Is Wisconsin ‘Flush With Cash’?

Why state has $4.3 billion surplus, what it means and how should it be handled.

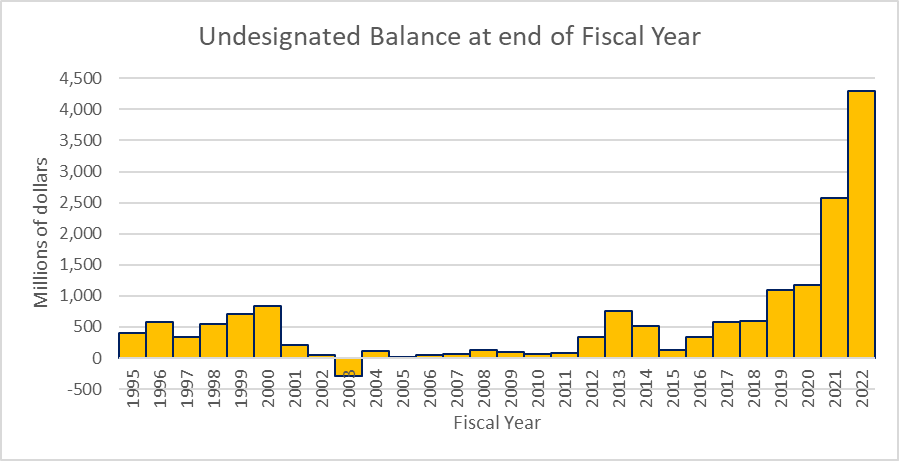

On June 30, 2022, Wisconsin ended its 2022 fiscal year with an unprecedented $4.3 billion cash balance. This balance is the amount of available funds that go unspent at the end of the year. In Wisconsin it is called the “undesignated balance.” This led the think tank Forward Analytics to issue a report saying Wisconsin is “Flush with Cash.”

The size of the balance mostly results from two causes. First, actual revenues were substantially greater than those predicted in the original budget (by about $1.6 billion). Second, the previous fiscal year’s ending undesignated balance ($2.6 billion) was carried forward as the beginning balance of the 2022 fiscal year.

Not everyone agrees with this sentiment, however. At the recent debate of candidates for governor, Tim Michels called the state’s burgeoning reserves “an awful thing.” The argument that budget surpluses should be immediately returned to the public through the mechanism of tax rebates is not a new one.

History may help explain why this argument is attractive to Michels. In 1979, Marty Schreiber, who became governor when Patrick Lucey was appointed ambassador to Mexico, ran for a full four-year term. His opponent, Lee Dreyfus, attacked the state’s surplus, arguing it should be returned to the voters as a tax decrease. With that argument, Dreyfus won the election and proceeded to cut taxes. According to his Wikipedia biography, “In Dreyfus’ final year in office, 1982, the state had a budget deficit of nearly $1 billion and a 12 percent unemployment rate.”

Dreyfus’ political success may help explain Wisconsin’s historically weak response to economic downturns. A governor who built up too much of a cash cushion could risk defeat at the polls. However, without such a cushion, Wisconsin was particularly vulnerable to the next recession. As the next graph shows, Wisconsin repeatedly faced years when there was no current year surplus and no cushion that would allow the state to ride out tough economic times.

Compounding Wisconsin’s vulnerability was the fact that unlike many other states, Wisconsin’s “rainy day” fund, although created in 1986, was unfunded. Officially called the “budget stabilization fund,” it was aimed at helping get the state through periods when the US economy was weak. So long as the US economy was humming along, Wisconsin was doing fine. Between 1992 and 2000, for example, state tax revenues rose an average of 7.1% per year. In such an environment, it might be easy to conclude that prosperity would continue forever and there was little need to build up the rainy day fund.

However, when the 2001 recession hit, Wisconsin was unable to turn to the budget stabilization fund for help. Voters took out their frustrations on the next governor, Scott McCallum, who was voted out of office. Even so, for the next decade or so efforts to increase reserves were unavailing.

By then it had been two decades since the budget stabilization fund was created, but no state funds had been put into it. When the Legislature finally acted, rather than directly appropriate state funds, it set rules for when future legislators would be required to fund the budget stabilization fund. It required that in years when tax revenue exceeded the amounts budgeted, half of the excess must be deposited into the budget stabilization fund, as a 2009 paper by the nonpartisan Legislative Fiscal Bureau explained. This requirement would continue until the balance in the fund reached 5% of spending.

In recent years, actual tax revenue has substantially exceeded estimates by the Fiscal Bureau. For the 2021-22 fiscal year, for instance, tax revenue was $1.6 billion more than estimated in the budget, reflecting that the Wisconsin economy had run unexpectedly hot.

As the result of previous under-estimations, the balance in the budget stabilization fund currently stands at $1.73 billion. Assuming a Wisconsin budget of around $20 billion, this is about 8.65% of the current Wisconsin state budget. Since this exceeds 5%, there was no legal requirement this year that a portion of undesignated balance be deposited into the budget stabilization fund.

What, then, should be done with the excess funds?

One possibility is to raise the target size of the budget stabilization fund. The current 5% would have fallen short in countering lost revenue in the Great Recession. It puts Wisconsin at about the tenth smallest among the states’ rainy-day funds. Raising the goal to 16%, as recommended by the Finance Officers Association, would put Wisconsin on firmer ground when the next recession comes around.

It turns out that increasing the goal to 16% would use about half of Wisconsin’s undesignated fund balance. There are several other possible uses including making a start on raising shared revenue for counties and municipalities (like Milwaukee) whose low average property values make it difficult to adequately fund government services.

Contrary to Michels apparent belief that the route to the governorship is to repeatedly declare that Wisconsin is a “mess,” the high budget surplus represents good luck and an opportunity. For years, the need for an adequate rainy-day fund in Wisconsin has been acknowledged, but not acted upon. For the first time in the past thirty years, adequately funding Wisconsin’s rainy-day account can be achieved without raising taxes or cutting programs.

Data Wonk

-

Why Absentee Ballot Drop Boxes Are Now Legal

Jul 17th, 2024 by Bruce Thompson

Jul 17th, 2024 by Bruce Thompson

-

The Imperial Legislature Is Shot Down

Jul 10th, 2024 by Bruce Thompson

Jul 10th, 2024 by Bruce Thompson

-

Counting the Lies By Trump

Jul 3rd, 2024 by Bruce Thompson

Jul 3rd, 2024 by Bruce Thompson

One responsible thing to do with a surplus would be to pay down Wisconsin’s debt. This could be done by calling outstanding bonds (if they were sold with a call provision) or by buying bonds on the open market (rising interest rates makes older, lower interest rate, bonds cheaper).