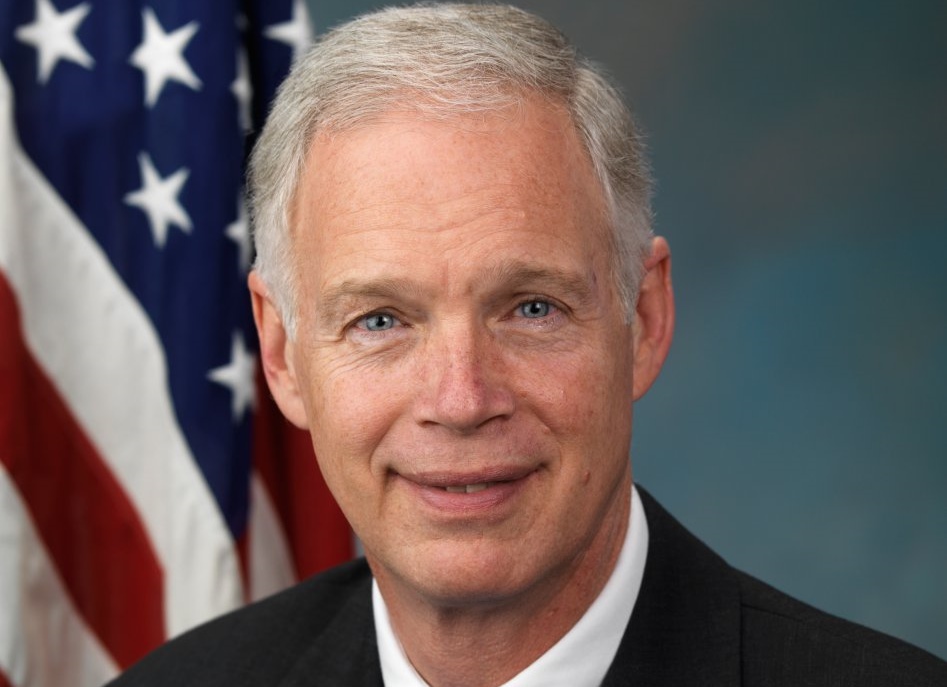

Ron Johnson a Hero for Small Businesses

His objections push Republicans to add federal tax breaks for small businesses.

Sen. Ron Johnson is hardly the proverbial Mr. Smith, the naïve small-town movie character who went to Washington and stumbled into reforming it. Our Wisconsin senator ran a relatively small plastics extrusion business, but married into a major business fortune.

It’s the connections to Bemis Corp. of Neenah and the founding Howard Curler family that allowed him to put $10 million into his successful reelection campaign against Russ Feingold in 2016. The senator and his wife Jane Curler had a net worth of $37 million in 2014, prior to the $10 million payout. But, with growth, it’s undoubtedly higher now.

His Oshkosh-based Pacur Inc. (named after Pat Curler, its founder and a brother-in-law) was listed in 2014 with about $30 million in sales and 73 employees. Bemis Company, from which Pacur was spun out, had revenues of $4 billion in 2016.

So, he has a foot in small business and large corporations. That gave him background and motivation to fight the good fight for tax cuts for both small and large businesses in Congress as the complex Republican bill was pushed through the political sausage machine.

Before Johnson’s high-profile holdout in the U.S. Senate over the last two weeks, the Republican plan was to give large corporations a huge tax reduction from 35% to 20% and give lesser cuts to “pass-through” companies. Those include most small businesses where the taxes are paid by the owners at personal rates.

Majority leader Mitch McConnell had to have Johnson’s vote to get to 51, so our version of Mr. Smith had big leverage, and he used it to get what he demanded. The bill ended up passing by 51 to 49. It was that close.

Johnson and his fellow Republicans are operating on the general premise that lower taxes bring faster economic growth. They also believe that high corporate taxes make the American economy uncompetitive.

Democrats believe in general that higher corporate taxes enable more investment in education, infrastructure and health care, which in the end promotes more prosperity. They have a hard time being pro-business.

There is little consensus among economists around either belief, except most concede that the U.S. 35% corporate rate is too high compared to other countries. The same goes for the 39.6% rate that hits some pass-through companies.

Bottom line: Republicans are making a big bet that they are right about the stimulus of lower rates. The economy has been improving for nine years, partly on the expectation of lower rates. Will passage of the GOP bill add more steam to the economic engine and keep the expansion going? No one really knows.

My bet for economic growth is always the entrepreneurs. They are the innovators who create jobs and prosperity in an dramatic way. The Dow Jones average has been riding high on the explosive growth of technology companies that were startups 20 years ago more less.

They, of course, depend on an orderly society based on law, investment in technology by government, an educated work population, a belief in advancing the common good through innovation and sensible regulations. But taxes are not their issue early on. Taxes are a down-the-road concern.

Is it too much to ask the two parties to at least agree that innovation via startups is a proven way forward? No economist disputes that thesis.

The Republicans are far less concerned than Democrats with economic equity in the American society. The personal tax breaks in the bill help all levels of taxpayers. But Democrats are saying it’s not enough and will not give the tax bill a single vote.

Unfortunately, the new law will be as partisan as the vote for Obamacare. That is not good for its long-term prospects. Bipartisan legislation (Social Security, Medicare, volunteer army) has a far higher probability of enduring.

Mr. Johnson can help the GOP on the equity front. The party still needs his vote for the final version of the tax bill, so he can he can insist that the tax bill include a high marginal tax rate for the fat cats that are taking far more from society than they are contributing. That would be at least 50% for any earned income (including carried interest) over $5 million.

He can insist on a minimum tax for large corporations who hire legions of, tax lawyers and accountants so they pay zero federal income tax. That is not equitable. They should pay at least 15% of pre-tax income – pre-loopholes.

Mid-size companies like Serigraph would have no problem with that floor.

Finally, Sen. Johnson, a deficit hawk through and through, must have a major case of heartburn over what the GOP tax bill does for the nation’s debt level. It jacks the deficit by $150 billion per year.

Debt reduction has been an article of faith for the GOP forever. How can Speaker Paul Ryan and Sen. Johnson sleep at night as leaders of legislation that makes then deficit worse? They will argue that the growth projections are under-estimated and the bill will be at least deficit neutral.

Let’s hope they prove right.

John Torinus is the chairman of Serigraph Inc. and a former Milwaukee Sentinel business editor who blogs regularly at johntorinus.com.

Ron Johnson is a crook.

Screw the poor, screw the middle class, screw the upper-middle. Screw the environment.

Johnson is a charlatan. He got his special tax cut for his own company. That’s all we need to know! See below:

http://www.pressreleasepoint.com/ron-johnson-gets-his-badger-bribe-vote-disastrous-tax-cut-plan

Time to Dump Johnson, Dump Walker, Dump Schimel, Dump Vukmir, we gotta do a lotta GOP dumping to do Wisconsin! Gonna need a fleet of Dump Trucks!

Let’s hope that some day John Torinus can someday understand that people make the world go round. We’ve been waiting thirty some years for conservative trickle down magic voodoo economics, all while transferring the obligation of government and it’s war machine onto the people. This Country is becoming very expensive to live in because we support business with our tax policy over people. Try to define this policy with one word. Fascism.Hoping Paul Ryan and Ron Johnson are right? Hope in one hand and shit in the other and tell me what you see.

So $30 million in sales is a “small” business? The small businesses that really need help are the mom-and-pop stores. What do you call them? Teensy, maybe? Insignificant? Losers? Ron Johnson’s business, which he married into, by the way, is hardly “small.”

Carried interest provision has to go. Let’s not hope Mr. Torinus. Let’s vote him out of office.

The Republican tax scam is trickle down theft. Since Reagan, it is the same plan that has led to over $20 Trillion in federal debt, adding over $1 Trillion annually. This is an epic immoral intergenerational theft scam. Nothing more than a remarketed pure stinking turd being sold to Americans as good for them. It is another huge toxic pill for the US worker.

Purchasing power for workers reached a peak in 1969, and has been in decline and stagnant ever since. About 600 people in the US own over 60% of all wealth, and 70% of all wealth gains since 2012 on the planet have been for these same people and the corporations.

Thank you for the Op Ed. I’ve always enjoyed your writings and respect the time and “reputation” you’ve committed to being somewhat in the public eye.

The two things you mention near the end of the article would be quite the coup if he tried to implement:

**************************

“Mr. Johnson can help the GOP on the equity front. The party still needs his vote for the final version of the tax bill, so he can he can insist that the tax bill include a high marginal tax rate for the fat cats that are taking far more from society than they are contributing. That would be at least 50% for any earned income (including carried interest) over $5 million.

He can insist on a minimum tax for large corporations who hire legions of, tax lawyers and accountants so they pay zero federal income tax. That is not equitable. They should pay at least 15% of pre-tax income – pre-loopholes.”

*************************

I sort of half-expected Pres Trump to go after Carried Interest. Scuttlebutt is that he was not a big fan of that part of NY society.

Do you think either of those is likely?

Tax break=more money to spend on tax accountants, lawyers, and MAYBE health care for workers,,,so it’s a wash…there won’t be any hiring of new workers.

Torinus is entirely too kind to Ron Johnson and his motivations. Johnson is the titular head of a small corporation that could very easily be brought in house by his father-in-laws company Bemis. Johnson pranced around suggesting he may be a no vote on this abortion of a tax bill, in order to get companies organized like his to have a piece of the action that “C” corporations are getting, that is, he wanted the same tax treatment for his small pass through company as the billionaires were getting for the large companies. The irony of all this is that no U. S. corporation pays the published tax rates. The actual % paid or the effective tax is far lower. Indeed the actual % paid, according to a study on CNBC yesterday may be as low as 13% after all deductions and credits. This means that a 20% rate will do very little to boost growth since companies are actually paying less than that now after all deductions, credits and rebates. I also do not believe that Johnson actually gives a tinkers damn about the deficit increase, since it is going not to the unwashed masses, but fat cats like himself. Deficits are only a problem when they are run up to boost the economic situation of the 99% of the citizens who are not millionaires. In Johnson’s country club world, deficits to make the extremely comfortable even more comfortable are just fine.

Ron Johnson extorted an amendment to line his own pocket in exchage for his vote. He’s No hero. What hrs did should be illegal. It’s certainly unethical at bed.

Torinus is very selective with his facts. The long term effect of the tax bill is very bad for most taxpayers. Some of these bad effects phase in over time with some Republican lawmakers claiming they will fix those negative effects before the negative effects kick in. But why have those written into the tax bill, if they plan to remove those later? Some claim that it is necessary due to Congress’ rules concerning legislation. However, there is no indication this bill is the only way to achieve the other goals. On top of that, the claims of positive economic effects are refuted by most economists (not some as claimed by Torinus). Trickle down was always a largely fabricated and untrue proclamation. The way society is currently organized, it is even less true now than it was 30 years ago.

People this a war on the working class that started with Reagan and continues to destroy our country. Walker, Trump have used this divide and conquer and make laws that give our money to the 1%.

Apparently not, as he’s still voting “Yes” after getting what he personally, his family, and his friends wanted.

How much did Ron get for you, John? Surely you feel owed something for your campaign investments…

So a proprietor of a ‘small business’ using a ‘pass-through’ will end up paying a significantly smaller tax than the employees working next to her?

Who is a bigger joke on economics? Johnson or Torinus? Both define “mediocre white men whose ‘big fish in a small pond’ situation means they think they are special.”

Disgusting self-dealing greedheads.