State Budget Outlook Improves

Revenue higher, spending lower than prior projections but debt is deferred.

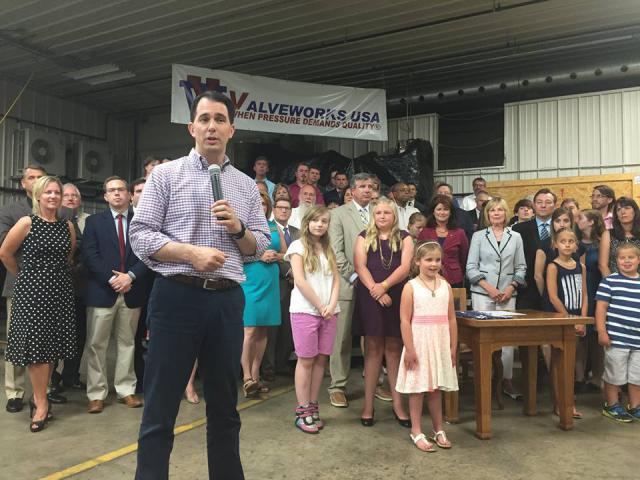

Governor Scott Walker signs the 2015-17 State Budget into law at Valveworks USA in Waukesha. Photo from the State of Wisconsin.

A modest upturn in the state revenue projections and a significant reduction in state spending estimates have created a much better outlook for the state budget.

Before elaborating on the latest numbers, which were released by the Legislative Fiscal Bureau (LFB) last week, I have to admit that the new state tax collection numbers are considerably better than I expected when I wrote a very cautionary story about the next state budget a week or so ago. This is one of two recent occasions (along with my prediction that the Packers would lose to Dallas) when I am very happy to have been wrong.

Despite those disappointing comparisons to the tax projections made about 18 months ago, the state budget picture now looks much better than it did when the Department of Administration released revenue and spending projections two months ago. Here are some of the key figures from the new LFB document:

- The state is now expected to finish this fiscal year with a balance of $427 million.

- Compared to the November projections, tax revenue is expected to be almost $455 million higher over three years ($63 million in 2016-17, $145 million in 2017-18, and $246 million in 2018-19).

- The new revenue projections, coupled with the estimated budget balance at the end of this fiscal year, provide enough General Fund revenue to fully fund the amounts sought by state agencies in their requests for the 2017-19 budget period, with a little left to make a small addition to the state’s meager reserves.

Considering that the latest tax collection estimates for 2015-17 are $388 million below what had been expected when the last budget bill was approved, it might come as a surprise that the balance expected at the end of this budget period is now projected to be almost $300 million above the balance estimated made when the budget bill was approved. That can be attributed to several factors, including a larger-than-expected balance carried into this biennium, but the major reason is a significant reduction in spending, relative to the amounts appropriated in the budget bill.

More specifically, the latest documents reveal the following:

- Net General Fund spending during the current fiscal year is now expected to be about $408 million less than the biennial budget bill assumed (and $226 million less than the state expected just two months ago).

- A major reason for the reduced spending is that the state share of Medicaid costs during 2015-17 is now projected to be $312.5 million (or 5.5%) below the amount appropriated.

- In May of last year, the Walker administration decided to defer a $101 million debt payment, pushing that cost off into future years.

The improved budget outlook prompted some legislators to quickly propose cutting General Fund taxes by about $300 million as part of a tax swap. The proposed tax cut, which hasn’t been specified, is part of a plan to increase the gas tax, in order to partially close a large hole in the Transportation Department’s budget. It’s a way of spending more on highways without causing a net increase in taxes and without appearing to raid the General Fund to get the new highway funding (though the hit taken by the General Fund would be the same).

I’ll defer judgement on the tax swap idea until we get more details, but it’s important to note that even the improved revenue projections for the next biennium only barely cover the amounts requested by state agencies, and most of those requests were very restrained (as directed by the Governor). Making additional cuts in state General Fund taxes in the next biennium would diminish the state’s capacity to address areas like K-12 and higher education, where larger investments are critically important for our state’s future economic success.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock