Will Federal Tax Plan Succeed?

Past economic data suggests it won’t. And voters think it will fail.

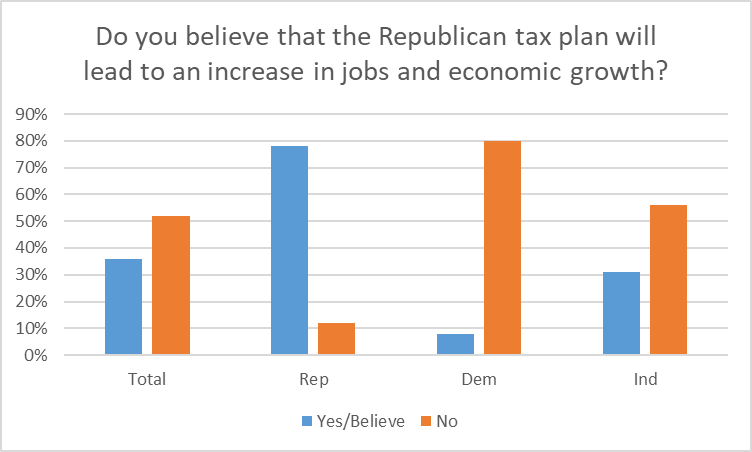

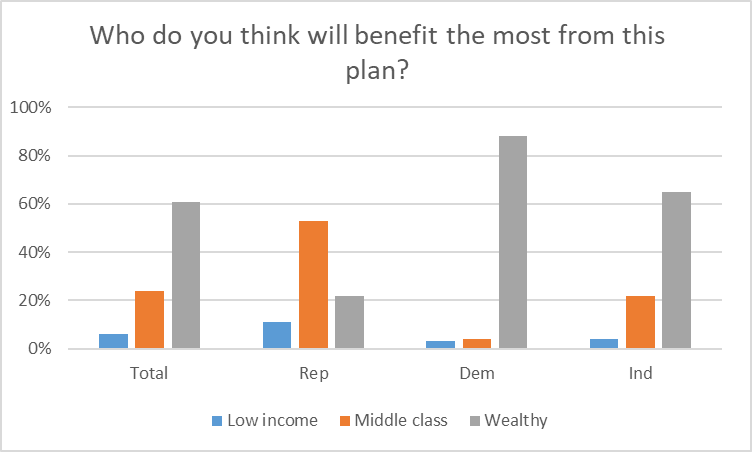

In recent years, orthodox Republican thinking about economics both in Wisconsin and nationally has been dominated by supply-side economics. This theory holds that the road to prosperity runs through reducing taxes, particularly on businesses and wealthy people. It is no surprise, therefore that there is a heavy partisan divide to responses to the recently-passed Tax Cut and Jobs Act. Here is what a recent Quinnipiac University poll found:

Despite candidate Donald Trump’s complaints about a tax system favoring the wealthy, as president he got behind legislation to further skew rates. This same approach — pushing tax cuts to boost the economy — underlies the ALEC ratings of state tax and other laws that have been the subject of several Data Wonk articles. Critics point to several counter-examples. For example, the George W. Bush tax cuts did not kick off the promised period of prosperity. And despite dire warnings, tax increases under Bill Clinton were followed by a period of economic growth and government surpluses.

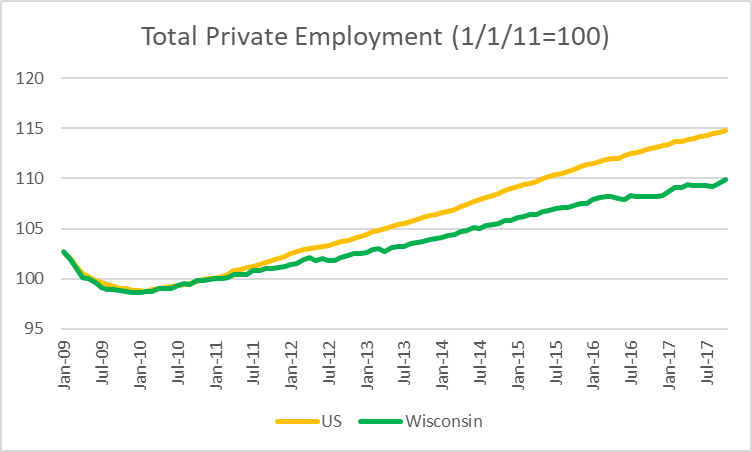

Wisconsin offers its own counter-example to disprove ALEC. The chart below shows Wisconsin’s private sector employment starting two years before the inauguration of Gov. Scott Walker. Following the inauguration, a gap between US jobs developed and has been growing ever since, even as Walker’s policies have been all about cutting taxes.

Whether or not one agrees that Trump is a “really smart … very stable genius,” during his campaign he showed a canny ability to identify political opportunity. By identifying the economic distress in Wisconsin, Michigan, and Pennsylvania, he managed to flip those states and thus win the presidency. While promising to bring relief by building a wall along the border with Mexico and renegotiate trade agreements, he also promised to crack down on the tax loopholes that benefited rich people and replace Obamacare with something much better.

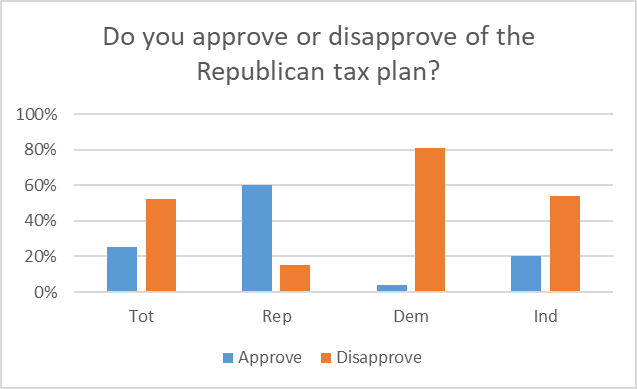

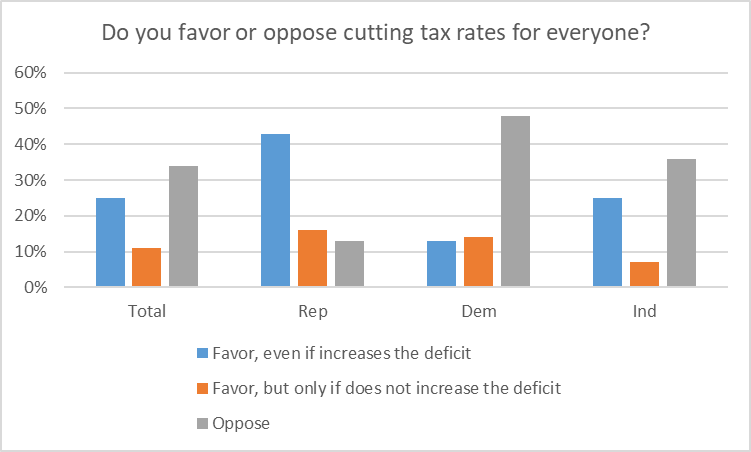

The recently passed Trump tax cuts have proved strikingly unpopular. Here is what the Quinnipiac University poll found:

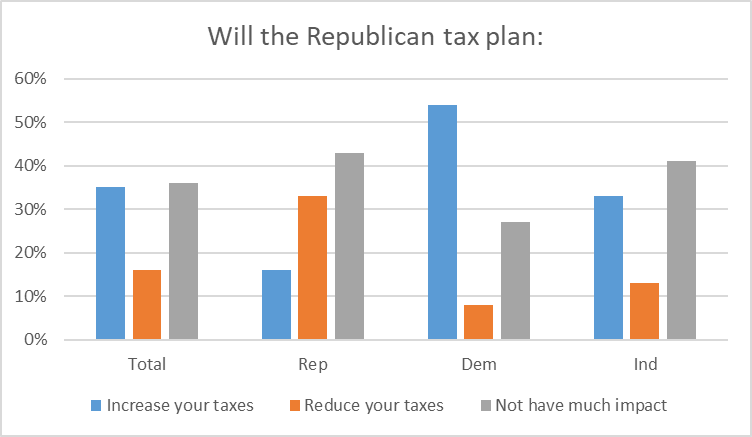

Several conservative commentators, including the Journal Sentinel’s Christian Schneider and the New York Times’ Bret Stephens, argue that the act’s poor showing results from a misunderstanding. Around 35 percent of the voters believed the plan would raise their taxes, as shown below, also from the Quinnipiac poll.

The Tax Policy Center estimates that “compared to current law, 5 percent of taxpayers would pay more tax in 2018, 9 percent in 2025, and 53 percent in 2027.” Thus, a strong majority will see either a reduction in taxes or no effect, at least in the short run. The assumption is that once people see reduced taxes, the act will become much more popular.

Yet, on other questions, the voters’ answers were much more accurate. Here are their responses when asked who the expected to benefit the most from the plan:

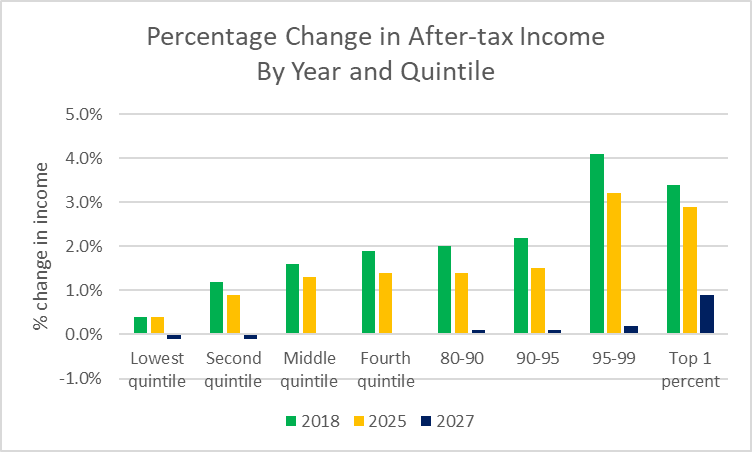

A majority of voters overall—except Republicans–accurately said that wealthy people would benefit most. Shown below are the Tax Policy Center’s estimates of the percentage increase in after-tax income for various income groups. As income goes up so does the percentage change. Thus, the tax cut is distributed in a regressive fashion.

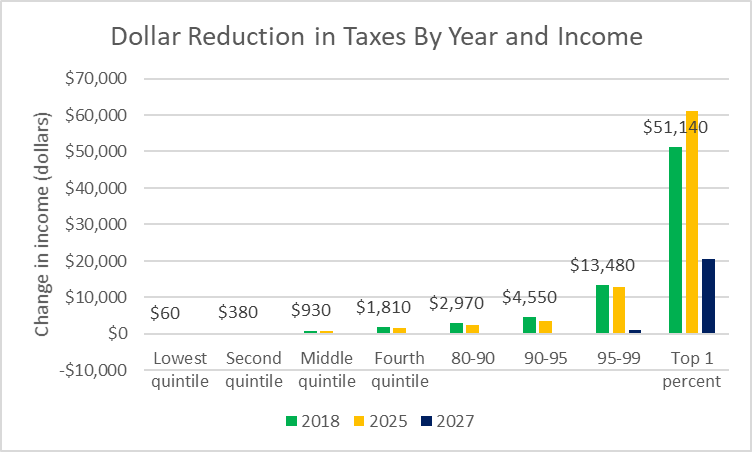

The disparity is even greater if the dollar value of the tax cut, rather than the percentage amount, is considered. The following graph shows the distribution of the cut by income level. Whereas the lowest paid quintile gets a $60 reduction and those in the middle get $930, the top 1 percent get $51,000.

Further making the tax act unpopular is its use of deficit spending to fund its tax cuts. When the Economist/YouGov poll asked voters if they favored cutting tax rates for everyone, a majority said they did. However, a majority favored tax cuts only if they were not funded by deficits.

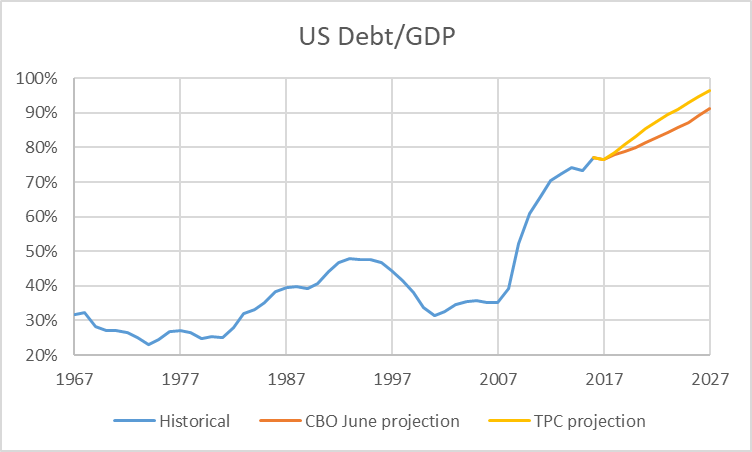

During the fight against the 2008 recession, Republicans in Congress positioned themselves as anti-deficit hawks. Yet it appears that deficits to fund tax cuts are fine. As the next chart shows, US debt grew substantially during the recession but recently leveled off. However, because of aging baby boomers, the Congressional Budget Office projects it to resume growing as shown by the red line. The tax cuts will further increase this growth, as shown by the yellow line based on the Tax Policy Center’s projections.

Yet recent comments from the two Republican candidates for US Senator suggest that they may soon resume their fixation on deficits. In comments to the Journal Sentinel, a spokeswoman for state Sen. Leah Vukmir said the nation needs to tackle its deficits and debt by addressing “the root of the problem, our spending.” She went on to say, “Leah agrees with Speaker Ryan, America’s debt is a threat to future generations and we must reform these programs.”

Businessman Kevin Nicholson‘s campaign commented that “too many typical career … politicians make empty promises to beneficiaries that the federal government can’t keep, and it’s not sustainable to generations of Americans who’ve not yet been born.”

Lately, Paul Ryan has also argued that the growing federal deficit is a reason to pass spending restraints on entitlements such as Medicaid, Medicare and welfare programs. It appears that deficits related to entitlements are a concern, but not those related to tax cuts focused on wealthy people.

There is a growing consensus that between them Trump and the Republican Congress have managed to put the next election in play. This seems to be reflected in the number of people running for the Democratic nomination for governor of Wisconsin and reports that Democrats nationally are signing up to contest historically Republican Congressional districts.

How far this has gone is suggested by a recent article by John Torinus published in Urban Milwaukee. In it, he suggests that the right kind of Democrat running the right kind of campaign could win the 58th Assembly District in Washington County. If any district should be a safe for Republicans, it is the 58th. In 2016, Clinton got 30 percent of the vote, down from Obama’s 32 percent in 2012. No Democrat ran for that seat in 2016, 2014, or 2012.

Democrats should recognize that the pain that Trump took advantage of is genuine. The Republican plan that was supposed to address this is heavily endorsed by their funders. However, there is little evidence that it works. In the next two Data Wonk articles, I plan to explore some of the reasons that have been advanced to explain why so many Americans are suffering and some possible policies that could help.

Data Wonk

-

Life Expectancy in Wisconsin vs. Other States

Dec 10th, 2025 by Bruce Thompson

Dec 10th, 2025 by Bruce Thompson

-

How Republicans Opened the Door To Redistricting

Nov 26th, 2025 by Bruce Thompson

Nov 26th, 2025 by Bruce Thompson

-

The Connection Between Life Expectancy, Poverty and Partisanship

Nov 21st, 2025 by Bruce Thompson

Nov 21st, 2025 by Bruce Thompson

What if the whole point of the tax plan was not to increase growth, but instead to transfer more wealth to the wealthiest and launder money placed in tax havens? If that was the goal, I think the tax plan was unequivocally a success.

In comments to the Journal Sentinel, a spokeswoman for state Sen. Leah Vukmir said the nation needs to tackle its deficits and debt by addressing “the root of the problem, our spending.” She went on to say, “Leah agrees with Speaker Ryan, America’s debt is a threat to future generations and we must reform these programs.”

-Everything is wrong with Vukmir’s reasoning.Your party just increased the deficit without any cuts in spending.Or was that not painfully evident to you ?

-And you want to be the next senator ?

Of course, the tax cut law will succeed. For those who wrote it and those that they work for, it is already a success. They know that they will be even richer, and corporations know that shareholder value and executive compensation will increase. And, even the not-so-rich rich, like businessman Ron Johnson, were able to get their snouts in the trough at the end, so it is a success for “small businesses” as well.

But the biggest winners will be the ideological reactionaries who may now have an opportunity to achieve their fondest goals, the wiping out of the markers of American social progress going back almost a century. As vast deficits pile up from the inevitable failure of the tax cuts to produce the promised growth, it will be absolutely essential to do “entitlement reform,” which is to say, get rid of Social Security, Medicare and Medicaid. And, at the same time, to increase military spending to chase a bunch of terrorists around the world and modernize the nuclear arsenal, all, of course, in the name of “supporting the troops.” As Ms. Vukmir says, we have a spending problem. But it is a very selective spending problem.

To keep the “little people” on board, it will be necessary to constantly crank up the search for scapegoats, making sure that hard earned tax dollars don’t go to food stamps for people who will just use them to buy malt liquor and drugs, health care benefits don’t go to poor people who don’t have non-existent jobs, low-income children realize that they will have to work harder to share in the American dream, and as many immigrants and their children as possible are kicked out of the country so that hard-working real Americans, especially the old ones who no longer have pensions,Social Security or Medicare, can get back to work. Even today, with the latest roundups, there are job openings for real Americans at 7-Eleven stores across the country.

So, from the standpoint of the plutocrats and reactionaries, the chances of success are very high, and Paul Ryan will live to see his Ayn Rand dream world come to fruition. In the resulting war of all against all, it won’t be easy to make the case for American exceptionalism anymore, but, hey, nothing is perfect.

The second Tax Policy Center graph is mislabled ( not a %).

In the “2027” (blue graph), are any of the bars actually negative?

For 80% (4 quintiles) of individuals and couples, the $ amount of annual tax reduction would be dwarfed by current health care costs. The loss of Health Care is the most likely impact for most quintiles.

This is not a win for middle class,unless only the top 10% are the middle, not quintiles 2,3,and possibly 4.

The most important indicator of middle class benefit (after healthcare) is not employment,or job growth, it is hourly and salaried wage growth.

Repulicans claims that the tax law changes and other new policies, will result in wage increases, but they have remained stagnant in most regions over 20 years. Wage growth has passed over urban areas, and most cities in the US. This will only change with concentrated expenditures in both education (not included in tax plan) and deliberate

governmental intervention (not a Republican concept).

Yep, It was never going to trickle down to the little guy…..right? All the doomer and gloomers have big time egg on their faces. Well over a million Americans in lower paid positions have gotten $1000 bonuses. To most of them, I suspect it’s a lot of money. Countless others are receiving pay raises and larger 401-K matches. And this is in the first two weeks. Every day, more announcements come out and they specifically cite the Tax Bill as the impetus for this. The Liberal media is still trying to spin this as no help for the little guy. Wrong again. Wisconsin farmers can sleep easier knowing that they will not have to sell the family farm if Dad dies, just to pay the estate taxes, and those farms can stay in the family for more generations as a result. I think the Liberal media is running scared, because they are afraid that Trump might actually succeed.

My perspective is if you are working class and have two jobs Trump did you a big favor. One the largest private employer Wal-Mart just announced $ 11 starting wage to all lower wage employees and $ 1000 bonus. This will drive wages in other low end jobs. Two, in February Trump will give you more take home pay, three a lot of poorer families have children. Under Obama, you received a $1000 Tax credit per child that has doubled $2000 under Trump. Three do you remember when Obama determined to kill the coal that heats you homes, and save you money. Trump has done away with punishing you with future high peer rates, in fact WE energies just received a HUGE tax break and you should demand local regulators give you lower rates. Fourth, lowering taxes incentives more work for the individual and the employer. More jobs lead to less crime and welfare. Five, more wealth in the lat year has gone into pensions for firefighters and teachers so they retire with less stress at 50 years of age. Six, companies like Apple that hold hundreds of billions of dollars over sea can now bring their money home without over taxation bring more money to the ITS. Seven, less American companies will want to leave America to foreign countries because it easier to do business in Germany then America.

Troll :

-“you should demand local regulators give you lower rates” ( WE Energies ?? —NOT GOING TO HAPPEN ).

-How do you explain that natural gas became a cheaper fuel source than coal ?? ( OBAMA did that too right?)

-. Fourth, lowering taxes incentives more work for the individual and the employer. NO ( Product / services DEMAND creates more jobs-No one hires workers just because they got a tax break. Very few overlook demand when considering to add staff )

– WHAT WORLD DO YOU OPERATE IN ?

If you want to know how real business works , ask Warren Buffett ; Not the man that ran a casino into bankruptcy ( Has that ever happened in the world to anyone else?)

Eric read up Baltimore, Denver, Washington DC utilities are in the process of lowering rates to customers. As a bonus rich people or Democrats on lake drive and Riverhills can no longer write off large amounts of their property taxes on their multiple homes. It seems their okay with Obama raising their taxes but Trump can’t ? Working class win. Rich Democrats lose.

Eric, are you trying to say Buffett over his career has never got it wrong? Other than Apple, he has bot been the best stock picker in recent years.

steve,

Thanks for pointing out the mislabeled graph. A replacement is on its way.

Yes, in 2027 several of the bars are negative, but only by small amount ($30, $60)

According to the Tax Policy Center: “The bill would also repeal the Affordable Care Act’s (ACA) individual mandate, but the distributional estimates presented here do not include the effects of that provision.”

Troll is not an economist. It’s hard to have a discussion with someone who is so ignorant. Coal’s decline began in the 1970s and natural gas is cheaper. It should be clear that those have nothing to do with Obama, unless Troll believes Obama instigated coal’s decline when he was 10. But don’t let pesky facts get in the way of your blind Trump love.

Troll : Did Berkshire-Hathaway ever declare bankruptcy ?

Hey Troll, if Trump’s tax cut is working at Walmart then why are they firing thousands of people?

Madison’s Sam’s Club is now closed.

West Allis’ Sam’s Club is now closed.

I didn’t even check the full list, which other ones closed in WI?

Eric, actually no, but did Buffett by companies that went bankrupt. Yes, Buffet lost 900 million dollars purchasing Energy Future Holdings but cut ties before its doomed bankruptcy in 2014.

PMD I am not an economist. I am a Troll, and yes Wisconsin still uses more coal than gas, and yes many times Obama stated his preference to end coal usage. His EPA actions attempted to kill coal and fracking on private lands. Killing fracking kills the glut in natural gas.

I

Tim…. Macy’s, Sears, Kmart, Boston Store, are all cutting back retail foot prints. I am just a Troll but my sense is that those stores were deemed zombie stores before the tax cuts passed. The all wise and powerful Trump cannot make the tides rise like Obama can.

Troll, very few Wisconsin homes are heated by coal. 65% of Wisconsin households are heated by gas.

https://www.eia.gov/state/data.php?sid=WI#ConsumptionExpenditures

Oh wow look at that facts prove Troll wrong, again. So you just make stuff up and hope no one facts check you or what?

And oops Walmart fired thousands of workers yesterday. So they buried that with headlines about the $11 starting wage. Tell that to the thousands of people they fired yesterday.

@steve Thanks. The graph has been corrected.

P.M.D, You mayBe naive but at times businesses fail. There is a Boston store that is downtown in milwaukee that is subsidies by the city of milwaukee. It makes. No profit which probably makes you happy. Wal-Mart does not have a deal like that at both Wisconsin sites maybe if the Same club was in milwaukee it would have survived. What may make you happy is the fact that Boston store will not benefit from the Trump tax cuts since Boston store wmis not a profitable company.