State Tax System Increases Inequality

Top 1% got tax cut of $10,015, bottom 20% got just $175.

![U.S Pennies. By Roman Oleinik (Own work) [CC BY-SA 3.0 (http://creativecommons.org/licenses/by-sa/3.0) or GFDL (http://www.gnu.org/copyleft/fdl.html)], via Wikimedia Commons.](https://urbanmilwaukee.com/wp-content/uploads/2016/06/U.S_pennies.jpg)

U.S Pennies. By Roman Oleinik (Own work) [CC BY-SA 3.0 (http://creativecommons.org/licenses/by-sa/3.0) or GFDL (http://www.gnu.org/copyleft/fdl.html)], via Wikimedia Commons.

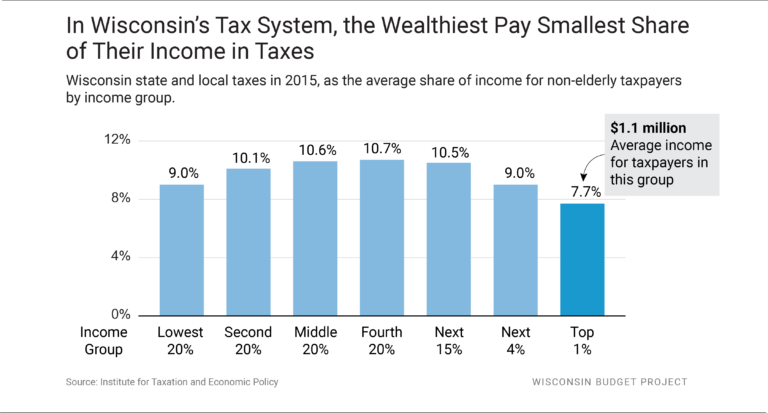

Lawmakers in Wisconsin have only made this problem worse by giving massive breaks to special interests while forcing cuts to things that benefit all of us, like education and clean air and water. As a result, low- and middle-income families in Wisconsin pay a bigger share of their incomes in state and local taxes on average than the wealthiest households. Our tax system requires low-and middle-income families to pay between 9 and 11 cents out of every dollar they earn in state and local taxes—yet the wealthiest households pay just 7.7 cents out of every dollar of income on average, the lowest of any income group.

Wisconsin’s middle class, while still one of the largest in the country, is shrinking. Most of the loss occurred as people fell out of the middle class to the lower income tier, rather than climbing into the upper tier. That trend should set off alarm bells for state policymakers, who should be using the tax system and other tools to help people work their way up the economic ladder, not just help those already at the top.

A Wisconsin Budget Project analysis shows that taxpayers in the top 1% could expect an average tax cut of $10,015 in 2017 from recently-approved state tax cuts, compared to just $175 for taxpayers in the lowest 20% of earners. That means that the top 1% got a tax cut 57 times larger than the earners in the lowest income group, and that the top 1% saved more on taxes each week than the lowest income group saved over the course of the entire year.

Even though many manufacturers and other corporations already pay little or nothing in income tax, Wisconsin lawmakers are further twisting the tax system by approving public payouts that involve actually sending checks to corporations. For example, Foxconn is set to benefit from up to $4.5 billion in tax breaks and spending from state and local governments, a large portion of which takes the form of refundable tax credits. (For more, see More than $1 billion of Foxconn Payout Has No Direct Connection to Job Creation.)

In Wisconsin, the top 1% is thriving, with their share of income reaching near record levels. We need to make sure our tax system doesn’t give the top 1% an additional advantage at the expense of taxpayers of more modest means, and holds corporations accountable to pay their fair share. Instead of looking for new ways to cut taxes for corporations and people with the highest incomes, state lawmakers should turn their attention to making investments that help Wisconsin communities and families thrive.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

That’s exactly how Career Politician and Big Government moocher Scott Walker and republicans want it! Keep the people dumb, broke and powerless. When they are powerless, well then Career Politician Scott Walker and republicans can just continue to loot, pillage and sell off the state and natural resources to their Big Corporate masters and do their bidding, all while living high on the hog off of us, the powerless Wisconsin taxpayers! That’s the Big Government mooching, Big Corporate Trump Toady republican way! Meanwhile the roads and infrastructure crumble away in Wisconsin as DOT debt grows into the billions, education is decimated, poverty rates are at 30 year highs, wages are mired at $7 an hour for crappy pee in a cup jobs, health care costs spike in the state because Walker and republicans hated a black guy as president so much that they sabotaged the system for years (note, premiums are not spiking in Minnesota, gee I wonder why??) and all republicans can do is just build more and more prisons. See how it works.

Welcome to the Third World Wisconsin!

Dump Walker 2018!

Alaska, Florida, Nevada, South Dakota, Texas, Washington.Wyoming, New Hampshire, and Tenessee have no income tax. What is the world coming to?

@Russian Troll, I grew up with no state income tax in Washington State. It was nice to not have to file an extra tax form with the state for sure but overall, no state income tax is regressive as hell. You just get hammered with 11% sales tax, sin taxes, tolls and other excise taxes. Believe me. It’s nothing for the mega-rich who occupy the city formerly known as Seattle to pay exorbitant Bainbridge Island ferry fees or Tacoma Narrows tolls everyday day back and forth but for the regular blue collar guy making 15-20 bucks an hour, it’s brutal.

Dump Walker 2018

Legalize cannabis!