Many City Renters Face Evictions

Black neighborhoods hit hardest as state pandemic aid program can’t keep up.

Wyconda Clayton is seen with pictures of family members inside her home in Milwaukee on July 17, 2020. She fell behind on rent while caring for her elderly mother, prompting her landlords to file for eviction. She received last-minute rental assistance through the state, but the landlords refused to accept it. She hopes to eventually remove the eviction from her public record under an agreement to move within 60 days. Photo by Will Cioci/Wisconsin Watch.

Kelli Walton waited four weeks to hear whether she qualified for state emergency rental assistance. When the news came, it was too late.

By the time the Social Development Commission, which distributes the aid, told her she was on a waiting list with thousands of others, Walton’s landlord had already issued a five-day notice — kickstarting an eviction.

The mother of two from Milwaukee said before the pandemic, she was paying rent on time. But Walton was infected by the coronavirus in April as it swept through the nursing home where she worked. She spent nearly three weeks in a hospital struggling to breathe.

She fell behind on her bills — including rent. That delay left Walton with a damaging eviction filing on her record, forcing her to scramble to stay in the home as she recovers from the virus.

“It’s really frustrating to know you can be put out,” she said. “Where can you go if you don’t have anywhere to go?”

Thousands of Wisconsin renters contemplated those questions since May 26. That was when Gov. Tony Evers’ 60-day moratorium on evictions expired. Evers was among the first governors to lift a state moratorium, and his $25 million statewide emergency rental assistance program is failing to meet the demands of thousands in need.

Local governments and housing advocates are now trying to catch individuals slipping through the cracks in the federally funded state program.

“A lot of us who are doing this work right now are working one person at a time trying to stave off disaster,” said Joanne Lipo Zovic, an attorney and mediator for Mediate Milwaukee, which helps tenants and landlords reach agreements outside of court and is collaborating with other social service groups to fill enormous needs. “We kind of feel like we’re drinking out of a fire hose.”

‘A racial pattern of filings’

Roughly 30 to 40 million renters nationwide are at risk of losing their homes this year as state moratoriums on evictions expire, according to an August study by the Aspen Institute, a nonpartisan humanities think tank. Eviction filings are already upending lives in Wisconsin, especially for Black residents in Milwaukee, even as health officials urge residents to stay at home as much as possible to avoid COVID-19.

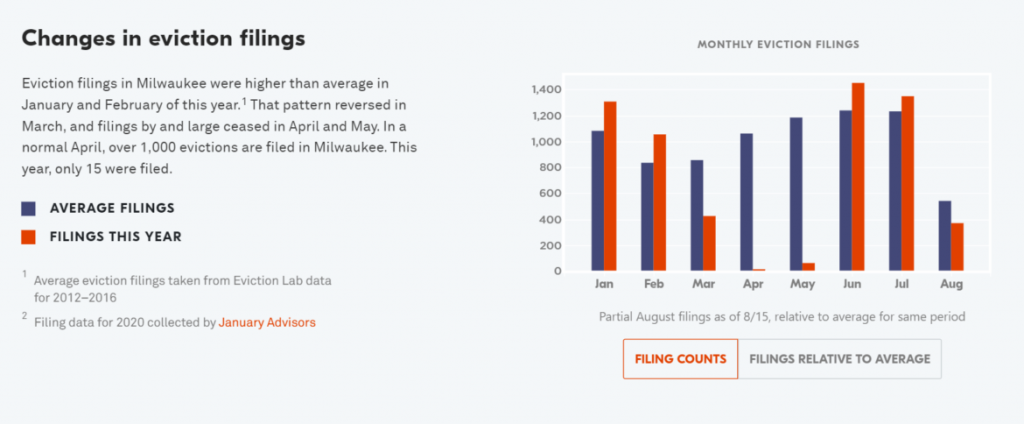

Milwaukee landlords filed for 1,447 evictions in June, 17% higher than pre-pandemic June averages, data from Princeton University’s Eviction Lab show. The city’s 1,347 eviction filings in July were 9% above averages from 2012 to 2016.

More than two-thirds of those filings hit Black-majority neighborhoods, according to Eviction Lab data, although Black residents make up just 39% of the population. The disparity highlights Milwaukee’s status as the nation’s most segregated metropolitan area, home to stark racial inequality created and maintained by decades of neglect from business and political leaders, according to research.

The pandemic is escalating the housing crisis a year after the city and Milwaukee County declared racism a public health crisis and while coronavirus continues to disproportionately infect and kill people of color.

The crisis is not confined to Milwaukee. Nearly 200,000 Wisconsin households, or 27% of state renters, are behind on rent and at risk of eviction, according to analysis of census data by Stout Risius Ross LLC, an international consulting and investment banking firm. The analysis projects 134,000 eviction filings statewide by November.

“What you’re seeing right now is two crises colliding,” said Brad Paul, executive director of Wisconsin Community Action Program Association (WISCAP), the network of agencies distributing the state’s rent assistance funds. “You’re seeing the preexisting housing crisis and COVID. It’s a lethal combination.”

Evictions ban short-lived

Walton started a new job in mid-July and is working part time. While she remains on the state housing assistance waiting list, she is receiving last-minute funds from Community Advocates, a nonprofit administering Milwaukee County’s separate rental aid program.

Those funds staved off an eviction. But the filing, although dismissed, could still scar her record, because some landlords reject would-be renters even for thwarted evictions, housing experts say.

“It’s still gonna be on my name,” Walton said. “I’m just trying to get back on my feet, slowly but surely.”

The Tenant Resource Center in Madison, Wis., provides various services to renters and housing insecure individuals in the city. It is seen on July 10. Photo by Will Cioci/Wisconsin Watch.

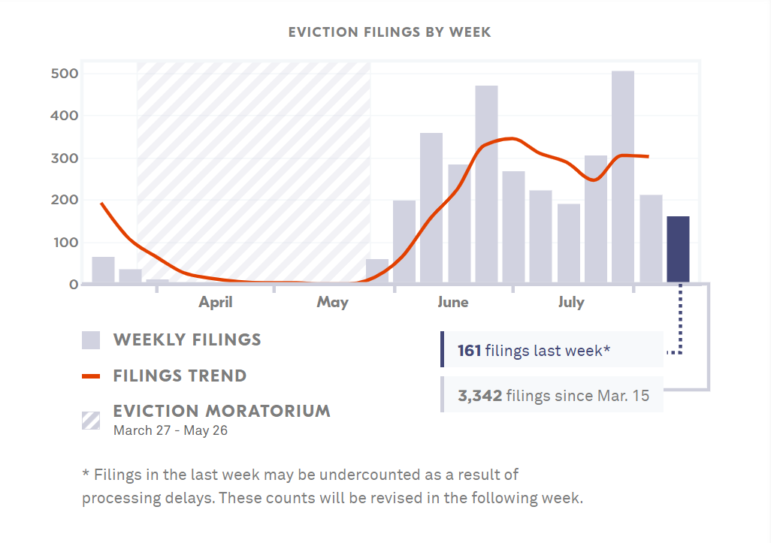

Evers, whose office did not respond to questions from Wisconsin Watch, took action early in the pandemic to keep people in their homes. His March 27 executive order banned landlords from evicting tenants for back rent and halted home foreclosures.

“Evictions and foreclosures pose a direct and serious threat to the health and well-being of Wisconsinites,” Evers said at the time, calling it “critically important” to ensure people keep a roof over their heads.

Although the order did not cancel rent, it temporarily accomplished its goal: Milwaukee County saw just 76 eviction filings during April and May, according to the Eviction Lab. (The order allowed evictions for purposes unrelated to nonpayment.)

Most states took similar actions as the virus spread, but Wisconsin lifted its ban before most of them. Neighboring Minnesota still has a moratorium in place, and Illinois Gov. JB Pritzker has vowed to extend a ban was set to expire Aug. 22. Wisconsin’s struggle to process unemployment claims and match renters with aid may offer a warning to other states of what is to come.

“We’re starting to see what might happen if the right resources aren’t put in place,” said Eric Collins-Dyke, Milwaukee County’s assistant administrator of supportive housing and homeless services.

“All of those people have a right to safe and affordable housing … and if we don’t do something, they’re going to end up on the street and in our shelters.”

‘The bubble is bursting,’ especially in Milwaukee

Hundreds of thousands of Wisconsin tenants lived paycheck-to-paycheck even before coronavirus upended the world.

More than 306,000 Wisconsin low-income renters met the U.S. Department of Housing and Urban Development’s definition of “worst-case housing needs”: They spent more than half their income on housing and did not receive government housing assistance.

“The bubble is bursting. We’ve been talking about this population for years, and it’s extremely large in Milwaukee,” said Collins-Dyke.

Renters make up more than half of households in Milwaukee County, which in 2016 had a higher percentage of renters than any other large Midwestern county, according to a study from the Wisconsin Policy Forum. Before the coronavirus, about half were considered rent-burdened, meaning they spent at least 30% of their income on rent, the study said.

Some Milwaukee neighborhoods in recent years saw eviction rates of 10% to 15% of households, according to a separate analysis by the Medical College of Wisconsin.

“There are a high number of people who are paying 50, 60, 70 or more percent of their income on housing,” said Lipo Zovic of Mediate Milwaukee. “That’s a policy problem, and a practical problem. It’s both.”

Emergency aid moves slowly

Days before his eviction ban expired, Evers funneled $25 million in federal pandemic relief into the Wisconsin Rental Assistance Program (WRAP). He tapped housing agencies to evaluate tenants’ applications and send up to $3,000 directly to landlords.

But the agencies could not start processing applications until June 8, nearly two weeks after landlords could resume evictions.

WRAP through Aug. 6 distributed about $7 million to about 4,000 households statewide, said Paul, the WISCAP executive director.

That is a fraction of the 24,000 applicants in just Milwaukee, Washington and Ozaukee counties applying through the Social Development Commission — the vast majority of them from Milwaukee County. The cost of fully funding those requests would be $72 million, nearly three times what Evers earmarked statewide.

In the first two months, SDC distributed $1.1 million of $6.7 million in initial WRAP funds. The city of Milwaukee this month sent $15 million in federal funds to the SDC and $1.6 million to Community Advocates to beef up aid to renters.

Eviction proceeds as landlord refuses aid

But the money didn’t flow fast enough to keep Wyconda Clayton out of court. The SDC ultimately granted her application — but her landlords refused the funds.

Clayton’s rent troubles started shortly before the pandemic. She lost work — and wages — as a home health care provider while caring for her elderly mother. She fell behind on rent, prompting her landlord to file for eviction in mid-March. The court delayed the case during the moratorium, court records show, offering Clayton a reprieve.

Wyconda Clayton is seen inside her home in Milwaukee on July 17, 2020. Black women are at least twice as likely to have an eviction filed against them compared to white renters in Wisconsin and 16 other states, according to an ACLU analysis of 2012-16 Eviction Lab data. Photo by Will Cioci / Wisconsin Watch.

Clayton’s mother died in April, and she said she used money she had saved for rent to pay for the funeral. She eventually picked up a few home care hours, she said. But some elderly clients remain leery about welcoming workers into their homes during the pandemic, preventing her from earning enough to pay back her landlord, Business Ventures Investments.

When the moratorium expired, the company continued with the eviction.

Days before her Aug. 6 hearing, Clayton finally caught a break: SDC told her she qualified for $3,000 in WRAP aid, following a month-long wait. The aid could cover the rent she owed since February.

“When (Clayton) called us about the rent assistance, she didn’t have that money yet,” said Dorothy Hampton. “And when it got to the end, Mr. Hampton decided he did not want to do it anymore.”

Community Advocates and Mediate Milwaukee are helping Clayton and the Hamptons negotiate an agreement to remove the eviction case from her public record if Clayton moves out within 60 days.

Clayton does not want to leave her Sherman Park neighborhood home, where she has lived for four years, but she hopes an agreement will prevent worse harm to her renting record.

Black women like Clayton are at least twice as likely to have an eviction filed against them compared to white renters in Wisconsin and 16 other states, according to an ACLU analysis of 2012-16 Eviction Lab data.

“Everybody is going through it, and nobody should have to go through this,” Clayton said. “I’m just trying to work out this issue and move forward.”

‘A huge bottleneck of applicants’

Some agencies administering Evers’ program are streamlining how they process aid applications. But meeting demand remains next-to-impossible.

“You had a great amount of housing insecurity long before COVID, and COVID has put this on hyperdrive,” said Paul of WISCAP. “There are delays in getting unemployment, you combine all of that, and there’s just a huge bottleneck of applicants for agencies.”

Members of the Milwaukee Autonomous Tenants Union and Rebecca Moore-Gnacinski, second from left, deliver a letter demanding that Berrada Properties, Moore-Gnacinski’s landlord, end its attempt to evict her on August 10, 2020. Photo by Will Cioci / Wisconsin Watch.

Community Action Coalition for South Central Wisconsin initially took 14 days to contact applicants in Dane, Jefferson and Waukesha counties and assess their eligibility, according to Amber Duddy, the agency’s executive director. But the agency teamed up with Energy Services Inc., which provides energy assistance to limited-income families, to speed up that process. Duddy expected to exhaust its $2.6 million in WRAP funds by Labor Day.

Officials at Community Action, Inc. say they have distributed at least $990,000 in aid to more than 528 households in Rock and Walworth counties. Staff sorted through 1,000-plus pre-application surveys, though not every applicant in need of help proved eligible.

It is unclear how long that agency can stretch its current funding, and whether it will receive more aid to distribute, said spokeswoman Beth Tallon.

‘I’m not sure where I’m going to go’

More than a dozen tenants told Wisconsin Watch through News414, a Milwaukee-focused service journalism project, that they have hit snags while applying for WRAP.

Niesha Joseph moved into her Milwaukee apartment during an emergency in February, picking the place so her two children could avoid switching schools. She lost her temp agency job when the pandemic struck weeks later, and she quickly fell behind on rent.

Wyconda Clayton’s home in Milwaukee is seen on July 17. She does not want to leave her Sherman Park neighborhood apartment, but her landlords pressed on with an eviction, refusing to accept last-minute aid from the state. Photo by Will Cioci / Wisconsin Watch.

Her landlord at XS Management, filed for eviction before the moratorium in March and continued the case in June. The landlord also harassed the family, Joseph alleges.

“She was calling and leaving threatening messages, coming and sitting in front of my house,” she said.

Joseph spent weeks waiting for SDC to process her application, only to learn that she missed a step that has tripped up other tenants in crisis: She had to first apply for energy assistance.

Joseph is waiting for a reply after taking that step, but she now plans to move out before her Sept. 15 court date; She said she no longer feels safe in the home and aims to prevent an eviction altogether.

“I just want to be gone,” she said. “I’m not sure where I’m going to go.”

The landlord, Tori Schultz, did not directly respond to Joseph’s allegations, but she told Wisconsin Watch that she took pleasure in ousting the family. Schultz unleashed a string of insults about the family.

‘I can’t let her see me cry’

Other tenants, including some outside of Milwaukee, discovered they cannot qualify for WRAP, despite struggling to stay in their homes.

Lisa Brady’s barrier: her roommate. The Dodge County woman applied after losing hours at the hotel where she works. But WRAP distributes funding on a per-household basis, requiring financial information from everyone living there. Brady said she was unable to get her roommate’s information while filling out the application.

“I’m 60 years old, should I go work as a cashier somewhere and deal with that ridiculousness?” she said. “Should I start looking for a van to live in? And I’m not kidding.”

Nathan Conner, who lost his factory job in Green Bay, unsuccessfully tried to negotiate a payment plan with his landlord while waiting for the state to process his unemployment claim. Conner said he did not yet owe back rent when he sought WRAP aid, but he anticipated falling behind while living on zero income. He could not qualify until missing a payment.

Conner left the apartment to avoid damaging his rental history with an eviction. He and his 6-year-old daughter are now living in a hotel, racking up credit card debt and watching his goal of homeownership move farther out of reach.

“I’m doing the right thing that you’re telling me to do, and I’m still losing everything. You understand how frustrating that is?” he said.

Conner recently accepted a forklift driver job near Milwaukee, and he found an apartment available in September; the landlord reached out after reading a story about his struggles published by the conservative Wisconsin Spotlight. But Conner last month said he did not know how he would pay his bills until work starts at the end of August, and he is trying to hide his stress from his daughter.

“I can’t let her see me cry, because she wants to know why we’re going through what we’re going through,” he said.

Scrambling for solutions

Recognizing Milwaukee’s chronic housing crisis, the county joined a coalition of renters, landlords and nonprofits two years ago in laying the groundwork for a Rental Housing Resource Center — a one-stop shop for tenants and landlords seeking to prevent evictions.

The center would offer mediation, financial assistance, case management, legal services and education.

“We have a lot of aligned interests,” said Lipo Zovic. “Landlords don’t want housing instability either.”

The pandemic scuttled plans for a planned physical opening in July, but legal and advocacy groups are teaming up remotely to try to plug the mammoth gap in state housing aid.

“We’re all sort of in the same building in a way, because we’re communicating so frequently now,” said Deb Heffner, housing strategy director for Community Advocates. The group has distributed just over $1 million in rental assistance to 600 families through mid-August to families in Milwaukee County.

But as the pandemic continues, advocates worry that even keeping tenants in their homes will be short lived as people struggle to find work and the pandemic creates health and child care problems.

“We may have just staved off an eviction for now, for it to only happen in a few months,” Lipo Zovic said. “We’re filling the hole behind us — and there’s a hole in front of us that’s opening.”

This story was produced through News414, a service journalism project that engages Milwaukee residents via text messages. Wisconsin Watch/WPR reporter Bram Sable-Smith contributed reporting. News414 is a collaboration between Wisconsin Watch, Milwaukee Neighborhood News Service and Outlier Media. The nonprofit Wisconsin Watch (wisconsinwatch.org) collaborates with WPR, PBS Wisconsin, other news media and the University of Wisconsin-Madison School of Journalism and Mass Communication. All works created, published, posted or disseminated by Wisconsin Watch do not necessarily reflect the views or opinions of UW-Madison or any of its affiliates.

-

Legislators Agree on Postpartum Medicaid Expansion

Jan 22nd, 2025 by Hallie Claflin

Jan 22nd, 2025 by Hallie Claflin

-

Inferior Care Feared As Counties Privatize Nursing Homes

Dec 15th, 2024 by Addie Costello

Dec 15th, 2024 by Addie Costello

-

Wisconsin Lacks Clear System for Tracking Police Caught Lying

May 9th, 2024 by Jacob Resneck

May 9th, 2024 by Jacob Resneck

Landlords do not make money from an eviction. Each eviction represents a crisis for the tenant that results in a conservative $4,000 loss for the housing provider. Looking at Milwaukee’s 12,000 evictions last year $48 million dollars got sucked out of the housing industry last year alone. Its been like this for at least 12 years. That’s a loss of over a half a billion dollars, of wages not paid, material not bought, housing units not rehabbed. This is where we are today.

Landlords shoulder the economic crises of tenants. In actuality, we are the last ones to get paid. We welcome societal alternatives. We support interventions far enough upstream to benefit everybody. We want more social services, drug treatment, child care and increased wages. We make income when tenants are happily fulfilled in their homes. Housing is better maintained when we have the income to do so. Our staff can make living wages.

This industry is on the fence along with our tenants. We are all about to go down the slide together. Landlords can and do fail, resulting in fewer housing units, which causes increased rents, which cause decreased tax collections, which results in less money for social programs that uplift people. We are all in this together.

Landlords do not make money from an eviction. Each eviction represents a crisis for the tenant that results in a conservative $4,000 loss for the housing provider. Looking at Milwaukee’s 12,000 evictions last year $48 million dollars got sucked out of the housing industry last year alone. Its been like this for at least 12 years. That’s a loss of over a half a billion dollars, of wages not paid, material not bought, housing units not rehabbed. This is where we are today.