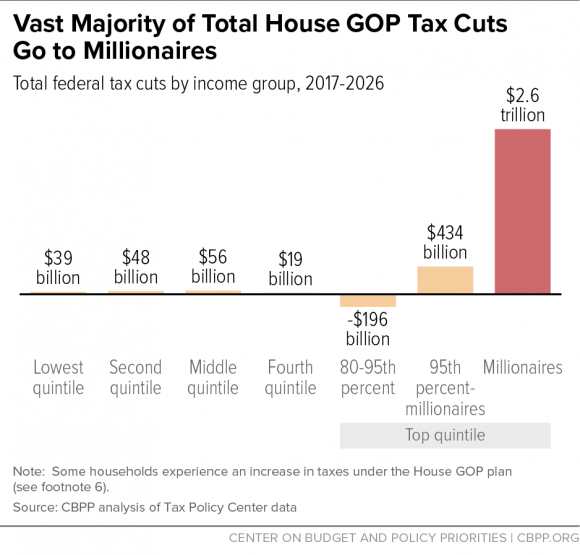

Ryan Plan Slashes Taxes for Millionaires

House GOP’s 10-year plan cuts taxes for rich by $2.6 trillion while slashing programs for poor, middle class.

Republicans who control the U.S. House of Representatives have proposed a budget framework that would raise the incomes of millionaires while cutting services for families and individuals with low and moderate incomes. The leader of the House of Representatives, Paul Ryan, represents a Wisconsin district that includes the cities of Kenosha, Racine, and Janesville.

The budget framework, called A Better Way, includes an emphasis on cutting taxes for people with very high incomes. According to an analysis by the Urban-Brookings Tax Policy Center, the GOP House tax plan would:

- Cut taxes for millionaires by an average of $330,000 per household in 2017, with their after-tax incomes rising by 15%. In contrast, the middle fifth of households by income would receive an average tax cut of $260, boosting their after-tax income by just 0.5%;

- Cut taxes for the top 0.1% of the population by income – a group with an average income of more than $3.7 million – by an average of $1.3 million per household in 2017, increasing their after-tax income by 17%; and

- Cut taxes for millionaires by $2.6 trillion over the next decade, forty times the $56 billion in tax cuts that the middle fifth of taxpayers would receive. The top 0.1% would receive more than half the proposed tax cuts, or $1.7 trillion.

In addition to enormous tax cuts for people with very high incomes, the GOP budget framework includes plans to cut programs for people with low- and moderate-income people by $3.7 trillion, or about 40 times the estimated $87 billion in tax cuts for the bottom two fifths of the population that the House GOP tax plan would provide. The framework doesn’t include information about which specific programs would be cut, nor does it address the deficits caused by the tax cuts in the plan.

The Center and Budget and Policy Priorities sums up the potential effect of the framework this way:

“In short, most households would be significant net losers under these budget and tax policies. At a time when many Americans believe income inequality has grown unacceptably large, the House GOP budget and tax framework would further widen this divide significantly.”

For more information about the tax effects of the House GOP budget plan, see “House GOP Framework Would Give Millionaires $2.6 Trillion in Tax Cuts, While Cutting Programs for Low- and Moderate-Income People by $3.7 Trillion,” by the Center on Budget and Policy Priorities.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Go Trump Go!