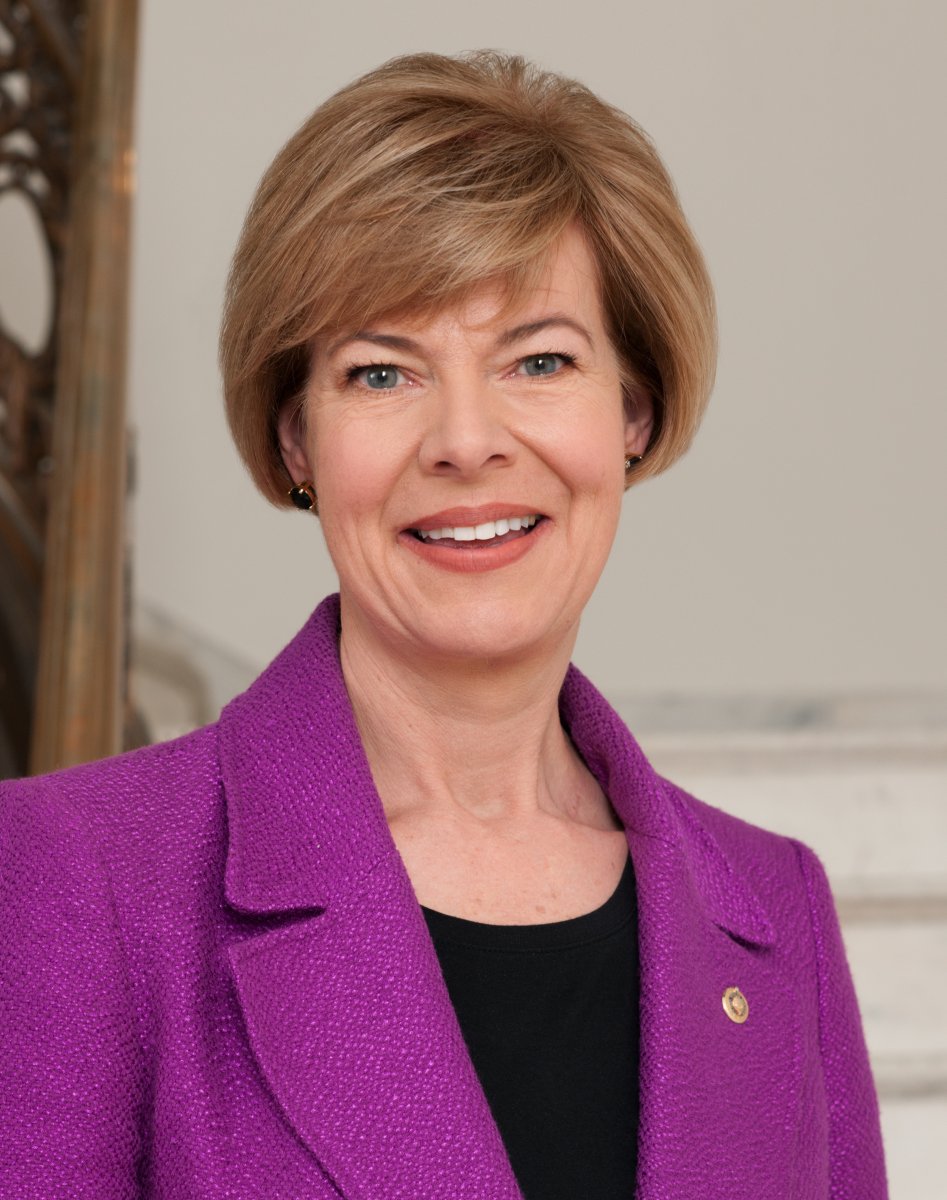

U.S. Senator Tammy Baldwin Helps Reintroduce Legislation to Simplify and Decrease the Costs of Tax Preparation and Filing

Taxpayers spend an average of 11 hours preparing and filing tax returns and pay $200 for tax preparation services

WASHINGTON, D.C. – U.S. Senator Tammy Baldwin helped reintroduce the Tax Filing Simplification Act, led by Senator Elizabeth Warren (D-MA), to ease the tax filing process for millions of American taxpayers and reduce their costs. Last tax season, American taxpayers spent an average of 11 hours and around $200 preparing their tax returns – a cost equal to almost 10 percent of the average federal tax refund.

“American taxpayers are spending too much time and money filing taxes when it doesn’t have to be that way,”said Senator Baldwin. “The Tax Filing Simplification Act will simplify tax filing and make it less expensive for taxpayers.”

“Taxpayers waste too many hours and hundreds of dollars on tax preparation each year, which disproportionately burdens low-income and minority taxpayers,”said Senator Warren. “This bill will require the IRS to offer easy, free, online tax-filing for all taxpayers. This is a simple idea with a long history of support from both Republicans and Democrats, and it’s time to make it a reality.”

The Tax Filing Simplification Act makes several commonsense changes to simplify and decrease the costs of the tax filing process for millions of American taxpayers by:

· Prohibiting the IRS from entering into agreements that restrict its ability to provide free online tax preparation or filing services;

· Directing the IRS to develop a free, online tax preparation and filing service that would allow all taxpayers to prepare and file their taxes directly with the federal government instead of requiring that they share private information with third parties;

· Enhancing taxpayer data access by allowing all taxpayers to download third-party-provided tax information that the IRS already has into a software program of their choice;

· Allowing eligible taxpayers with simple tax situations to choose a new return-free option, which would provide a pre-prepared tax return with income tax liability or refund amount already calculated;

· Mandating that these data and filing options be made available through a secure online function and requires any participating individual to verify his or her identity before accessing tax data; and

· Reducing tax fraud by getting third-party income information to the IRS earlier in the tax season, allowing the agency to cross-check this information before issuing refunds.

First introduced in 2016 and reintroduced in 2017, this approach to tax filing has been endorsed by tax scholars and a bipartisan set of policymakers. The bill is endorsed by the National Consumer Law Center (on behalf of its low-income clients), the Institute for Taxation and Economic Policy, Americans for Tax Fairness, Economic Security Project Action, the Hispanic Federation, Americans for Financial Reform, and Public Citizen.

Senators Baldwin and Warren are joined by Senators Richard Blumenthal (D-CT), Cory Booker (D-NJ), Tammy Duckworth (D-IL), Maggie Hassan (D-NH), Ed Markey (D-MA), Jeff Merkley (D-OR), Bernie Sanders (I-VT), Jeanne Shaheen (D-NH), Tom Udall (D-NM), and Sheldon Whitehouse (D-RI) in reintroducing this legislation.

A companion bill in the House is being reintroduced by Representative Brad Sherman (D-CA) along with Representatives Don Beyer (D-VA), Earl Blumenauer (D-OR), Katie Hill (D-CA), Eleanor Holmes Norton (D-DC), Alexandria Ocasio-Cortez (D-NY), Jamie Raskin (D-MD), Tim Ryan (D-OH), and Jackie Speier (D-CA).

An online version of this release is available here.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by U.S. Sen. Tammy Baldwin

On 3rd Anniversary of Roe Being Overturned, Baldwin, Blumenthal, and Murray Lead Senate Dems in a Bill to Restore Abortion Access Nationwide

Jun 24th, 2025 by U.S. Sen. Tammy BaldwinWomen’s Health Protection Act comes as Trump and Congressional Republicans move to restrict a woman’s right to choose and toward a national abortion ban

Baldwin Joins Bipartisan Group Urging Trump Admin to Reverse Closure of Job Corps Centers

Jun 23rd, 2025 by U.S. Sen. Tammy BaldwinBaldwin has been outspoken advocate for Wisconsin’s Job Corps centers that help young Americans get career training and are a path to good-paying jobs