Rich Pay the Least in State Taxes

Poor and middle class pay much higher percentage of their income in taxes.

New research shows Wisconsin’s tax system contributes to the growing concentration of wealth by calling on the richest residents to pay the smallest share of their income in taxes, and requiring residents with low and moderate incomes to pay more than their fair share.

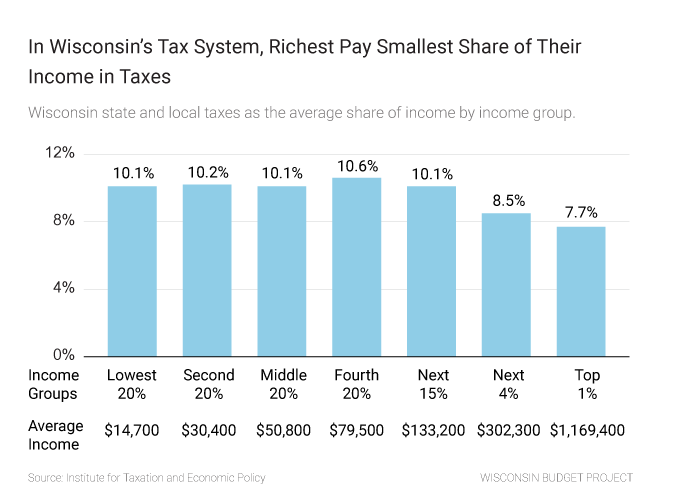

Wisconsin residents with the lowest incomes pay about a third more of their income in state and local taxes than the wealthiest residents, according to new figures from the Institute on Taxation and Economic Policy. The poorest 20 percent of Wisconsin residents—a group with an average income of $14,700—pays 10.1 cents out of every $1 of their income in state and local taxes on average. In comparison, the richest residents of Wisconsin, who have an average income of $1.2 million, pay just 7.7 cents out of every $1 in income in state and local taxes.

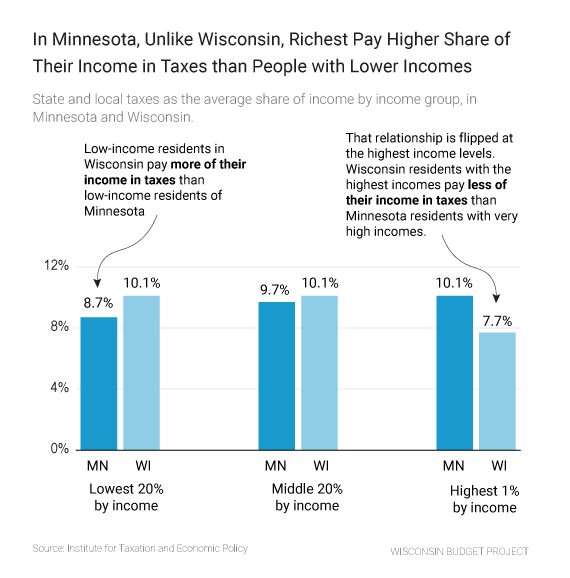

Wisconsin is one of 45 states that taxes poorer residents at a higher rate than richer residents. Our neighbor Minnesota is one of the states that provides a model for a more equitable tax system, one that taxes poorer residents a smaller share of their income and the richest residents a higher share. In Minnesota, taxpayers in the lowest 20 percent by income pay 8.7 percent of their income in state and local taxes on average, lower than the 10.1 percent paid by the lowest income group in Wisconsin. That relationship is reversed at the highest income level: The top 1 percent in Minnesota pays 10.1 percent of their income in taxes on average, compared to just 7.7 percent in Wisconsin.

Our tax system is a major driver of inequality and contributes to the increasing concentration of income and wealth in a few hands—hands that are most likely to be white, due to a long history of racial discrimination. The recent tax changes at the federal level under the GOP Tax Plan also demonstrate how our tax system can be changed to funnel resources to a small group of wealthy, typically white individuals. The tax cuts that President Trump signed into law last year reward white wealth at the expense of the economic security of poor, middle-class households and households of color. On average, white households receive $2,020 from the Trump tax cuts, Latino households receive $970, and Black households receive $840, according to research from the Institute for Taxation and Economic Policy. Even among the ultra-wealthy, whites fare better, because the law gives bigger tax cuts to income earned in ways that are more typical of white individuals than individuals of color.

Wisconsin can improve its state and local tax system in a way that gives all families greater access to opportunity, regardless of race, ethnicity, or income. Here are four steps state lawmakers could take to make sure Wisconsin families and communities can thrive, and what they’re doing instead:

- Boost tax credits aimed at supporting taxpayers with low and moderate incomes. Instead, Wisconsin lawmakers have cut and/or restricted eligibility for two important tax credits in recent years: the Earned Income Tax Credit (EITC), which gives a bigger tax refund to working parents, and the Homestead Credit, which keeps property taxes manageable for people with low incomes.

- Reduce tax loopholes that benefit the wealthy. Wisconsin lawmakers have introduced several new loopholes in recent years that direct resources into the pockets of the very highest earners and shut out nearly everyone else. One example is the state’s Manufacturing and Agriculture Credit, which allows the owners of manufacturing companies and some other businesses to pay next to nothing in income taxes.

- Implement highly progressive income tax brackets and rates. An income tax rate structure that taxes people with higher incomes at higher rates can counteract the effect of regressive sales and property taxes. In Wisconsin, the record on this is mixed: In recent years, state lawmakers broadened the gap between the top and bottom marginal tax rates, but also collapsed two tax brackets into one, giving taxpayers with moderately high incomes a significant income tax rate cut.

- Design a state tax system that relies more on the income tax than the sales tax. States with no income tax typically have a very high sales tax, and shift the responsibility of paying for schools, roads, and communities onto those who can least afford it.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock