State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Not a dollar for half of all taxpayers, thousands in tax cuts for the most wealthy.

Wisconsin lawmakers passed an enormous income tax cut in the 2021-23 state budget that further tilts our tax system in favor of the wealthy. The tax cut almost completely leaves out households with low incomes, and gives white households larger tax cuts than Black or Latinx households.

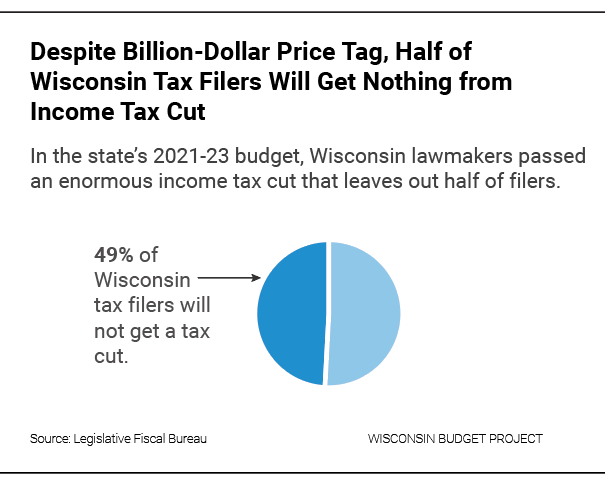

This huge tax cut widens the economic divide in our state and makes it harder to invest in critical public services. Almost half—49%—of all tax filers will receive no portion of the $1 billion per year tax cut, because their incomes are too low, according to an analysis by Wisconsin’s Legislative Fiscal Bureau.

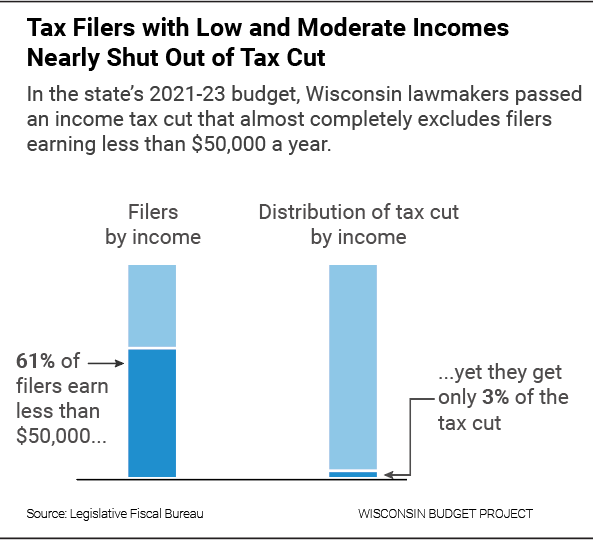

Low-income households that do get a tax cut will get only a very small one. More than 6 out of 10 filers in Wisconsin earn under $50,000 a year. Yet these filers will get just 3% of the total value of the tax cut. This means that families that are struggling to make ends meet will get little or nothing in the way of a tax cut, while the majority of the tax cut is delivered to higher-income households. Filers earning under $50,000 a year get about 34¢ a week from this tax cut, or about $18 per year. In contrast, filers earning more than $300,000 per year get an average income tax cut of $2,785.

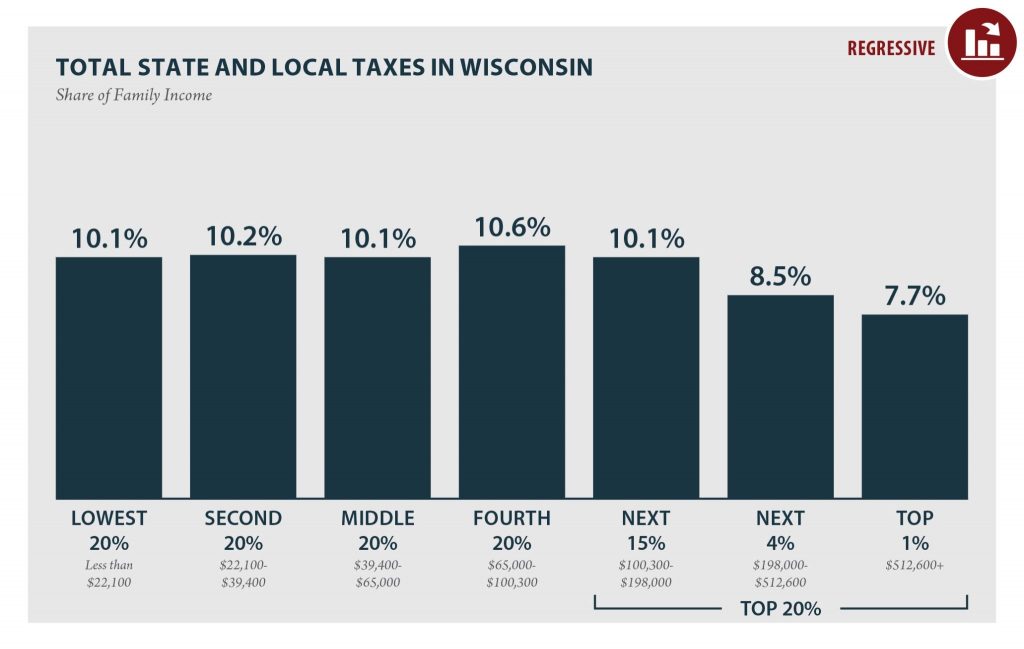

Shutting low-income families out of the tax cut will further skew Wisconsin’s tax system, which already requires people with low incomes to pay a higher share of their incomes in state and local taxes than people with much higher earnings. The lowest 20% of Wisconsin households by income, in which households earn less than $22,000 per year, pay 10.1% of their income in state and local taxes, according to an analysis by the Institute for Taxation and Economic Policy. In contrast, the top 1% of households by income—a group with incomes of $513,000 and above—pay only 7.7% of their income in state and local taxes.

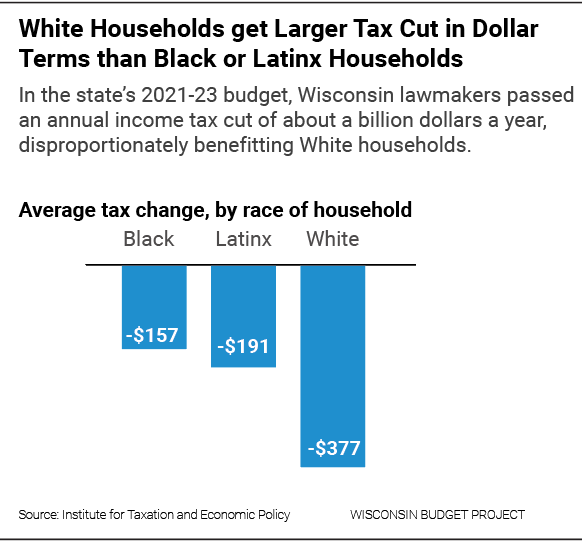

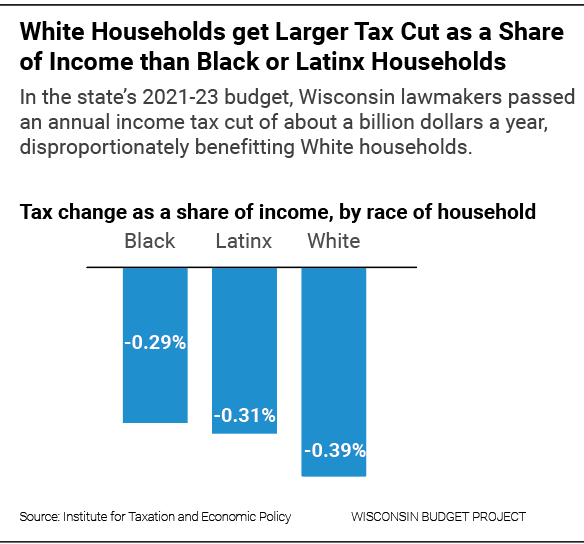

The tax cut also will widen racial disparities in the economic well-being of Wisconsin households. White households get a significantly larger tax cut on average than Black or Latinx households. Historical and present-day racial discrimination in Wisconsin’s schools, health care system, and job market have lowered the wages of Black and Latinx households, making them more likely to be among the low-income households that are excluded from receiving a portion of this tax cut. As a result, white households will get an average tax cut of $377, twice as large as the average tax cut received by a Black household ($157) or a Latinx household ($191), according to ITEP.

Even when comparing the size of the tax cuts relative to income, white households get a far larger tax cut than Black or Latinx households. The tax cut amounts to 0.39% of white households’ income, compared to 0.29% of Black households, and 0.31% of Latinx households.

In its current state, Wisconsin’s tax code is a major driver of economic inequality, and contributes to the increasing concentration of income and wealth in a few hands—hands that are most likely to be white, due to a long history of racial discrimination. By directing the bulk of a mammoth tax cut to households with high incomes, state lawmakers are making this problem worse.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

-

BadgerCare Expansion Too Good to Go Away

May 9th, 2021 by Jon Peacock

May 9th, 2021 by Jon Peacock

Ah, but many Republicans will say, the wealthy pay more taxes, are the job creators and create more opportunities, unlike the takers, who were getting extra unemployment benefits and not going back to work and who are relying on ‘handouts’. Those same people who are at increased risk for being evicted, becoming homeless, who are in need of child care in order to get back to work but can’t afford it or it is no longer available because of shortages in services, and the list goes on. So, it is in their interest (Republicans) to increase and widen the disparities in wealth instead of seeking solutions that will benefit all.