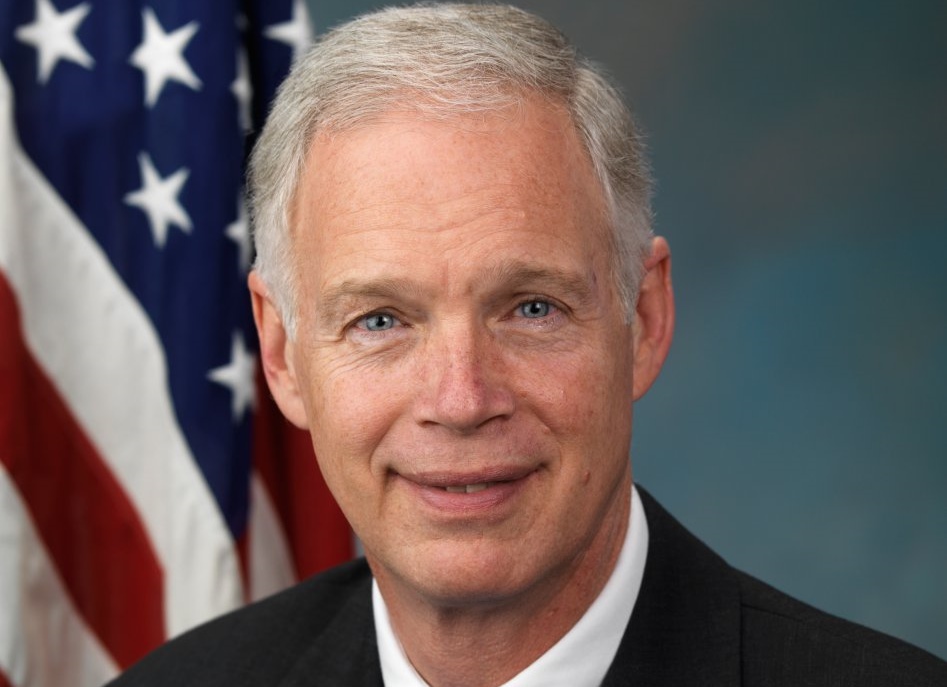

Did Sen. Ron Johnson cut a Tax Bill deal that will enrich him personally?

Johnson a 'yes' now on the tax bill after a high-profile battle that benefits his business

MADISON — After much political theater and talk about the federal deficit, Sen. Ron Johnson has announced that he is a ‘yes’ vote on the latest version of the Senate tax bill after a deduction for pass-through businesses like his own was increased. Stories leaked by Republicans about Johnson’s negotiations with Trump show businesses like his own trumped any concern he reportedly had on the deficit.

He confirmed to reporters that raising the pass-through deduction to 23% was what secured his support for the bill. This move will reportedly add another $60 billion to the cost of the tax package. His Senate office also confirms he retains an ownership stake in Pacur.

“The people of Wisconsin deserve to receive full disclosure from Sen. Johnson on how his changes to the tax bill will benefit him personally,” said Wisconsin Democratic Party Chair Martha Laning. “Sen. Johnson should not join the president in obfuscating what could be his own personal gain on this tax bill that hurts real people to further enrich the 1%.”

Johnson also negotiated a future role at the negotiating table to reconcile the House and Senate versions of the bill, where he can again protect his own self interests, so being open with the people of Wisconsin is even more important.

A report in the Washington Post that deserves heightened Wisconsin attention given Johnson’s role in the tax bill, cited these details from Johnson’s own financial disclosures:

- Johnson is invested in four limited liability corporations that earned anywhere between $250,000 and $2 million in pass-through income in 2016

- Johnson and his wife own 100% of a piece of commercial real estate that is worth anywhere between $5 million and $25 million and leased to Pacur

- Johnson owns 5% of Pacur LLC, worth between $1 million and $5 million

Pass-through entities are not small businesses as Johnson describes. While some pass-through entities include small businesses, 70% of pass-through income goes to the top 1% of American earners.

“We know Johnson did not fight to change this bill because it leaves millions of lower and middle-income families without health care and paying more in taxes,” said Laning. “It appears he may have done this for his own personal gain, which is not how Wisconsin deserves to be represented. He must disclose immediately the impact his changes will have on his own fortune.”

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by Democratic Party of Wisconsin

WisDems First Vice-Chair Sarah Godlewski on State Supreme Court Invalidating 1849 Abortion Ban

Jul 2nd, 2025 by Democratic Party of WisconsinThe state’s liberal majority on the state supreme court has ruled the pre-Civil War law as invalid

The assault on the middle class just keeps coming. Sen. Johnson stated he will not run for re-election so he does not have to answer to the voters.