele’s action “immoral.”

Abele blames the recurring problems on complexity. “It’s a really, really complicated system.”

The county retirement system was first created in 1937, and over the decades so many special deals and amendments have been passed there are said to be 180 different pension calculations to be made.

The management is nearly as complicated. “There is no tight line over who has authority over it, so it’s very difficult to reform it,” Abele notes.

Certainly the executive has considerable authority, but as proven by the 2014 dispute, the board can override his decisions.

Another major player is the county Pension Board, which has 10 members, including three appointed by the county exec, two by the county board chair, one by the Deputy Sheriffs Association, three elected by county employees and one by county retirees. The board in turn gets advice from the county Corporation Counsel and from an outside attorney.

Abele has asked the county’s pension auditor, Baker Tilly, to do a “deep dive” analysis of the pension system “to find out what else we might be missing.” He expects they’ll probably find “a lot more errors.” So things could actually get even worse.

Wasserman has proposed the county explore having the state take over management of the county system. The state retirement system is considered one of the best-run public pensions in the country, if not the world. Both Abele and Lipscomb say they support a study of such a change, though Abele seems more enthusiastic.

A proposal for state takeover of the system was actually proposed back in 2010 by Dimitrijevic and Sup. John Weishan, but it failed on a tie vote (with Lipscomb then voting yes).

The management of the county’s pension funds could be easily taken over by the highly rated state Investment Board, but the management of retiree payments could add a system quite different than the state’s, and wouldn’t be a slam dunk. Nor, it appears, have any inquiries been made with state officials as to their willingness to take over the system.

That doesn’t concern Wasserman. “The county needs help,” he says. “We can’t seem to compute any person’s pension. Why don’t we give it to the experts who know how to get the job done?”

If you think stories like this are important, become a member of Urban Milwaukee and help support real independent journalism. Plus you get some cool added benefits, all detailed here.

More about the Milwaukee County Pension Scandal

- Back in the News: Actually, County Comptroller Could Get $1.3 Million Backdrop - Bruce Murphy - Jul 12th, 2023

- MKE County: Pension Backdrop Costs Hit $354 Million - Angeline Terry - Aug 16th, 2021

- Murphy’s Law: Mr Pension Scandal Wants Your Vote - Bruce Murphy - Jul 22nd, 2020

- Murphy’s Law: Schmidt’s Pension An Issue for Deputies - Bruce Murphy - Aug 13th, 2018

- Murphy’s Law: Schmidt Will Get $1 Million Pension - Bruce Murphy - Aug 2nd, 2018

- Murphy’s Law: Schmidt Pension At Issue In Sheriff Race? - Bruce Murphy - Aug 2nd, 2018

- The $400 Million Pension Problem - Mitchel Writt - Jun 6th, 2017

- Eyes on Milwaukee: Will County Give Pension to State? - Jeramey Jannene - Mar 23rd, 2017

- Murphy’s Law: Who’s To Blame for Pension Mess? - Bruce Murphy - Mar 7th, 2017

- Murphy’s Law: County Pension Scandal Poster Boys - Bruce Murphy - Mar 3rd, 2016

Read more about Milwaukee County Pension Scandal here

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.

Murphy's Law

-

Is Legislature Biased Against Working Class?

Apr 4th, 2024 by Bruce Murphy

Apr 4th, 2024 by Bruce Murphy

-

Associated Press Will Decline in Wisconsin

Mar 27th, 2024 by Bruce Murphy

Mar 27th, 2024 by Bruce Murphy

-

City Attorney Race Is Vitally Important

Mar 25th, 2024 by Bruce Murphy

Mar 25th, 2024 by Bruce Murphy

Ineptitude plus a partially manufactured and certainly politically convenient crisis…Walker left it all there so as to not damage his image on the way up and allowing it to brew ensured that in the future we’d all come to hate and thus support disbanding county government to consolidate more power to the state (ironic for a states’ rights a-hole, isn’t it?)

You continue to ignore that Chris Abele’s original plan to deal with the 2014 “overpayments” was TO COLLECT THE $26 MILLION THAT HAD BEEN PAID OUT TO RETIREES.

That fact is very relevant, but since you ignore it to push your pro-Abele narrative, you ignore the major issue here: how much of the recently-discovered overpayments is covered by a six-year statute of limitations and is barred from recovery?

We know the statute of limitations exists because Abele scrapped his original plan to collect the 2014 overpayments after he found out that $20 million of the $26 million could not be collected, and that his plan to save taxpayer money would have actually forced Milwaukee County to pay that $20 million and any of the remaining $6 million that could not be collected to the pension fund. The plan was as dumb as it sounds, so why do you ignore it?

Abele’s ridiculous claim that he didn’t know about the hidden report by blaming the governance of the pension is also bogus because the County is liable to the IRS, not the pension board, so any IRS communications, like the hidden report, are the responsiblity of his staff, not the pension board. Abele is lying and you are his parrot.

Get out of here with this garbage “journalism.” Wasserman is a tool for his rich constituents and has no real understanding of the pension system.

Milwaukee county is worst run govt group in Wisconsin except maybe for MMSD.

Abelel likes to be thought of as a leader but he is a little jerk who spends timer and money of Clarke who is ten times the man. What has he accomplished?

Out state thinks we are outhouse down here, one stupid deal after another. Free bus rides?

My old County Supervisor, Daniel J. Diliberti , came to my house to apologize for voting for that mess. I thanked him but told him I voted for him to represent me and I felt he failed me. So what happens? Milwaukee County residents elect him Milwaukee Treasurer. Grrr. I was amazed at what Dennis Hughes, above, alluded to. If the IRS overpaid me and caught it, I’d have to pay them back. I didn’t understand why that wouldn’t have been the case with the pension money. That wasn’t their money to keep. All I know is that the problem doesn’t lay with me.

To Observers point, when I was laid off in 2008, the state overpaid me in unemployment insurance payments… when they discovered it much later, I had to pay that back. Why would I assume I can keep money just because they had an error? This isn’t Monopoly where a bank error in your favor gets your extra cash.

There does seem a contradiction between the first sentence and what follows

County Board chairman Theo Lipscomb blames all the problems on Abele and none on the board. “I’m not blaming Abele for the mistakes that predate his first election, but he’s been county executive for nearly six years.”

Observer – Evidence of hundreds of additional overpayments was hidden because the County Executive did not want to deal with the overpaid pensioners as a group. If the IRS report had been revealed to the County Board, it would have dealt with the problems en masse. Instead, Abele’s administration made the cold calculation that hiding the IRS report would maximize the likelihood of error repayment because it would allow ERS, led by Marian Ninneman whom Abele gave a secret $10,000 to after the overpayments were revealed, to attack pensioners individually, like the widow of a slain Sheriff’s deputy. Dealing with the problems individually made collection more likely because individual pensioners have less power than would the hundreds affected if they were informed at the same time and got organized to take legal, political, and direct action collectively.

If the County Board had been notified, it could have created a reasonable policy to deal with the problem and establish safeguards to ensure that it didn’t happen again, but the Board’s resolution could not have sought collection of overpayments made more than 6 years ago due to that statute of limitations. So, Abele’s administration has willfully ignored the policymakers by hiding the IRS report in order to be unrestrained in demanding all “overpayments” from unsuspecting pensioners, the vast majority of whom lack the resources to defend themselves by invoking their legal right to retain the payments made more than 6 years ago and most likely accepted cuts to their future pension benefits as a result.

__________

Re: 2014 “overpayments”- The difference between the IRS or State seeking overpayment collection, is that Milwaukee County offered the ~200 retirees individual written contracts for the buy-in/buy-back “overpayments,” so if the County did adopt Abele’s Plan B to stop the “overpayments” moving forward (instead of Plan A to stop future payments AND collect all past overpayments), it would have saved the pension fund $0 and would have wasted potentially millions more taxpayer dollars in the form of hundreds of legal fees and potential damages caused by the decision to breach its contracts and withhold those payments (see also “promissory estoppel”).

That’s the idea that Bruce Murphy claims is more reasonable than the County Board’s final action, which allowed the contractually-obligated pension “overpayments” to continue, but had no impact on the pension fund because those “overpayments” were already part of the fund’s actuarial calculations. In fact, the Pension Board supported the County Board’s action, not Abele’s plan to cut future pension payments, which proves that the County Board’s action was the best strategy for protecting the pension fund since the Pension Board has a fiduciary responsibility to make the most financial sound decision for the pension fund. The County Board’s action was such an obvious solution that Bruce Murphy’s refusal to even acknowledge it has made me lose a lot of respect for him.

Here is a link to the audio of the January 29, 2015 County Board Finance Committee, which was when the County Board was presented with Abele’s Plan B. It basically summarizes the 2014 fiasco and also sheds light on the best path forward for the hundreds of recently-revealed overpayments – https://drive.google.com/open?id=0Bxh1fZ1YBlTcX2lpampkbE9fTFU

(start at 34:30 if you want to understand how Bruce Murphy is misleading his readers to protect Abele’s incompetence; go to 57:10 if you want to hear the County Executive’s Chief of Staff, Raisa Koltun, essentially admit that Abele’s administration knew about the hidden IRS report; or 62:12 to hear how there is no confusion that Milwaukee County was responsible for the hidden communication with the IRS, not the pension fund, despite the Abele misinformation that Bruce Murphy fails to criticize despite its obvious absurdity)

Thanks Dennis for the amazing leg work!

WCD, “We”? And what of Scott Walker’s role?

And Clarke is a buffoon so perhaps he does belong in this discussion.

What was Walker role. I believe he fixed the first mess but was gone fro second but check it out I want to know. thank God he saved us from the Halfastn Train and the Medicaid mess.

This situation is one of the major reasons people don’t earmark Milwaukee as a destination for business relocation. I’m living in Indianapolis and it’s a third world country. It’s a great example of what happens to a city when you let the republicans take over. They haven’t paved a sidewalk, put in a street light, or curbed any part of the city since 1980, because the right wing didn’t want to pay taxes for it. I think the paper reported 270 people being killed walking on dark streets since then. I could go on and on.

What amazes me (after I’ve lived other places in the mid-west), is how great Milwaukee is, from culture, to people starting small hipster businesses (and having the ability to do so), to the bus system which is virtually nonexistent where I am now, and the entertainment centers, etc. The sticking point, and I’ve know people who moved their businesses out of Milwaukee county because of this, is that no one can get a handle on this give-away pension situation, and a lot of the tax money goes into this! This goes back to Ament, and should have been nipped in bud way back then, regardless of turmoil. The man mad a gross error, and Milwaukee’s been paying for it ever since.

Trust me when I say, you don’t want to live someplace with marginal taxes and few city services. The police in Indianapolis cannot even protect households in better neighborhoods from home invasions (200,000 more people than Milwaukee, 300 less cops). You want to solve this problem, penalize that pension grafters, and get back to correctly funding one of the best cities in the U.S., and get back to attracting major players!

Thanks Bruce for keeping your eye on the county pension mess. I agree that this has gone on way too long and it is time to let the adults who mange the state pension system take this over from the children who currently run it at Milwaukee County.

Milwaukee county should not be allowed to run a a Pitch n Putt course.

Yes cause the state is doing such a remarkable job (Lincoln Hills, road funding, education funding, etc.). Don’t throw stones in a glass house.