Press Release

Sen. Johnson, Colleagues Reintroduce Bill to Permanently Repeal the Death Tax

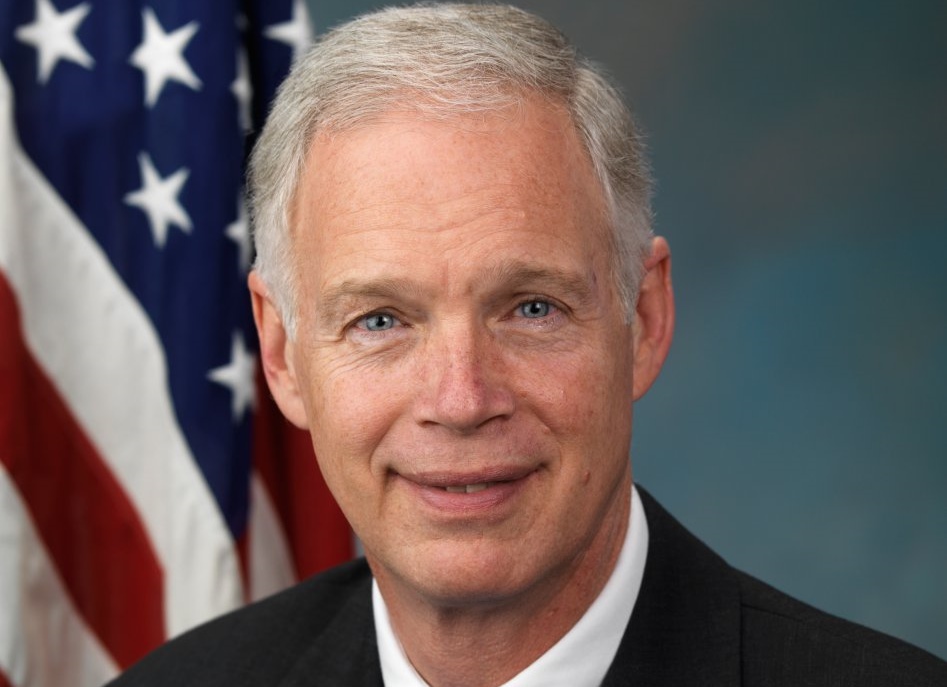

WASHINGTON – Yesterday, U.S. Sen. Ron Johnson (R-Wis.) joined Senate Majority Leader John Thune (R-S.D.) and 44 senators in reintroducing legislation to permanently repeal the federal estate tax, commonly known as the death tax. The Death Tax Repeal Act would end this purely punitive tax that can hit family-run farms, ranches and businesses as the result of the owner’s death.

Sens. Johnson and Thune were joined by Senators

Jim Banks (R-Ind.),

John Barrasso (R-Wyo.),

Marsha Blackburn (R-Tenn.),

John Boozman (R-Ark.),

Katie Britt (R-Ala.),

Ted Budd (R-N.C.),

Shelley Moore Capito (R-W. Va.),

John Cornyn (R-Texas),

Tom Cotton (R-Ark.),

Kevin Cramer (R-N.D.),

Mike Crapo (R-Idaho),

Ted Cruz (R-Texas),

John Curtis (R-Utah),

Steve Daines (R-Mont.),

Joni Ernst (R-Iowa),

Deb Fischer (R-Neb.),

Lindsey Graham (R-S.C.),

Chuck Grassley (R-Iowa),

Bill Hagerty (R-Tenn.),

Josh Hawley (R-Mo.),

John Hoeven (R-N.D.),

Cindy Hyde-Smith (R-Miss.),

Jim Justice (R-W. Va.),

John Kennedy (R-La.),

James Lankford (R-Okla.),

Mike Lee (R-Utah),

Cynthia Lummis (R-Wyo.),

Roger Marshall (R-Kan.),

Mitch McConnell (R-Ky.),

Dave McCormick (R-Pa.),

Jerry Moran (R-Kan.),

Bernie Moreno (R-Ohio),

Markwayne Mullin (R-Okla.),

Pete Ricketts (R-Neb.),

Jim Risch (R-Idaho),

Mike Rounds (R-S.D.),

Eric Schmitt (R-Mo.),

Rick Scott (R-Fla.),

Tim Scott (R-S.C.),

Tim Sheehy (R-Mont.),

Thom Tillis (R-N.C.),

Tommy Tuberville (R-Ala.),

Roger Wicker (R-Miss.) and

Todd Young (R-Ind.).

The full text of the legislation can be found here.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

People:

Bernie Moreno,

Bill Hagerty,

Chuck Grassley,

Cindy Hyde-Smith,

Cynthia Lummis,

Dave McCormick,

Deb Fischer,

Eric Schmitt,

James Lankford,

Jerry Moran,

Jim Banks,

Jim Justice,

Jim Risch,

John Barrasso,

John Boozman,

John Cornyn,

John Curtis,

John Hoeven,

John Kennedy,

John Thune,

Joni Ernst,

Josh Hawley,

Katie Britt,

Kevin Cramer,

Lindsey Graham,

Markwayne Mullin,

Marsha Blackburn,

Mike Crapo,

Mike Lee,

Mike Rounds,

Mitch McConnell,

Pete Ricketts,

Rick Scott,

Roger Marshall,

Roger Wicker,

Ron Johnson,

Shelley Moore Capito,

Steve Daines,

Ted Budd,

Ted Cruz,

Thom Tillis,

Tim Scott,

Timothy Patrick Sheehy,

Todd Young,

Tom Cotton,

Tommy Tuberville

Recent Press Releases by U.S. Sen. Ron Johnson

Senator Howdy Doody once again representing only the smallest of minorities, people with estates valued over $12.06 million or for couples $24.12 million. In 1917 only 2 out of 1000 estates were liable for this tax. If anything be held liable for this tax would mean someone was asleep at the switch because of the myriad of different means to arrange estates to avoid this tax. This carryover of assets does nothing to improve the country or society and it fact leads to even more oligarchs who care for little or anyone but themselves.

I could tell by the headline alone that this was a PR piece, unedited by Urban Milwaukee, with Death Tax being a preferred expression among conservatives. At a minimum, maybe UM should put the following note at the top of all such articles? NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

…”The Death Tax Repeal Act would end this purely punitive tax that can hit family-run farms, ranches and businesses as the result of the owner’s death.”

Who is saying that?

Unless the details of this tax have changed, moms & pops are not going to lose their farms or businesses. The triggering point is in the multimillions.

A bird’s-eye view over the wall of bullshit will reveal

why this repeal idea is coming back.

Search term:

America’s Un-American Resistance to the Estate Tax

(From Archive, 2016)

Other sources – Bill Gates SENIOR’S opinion of estate taxes!

…or Teddy Roosevelt, … or Alexis de Tocqueville.

Wonder how many of these Republican senators families would benefit from this legislation?

Members of Congress who have held office for a number of terms have increased their family wealth by significant amounts.

Rojo is a perfect example. In 3 terms he has come close to tripling his wealth. Hard to believe he did that through his own brilliance at investing.

To be fair there are a few members who have not overly profited. Bernie Sanders wrote a successful book.

Gwen Moore does not appear to have become a multimillionaire during her long service.