The Impact of Republican Tax Cuts

It relies on supply side economics. So how well is that working?

The theory of supply-side economics became popular during the Reagan administration. It held that economic growth can be most effectively created by lowering taxes and decreasing regulation.

Its most extreme form is illustrated by Arthur Laffer and his Laffer Curve. Supposedly originally written on a restaurant napkin, it showed tax revenue decreasing as tax rates increased. The implication was that a decrease in taxes would pay for itself: that a tax rate decrease would result in more economic activity causing tax revenues to increase.

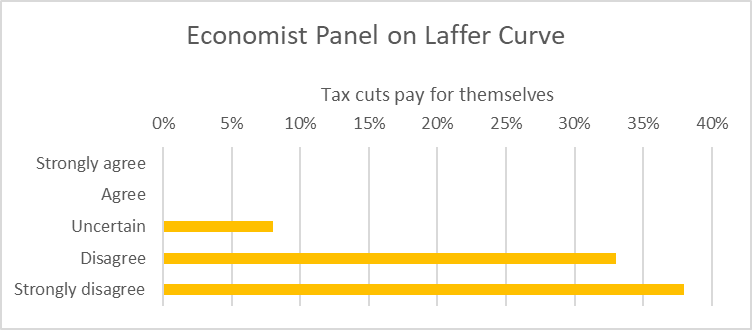

Economic research has not been kind to the Laffer Curve. The University of Chicago periodically surveys a panel of economists on various issues. In 2012, the panel was asked to respond to the following statement: “A cut in federal income tax rates in the US right now would raise taxable income enough so that the annual total tax revenue would be higher within five years than without the tax cut.” As the graph below shows, none of the economists agreed that a strategy of reducing tax rates would actually increase total revenues.

The Laffer Curve incorporates a truism: as tax rates approach 100 percent at some point the activity taxed will decrease sufficiently that revenue will go down. Which would be instructive if you could find any nation that set its taxes so high. Yet the Laffer Curve and its more moderate cousin have not lost their political appeal. Like the fantasy of ice cream with negative calories — the more you eat the thinner you get — it suggests there’s no need for trade-offs.

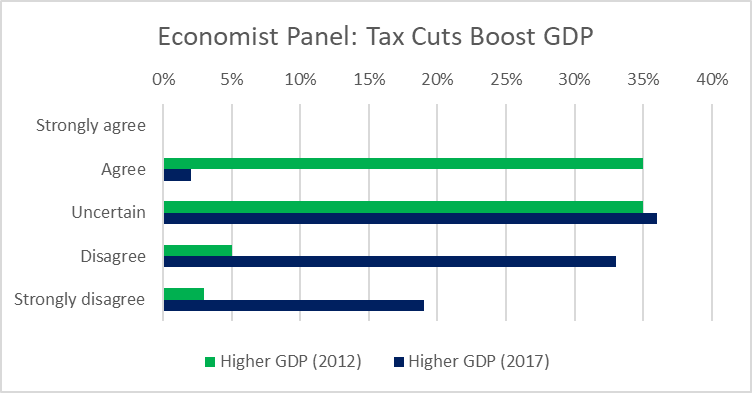

A softer version of supply-side economics argues that tax rate decreases, even if they don’t pay for themselves, result in an increase in economic activity. The same 2012 survey of economists asked them to respond to the statement: “A cut in federal income tax rates in the US right now would lead to higher GDP within five years than without the tax cut.” As the green bars in the plot below show, a majority of economists either agreed or were uncertain.

But late last year, as the Tax Cuts and Jobs bill neared passage the panel was asked to respond to a very similar statement: “If the US enacts a tax bill similar to those currently moving through the House and Senate — and assuming no other changes in tax or spending policy — US GDP will be substantially higher a decade from now than under the status quo.”

As can be seen in the purple bars in the graph below, the consensus turned considerably more negative towards the idea that reducing taxes would increase GDP. It is likely that part of this change results from research findings. An additional cause may be the timing for the tax cut, after several years of economic recovery. As the economy approaches full recovery, the idea of an additional stimulus makes less and less sense.

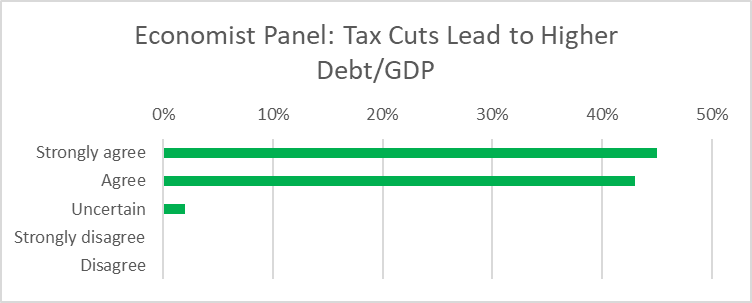

Finally, the panel was asked to respond to the following statement: “If the US enacts a tax bill similar to those currently moving through the House and Senate — and assuming no other changes in tax or spending policy — the US debt-to-GDP ratio will be substantially higher a decade from now than under the status quo.” Even the minority who believe that the tax cut will substantially increase the gross domestic product acknowledge that the cut would increase the debt more than the GDP.

The fact that tax cuts lead to higher deficits escapes some politicians. President Donald Trump and some of his economic advisers have claimed the tax cut will help reduce the deficit. Trump is not alone. For example, recently the Journal Sentinel reported that Paul Ryan blamed spending, not tax cuts, for rising deficits. “The issue is entitlements. It always has been and always will be,” according to Ryan. Ryan seems to have flunked basic arithmetic.

Supply-side economics has infected state decision making, particularly states dominated by Republicans. Well-funded think tanks have issued state ratings based on supply-side concepts. Typical of these are the state ratings put out by the American Legislative Exchange Council under the title Rich States, Poor States. Arthur Laffer is credited as one of the report’s three co-authors. As Wisconsin’s Senator Leah Vukmir, 2016 ALEC National Chairman, and current candidate for US Senate, explains on ALEC’s website:

State policymakers across America depend on Rich States, Poor States to provide an annual report on their current standing in economic competitiveness. Hardworking taxpayers want their states to follow the best policy solutions that will lead to greater economic opportunity for all. This publication provides exactly that roadmap for economic success in the states.

The graph below comparing Wisconsin and Minnesota shows the measure that ALEC uses in rating the states’ policies, its so-called “Outlook” score: The bigger the number, the worse the policy, in ALEC’s view. As can be seen, the measures are heavily skewed towards low taxes, particularly taxes on wealthy people. Conversely, states are penalized for such measures as minimum wage laws that are aimed at helping lower-income people. In most cases, Minnesota (in blue) has a higher and thus worse rating than Wisconsin (in red).

In their overall “Outlook” score, Wisconsin ranks 19th best, easily beating Minnesota, which ranks 44th best among the states. Yet when it comes to ALEC’s ranking of the states’ performance, Minnesota, in 22nd place, is far ahead of Wisconsin at 37th.

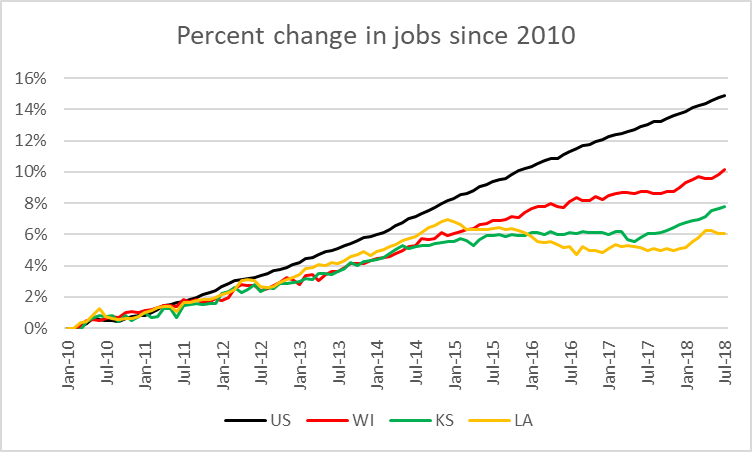

The best-known attempt to apply supply-side principles at the state level is Governor Sam Brownback’s in Kansas. Taxes were radically slashed, as was state spending on services like education. The cuts in services led to a backlash and a split between moderate and very conservative Republicans. Another governor entranced by the supposed economic magic of tax cuts was Louisiana’s Bobby Jindal in 2008-2016, who left his state in dire financial straights without creating the promised economic boom. As can be seen below, both attempts failed to generate the promised economic gains from businesses rushing in to take advantage of the lower tax rates. instead, job growth in both states badly trailed the nation.

This brings us to Wisconsin and the eight years of Scott Walker administration. As a whole, Walker’s policies follow the supply-side prescriptions—cut taxes, weaken regulations particularly on the environment, and keep labor cheap to attract industries. Has this worked? As the chart above shows, Wisconsin has seen job growth during this period that is moderate but well below the national average.

The question then is how much of the gap results from things inherent in Wisconsin (cold winters, dependence on manufacturing, the state’s culture, etc.) and how much on Walker’s policies. In a recent column, I presented one way to get at this question. Calculating Wisconsin’s relation to six other upper Midwest states in the period before Walker took office and projecting it to the Walker period results in a prediction about 80,000 jobs higher than the actual Wisconsin count. Walker’s policies, in short, have cost the state 80,000 jobs.

Supply-side economics suffers from three strikes. First, at a time when growing economic inequality is raising increased concerns, its recommendations help increase the gap. Second, it results in more pollution and a less-desirable environment. Finally, the evidence indicates it fails as an economic development strategy. With the support of wealthy people who benefit from supply-side’s prescription, the theory has lasted long beyond its expiration date. The sooner it is taken out back and buried, the better off we will all be.

Data Wonk

-

Why Absentee Ballot Drop Boxes Are Now Legal

Jul 17th, 2024 by Bruce Thompson

Jul 17th, 2024 by Bruce Thompson

-

The Imperial Legislature Is Shot Down

Jul 10th, 2024 by Bruce Thompson

Jul 10th, 2024 by Bruce Thompson

-

Counting the Lies By Trump

Jul 3rd, 2024 by Bruce Thompson

Jul 3rd, 2024 by Bruce Thompson

On a national level, I wonder if the linking, whether intentional or not, of tax cuts with defense spending increases is what acts as a bigger stimulant to the economy! Congress just cut taxes for the wealthy but increased defense spending by some $70 Billion! Both will go, on the whole, to the largest corporations and the wealthiest stock holders of those corporations. In fact, if one studies the Pentagon budget and “drills down” into it, it is that budget which under girds the economy. We/the United States cannot afford peace as that might lead to cuts in this not simply sacred cow but foundational pillar of the economy. How we get out of this mess is something our grandchildren may have to face? It sounds so paranoid but we don’t have a clue about the role of government in the economic well being of the nation without war and/or the threat of “terrorism”. Not even the most liberal of politician dares to question this spending as it is so intertwined with every part of our economy. Perhaps the next “wonkish” article should be on Pentagon spending in Wisconsin? peace, tw