Supreme Court Upholds Brown County Sales Tax

Conservative group sued, arguing tax could only fund property tax relief.

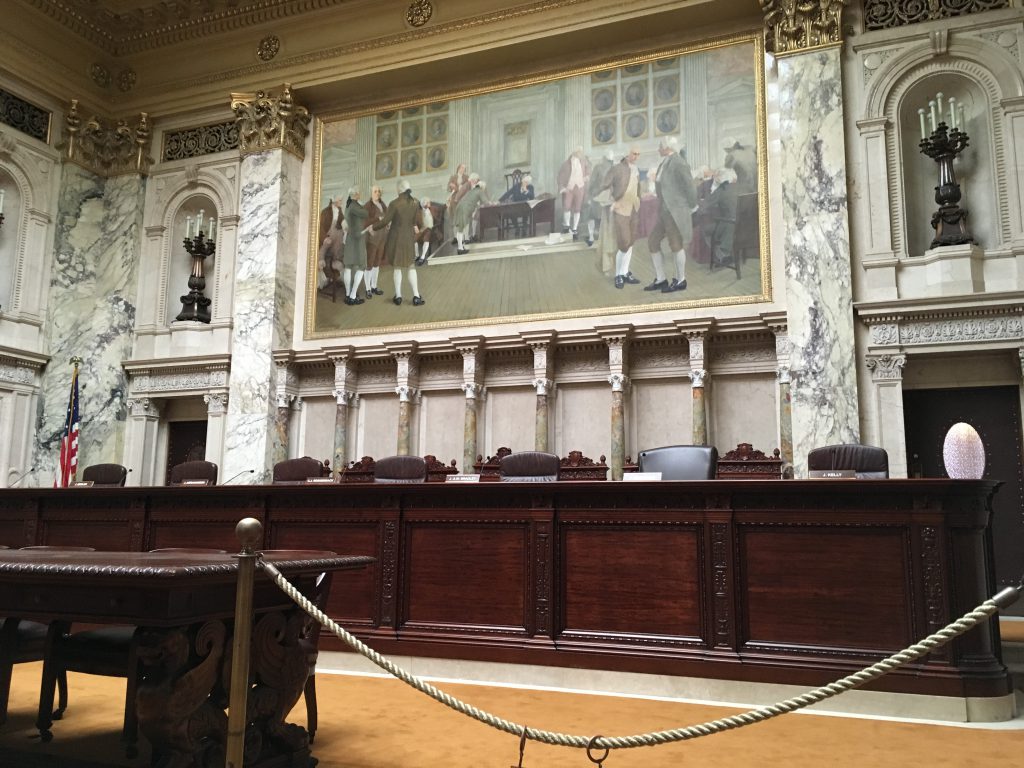

In a 5-2 decision on Friday, the Wisconsin Supreme Court ruled that Brown County’s 0.5% sales tax is legal.

A challenge to the tax had been brought by a local organization, the Brown County Taxpayers’ Association (BCTA), and the right-wing Wisconsin Institute for Law & Liberty, arguing that under state law sales tax revenues could only be used to reduce property taxes and not fund new spending.

In 2018, the county instituted the tax to fund new capital spending, including road projects, library improvements and public safety, among other projects the County Board found “necessary” for the “long-term viability of the county.” The board said that using the sales tax to fund the projects prevents it from having to raise property taxes.

In the majority decision, which was written by Justice Ann Walsh Bradley and joined by Justices Rebecca Dallet, Brian Hagedorn, Jill Karofsky and Patience Roggensack, the court decided that the county was correct and the BCTA was wrong in arguing that sales tax revenues must correspond with a “dollar-for-dollar” reduction in property taxes.

In a dissenting opinion, Justice Rebecca Bradley, after opening with a passage from Lewis Carroll’s ”Through the Looking-Glass and What Alice Found There,” writes that the decision gives local governments a “blank check” for spending.

“The Board maintains the property tax levy otherwise would have had to increase in order to pay for all of the new projects,” she writes. “The Board decided to avoid an increase in the property tax levy by instead imposing a sales and use tax to directly pay for the projects. The majority permits this, contorting a statute designed for property tax relief into a blank check for unaffordable spending. The majority may do so as the masters of law-declaring in Wisconsin, but the statute does not mean what the majority says.”

In a statement, Brown County Corporation Counsel David Hemery said that the lawsuit cost the county hundreds of thousands of dollars to prove it can spend money on important capital projects.

“It has been obvious all along that our fiscally conservative Debt Reduction, Infrastructure and Property Tax Relief Plan was legal, and it’s a shame we had to spend hundreds of thousands of Brown County taxpayer dollars defending a law that has been clear for over two decades,” he said. “Utilizing revenue from the sales tax, the County has made crucial investments in our infrastructure, while paying down our debt and providing tax relief to property owners here in Brown County.”

Supreme Court upholds Brown County sales tax was originally published by the Wisconsin Examiner.

Given the success of this argument by Brown County for funding of specific projects with a sales tax, indirectly reducing property tax burdens; would a similar approach work in Milwaukee County as well? Or are the county’s hands tied due to the state limitations which apply only to the city of Milwaukee?