Wealthy Hospitals Grab Pandemic Payouts

Ascension Health and 19 other health care giants grab $5 billion in federal funds while smaller hospitals get little.

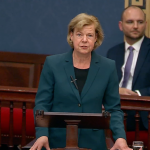

Ascension SE Wisconsin Hospital–St. Joseph Campus in Milwaukee. Photo by Coburn Dukehart / Wisconsin Watch.

Ascension Health, the St. Louis based health care chain which runs a dozen hospitals in metro Milwaukee, was one of 20 wealthy health care chains that received more than $5 billion in federal grants even while they were sitting on more than $100 billion in cash, as the New York Times reported. “The Department of Health and Human Services has disbursed $72 billion in grants since April to hospitals and other health care providers through the bailout program,” but “smaller, poorer hospitals are receiving tiny amounts of federal aid.”

Ascension got $211 million in federal funding. While it operates as a tax-exempt non-profit, Ascension has $15.5 billion in cash on hand and “operates a venture capital fund and an investment advisory firm that helps other companies manage their money,” the story notes.

It also pays huge salaries to its executives as Urban Milwaukee has reported. Its most recent federal tax form, for 2018, shows that its top paid executive Anthony Tersigni, got $13.25 million in total compensation, while five other executives were paid a total of $33,5 million.

Jamie Lucas, Executive Director of the Wisconsin Federation of Nurses and Health Professionals, criticized the federal payout in a comment for Urban Milwaukee. “Ascension sits on billions of dollars yet functions as a not-for-profit,” he charged. “Who is really benefitting when a corporation with that much money is making nurses reuse masks and gowns? Should a corporation with billions of dollars be refusing nurses hazard pay on the frontlines of a global health crisis? This is allowed to happen because there’s almost no accountability in how these corporations provide healthcare.”

An analysis of federal bailouts to hospitals by Axios shows that Advocate Aurora got a $148 million federal CARES bailout payment and $701 million loan, while Froedtert got at $61 million grant and $172 million loan. There has been discussion of ultimately turning the federal loans into grants.

Advocate Aurora is the result of a 2018 merger of Aurora Health Care, the largest health care system in Wisconsin and Advocate Health Care, the largest such system in Illinois. It created the ninth largest such system in America, with a combined budget of $11.6 billion, and more than 500 facilities, including 27 hospitals. Its two CEOs earned $11.4 million and $11.7 million prior to the merger, which was about 755 times the average minimum wage worker for Aurora, as Urban Milwaukee has reported.

Ascension has threatened to close St. Joseph’s hospital in Milwaukee because it was losing $20 million a year at a time when the organization was earning $1.9 billion in net income (or profit) and had $5.6 billion in reserves, as Urban Milwaukee has reported.

Lobbyists for big health care groups “reached out to” top federal Health and Human Services officials to discuss how the CARES act money “would be distributed,” the Times reports. The department then devised formulas to quickly dispense aid which “favored large, wealthy institutions. One formula based allotments on how much money a hospital collected from Medicare last year. Another was based on a hospital’s revenue.”

“Hospitals that serve a greater proportion of wealthier, privately insured patients got twice as much relief as those focused on low-income patients with Medicaid or no coverage at all, according to a study this month by the Kaiser Family Foundation,” the story noted.

“A huge chunk of those emergency funds likely won’t go to lifesaving care or equipment,” a story in Time noted, “but to underwriting the astronomical administrative costs of negotiating a complicated network of private insurance providers and other bureaucratic functions.” The story noted a study which found that for hospitals, “the mean share of expenditures devoted to administrative costs in the U.S. was 26.6%.”

“Every cent of future relief money should come with standards that require safe staffing, hazard pay, adequate PPE, childcare, and covered medical treatments for all of their healthcare professionals – nurses, housekeepers, respiratory therapists, nursing assistants, and lab techs alike,” Lucas told Urban Milwaukee. “Clearly, Ascension has always had the resources to do better, and we deserve better, especially right now.”

Urban Milwaukee reached out to Ascension and has not heard back. Nick Ragone, a spokesman for Ascension, told the New York Times that the federal funds it received “facilitated our ability to serve our communities during this unprecedented time,” and that Ascension had not furloughed or laid off any workers and wouldn’t do so for “as long as possible.”

Update: After the story was published Aurora Advocate offered this statement to Urban Milwaukee: Since March, all of our team members have received their full pay, even if they were unable to work because elective procedures and surgeries were halted. At the same time, team members who serve in dedicated COVID-19 units, emergency departments and units that have a COVID-19 patient population of 50 percent or greater earn additional compensation. These special pay practices are in effect from the end of March through the end of May and will be evaluated monthly thereafter.

Additionally, our CEO began taking a 50 percent salary reduction in May for at least 12 weeks. That reduction will be evaluated on a monthly basis thereafter, as will the salary reductions of other senior leaders, including senior executives, system vice presidents and hospital presidents. The dollars saved will be redirected to the Team Member Crisis Fund, which provides assistance to team members experiencing an emergency that makes it difficult to cover basic needs for themselves or their family.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

More about the Coronavirus Pandemic

- Governors Tony Evers, JB Pritzker, Tim Walz, and Gretchen Whitmer Issue a Joint Statement Concerning Reports that Donald Trump Gave Russian Dictator Putin American COVID-19 Supplies - Gov. Tony Evers - Oct 11th, 2024

- MHD Release: Milwaukee Health Department Launches COVID-19 Wastewater Testing Dashboard - City of Milwaukee Health Department - Jan 23rd, 2024

- Milwaukee County Announces New Policies Related to COVID-19 Pandemic - David Crowley - May 9th, 2023

- DHS Details End of Emergency COVID-19 Response - Wisconsin Department of Health Services - Apr 26th, 2023

- Milwaukee Health Department Announces Upcoming Changes to COVID-19 Services - City of Milwaukee Health Department - Mar 17th, 2023

- Fitzgerald Applauds Passage of COVID-19 Origin Act - U.S. Rep. Scott Fitzgerald - Mar 10th, 2023

- DHS Expands Free COVID-19 Testing Program - Wisconsin Department of Health Services - Feb 10th, 2023

- MKE County: COVID-19 Hospitalizations Rising - Graham Kilmer - Jan 16th, 2023

- Not Enough Getting Bivalent Booster Shots, State Health Officials Warn - Gaby Vinick - Dec 26th, 2022

- Nearly All Wisconsinites Age 6 Months and Older Now Eligible for Updated COVID-19 Vaccine - Wisconsin Department of Health Services - Dec 15th, 2022

Read more about Coronavirus Pandemic here

Murphy's Law

-

The Last Paycheck of Don Smiley

Dec 17th, 2025 by Bruce Murphy

Dec 17th, 2025 by Bruce Murphy

-

Top Health Care Exec Paid $25.7 Million

Dec 16th, 2025 by Bruce Murphy

Dec 16th, 2025 by Bruce Murphy

-

Milwaukee Mayor’s Power in Decline?

Dec 10th, 2025 by Bruce Murphy

Dec 10th, 2025 by Bruce Murphy

I don’t understand why losses are not mentioned in these articles. Advocate Aurora received a $148 million federal CARES bailout along with a $701 million loan *but they lost $300 million in April* (source link below.) In order to accommodate the potential massive influx of Covid patients, area hospitals converted their profit making, non-essential departments into additional space to prevent patient capacity issues and to allow for distancing (thus the massive losses followed by loans and bailouts.)

https://www.jsonline.com/story/money/business/2020/05/12/advocate-aurora-healths-wisconsin-operations-were-down-around-300-million-april/3115372001/

Every hospital in the Greater Milwaukee Area is a member of one of the “wealthy health care chains” including Saint Joseph’s. The hospitals consolidated in order to force higher payments from insurance companies; the insurance companies consolidated to get deeper discounts from hospitals. A formula basing “allotments on how much money a hospital collected from Medicare last year” sounds like an attempt to distribute funds based on the relative size of the hospital as should be expected. It may not be a perfect method but if the goal is to rapidly distribute funds to benefit the most patients possible this method appears to accomplish that.

Profitable hospitals are a good thing. If you look at the Froedtert system for example, they have expanded the cancer center twice in recent years and constantly add, upgrade and expand their reach around the region. They have opened smaller clinics throughout the area including one downtown adjacent to the Haymarket and Hillside neighborhoods. Their large annual income allows for this growth and expansion. Nationwide the trend is shifting to smaller clinics for everyday healthcare with hospitals being used for more specialized treatment like surgery or cancer care. The CEO salaries sound egregious at first glance, but when you take into consideration the size of the system they are managing .002% of the budget doesn’t seem all that crazy ($23.1 million from a budget of $11.6 billion.) Even though they are non-profits, they still have to compete with the private sector for employees. Generous, incentive based salaries are generally how large entities hire and retain talent.

The fact that individual hospitals are sitting on $100 billion in cash seems unlikely. The money is most likely invested in hundreds of companies around the world through the market as well as the venture capital the article mentions. If they have invested in startups and other companies, it may be under contract and unable to be liquidated. Even if cashing out billions of dollars were possible taking billions of dollars from a sea of other companies all at once would be a foolish decision. It’s not a decision based on greed; it’s based on financial prudence. The investments guarantee the long-term health of the health networks.

Milwaukee area hospitals have plenty of problems that need addressing; however, to this reader, it appears the leadership at local hospitals are doing the best they can during the current situation. PPE is in short supply throughout the globe. I imagine this is why the governor attempted to pool resources with other states but even that didn’t work. Expecting individual hospitals to be able to out-compete nations and regions seems unrealistic and calling individuals greedy for failing to meet all of a group’s demands seems unjustified.

Healthcare is too important to be left to for-profit or not-for-profit corporations with billions in reserve. The purpose of big business is to maximize profit and minimize expenses. Their connections to private equity are an added indication of that. That should not be the purpose of a health care institution. Also, losses during a pandemic (or any other time) are not an indication of their fiscal health.

Hospitals should be public institutions if we want them to serve the public good. Short of that they should be heavily regulated so that employees are not risking their lives and patients are not being financially soaked. (Notices of price increases have been running this week in the Journal Sentinel.)

Whether corporate, non-profit, government or individual, losses *must* be considered a part of fiscal health. If a hospital is losing $300 million dollars a month, that is a significant problem. The idea that they should be spending significantly more while losing massive amounts of money would not be prudent. If I lost my job/income and still have bills to pay ($800 a month) I should not be signing up for faster internet or starting a new expensive long-term home repair project. That doubles the losses and creates an inescapable financial hole in the future.

Their “connections to private equity” is the result of hiring companies to invest their money to remain stable in the long run. The State of Wisconsin has been rebuilding a similar rainy day fund of money so that in troublesome times the state can continue to operate as expected despite a diminished tax pool. This is desirable behavior. If your company has $10 million without a budgeted use, leaving it in a bank account to earn 0.1% interest is foolish when it could be earning 6-10% wisely invested. The funds are also used to finance startups that may bring benefit the healthcare system in the long run too.

Assuming the article’s numbers are correct and 26% of of current hospital expenses are administrative, this is at least partially the result of a significant amounts of existing regulation. The more rules and laws added, the more complicated (and expensive) everything continues to get as everyone works around them.

I very much agree that the current state of affairs in healthcare is painful to navigate but forcing all hospital systems to be public seems a bit much.

Healthcare costs are extremely high but this is mostly hitting insurance companies and government spending (medicare/medicaid.) Figure 6 at the below link 1 shows the health care patients pay 13% of the bill for healthcare. Meanwhile, the US spends more per capita (link 2) on healthcare than any country in the world by a wide margin. Publicizing hospitals and spending more money shifts all of those expenses onto us (the taxpayers) instead of the non-profits and insurance companies. Insurance companies invest the money we pay them to pay for the medical treatments we need. The more likely you are too need medical coverage the higher your rates will be as they need to be able to pay the hospitals and not go bankrupt.

1. https://www.ahrq.gov/research/findings/nhqrdr/nhqdr16/overview.html

2. https://www.npr.org/sections/goatsandsoda/2017/04/20/524774195/what-country-spends-the-most-and-least-on-health-care-per-person

I would love to see rules that require hospitals and clinics to annually print statistics on the quality of their care for each department. For example, what percentage of people receiving cancer treatments at this hospital improve? How many people treated for heart disease at this hospital survive? How many medical error cases (third leading cause of death in US) happened in this department? How many pregnancies resulted in complications?

With healthcare spending as high as it is, there are a multitude of ideas and options to explore short of publicizing the hospital networks. Bringing spending (way) down and figuring out how to make sure everyone that wants/needs insurance is covered should be the main focal points for all of us.