In Defense Of The 1 Percent

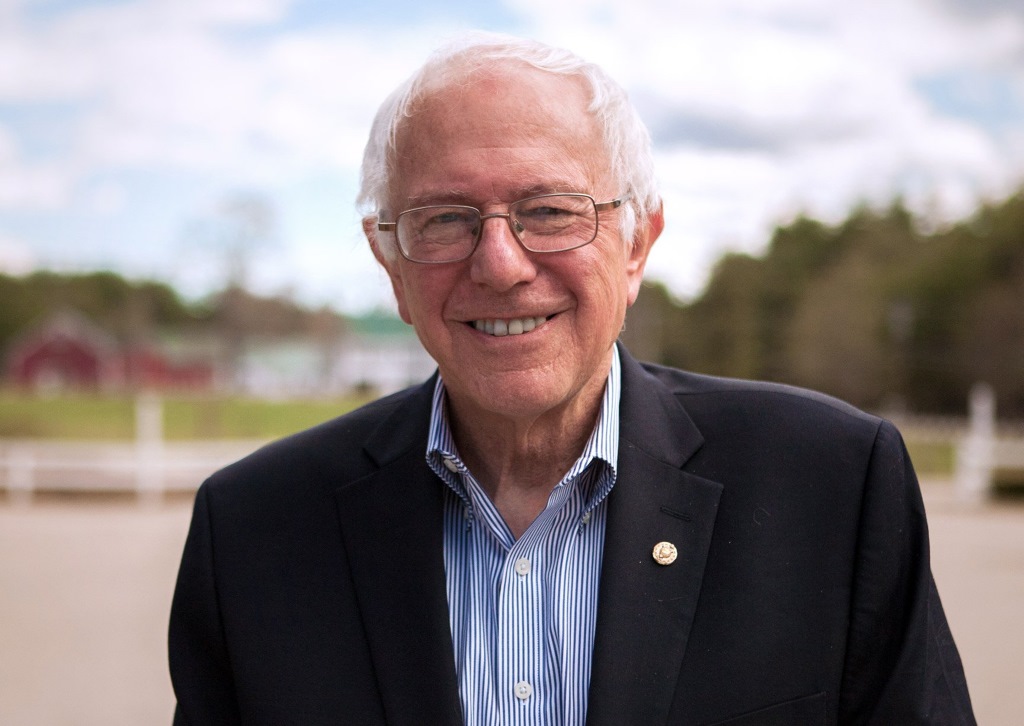

What they pay in taxes and why Bernie Sanders is wrong.

Are you getting tired of the negative picture of the United States being collectively painted by the presidential candidates from both parties as they debate their way through the primaries?

Is nothing going right in this fabulous country?

There are lots of issues in this fractious world, but there are always major challenges in an ever-changing world.

For the sake of balance, are you not somewhat buoyed by the low unemployment rate, by people having the knowledge of the world at their fingertips, by amazing medical and scientific breakthroughs, by longer lives, by the relative health of the U.S. economy, by not having our troops involved in a major war, by the enduring charitable giving by Americans at all levels from workers to billionaires, by a cleaner environment?

Leaders have a moral obligation to get a full grip on reality. Fear mongering is the vocabulary of demagogues. Pragmatic optimism is at the core of leadership.

Are you fed up with Donald Trump trying to insult his way into the presidential nomination? That’s playground stuff, not Oval Office behavior?

Are you fed up with the sound bite answers to complex issues engendered by television “news” people?

Take the simplistic approach of revolutionary Bernie Sanders on income inequality. He is going to equalize incomes by raising taxes on the billionaires he demonizes, even though he and we all know that they already face marginal income tax rates of around 50% and raising it 10 or 20 points won’t raise enough revenue to dent the issue. Doubling their marginal rate won’t pay for all the things he wants to pay for.

No doubt that big time CEOs have soiled the capitalistic nest with their greedy compensation packages. Ditto for star ball players, Hollywood stars, surgeons and Wall Street traders. They are the poster children for greed and inequality.

That said, here are realities of the facts surrounding the 1% issue:

- The 1% pays about nearly half of federal incomes taxes, while the bottom 60% pays about 2%. That 1% share of taxes has risen under President Obama by about six points.

- The 1% pays about 28% of all federal taxes, including payroll taxes.

- The 1% takes in about 16.5% of all income.

- The 1% pays an average tax rate for all income of about 20%.

Note that the lower level earners have benefited from an explosion of tax credits.

Note that the top 10% pays more than half of all federal taxes and two-thirds of all federal income taxes.

So, there is inequality, but some of the issue has been addressed. Sen. Sanders is not the first to raise the issue. He is silent on the progress.

When it comes to tax rates, though, Sen. Sanders could make the point that the 1%, because much of their income is dividends, capital gains and interest, escape the alternative minimum tax (AMT), which could be solved by applying the 28% AMT to all forms of income: capital gains, dividends and interest. That level could be raised to a higher rate, say 40%, for the .1%. Their grotesque paychecks would then work on behalf of the republic.

My view: that that would be fair. The issue is fairness not retribution for being successful. Sanders spits out the word “billionaire” with disdain, even though many of them got there by providing fabulous advances for society

His proposal to raise the base for Social Security taxes from the current $118,500 to total wages does make sense. I’m for it. I’ve been paying into the Social Security system for 64 years, but I am also good with means testing for payouts. Rich people would get zip from Social Security, even after decades of contributions. Some might see that as unfair.

The point is that we need a substantive discussion of solving the inequality equation.

Further, if Sen. Sanders were intellectually forthcoming, he would acknowledge that wages have been moving up in recent quarters. He would be a pro-growth Democrat (like Bloomberg), not just a redistribution zealot.

He would extol profit sharing models, like the recent announcement by Southwest Airlines that its employees will receive two months of extra pay as a share of its 2015 record profits. Note: as a public company, the households of American have a direct interest in its success; their retirement accounts own its shares.

Missing from the Sanders “revolution” is an appreciation for the producers who build companies, the entrepreneurs who create all the new jobs and the 40% that pay all federal taxes. In short, he takes the economy for granted.

He talks not a whit about job creation, when every anti-poverty thinker agrees that a good job is the best way out of poverty — the best route to less inequality.

He must believe that he makes more points by being negative, that winning politics requires enemies. He is pure and then establishment is decidedly not.

The strength of this country lies not with our politicians. It lies with individual Americans who work hard, innovate and contribute in many ways small and big ways.

The main job of the smart set inside the beltway is to not to screw up the economy and to keep us secure and out of dumb wars. Just don’t mess up. Our leaders got us into quagmire wars in Vietnam and Iraq. And they enabled the 2008 meltdown by encouraging excess leverage in the housing/mortgage markets. It wasn’t just Wall Street at fault. You were there, Sen. Sanders; take some ownership.

And learn the lesson from the Great Recession; it’s excess leverage that is perilous, whether in mortgages, personal debt, bank capital ratios; stock markets, student debt, national debt or state debt. Democrats and Republicans encouraged some of that dangerous leverage with Santa Claus largesse. Their mistakes crushed the 90%.

Have some humility in place of the outrage.

My preference is for pragmatism, for solving problems as they arise. It’s for collaborative models, as with Southwest Airlines, versus outmoded adversarial models.

Indeed, the sourness of the 2016 campaign stems from an excess of adversarial partisanship.

Is that getting old for you, too?

John Torinus is the chairman of Serigraph Inc. and a former Milwaukee Sentinel business editor who blogs regularly at johntorinus.com.

Op-Ed

-

Wisconsin Candidates Decry Money in Politics, Plan to Raise Tons of It

Dec 15th, 2025 by Ruth Conniff

Dec 15th, 2025 by Ruth Conniff

-

Trump Left Contraceptives to Rot; Women Pay the Price

Dec 8th, 2025 by Dr. Shefaali Sharma

Dec 8th, 2025 by Dr. Shefaali Sharma

-

Why the Common Council’s Amended Budget is Good Policy for Milwaukee

Nov 20th, 2025 by Alds. Marina Dimitrijevic and Russell W. Stamper, II

Nov 20th, 2025 by Alds. Marina Dimitrijevic and Russell W. Stamper, II

If the world needs anything right now, it is more vociferous defenses of the 1%. Way to go John. You sure have your pulse on the people.

Typical BS by Mr. Torinus.

“by the enduring charitable giving by Americans at all levels from workers to billionaires”

Charitable giving at the expense of federal revenue that could be spent fairly funding all important causes.

“he would acknowledge that wages have been moving up in recent quarters”

For whom? For how long? Wages of the middle class have not even matched the inflation rate for almost a generation now.

“employees will receive two months of extra pay as a share of its 2015 record profits”

Ha. Great. You found a company doing the right thing. Now you’ve just got to get the other 50 million companies to do the same.

Agreed !!

We can provide a decent standard of living for all human beings then let the 1% fight for what people don’t need for a dignified, healthy existence. There is this concept called “enough” that is difficult for some people to understand. There is greed and there is corruption and there is needless suffering and pain. The amount in taxes paid by people who have too much from a rigged system is not the standard to determine whether the system is fair. If it were, why not let killers and terrorists and pedophiles pay higher taxes?

Sander’s detractors are a lot easier to listen to when they actually criticize Sander’s plans and rhetoric rather than the distorted nonsense that is so often reported in it’s place. Maybe check into what his actual proposal are, then decide what you think of them. You only report distortions here.

The 1% pay a large share of all federal taxes because they make so much more money than the rest of us! If the federal government taxes 10% more of my income it would be a small dollar amount but even still I would probably have to move into a smaller apartment. If they federal government taxes 10% more of your income it would be a huge dollar amount but you might have to buy only one private jet instead of two. If you want to pay less in taxes, MAKE LESS MONEY!

Well, people in the 1% come in many stripes. Some are generous philanthropists and others are greedy jerks. You can’t label an entire group whether they’re rich, poor, black, white or whatever. However, one thing I can agree with Jon on is that the AMT should apply to dividends, capital gains, and interest.

The most concerning thing I’ve read here though is Dave’s comment about charitable giving. That somehow it’s stealing from the government to give charitable donations. Does a real nice job of showing me where his mind is at.

I suppose “Five Great Tax Reform Ideas” doesn’t have quite the same bite as the actual headline.

Does it, AG or do your comments show how ignorant you are? The fact is, the government can much more efficiently fund many charitable causes (i.e. cancer research) or fairly fund a wide variety of issues instead of private dollars flowing into religious causes which are offensive or detrimental to much of the population.

AG,

I agree. I’ve never understood the demonizing of charitable giving. Yes, you get a deduction from it, but you as a person are still “out” the money you donated. It’s basically like you never earned it, AND a charity gets the benefit of a bunch of money. It’s a deduction, not a tax credit.

Dave, doubling down on your opinion doesn’t make it any better.

Are you really so worried about donations to religion based groups? Only 35% of charitable donations go to religious groups (which can be chruches, faith based programming, religion based educational institutions like schools and universities, faith based community outreach groups, etc). Roughly 4 out of 5 Americans have some religious affiliation… but religious causes are supposedly offenseive and detrimental to much of the population?

Meanwhile, as someone who supports government funding of planned parenthood, you don’t think it’s offensive to fund an organization that performs abortion services which more than half the population thinks should not be allowed in most situations?

That is exactly why private donations make more sense. People can fund the organizations they support and not have their money go towards organizations they are “offended by.”

And the idea that Government is better at allocating any funds efficiently is rather laughable.

I question Mr. Torinus’ figures. For example, he claims that the top 1% pay “nearly half” of federal income taxes. According to Kiplinger, that number (for 2013) is 37.8%, not “nearly half” (unless you assume 3/8 and 1/2 are the same thing).

http://www.kiplinger.com/article/taxes/T054-C000-S001-your-rank-as-a-taxpayer.html

Also, the money earned by the 1% only includes the amounts actually reported on their tax returns. While most Americans have to report all their income on their 1040s, this becomes somewhat optional as you get richer because of loopholes or off-shore holdings (like the Cayman Islands corporations that are reportedly 100% owned by Mitt Romney’s family).

One such loophole is “unrealized capital gains”. Whereas salary and interest are reported (and taxed) in the year earned (even when the interest income is unavailable—locked away in a long-term CD), capital gains are not reported until “realized” (if and when the asset is sold).

For example, I bought (and still own) 100 shares of Apple stock at $20/share back in 2003 (total investment $2,000). Today, Apple stock is $96 (and has split 14-for-1 since then), so I now own 1,400 shares worth $96 each—total value $134,400—a $132,400 gain.

Since I haven’t sold this stock, none of this $132,400 gain has ever been reported (or taxed). If I die holding these shares (I turn 65 next week) and leave them to my niece, my gain will NEVER be reported. (If she sold them, she would only report the gain accrued after my death; the gain before my death would not be reportable.) If, while still alive, I become a philanthropist and donate these shares to charity, I can deduct the entire $134,400, again without ever paying taxes on the $132,400 gain.

While this loophole is 100% legal and available to all Americans, regardless of wealth, it is meaningless to anybody living paycheck-to-paycheck, so the vast majority of (unreported) “unrealized” capital gain income goes to the richest Americans.

When looking at very rich people (like the “1%”), their tax return only reports a small portion of their true income.

“And the idea that Government is better at allocating any funds efficiently is rather laughable.”

Really? Perhaps you are not familiar with our private health insurance model or wasteful administrative costs of many charities.

Dave,

I’m plenty liberal and pro-government (and and pro-taxation as it relates to this discussion), but there is no way on balance the government is more efficient that most charities. I can guarantee a higher percentage of the money I send to the Rescue Mission (also technically religious even though their mission is predominantly helping those in most need without religious restrictions) is allocated better to the actual mission than a government grant or program.

Dave, do you want to do a back and forth of examples of wasteful spending? We could do that all day.

Tom D, our federal income tax system is based on… well, income . Not assets. You do not realize the gains on investments or the like until you actually sell them (except of course from items like dividend or interest income). That is not a loop hole. Unless you think we should tax any equity value increase from your home appreciating in value each year (not to confuse that with your property tax)? Perhaps we should tax the increased value of your coin or Lionel train collection? Our system just doesn’t work that way.

AG has to bring up abortion. Thanks for that. I love your misleading phrasing too. A Gallup poll from May shows that Americans choose pro-choice for the first time in seven years (their wording). Talk about something we can go back and forth on.

Also, there is a whole lot of debate on whether or not charity is more efficient/effective than government. Many economists don’t believe it is. It’s not a cut-and-dried issue.

Vincent, I was going to use investing in highways or mass transit as examples of times when people do not want their money going towards a particular topic… but then I thought of you and your comments during our PP discussions so went with that instead. What better example is there of strong opinions one way or another?

(Side note, that title doesn’t really reflect what their survey said. You only come up with 51% by including people who are pro-life except in certain circumstances like the mothers health at risk. So you’d have to count people like me in order to come up with that majority.)

As long as we keep our heads and prevent Hillary the beast from getting into office we just might have a chance to stop this ongoing dismantling of our country by the banks and ruling corporations.

Good article worthy of debate about a presidential candidate. I believe Bernie Sanders main appeal is that he firmly believes in “one vote” for each person rich or poor. Given the amount of money pouring into state and federal elections from the 1 percenters, I doubt most of them agree with that fundamental democratic principle. Sanders from “a poor state” still believes in the America where all the people have an equal voice/vote and they will elect a president to serve them no matter what their socioeconomic status is.

I’m glad Sanders is in the race. He talks about important issues and I agree with a lot of what he says. But that’s a far cry from meaning he’s presidential material. Some of his policies are hard to take seriously.

http://www.npr.org/sections/health-shots/2016/02/23/467639551/sanders-health-plan-renews-debate-on-universal-coverage

I agree some of his proposals may be a little wacky but this country has skewed so far in favor of the 1% and large corporations, maybe it’s time for something drastic to level the playing field a bit. Due to massive gerrymandering, it’s not like the GOP is in danger of losing the house anyways meaning he probably wouldn’t get much done but at least his populism would be elevated to this highest platform in the land.

And that’s why I am glad he’s in the race Dave. The issues he talks about incessantly are important and I’m glad he keeps them on people’s radar. I just don’t think he’d make a good POTUS.

400 INDIVIDUALS in the U S have more wealth than the bottom 61% of the population

20 INDIVIDUALS in the U S have more wealth than the bottom half of the population

91% of the nation’s income growth from 2008- 2011 went to the top 1%

68% of Americans support raising taxes on people earning more than $1 million

75% of Americans support increasing the minimum wage

As long as wealthy individuals and huge corporations can buy elections and dictate policy the inequality will only grow. Since 2008 larger chunks of income and wealth gains have flowed to the top 1%. Real democracy cannot exist along side massive personal and corporate fortunes. In this era of hiding trillions of dollars offshore and avoiding taxes the super rich must be held to account. What Bernie proposes is letting the people set the rules of the economic game and thereby let them in on the dirty little secret of how those at the top control how the government sets the rules to favor those at the top, Wall Street and the “BIG: BANKS. Taxing Wall Street is one possible solution. Taxing capitol gains would raise $600 billion over 10 years. Bernie is saying in perhaps not the kindest way…”Lets put everything on the table and look at how the top is benefiting and the rest or not and then lets change the rules so that the rest of us have a chance and those at the top still have plenty. The issue is not so much if those at the top have too much, it’s if those at the bottom have enough!

Jerry, capital (not capitol) gains are already taxed.

They sure are, just not as much as the rest of us:

https://en.wikipedia.org/wiki/Capital_gains_tax_in_the_United_States

By “the rest of us” do you mean many people who are or will soon be retiring?

I thought this was a thoughtful article. While I don’t agree with all Torinus’ points, it would be nice to have a civil discussion.

I would not want Urban Milwaukee to go the way of most conservative media, where anyone who could offer constructive criticism has long ago been driven out.

The article isn’t bad. It’s the headline, the idea that the one percent are poor victims who need defending. I hope his next piece is titled “Why Old Wealthy Straight White Males Need Anti-Discrimination Laws.”

This is copied from the Onion, right?!?

I agree with Bruce Thompson that this was a thoughtful article as well as his point about the importance of civil discussion. Many of the comments were similarly thoughtful and interesting, just what you want from Urban Milwaukee. I would like to encourage Mr Torinus to write similar articles about his take on the other major presidential candidates.

Mr. Torinus seems to have a problem with facts.

In addition overstating by nearly a third how much the 1% pay in federal income taxes (see post 12), he also calls Vermont “a very poor state”. I think he says this to imply that only poor, desperate people would elect such a progressive senator.

His “very poor state” assertion just isn’t true. According to the US Census QuickFacts website, Vermont is BETTER than the overall US on all 4 financial metrics listed. Its median home value, per capita income, & median household income are all HIGHER than the US, and its poverty rate is LOWER.

Hardly “a very poor state”!

http://quickfacts.census.gov/qfd/states/50000.html

Tom D, I found different information. This CNBC article points to a study that disagrees with you and shows that the top 1% does indeed pay almost half of all individual income taxes:

http://www.cnbc.com/2015/04/13/top-1-pay-nearly-half-of-federal-income-taxes.html

Also, regarding your comment #12, the United States has a world wide tax system. Hiding money overseas is not an option to avoid taxes unless you are willing to commit a crime. Unless you’re implying that hiding money overseas is viewed by rich people the same way I view giving a “healthy” value to the items I donated to goodwill.

I support, as stated, that we should look at applying the AMT to all sources of income… but lets not go out of our way to vilify everyone who makes a couple hundred grand a year. Raising taxes, changing tax code to tax wealth instead of income, removing tax credits for charity, etc may affect our economy in ways many might not expect. One infamous example is the luxury tax of 1990 that helped gut an already struggling yacht manufacturing industry and many jobs with it.

In the end, business owners and leaders don’t create jobs out of the goodness of their heart, but generally because to make more money they need people. We shouldn’t give away the store, but at least recognize that the evil 1% is also at the reigns of the entities that give most (I’m guessing) Americans their jobs.

About Tom D’s post on capital gains and inheriting stock. Currently the person inheriting stock gets a tax basis at the current market value at time of inheritance. No tax, other than the inheritance tax, is levied on the gains on it made by the deceased person. I think stock should be inherited along with inheriting the tax basis of the deceased person and the stock value should not be included in determining any inheritance tax. This would close the big tax loophole and still shelter the inheritance from a burdensome estate tax until it is actually sold. If the tax basis cannot be acquired from deceased person’s estate, then a tax basis should be zero for the inheritor. However, deceased persons should have had records of their tax basis for tax purposes.