Lawsuit Says Top Fire Truck Manufacturers Are Colluding

Charging they raise prices, limit supply. Two of three companies are in Wisconsin.

The city of La Crosse’s 2020 Pierce Saber pumper tanker truck is seen in this photo. Photo courtesy of Hagens Berman

The city of La Crosse is suing three fire truck manufacturers — including two headquartered in Wisconsin — in federal court, accusing them of unlawfully coordinating to limit the supply of trucks and raise prices.

The class action suit was filed last week against the manufacturers Oshkosh Corporation, REV Group and Rosenbauer America. It also names the Fire Apparatus Manufacturers’ Association. Oshkosh Corporation is based in the Fox Valley. REV Group is headquartered in Brookfield, and Rosenbauer is headquartered in South Dakota.

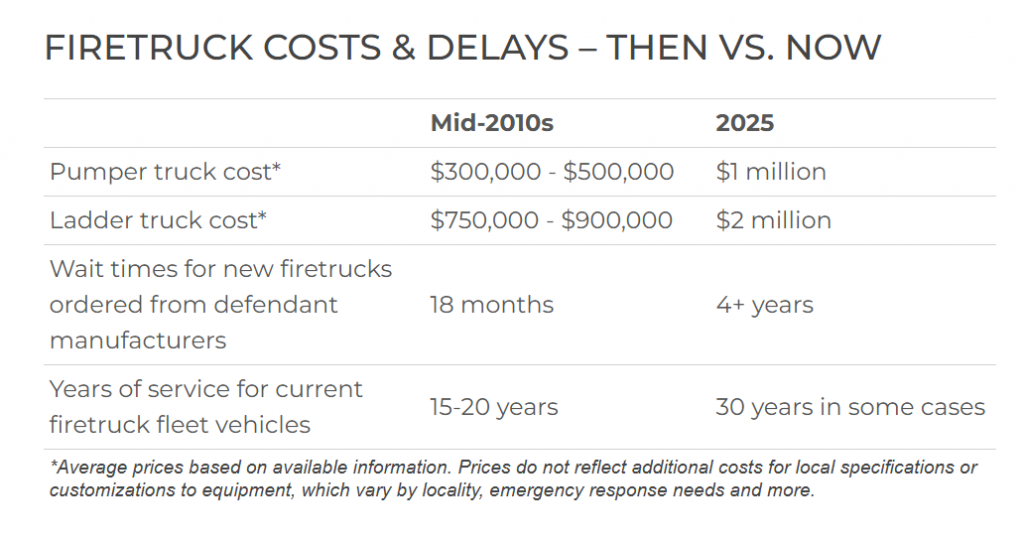

According to the civil complaint, fire truck prices have doubled in the last decade, exceeding the rate of inflation. For example, a ladder truck that cost $900,000 in the mid-2010s now costs more than $2 million, the suit states. Meanwhile, wait times for new trucks have ballooned from 18 months to more than four years.

The three manufacturers listed in the complaint are “responsible for increasing fire truck prices and perpetuating lengthy backlogs” as they control 70 to 80 percent of the U.S. fire truck market, the suit says.

The lawsuit also alleges the manufacturers used the backlog as an excuse for increasing the final price of new fire trucks after they go into production.

Rising prices and long delivery times have made it harder for municipalities to replace their aging vehicles in a timely manner, leaving fire departments using trucks that “have exceeded their service life,” the complaint says.

“Cities and towns across the country are facing a crisis where demand for new fire trucks has outstripped availability and funding,” the suit says.

The city of La Crosse declined to comment on the suit.

The problem isn’t limited to La Crosse. According to the lawsuit, Chicago recently celebrated a fire truck’s 30th birthday. Municipalities in Connecticut, Illinois, Michigan, New York, New Jersey, Pennsylvania, Texas, Kansas and West Virginia are facing similar issues.

This graphic shows changes in firetruck costs and delays from the mid-2010s to 2025, according to the Hagens Berman law firm, which is representing the city of La Crosse in the lawsuit. Graphic courtesy of Hagens Berman

Lawsuit says consolidations limited competition

From the mid-2010s to 2020, REV Group acquired six different fire equipment brands, including companies that had been direct competitors in the fire truck industry, the suit says.

The acquisitions “solidified REV Group’s position as the top fire truck manufacturer in the United States,” the complaint states.

Similarly, Oshkosh Corporation subsidiary Pierce Manufacturing completed a pair of acquisitions of fire equipment manufacturers in 2021 and 2022, giving Oshkosh Corporation control over “a full quarter of the U.S. fire truck market,” the lawsuit says.

Oshkosh Corporation also “embarked on a strategy of consolidating the U.S. brands already within its purview, reducing geographic overlap between its dealers” from 2018 to 2025, which “reduced or eliminated competition among Pierce subsidiaries,” the suit says.

This photo of the Chicago Fire Department celebrating a fire truck’s 30th “birthday” was included in the lawsuit against three fire truck manufacturers and a trade group. Photo via court documents

Manufacturers allegedly exchanged economic information through trade group

Aside from using consolidations, the suit alleges that Oshkosh Corporation, REV Group and Rosenbauer have worked to cooperate with each other instead of compete.

The manufacturers allegedly exchanged confidential and “competitively sensitive” economic information through the Fire Apparatus Manufacturers’ Association.

The suit accuses the manufacturers of using that data to “coordinate price increases and suppress production,” as well as to “monitor their co-conspirators to ensure continued adherence to the conspiracy.”

“This information exchange is particularly likely to have anticompetitive effects because so few sellers control the fire truck market,” the complaint states. “Thanks to their conspiracy, (manufacturers) have been able to increase their margins by several percentage points and boost total profits.”

The lawsuit also alleges the manufacturers’ association organizes two meetings each year, where manufacturers have “ample time and opportunity to exchange sensitive economic information and coordinate supply restrictions and price hikes at these meetings.”

The suit asks the court to declare that the manufacturers and association violated antitrust law, require the manufacturers to stop their alleged anti-competitive behavior and to award La Crosse and other possible plaintiffs damages.

Oshkosh Corporation, REV Group say the suit is without merit

Rosenbauer America and the Fire Apparatus Manufacturers’ Association did not immediately respond to requests for comment.

Similarly, a statement from Oshkosh Corporation called the lawsuit “without merit.”

“Oshkosh has a long history of reinvesting in our businesses, driving organic growth, enhancing efficiency and expanding capacity to better serve our customers,” the statement reads. “We remain committed to delivering high-quality, safe fire trucks to meet the record demand of recent years.”

La Crosse sues fire truck manufacturers, says they coordinated to raise prices, limit supply was originally published by Wisconsin Public Radio.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

We used to enforce the Sherman anti trust laws.

in the 1960s the Supreme Court barred the merger of the Kinney and Buster Brown shoe companies because the new combined company would control a mere 5 percent of the shoe market.

Reagan, in 1983, ordered the DOJ, SEC, and FTC to stop enforcing the Sherman Act, which is why today Nike, for example, controls about a fifth of the entire nation’s shoe market.

Thom Hartmann’s big brain points these things out.